Perfect Tips About Example Of Vertical Balance Sheet

![[Solved] Please help with my review! 1. Explain briefly the ratios and](https://images.template.net/wp-content/uploads/2016/09/20052308/Vertical-Balance-Sheet-Template.jpg)

Apply vertical analysis and comment on their financial positions.

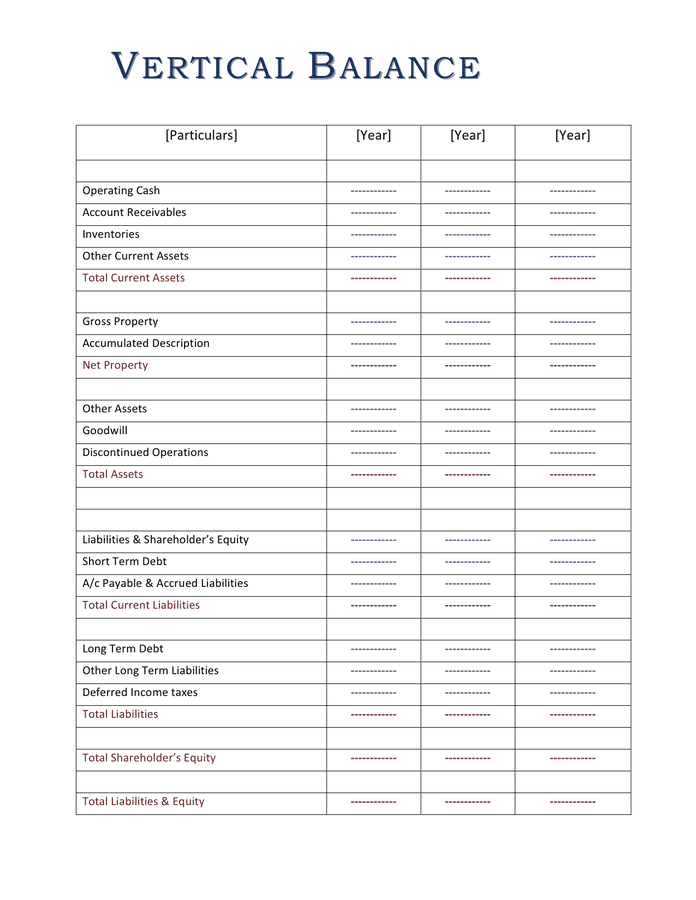

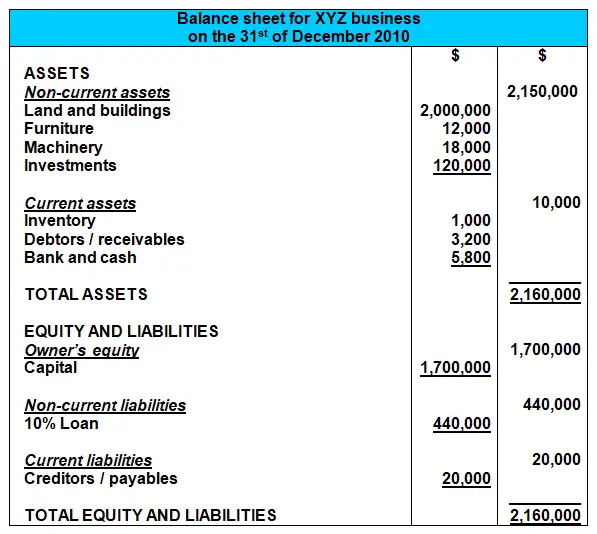

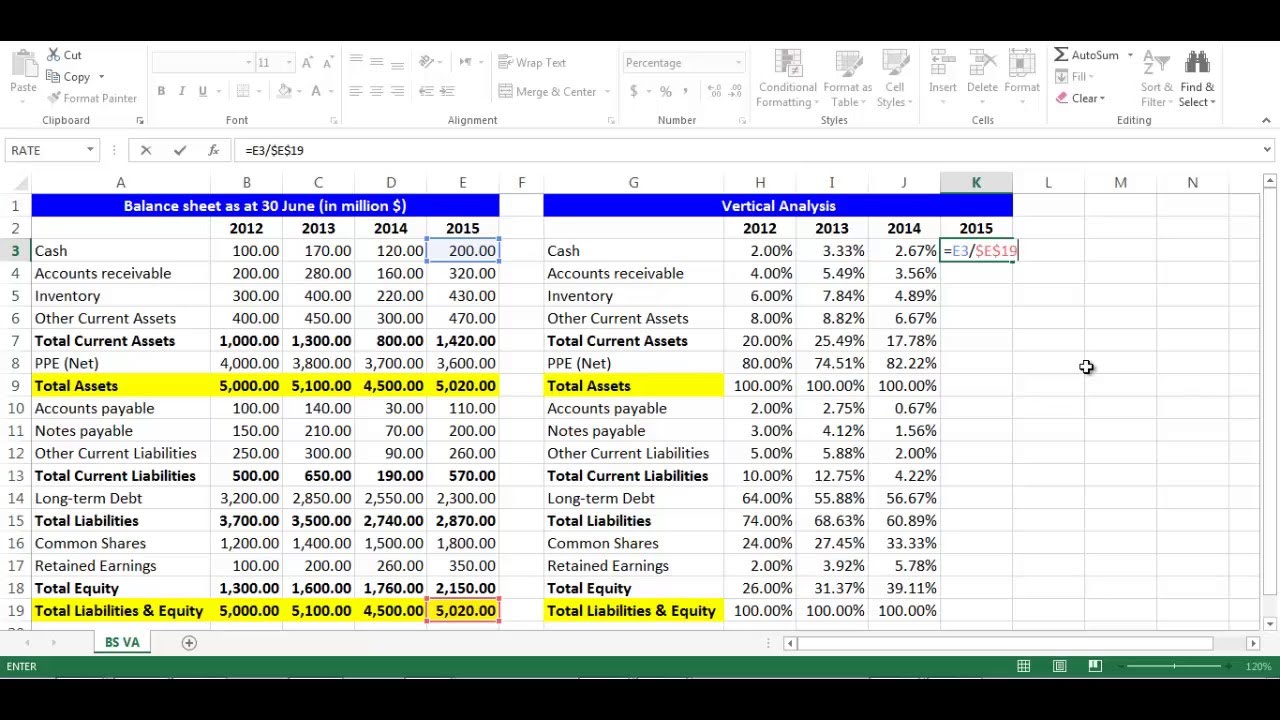

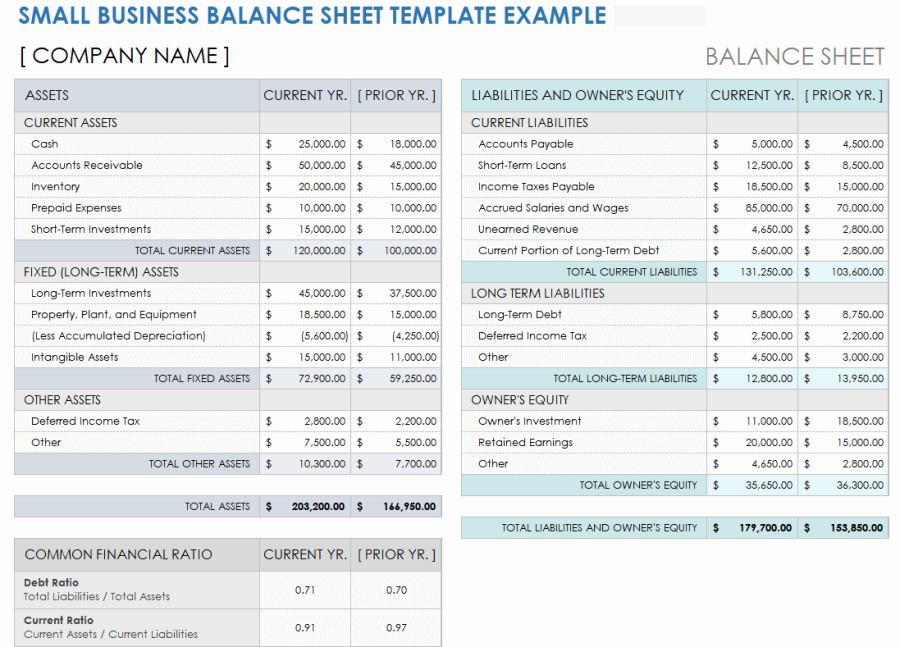

Example of vertical balance sheet. Vertical analysis, balance sheet = balance sheet line item ÷ total assets vertical analysis calculator we’ll now move to a modeling exercise, which you can access by filling out the form below. For example, this analysis can be performed on revenues, cost of. The intent of a vertical balance sheet is for the reader to make comparisons between the numbers on the balance sheet for a single period.

