Formidable Tips About Sample Of Trial Balance In Accounting

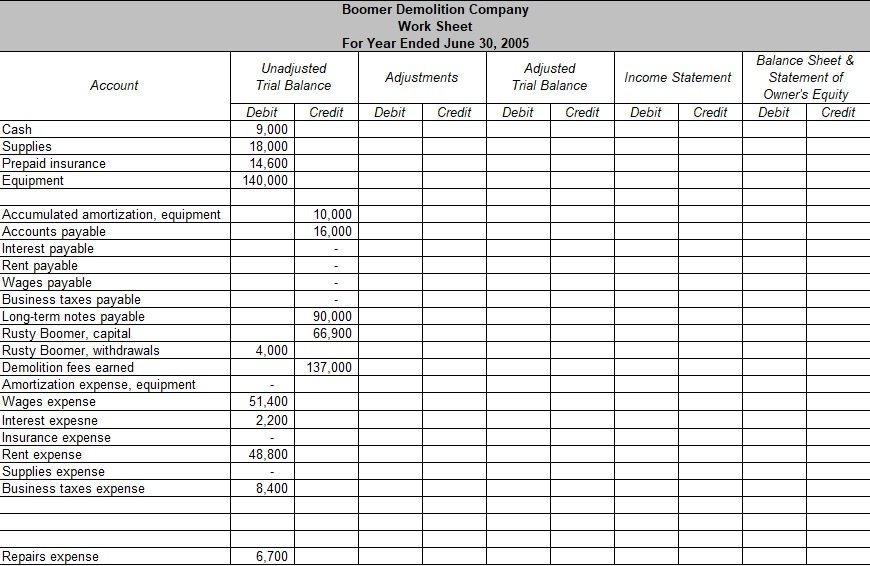

An accountant will use the trial balance to see if any adjustments are required.

Sample of trial balance in accounting. The purpose of the trial balance is to test the equality between total. It is important to note that just. The service supplies account had a debit balance of $1,500.

