Lessons I Learned From Info About Liabilities And Equity Balance Sheet

Understanding balance sheets the assets on the balance sheet.

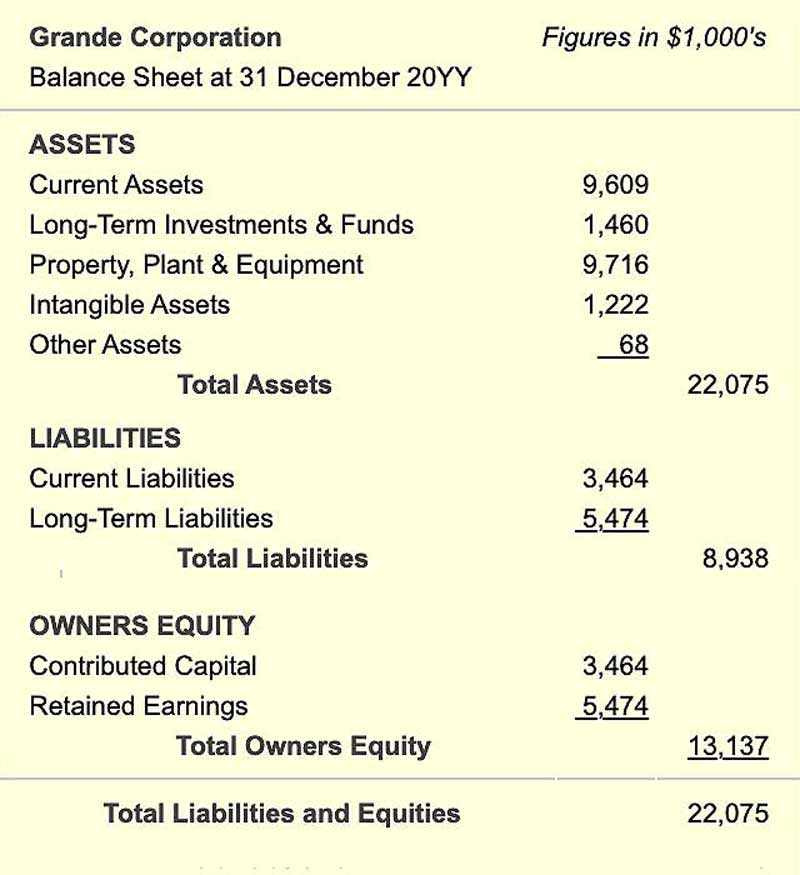

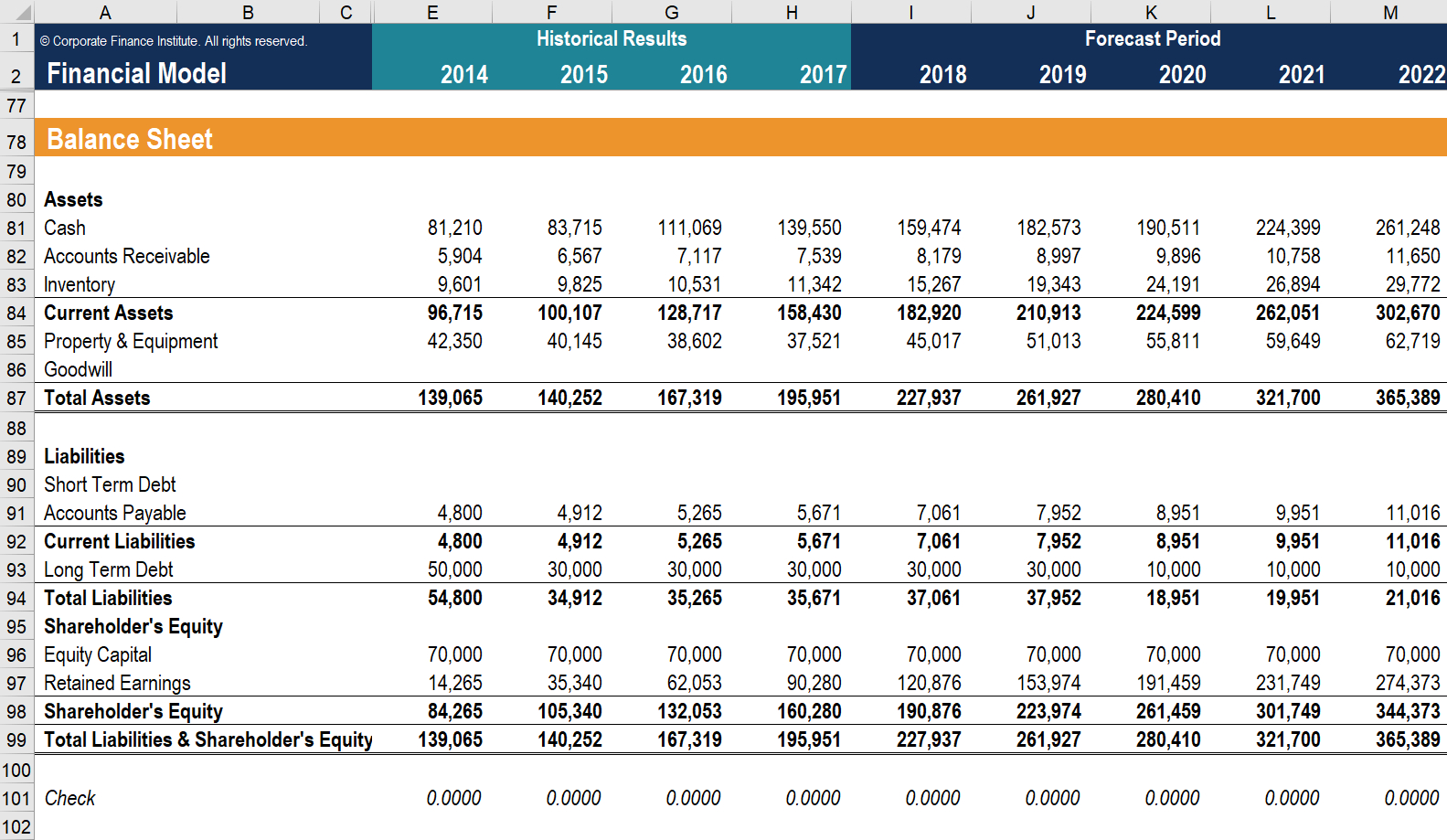

Liabilities and equity balance sheet. You pay for your company’s assets by either borrowing money (i.e. Since the corporation's assets are shown at. September 4, 2023 what is a balance sheet?

The balance sheet is based on the fundamental equation: As a result accountants often refer to stockholders' equity as the difference (or residual) of assets minus liabilities. What the company has an obligation to pay.

A balance sheet is a financial statement summarizing a company's assets, liabilities, and shareholder's equity at a specific time, giving an overview of its financial position author: It can also be referred to as a statement of net worth or a statement of financial position. The balance sheet is one of the financial statements through which a company presents the shareholders’ equity, liabilities, and assets at a particular time.

