Lessons I Learned From Info About Journal Entries To Trial Balance

Discover the meaning of a journal entry and a trial balance, types of journal entries, how a general ledger differs from a trial balance, and some examples.

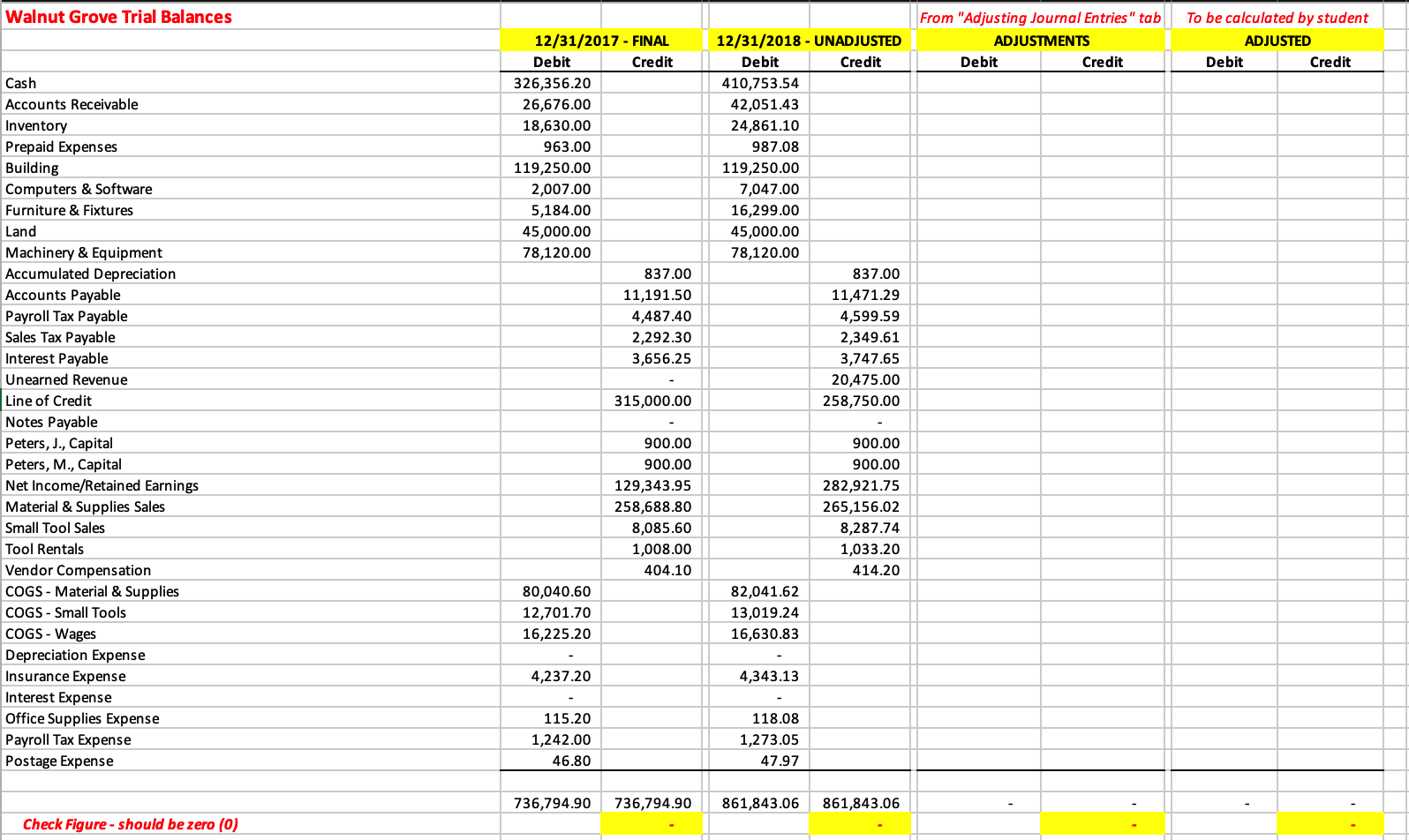

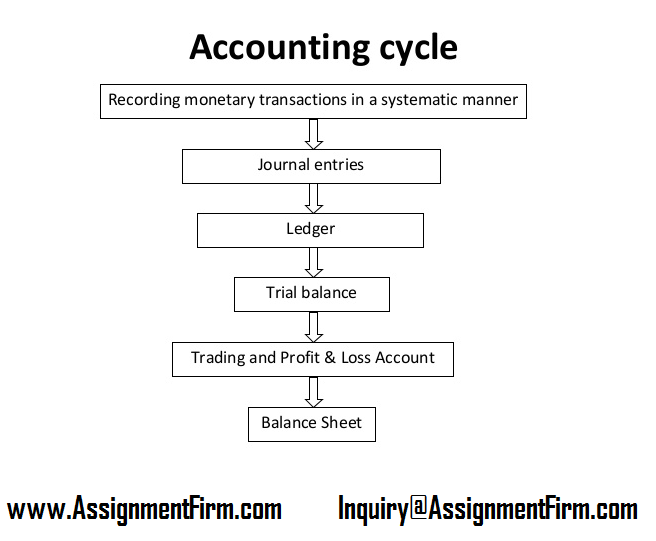

Journal entries to trial balance. An account is a part of the accounting system used to classify and summarize the increases, decreases, and balances of each asset, liability, stockholders’ equity item, dividend, revenue, and expense. This trial balance is an important step in the accounting process because it helps identify any computational errors throughout the first five steps in the cycle. To prepare a trial balance, you will need the closing balances of the general ledger accounts.