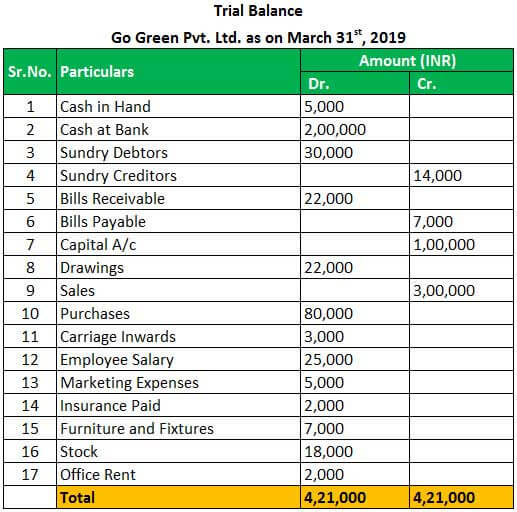

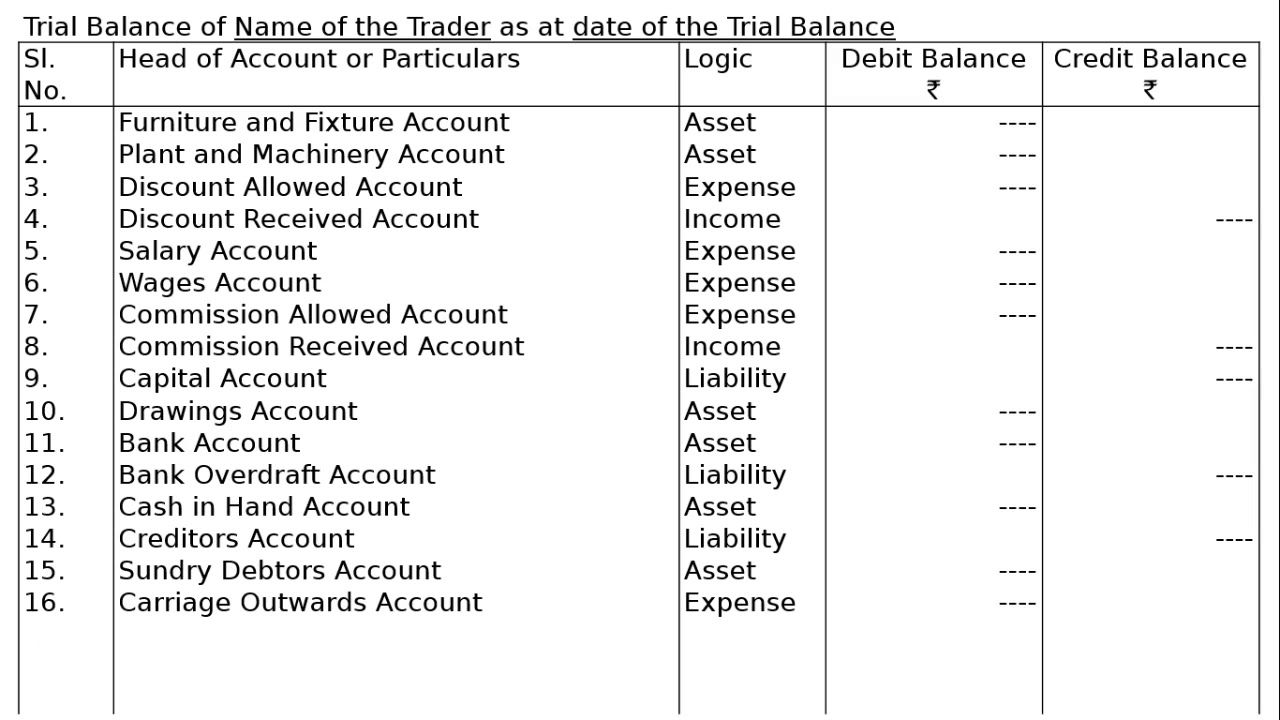

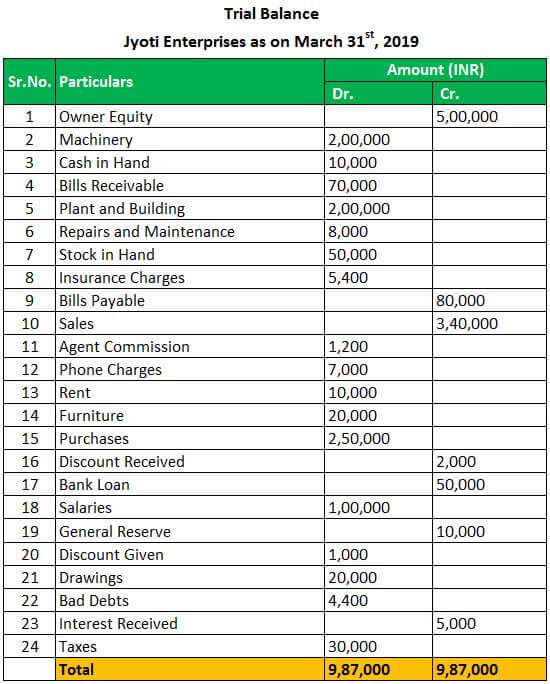

A trial balance is a report that lists the balances of all general ledger accounts of a company at a certain point in time. It helps find any errors in the financial records by checking if the debit column’s total matches the credit column’s total. An organisation prepares a trial balance at the end of the accounting year to ensure all entries in the bookkeeping system are accurate.

