Perfect Tips About Single Statement Of Comprehensive Income

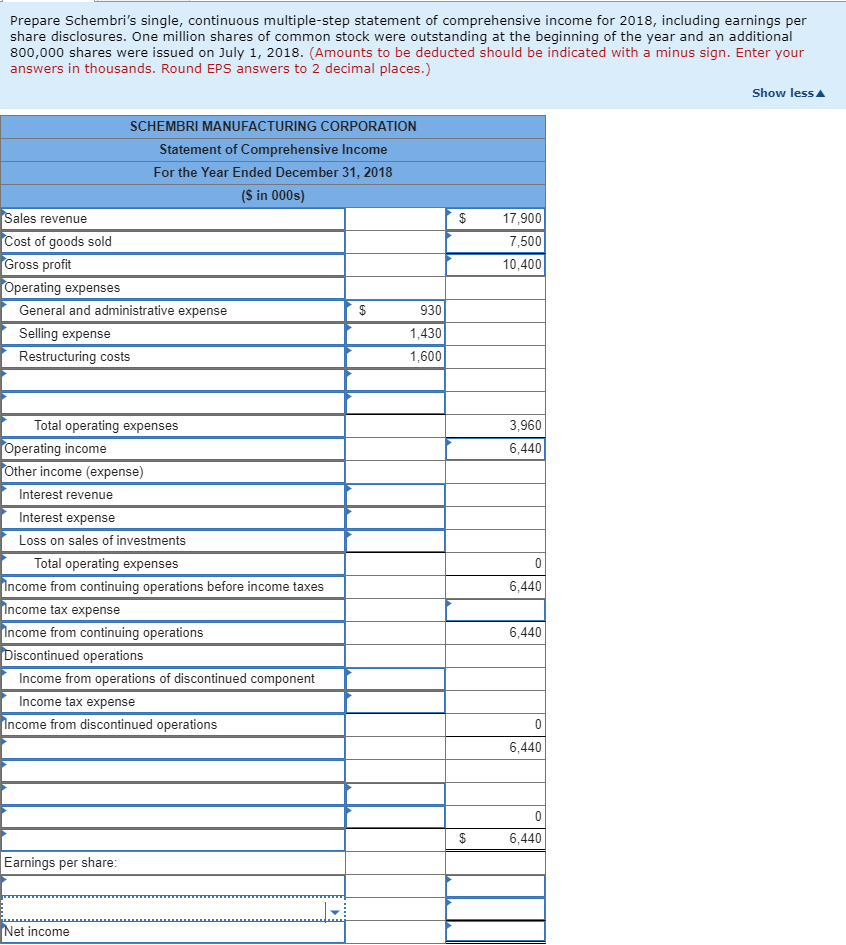

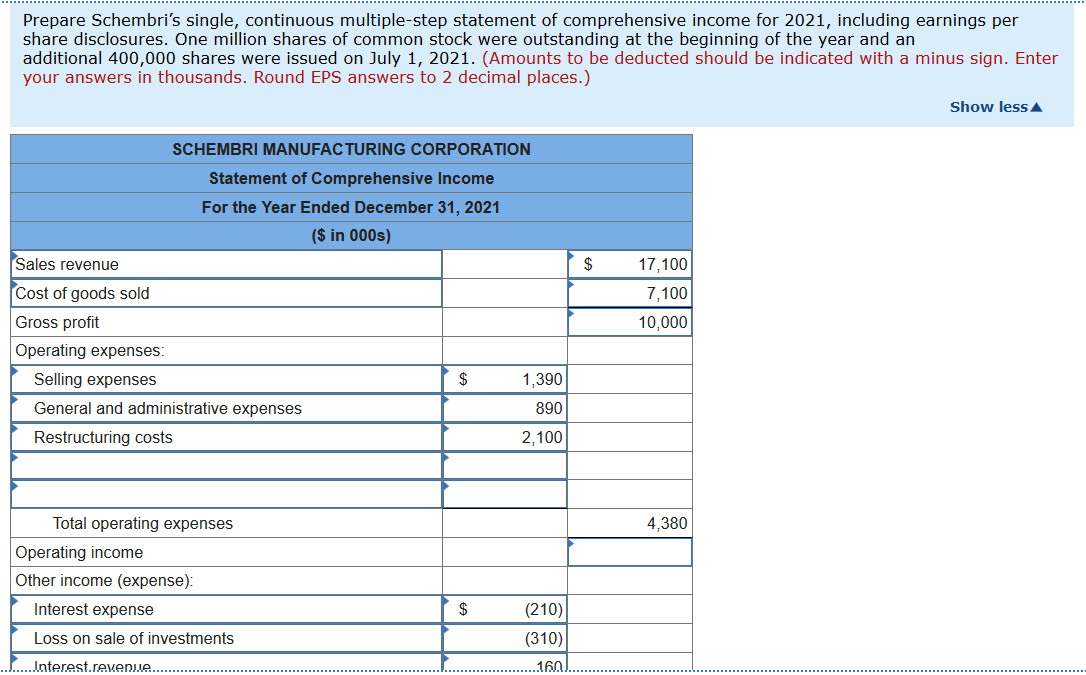

Statement of comprehensive income 108 presented in a single.

