Painstaking Lessons Of Info About Income Statement Explanation

Revenue, expenses, gains, and losses.

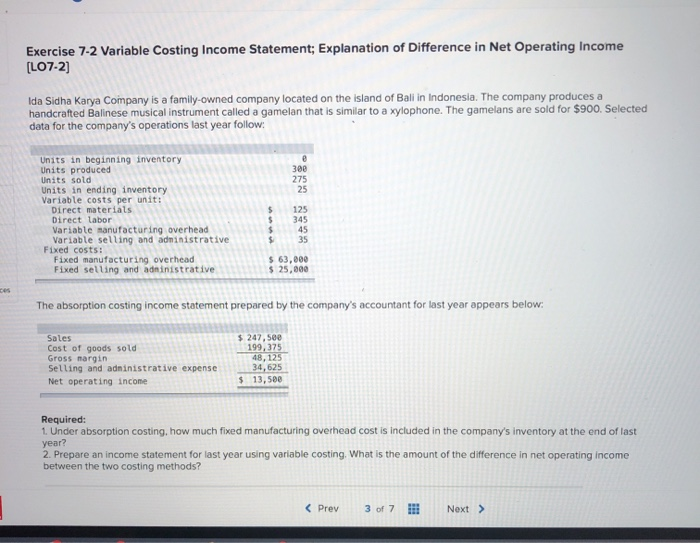

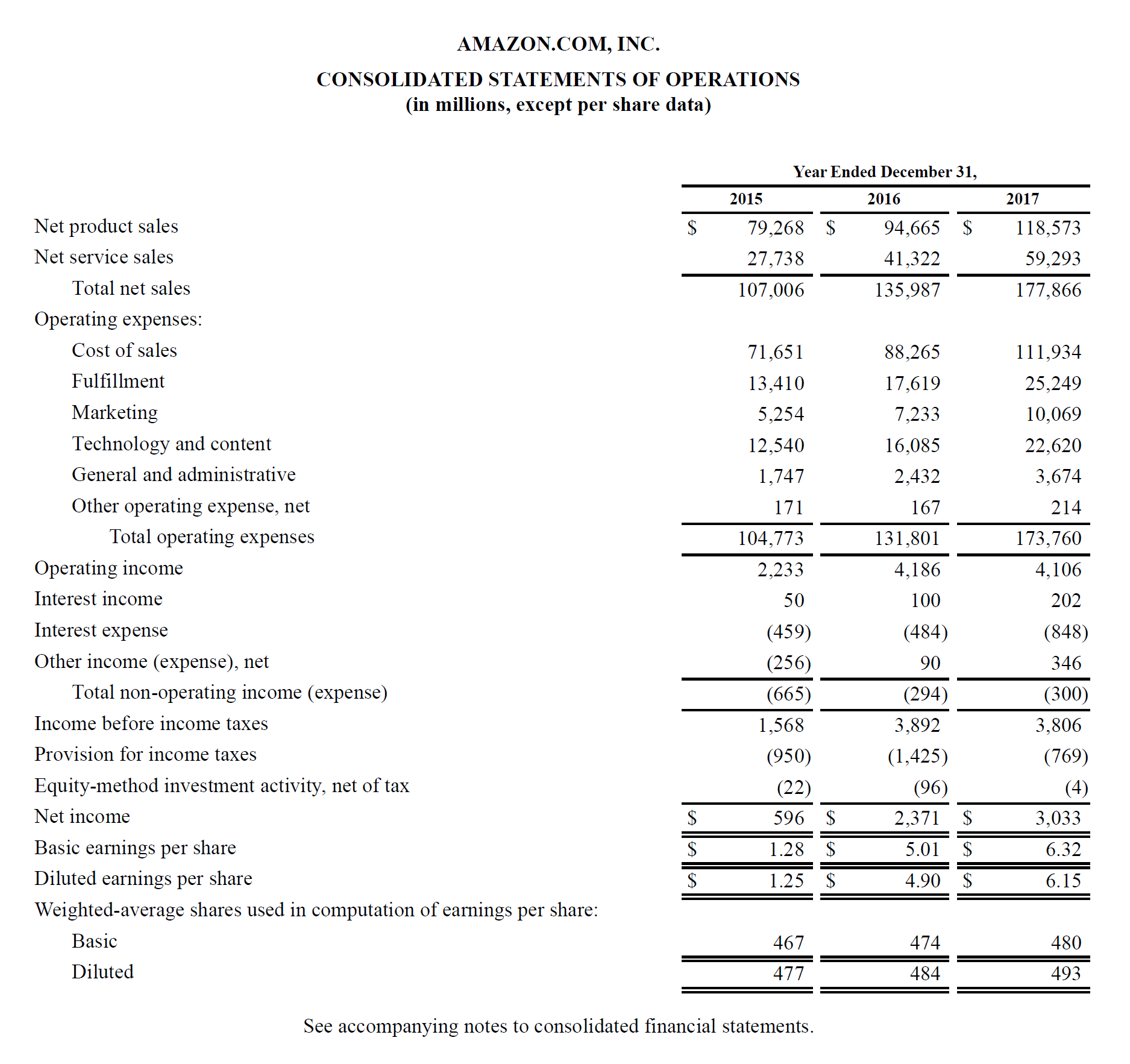