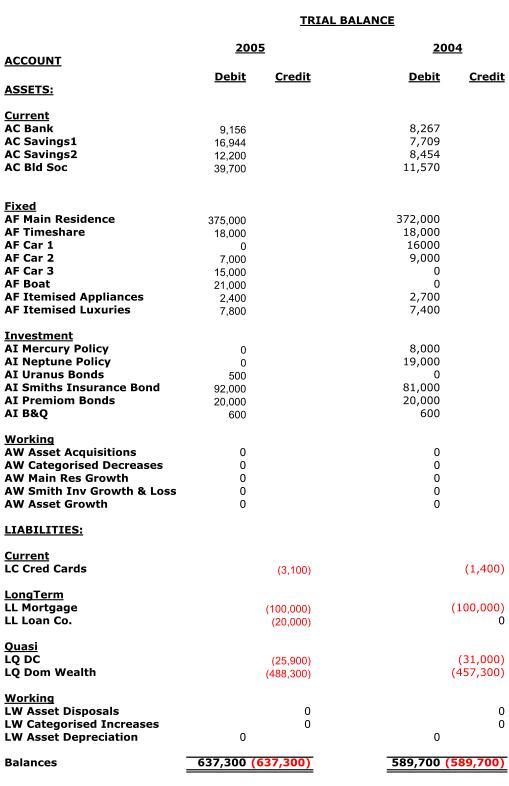

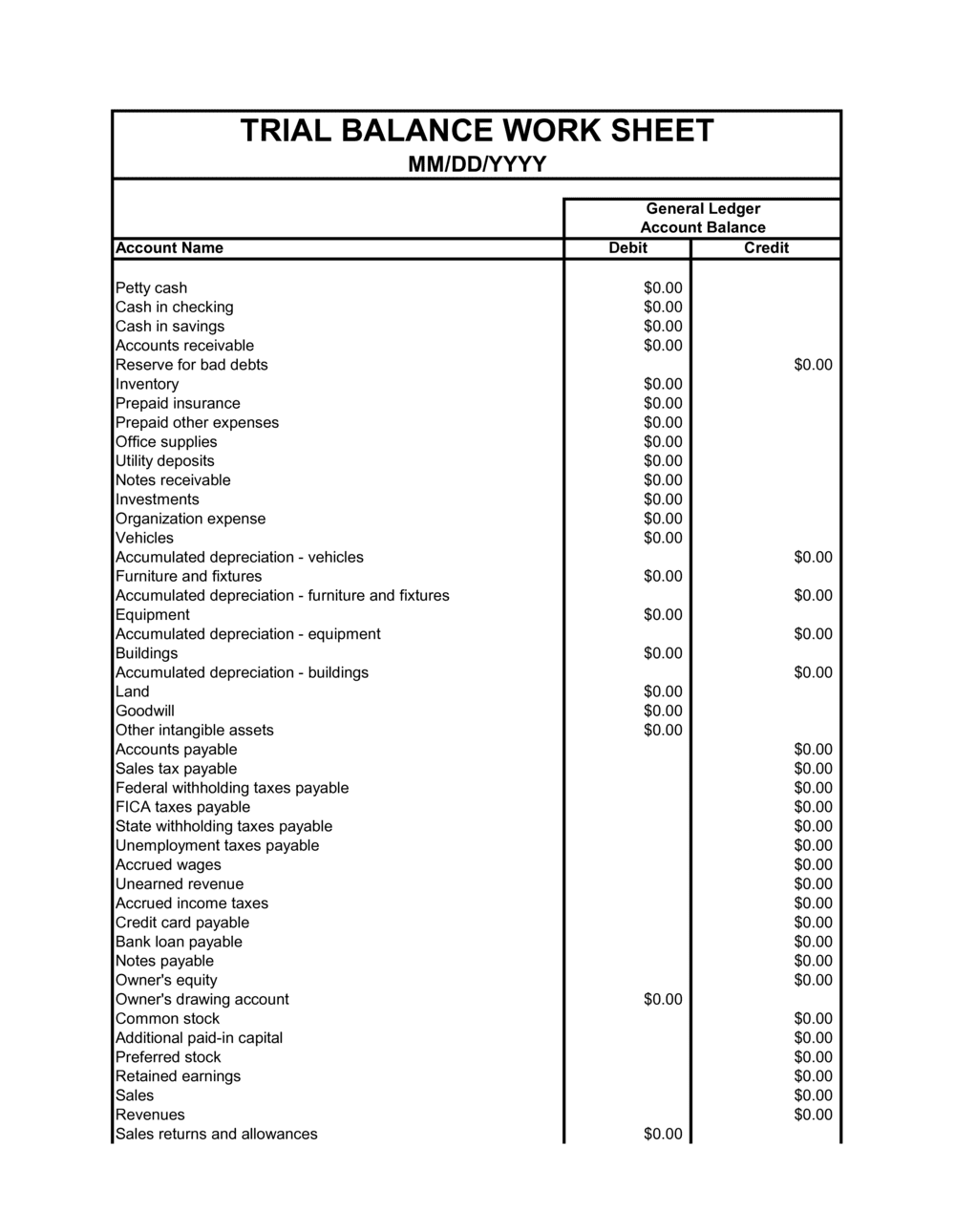

A trial balance is a worksheet with two columns, one for debits and one for credits, that ensures a company’s bookkeeping is mathematically correct. What adjustments do accountants make? In a trial balance, each general ledger account is listed with the account number, account name description, debit amount in the debit column, and credit amount in the credit column.