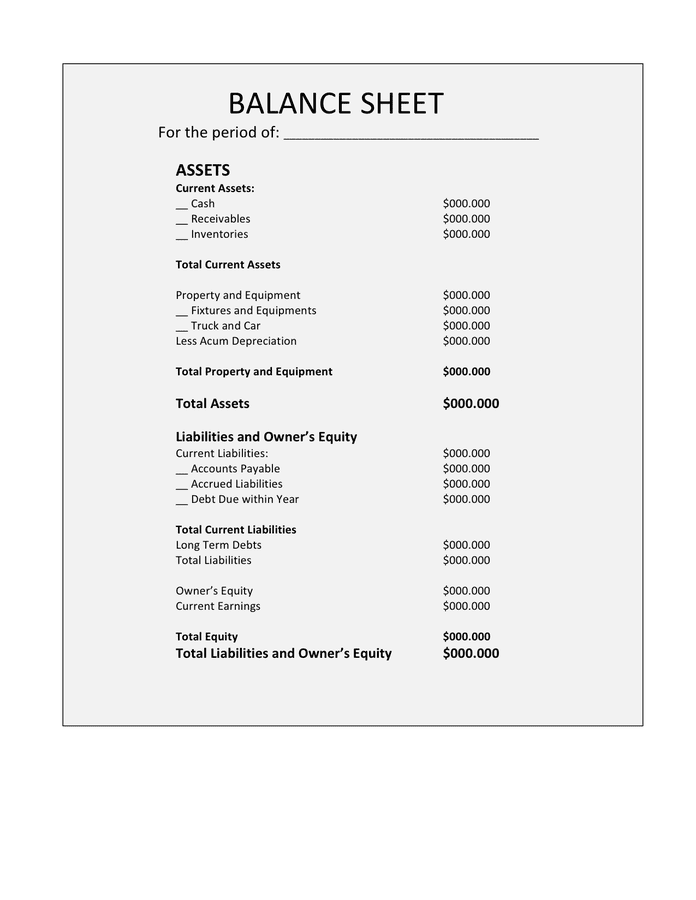

Vertical analysis shows a comparison of a line item within a statement to another line item within that same statement. Remember, on a balance sheet, your base number is always your total assets and total liabilities, and equity. ($50,000 / $64,000) × 100 = 78.13% **2018:

For example, a business may compare cash to total assets in the current year. Vertical analysis of income statement. Vertical analysis refers to the analysis of specific line items in relation to a base item within the same financial period.

