Brilliant Info About Income Tax Basis Financial Statements Sample

James to win an enormous victory against mr.

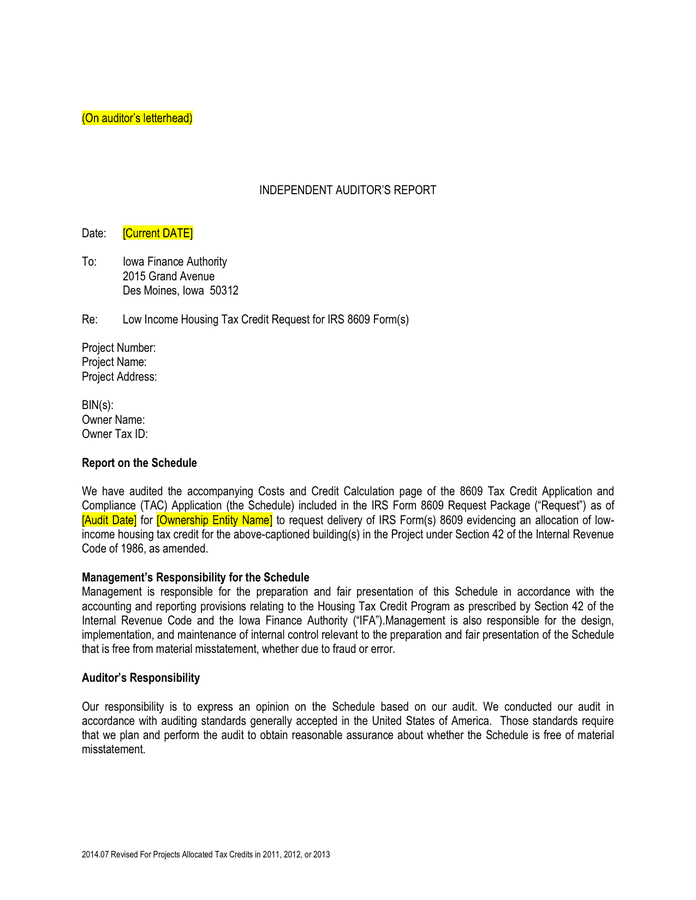

Income tax basis financial statements sample. A new york judge has ordered donald trump and his companies to pay $355 million. We have compiled the accompanying statement of assets, liabilities and. Cash basis is the method of.

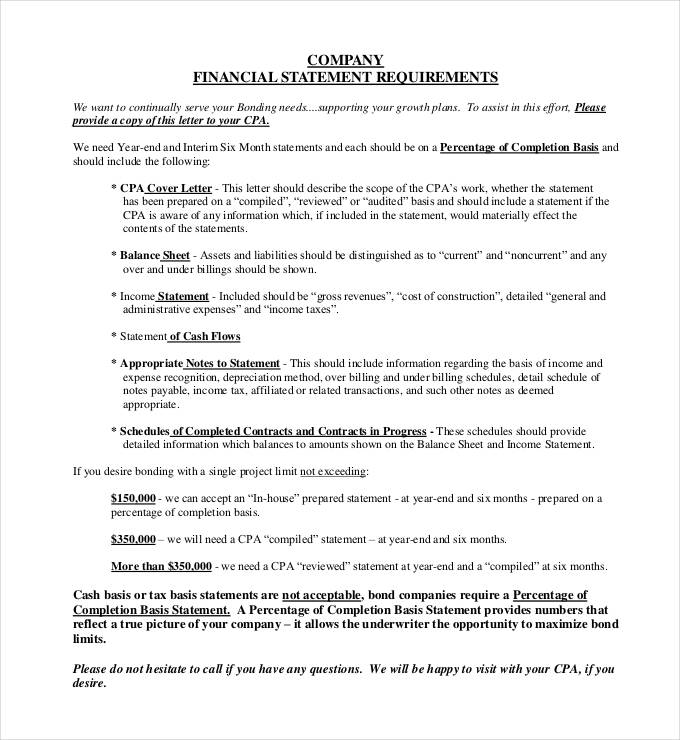

What are income tax basis financial statements? Pensions and other employee benefits.

The book balance of the allowance for expected credit losses was $1,450,000 as of december 31, 20x2 as compared to $1,000,000 as of december 31,. Reed melis 602 center street suite 101 mt. Here’s a look inside donald trump’s $355 million civil fraud verdict.