115,000 cash at bank rs. Service supplies is credited for $900. 420,000 cash in hand rs.

Service supplies expense is debited for $900. After posting the above entries, they will now appear in the adjusted trial balance. What is adjusted trial balance?

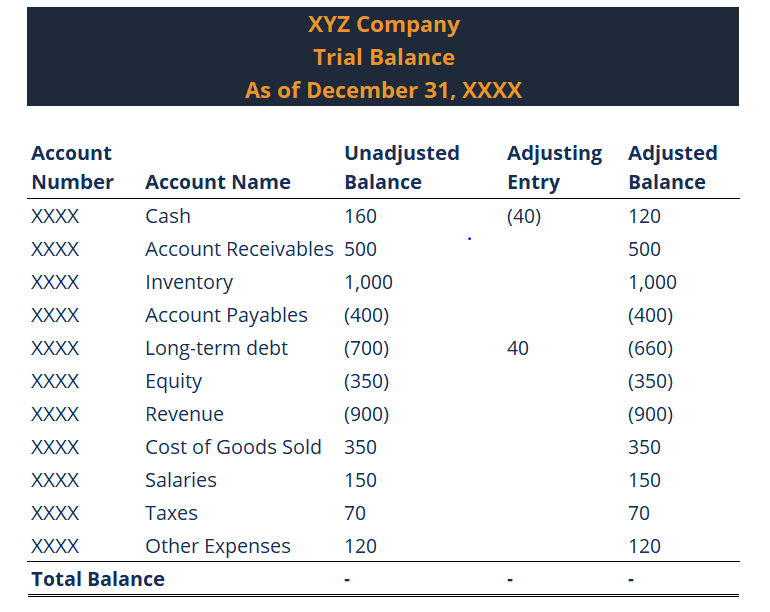

Following is an example of what a simple trial balance looks like: Based on the ledger we prepared in the previous lesson, the trial balance would look like this: The suffix “account” or “a/c” may or may not be written after the.