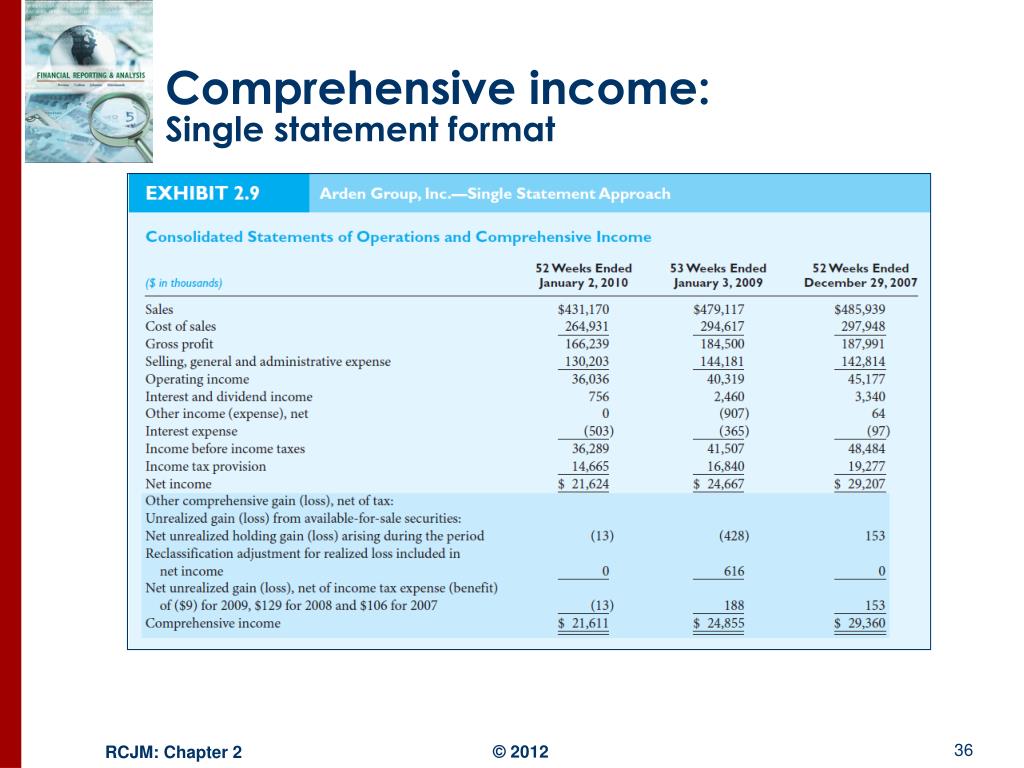

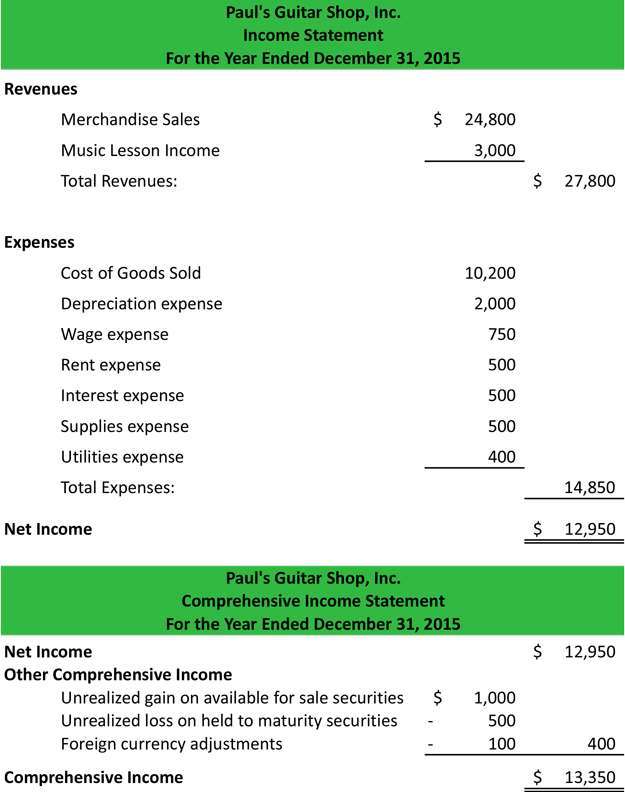

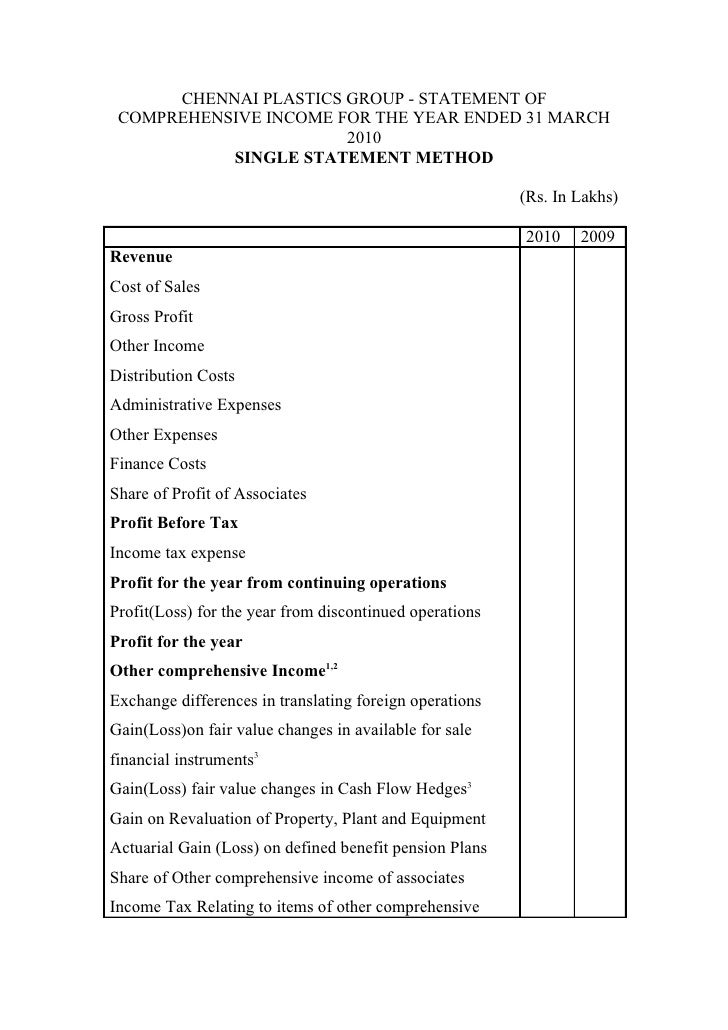

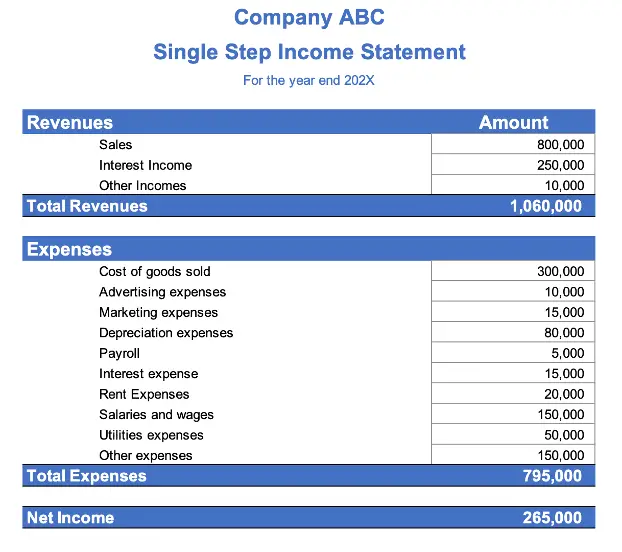

Single statement of comprehensive income. 1 this section requires an entity to present its total comprehensive income for a period—ie its financial performance for the period—in one or two financial. Proponents of the single statement prefer its simplicity, while proponents. Single step income statement is a method of expressing a profit and loss statement that lists all expenses, including the cost of goods sold, in one column rather than breaking.