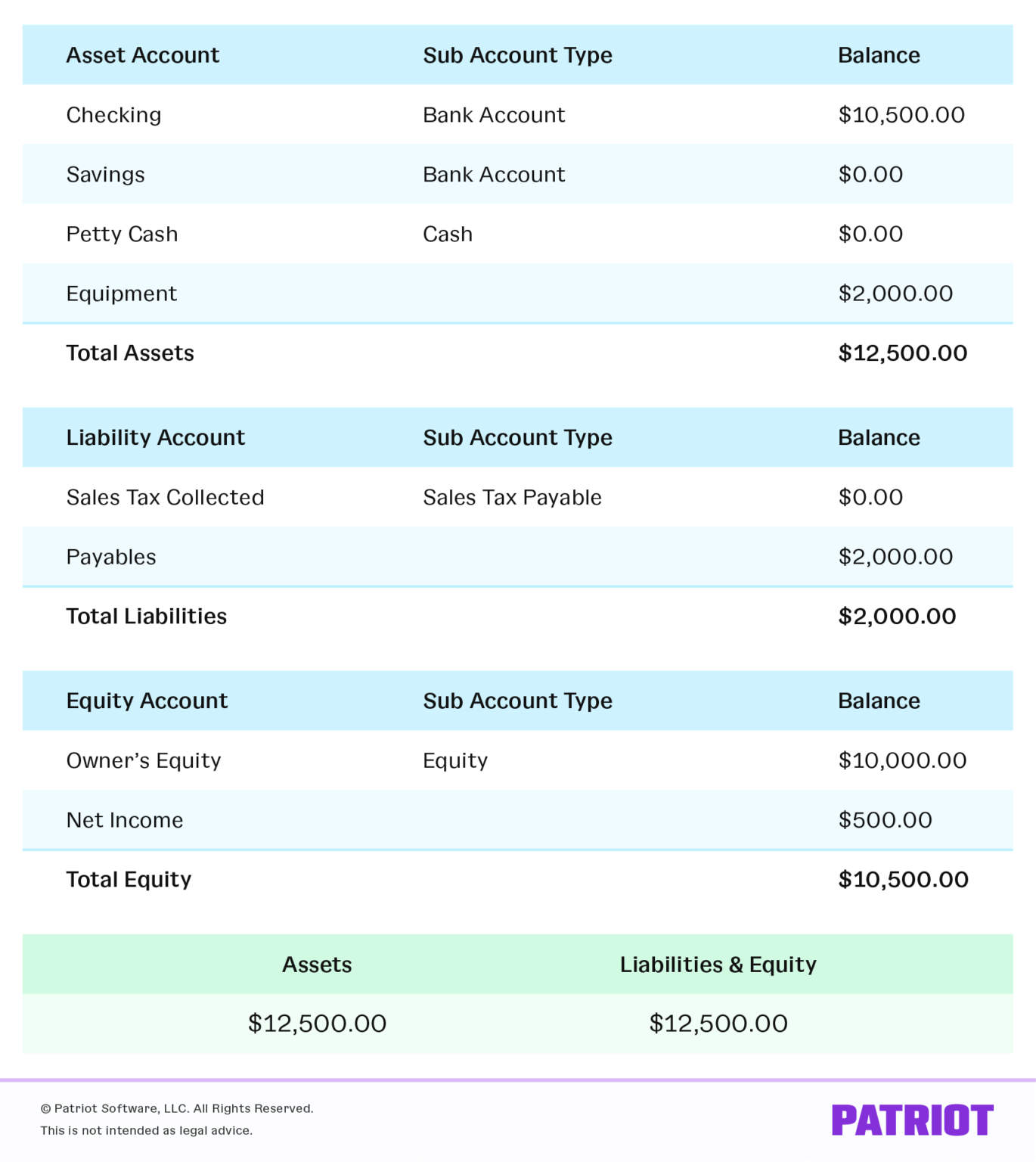

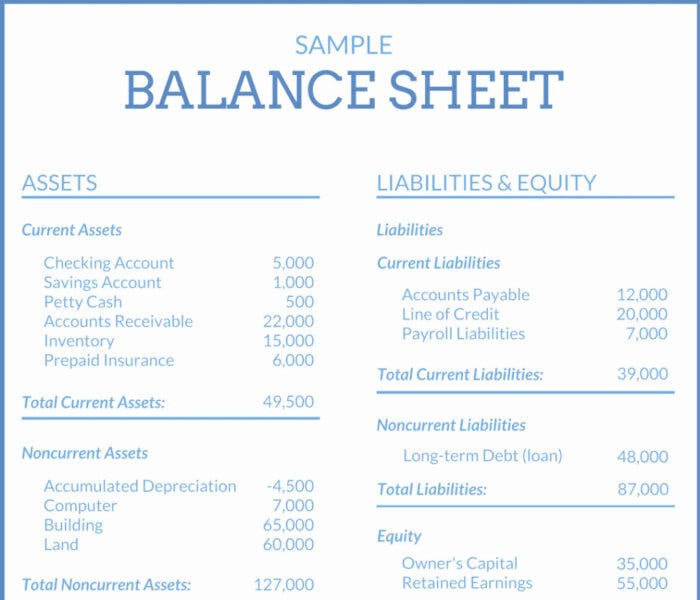

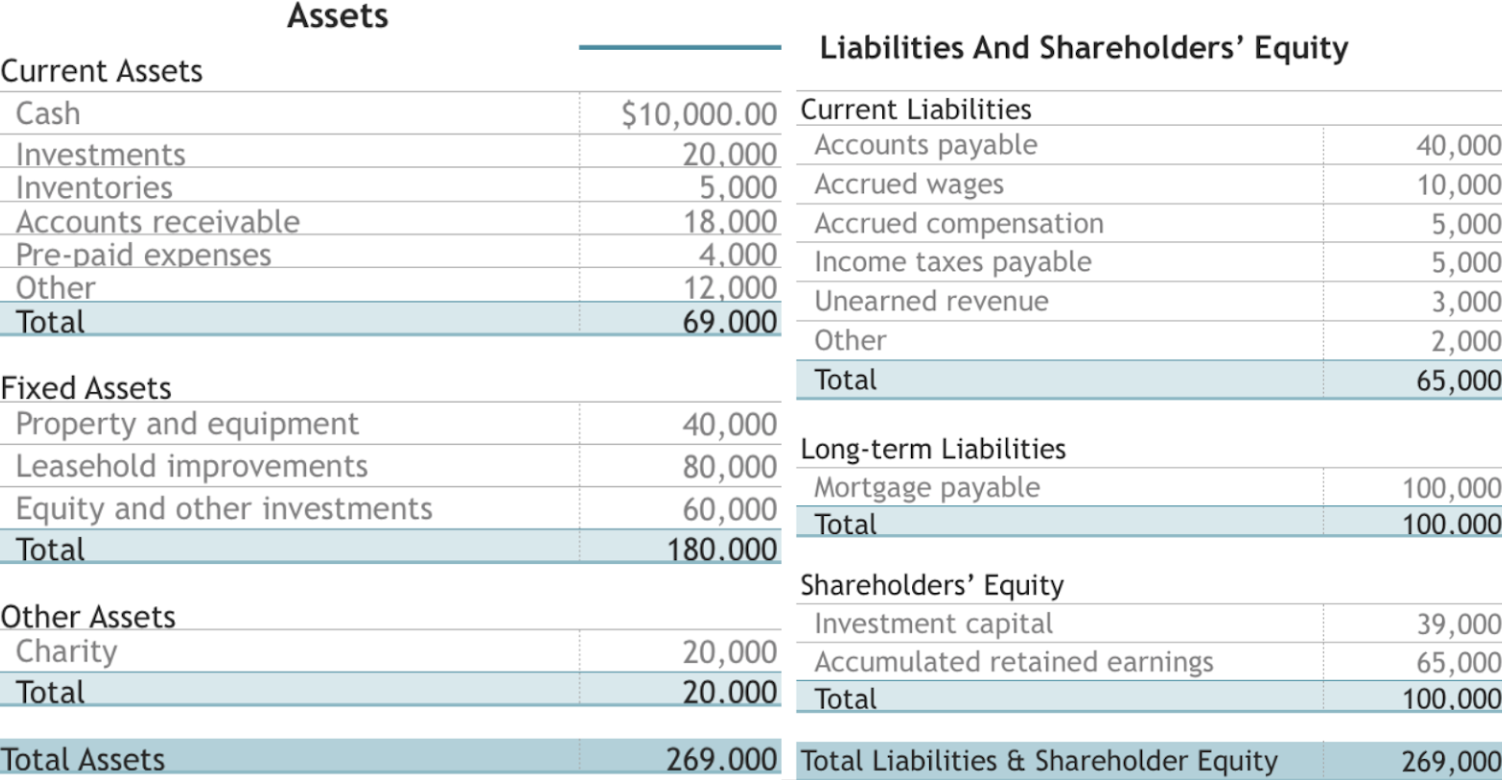

A balance sheet consists of three primary sections: In other words, the left and right sides of a balance sheet are. These can be divided into two main types:

The balance sheet is so named because all of the assets. The amount of stockholders' equity is exactly the difference between the asset amounts and the liability amounts. I owe nothing to anyone.

When you look at your accounting software or spreadsheets and look at your liabilities, you’re asking: From an accounting perspective, liabilities and equity balances are both shown on the credit side of the balance sheet. Increasing your liabilities) or getting money from the owners (equity).

With assets listed on the left side and liabilities and equity detailed on the right. The layout of a balance sheet reflects the basic accounting equation: Consistent with the equation, the total dollar amount is always the same for each side.

How much do i owe? The name balance sheet is based on the fact that assets will equal liabilities and shareholders' equity every time. It's a summary of how much a company owns in assets, owes in liabilities and the difference of the two, which is shareholders' equity.

Balance sheets provide the basis. It is based on an accounting equation stating that the total liabilities and the owner’s capital.

The balance sheet, together with the. Assets go on one side, liabilities plus equity go on the other. So my equity must be $250,000.

:max_bytes(150000):strip_icc()/phpdQXsCD-3c3af916d04a4afaade345b53094231c.png)

:max_bytes(150000):strip_icc()/balancesheet.asp-Final-d803d4cbbabf4a1e8e1d18525ba6f85d.png)

![[Solved] Required a. For the balance sheet, identify how](https://media.cheggcdn.com/media/1fa/1fa88419-d3af-4dc0-ae82-cc7695ce9b66/phpfl6iz4)