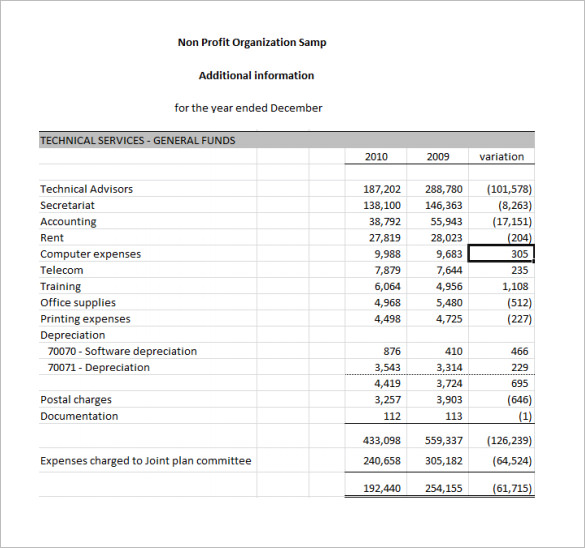

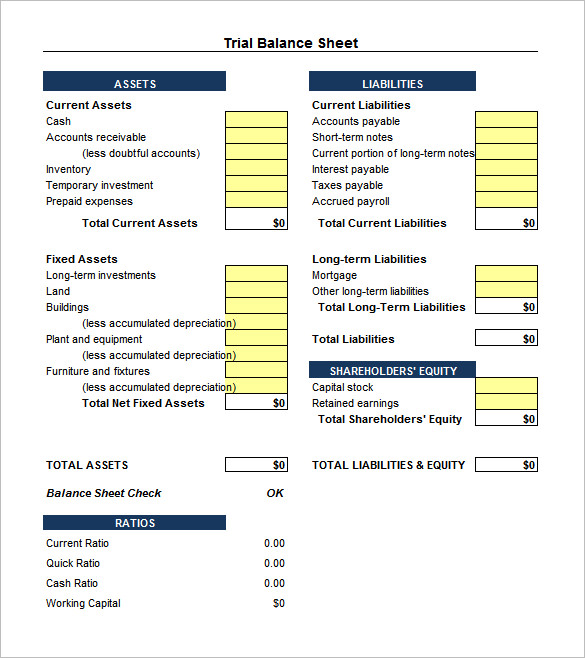

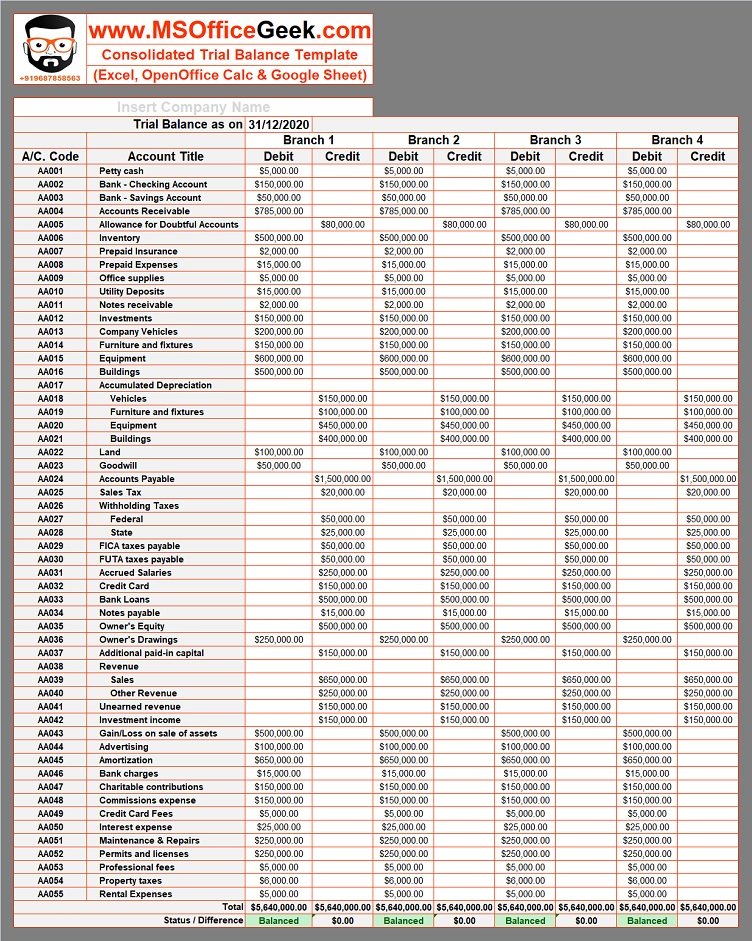

Example how to use the trial balance. This sample trial balance report reflects the closing balance of different ledger accounts related to all transactions that took place within the business. As you can see, the report has a heading that identifies the company, report name, and date that it was created.

A trial balance is a list of all accounts in the general ledger that have nonzero balances. Resources technical skills accounting articles trial balance trial balance a vital auditing technique used to ensure whether the total debit equals the total credit in the general ledger accounts, which plays a crucial role in creating financial statements. This article is a guide to the format of trial balance.

At the end of every accounting period the accounting books are to be closed and preparing the trial balance is the first step towards it. Title provided at the top shows the name of the entity and accounting period end for which the trial balance has been prepared. Definition of trial balance in accounting.

The debits and credits include all business. Here, we discuss trial balance examples in excel and their purpose with a detailed explanation. This trial balance example includes an image and a description of a trial balance.