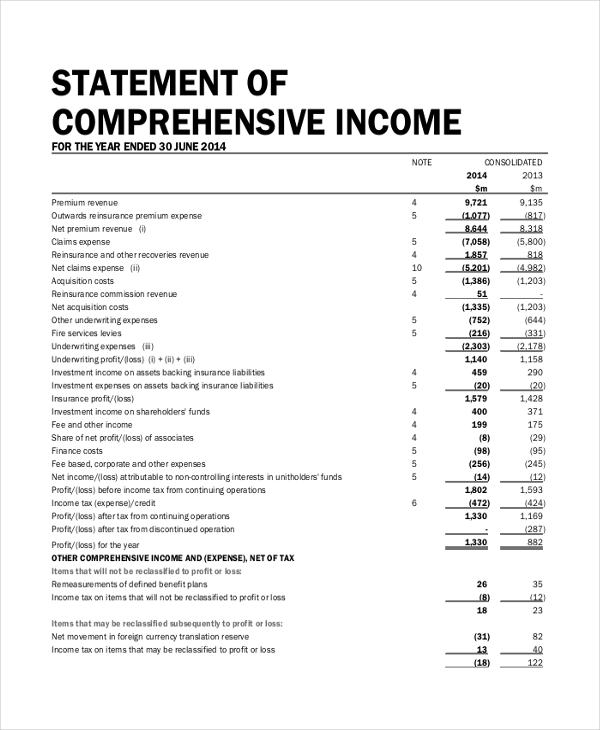

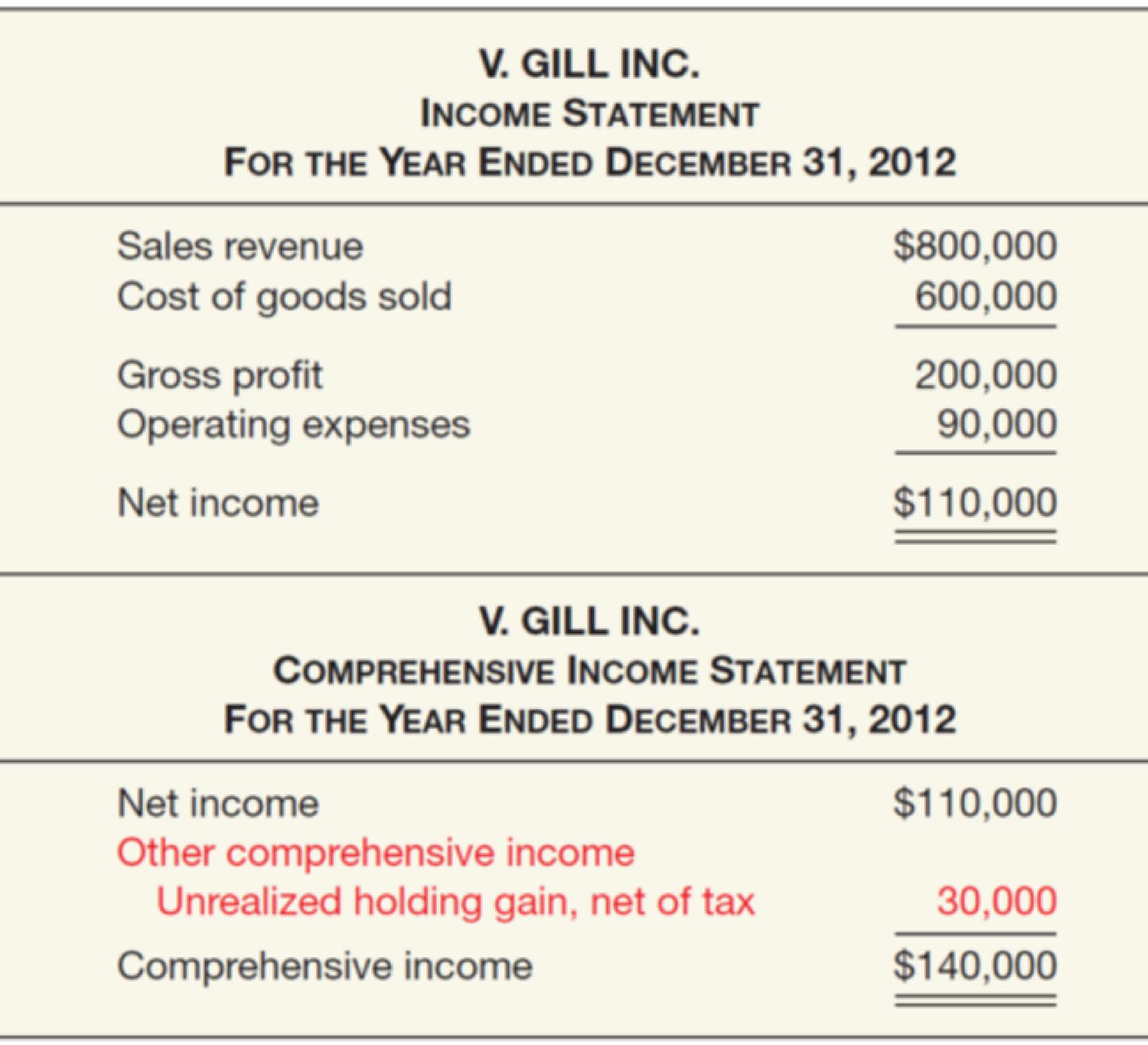

Comprehensive income may be presented in a single statement or in two consecutive statements. What is a statement of comprehensive income? The statement of comprehensive income illustrates the financial performance and results of operations of a particular company or entity for a period of.

A single statement: A reporting entity should disclose the income tax effect of each component of oci, including reclassification adjustments, either on the face of the statement in which those. The ‘statement of comprehensive income’;