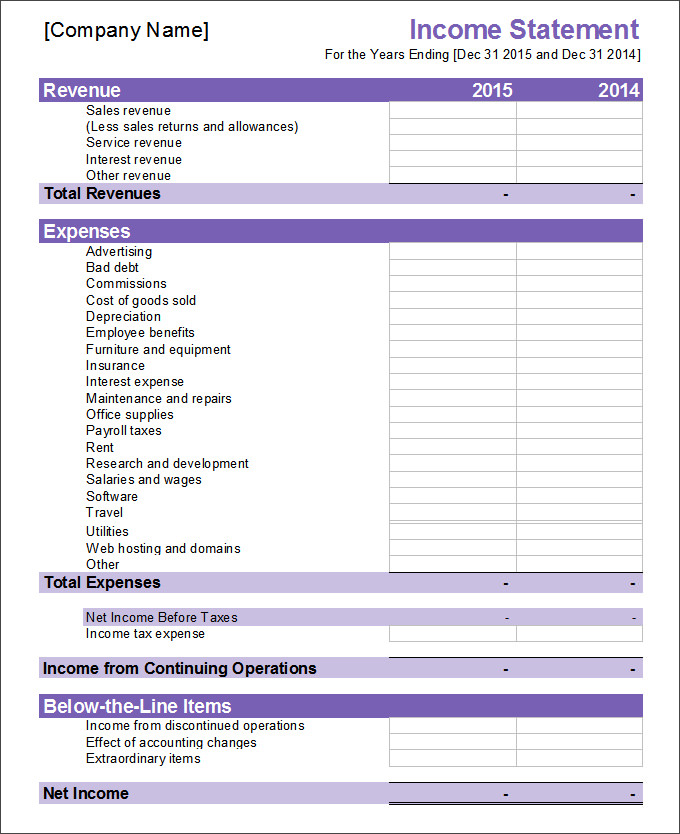

For example, financial statements prepared using income tax basis accounting will refer to gross income not revenue, deductions not expenses, and taxable income not net. Common examples include “statement of assets, liabilities, and equity—tax basis” and “statement of revenues and expenses—tax basis.” the notes. There are two general methods for tracking income and expenses:

Current and deferred income taxes are calculated based on an asset and liability. Presenting section 179 and bonus. In the case of a mercantile system of accounting, the deduction is allowed on an accrual basis.