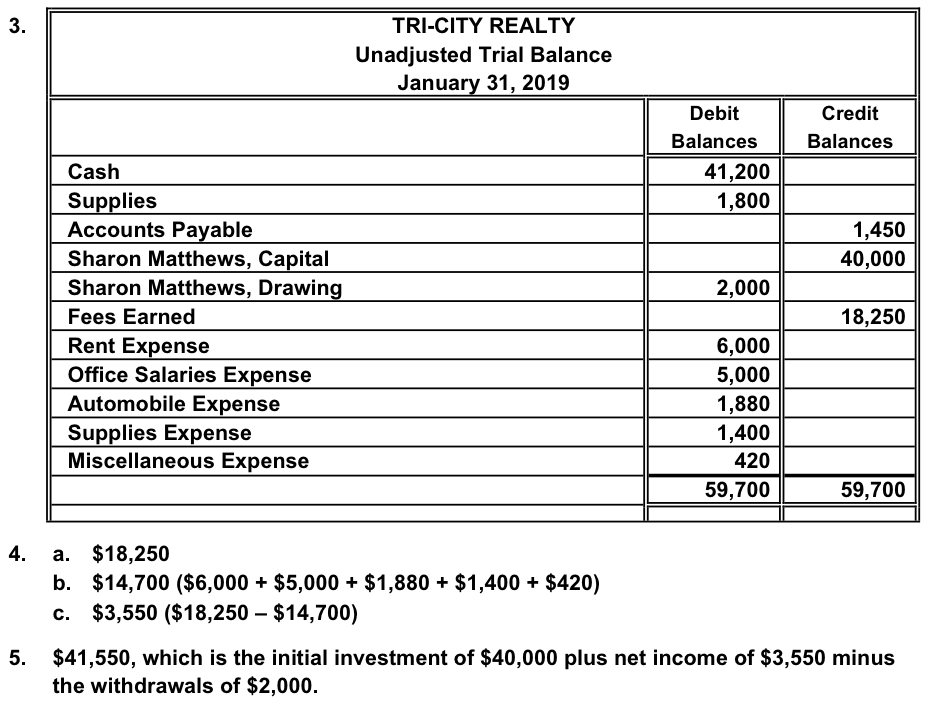

A trial balance is a listing of all accounts (in this order: A trial balance is a statement that is prepared to check the arithmetical accuracy of books of accounts. A trial balance sheet is a report that lists the ending balances of each account in the chart of accounts in balance sheet order.

A trial balance is a list of all accounts in the general ledger that have nonzero balances. After posting all financial transactions to the accounting journals and summarizing them in the general ledger, a trial balance is prepared to verify that the debits equal the credits on the chart of accounts. With his trial just two weeks away, james crumbley is fighting to block jurors from any testimony or evidence involving his teenage son's mental health, journal or text messages he sent to a.