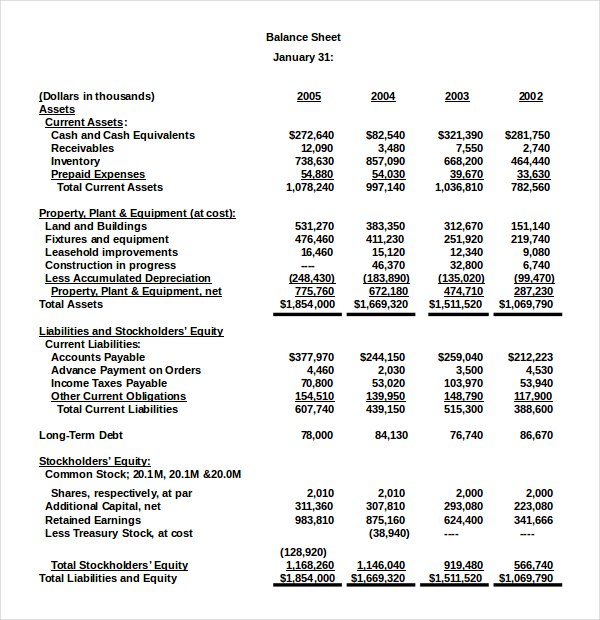

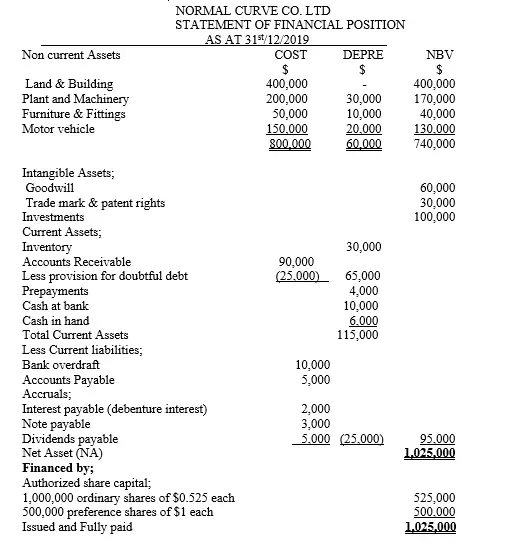

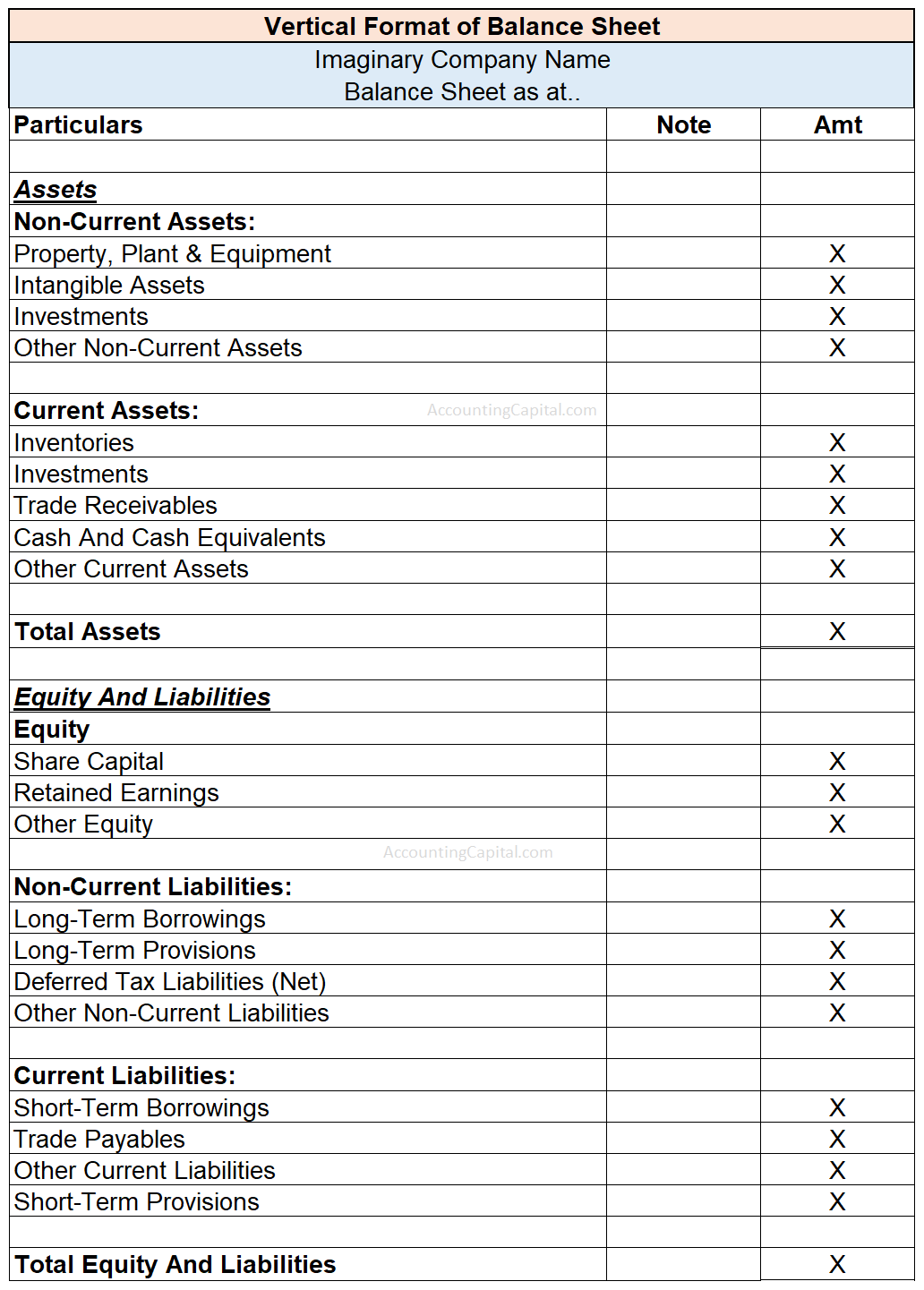

By examining the relationship between liabilities and equity as percentages of total assets, you can assess the level of debt and the proportion of equity financing. The image below is an example of a comparative balance sheet of apple, inc. A vertical balance sheet is one in which the accounting report format or design is shown in a sole column of numbers, starting with resource or asset details, trailed by liability details, and finishing with investors’ value or shareholders’ equity details.

This balance sheet compares the financial position of the company as of september 2020 to. Dec 5th, 2022 | 18 min read contents [ show] a balance sheet is one of the three crucial financial statements that help in the evaluation of a business. For example, someone might compare the current assets total to the current liabilities total to estimate the liquidity of a business as of the balance sheet date.

Say jackson widget company’s balance sheet shows the following amounts as of december 31, 2023: Vertical analysis for income statements ($43,000 / $56,100) × 100 = 76.65% 2.

In this lesson, we explain what the vertical analysis of a balance sheet or the vertical analysis of the statement of financial position is and why it is done. Horizontal analysis of financial statements can be performed on any of the item in the income statement, balance sheet and statement of cash flows. In the 3rd year, the cogs decreased compared to the previous years, and the income increased.

The calculations are performed in google sheets, but you can easily do the same in excel. Vertical analysis of the balance sheet provides insights into a company’s financial health and leverage. Comparative balance sheet with vertical analysis example.

Vertical format of balance sheet the vertical format is also known as the report format. Below are the balance sheets of x ltd and y ltd as of 31st december 2021. Let us now calculate the vertical analysis of the balance sheet with the help of another example.

Example of the vertical analysis formula let’s look at an example to see how applying the vertical analysis formula might work in the real world. For example, the amount of cash reported on the balance sheet on dec. The format is categorized into sections that are in descending order of liquidity, which means prioritizing items that are less liquid in nature.