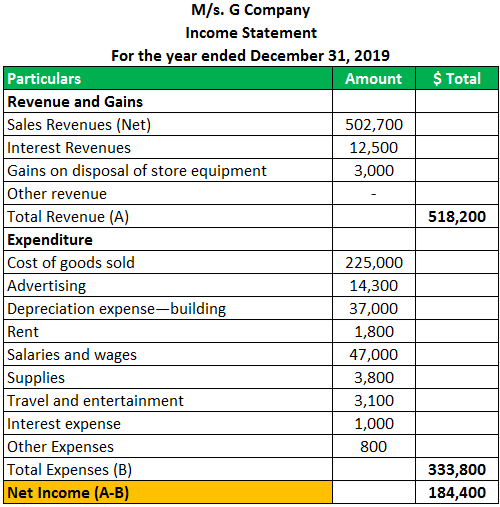

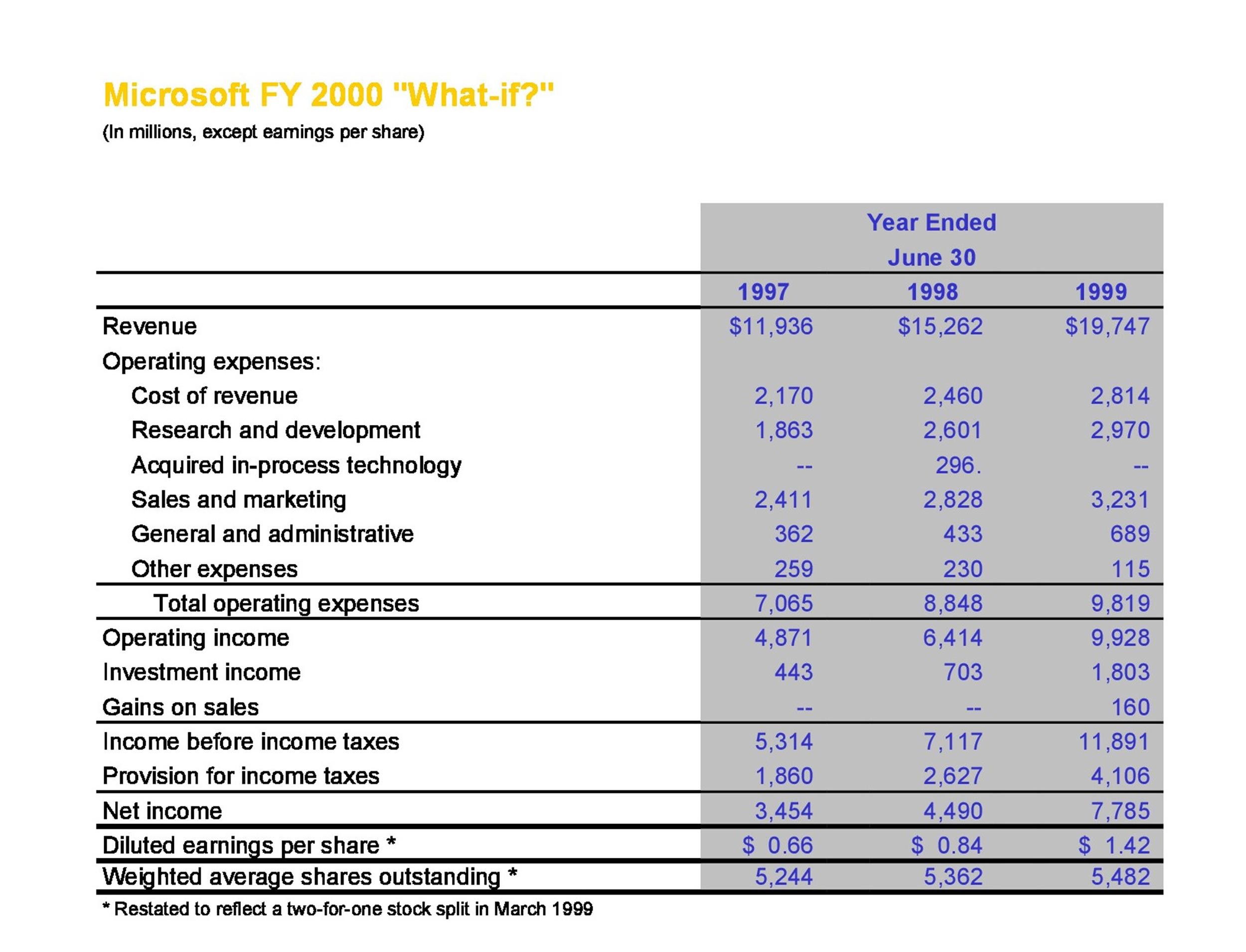

Course fundamentals of accounting 1 (acco 05bc) 137. Organising the statement of profit 106 or loss by function of expenses appendix b: One of the most important components of the statement of comprehensive income is the income statement.

An income statement displaying profit or loss followed. It summarizes all the sources of revenue and expenses, including taxes and interest charges.

A separate income statement and a statement beginning with profit or loss and displaying components of other comprehensive income. Ias 1, presentation of financial statements, permits an entity to present comprehensive income either in a single statement of comprehensive income or in two separate. The statement of comprehensive income and other comprehensive income continues to require the profit and loss account to be laid out in line with that.

A single statement or.