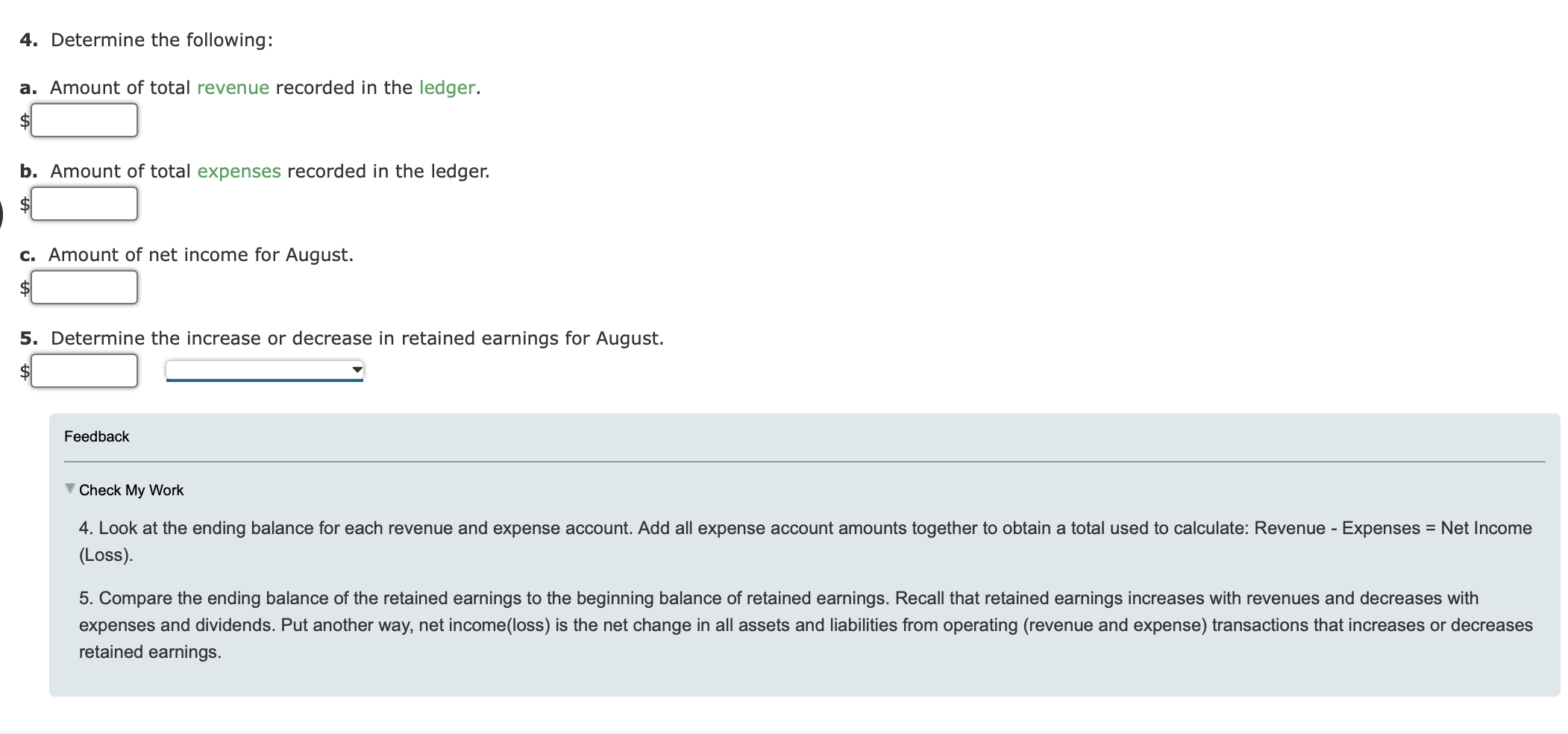

Your business transactions are initially recorded in your general ledger. In this topic, we also cover how to prepare journal, ledger, and trial balance with practical problems and solutions. Define “trial balance” and indicate the source of its monetary balances.

