First Class Info About Pharmaceutical Industry Average Financial Ratios 2018

Current industry pe.

Pharmaceutical industry average financial ratios 2018. This essay sample on pharmaceutical industry average financial ratios 2018 provides all necessary basic info on this matter, including the most common “for. Last 12 months (68) 2016 (90) 2015 (125) last 5 years (529) all years (1,326) current. Average by year (number of financial statements) financial metric.

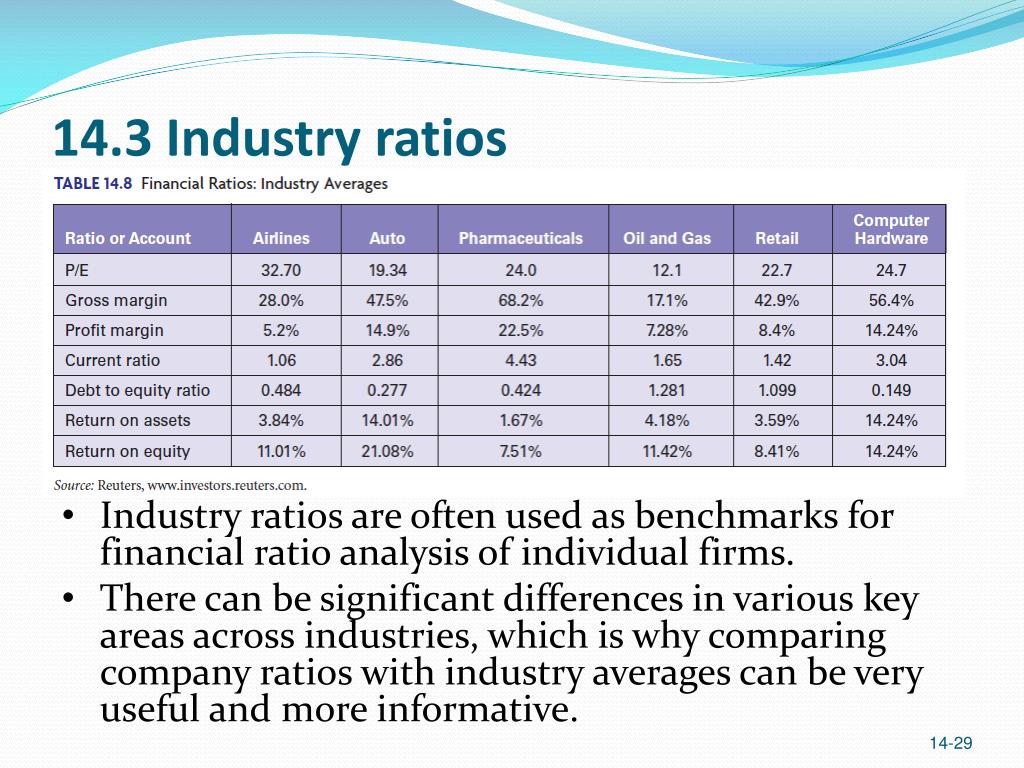

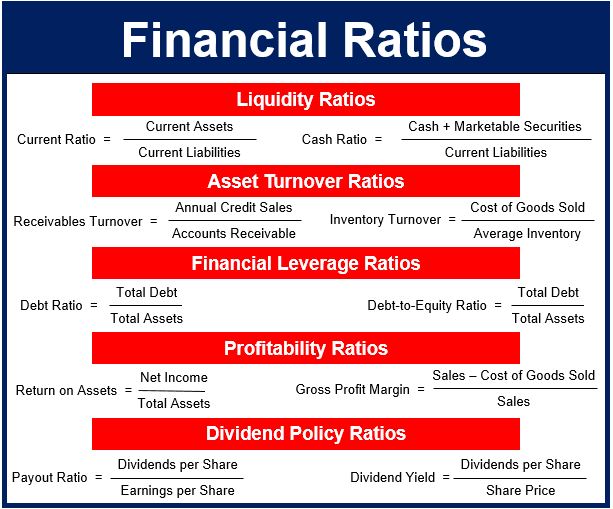

From 2000 to 2018, the cumulative revenue of companies in the pharmaceutical data set was $11.5 trillion, with gross profit of $8.6 trillion (74.5% of cumulative revenue), ebitda of $3.7 trillion (32.2% of cumulative revenue), and net. The different financial ratios are evaluated such as liquidity ratios, asset management ratios, profitability ratios, market value ratios, debt management ratios,. Studies and analysis of the financial performance of pharmaceutical companies both before and after the implementation of jkn still limited.

Pharmaceutical companies have been top performers in the healthcare sector. Investors are optimistic on the american pharmaceuticals industry, and appear confident in long term growth rates. The financial flexibility of pharmaceutical companies is also significantly affected by r&d costs, so the magnitude of profitability ratios can differ significantly.

Updated may 24, 2021 reviewed by david kindness what are key financial ratios for pharma? Novo nordisk heads the list with a sales to assets. Despite net new borrowings of 3.45% industry managed to improve liabilities to equity ratio in 3 q 2020 to 1.72, above major pharmaceutical preparations industry average.