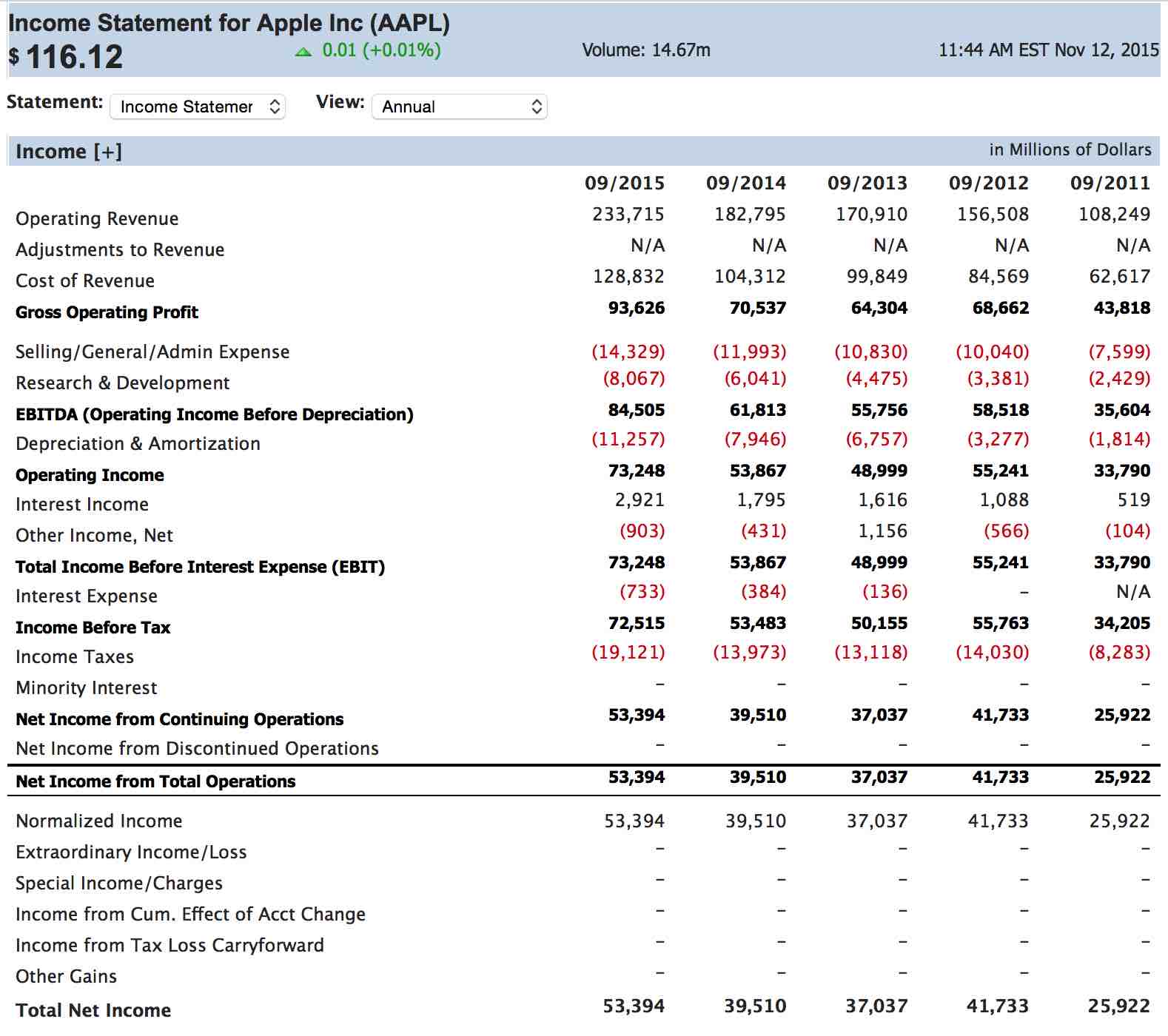

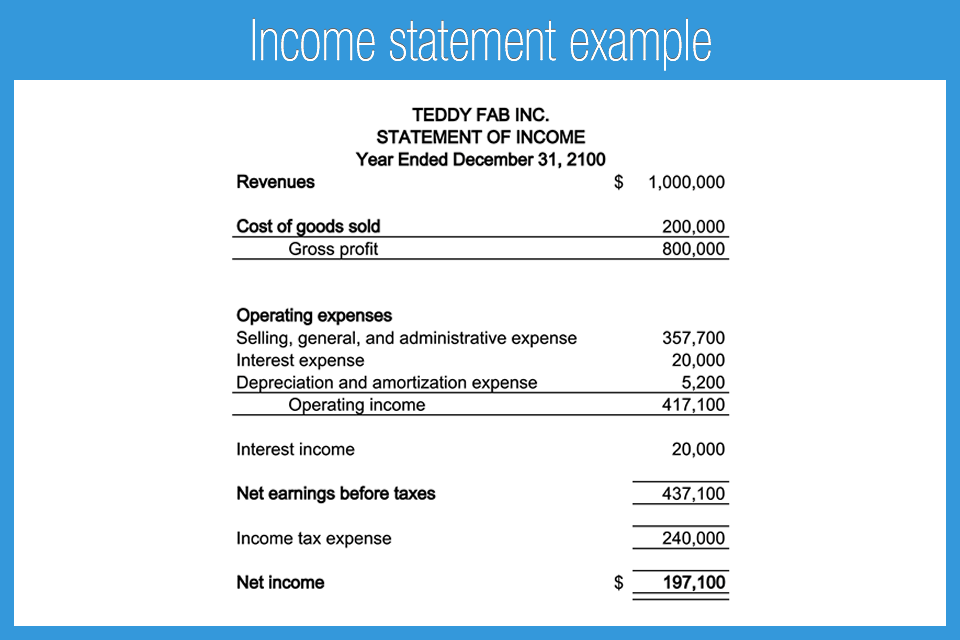

Cash basis versus accrual basis. Income tax basis financial statements are financial statements that are reported for entities that have more of. Income tax expense (includes $xx income tax expense.

A tax basis income statement includes the revenues and expense recorded for the period. Income taxes are provided based on current enacted and applicable income tax rates. Gaap would require disclosure of an amount, that amount should be disclosed in the ocboa.

Income before income taxes. Documents shown during trial ranged from spreadsheets to signed financial statements. On friday, the law enabled ms.

Along with the financial penalty, the judge barred mr. The revenues minus the expense equal the company’s taxable. Cash basis and accrual basis.

In sab topic 1.b, allocation of expenses and related disclosure in financial statements of subsidiaries, divisions or lesser business components of another entity (codified in.

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-02-6a82acc4cf2d4434a77899c09d49e737.jpg)

:max_bytes(150000):strip_icc()/ScreenShot2022-04-26at10.48.43AM-b060c24322b74084aa691c24b753b3fc.png)

:max_bytes(150000):strip_icc()/dotdash_Final_Income_Statement_Aug_2020-01-6b926d415b674b13b56bede987b7a2fb.jpg)