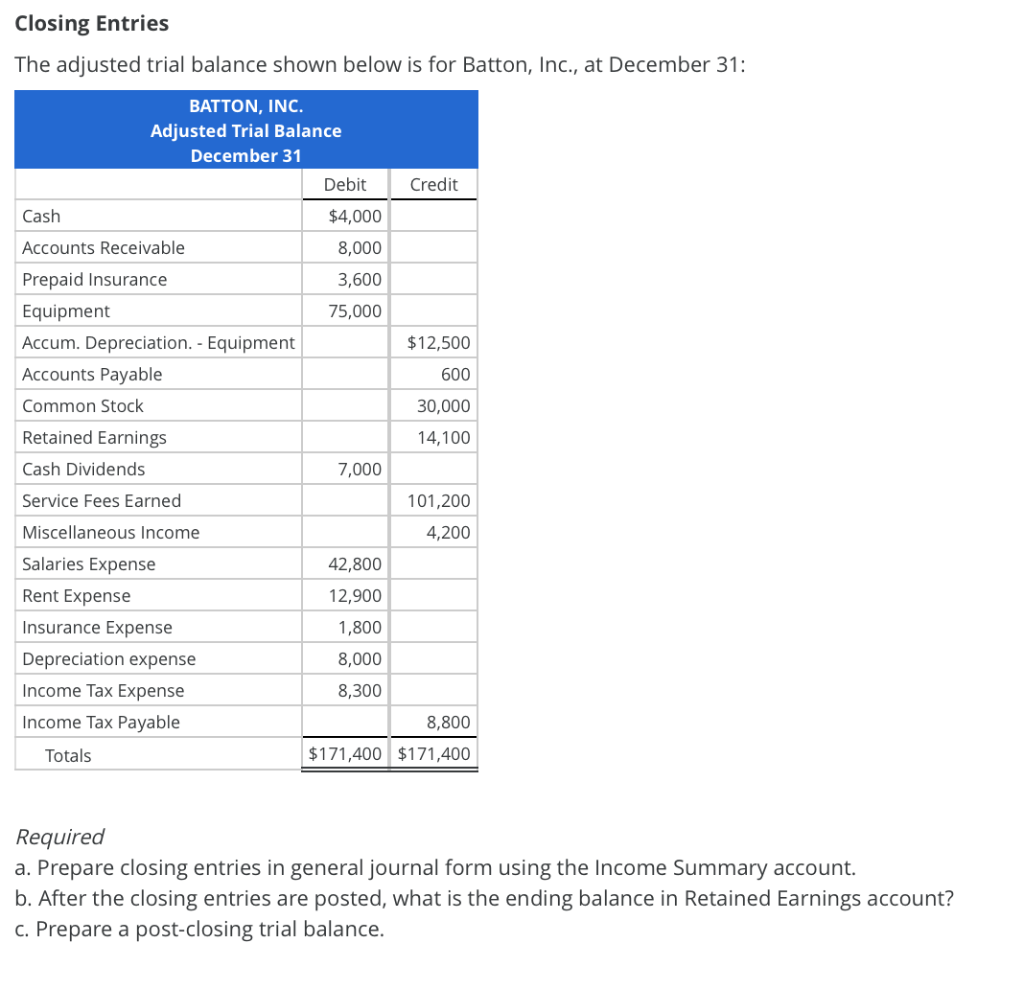

Income statement s will include all revenue and expense accounts. The trial balance is prepared after posting all financial transactions to the journals and summarizing them on the ledger statements. It is called a trial balance because the information on the form must balance.