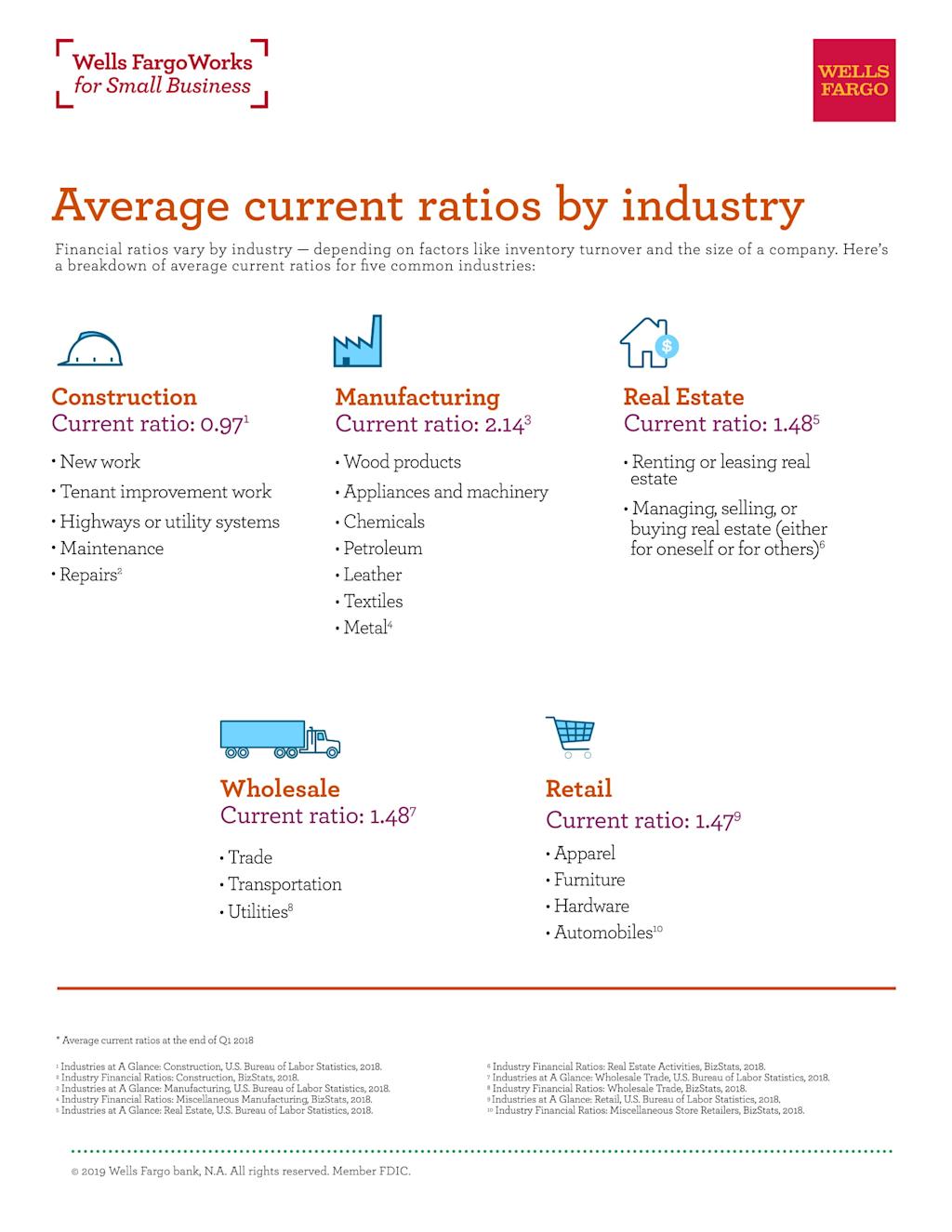

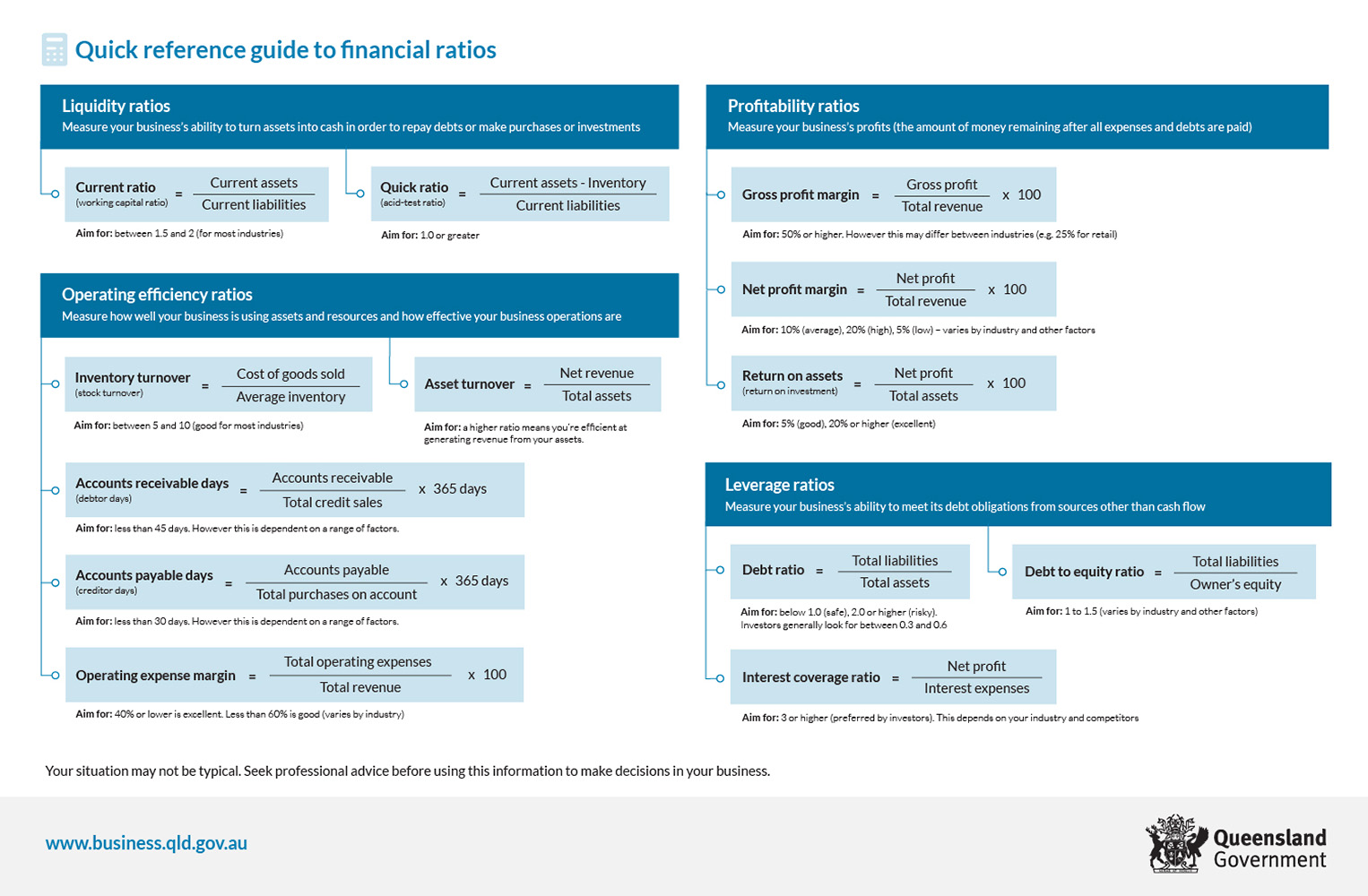

Ratios analyzed cover core financial ratios namely liquidity ratios, solvency ratios, activity ratios and profitability ratios. Mckinsey on finance 68 2018 pharma m&a exhibit 1 of 2 the share of revenues coming from innovation sources outside of big pharma is rising. This statistic lines up some of the global top pharmaceutical companies' sales to assets ratio for the year 2022.

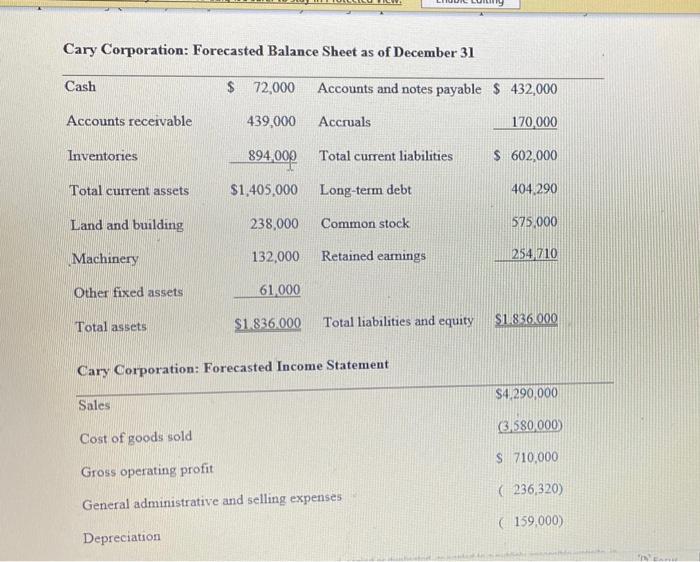

On the trailing twelve months basis biotechnology & pharmaceuticals industry's cash & cash equivalent grew by 136.47 % in the 4 q 2023 sequentially, faster than current. On the trailing twelve months basis major pharmaceutical preparations industry's ebitda grew by 13.83 % in 4 q 2023 sequentially, while total debt decreased, this led to. Kimia farma, tbk with ratios from 2016 to 2018.

Hence, this are study would like.

/GettyImages-941395072-ff92e929f7494d9286d50006505262cf.jpg)