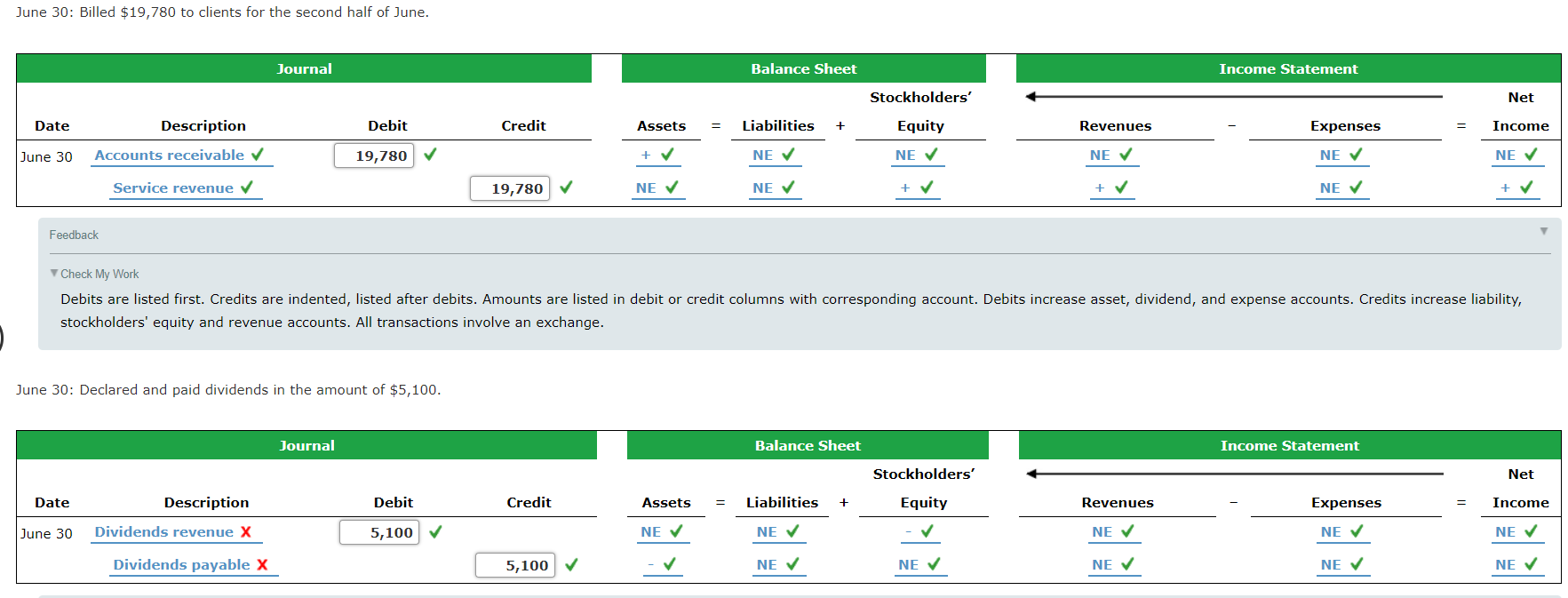

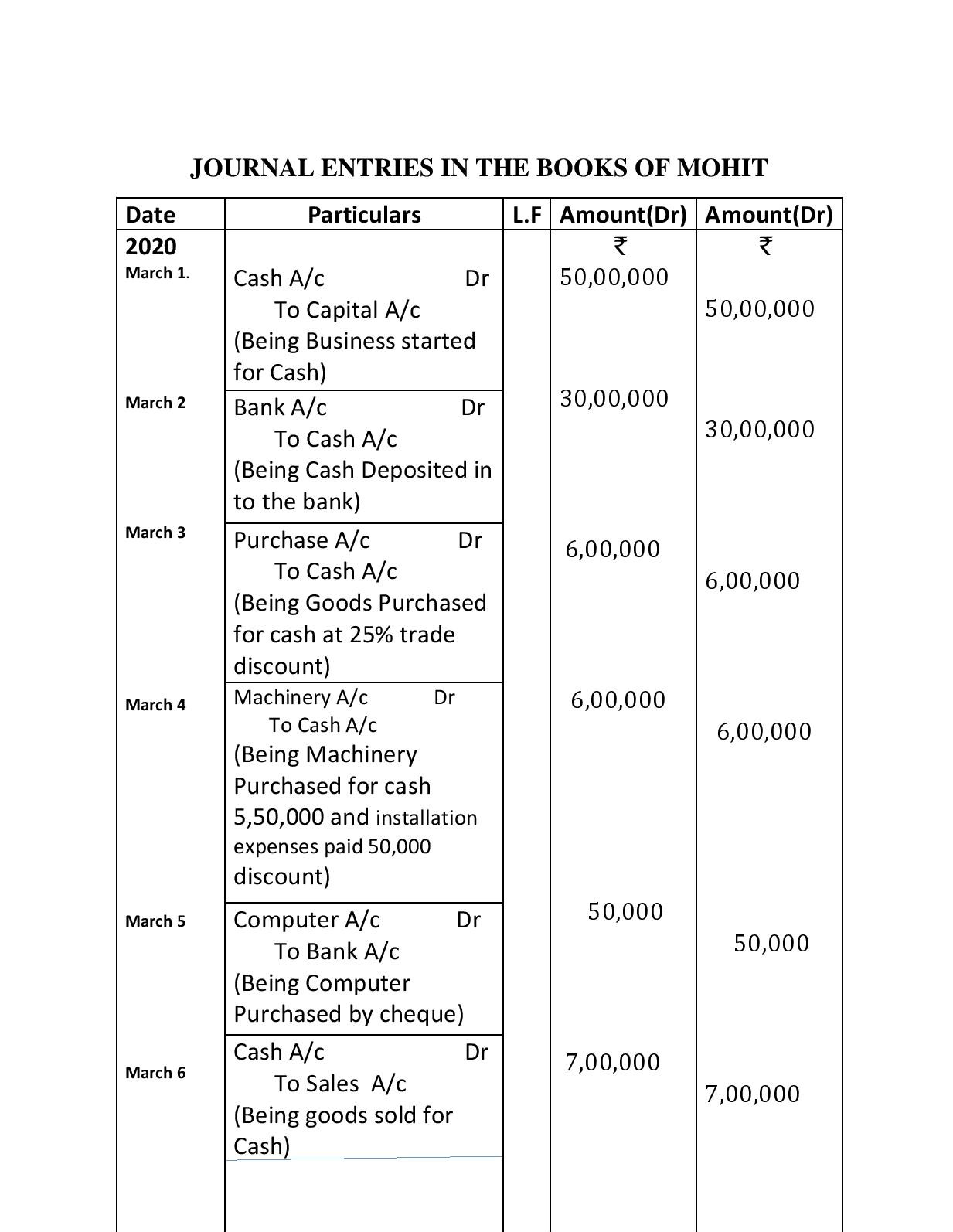

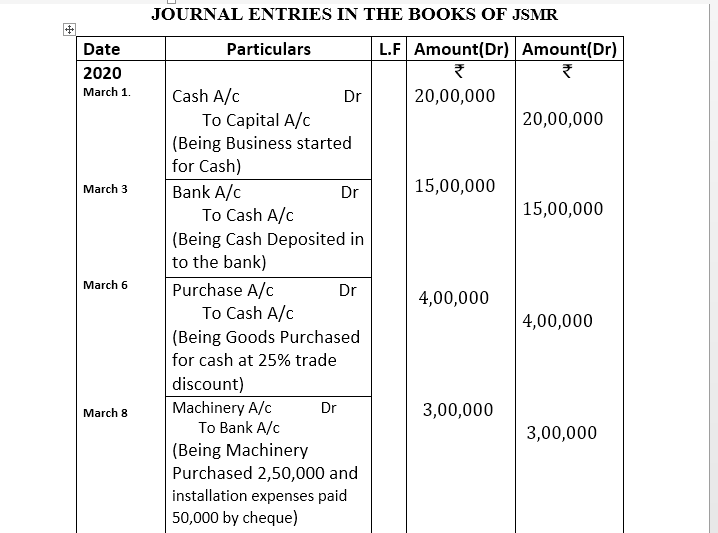

The date of the transaction the accounts to be debited and credited the amounts of the debit and credit entries a brief explanation of each transaction formatting when recording journal entries include a date of when the transaction occurred. Journal, ledger and trial balance (financial accounting) in this article, we will discuss the basic concepts of financial accounting i.e. Asset, liability, equity, revenue, expense) with the ending account balance.

A trial balance is a summarization of all journal entries made, aggregated by account. A trial balance is a worksheet with two columns, one for debits and one for credits, that ensures a company’s bookkeeping is mathematically correct. The result is a report that shows the total debit or credit balance for each account, where the grand total of the debits and credits stated in the report sum to zero.

The trial balance is the next step in the accounting cycle. A trial balance is a report that lists the balances of all general ledger accounts of a company at a certain point in time. Trial balance is the first step in preparing the financial statements of any firm.

To prepare the financial statements, a company will look at the adjusted trial balance for account information. This series focuses on balancing a trial balance, and correcting errors with journals, for aat students working on. An adjusted trial balance is a list of all accounts in the general ledger, including adjusting entries, which have nonzero balances.

20 transactions with their journal entries, ledger and trial balance The accounts reflected on a trial balance are related to all major accounting items, including assets, liabilities, equity, revenues, expenses, gains,. Prepare journal entries to record the effect of acquiring inventory, paying salary, borrowing money, and selling merchandise.