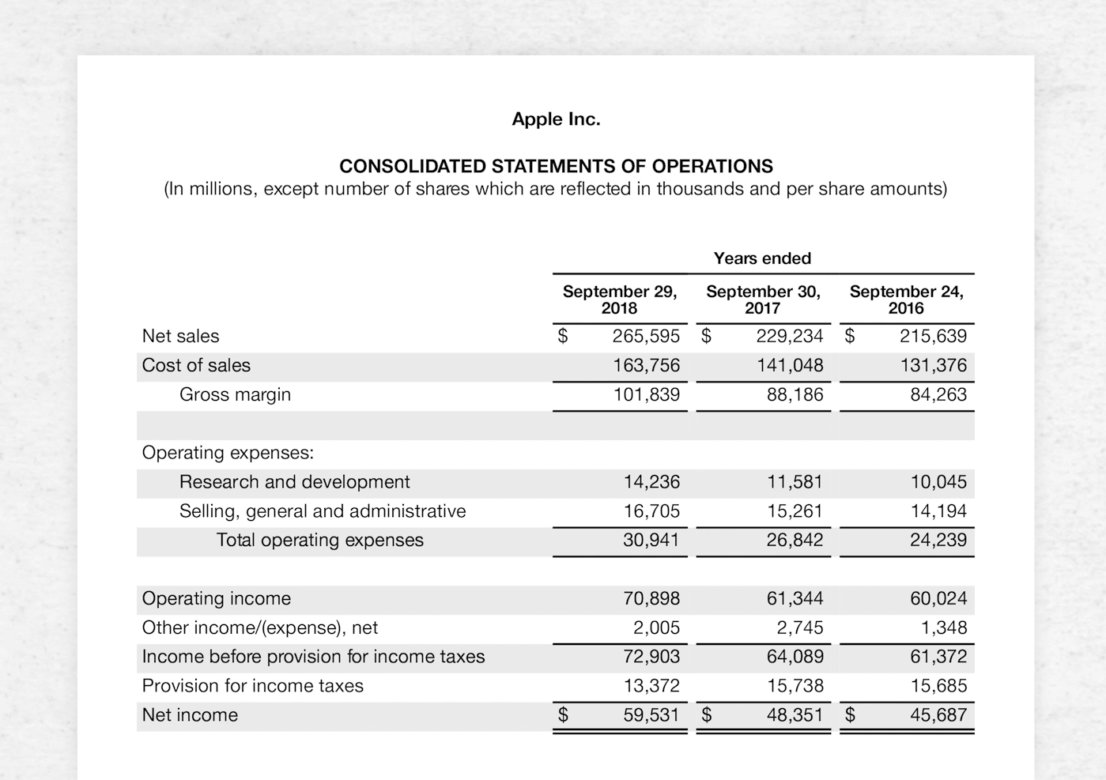

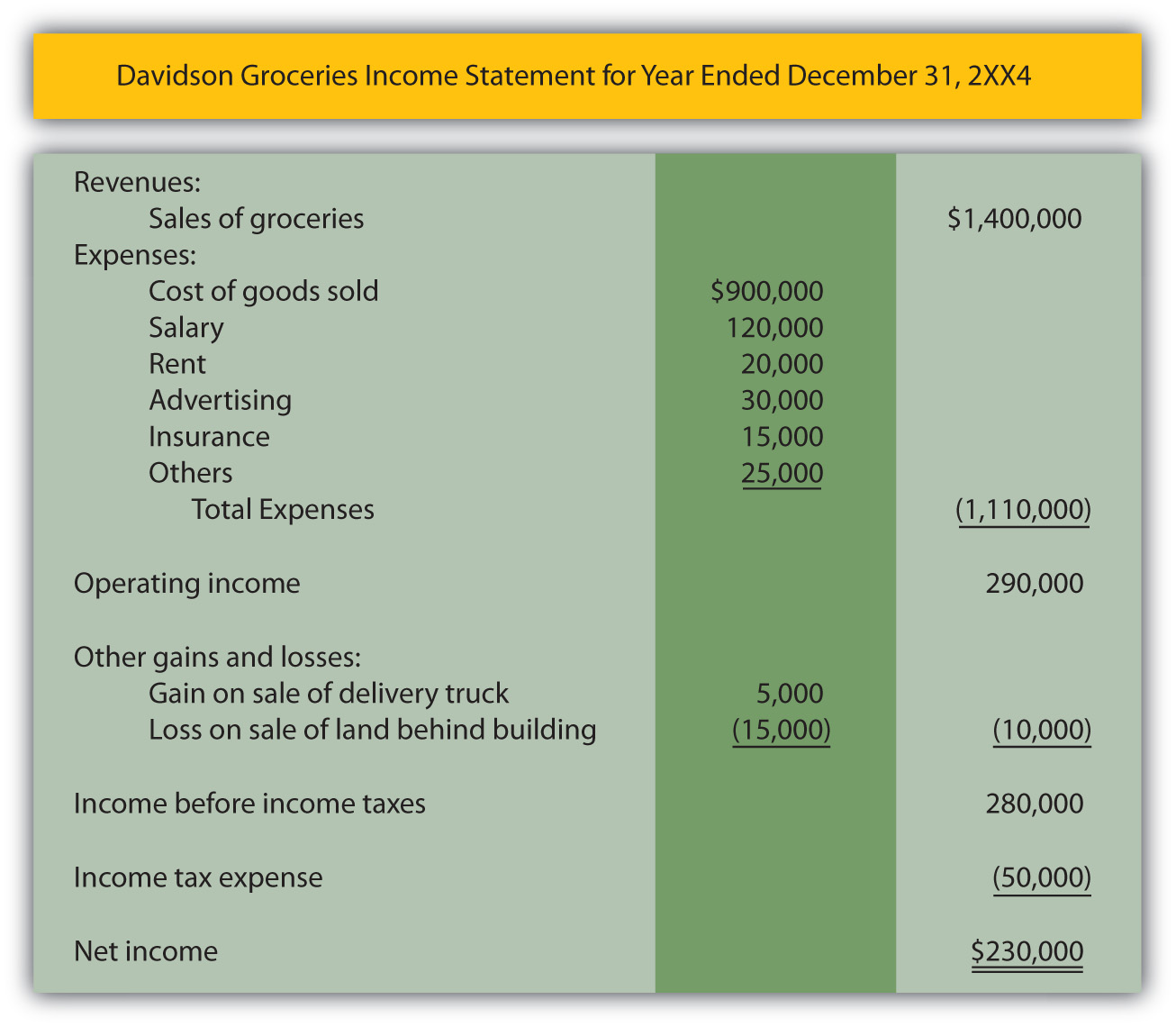

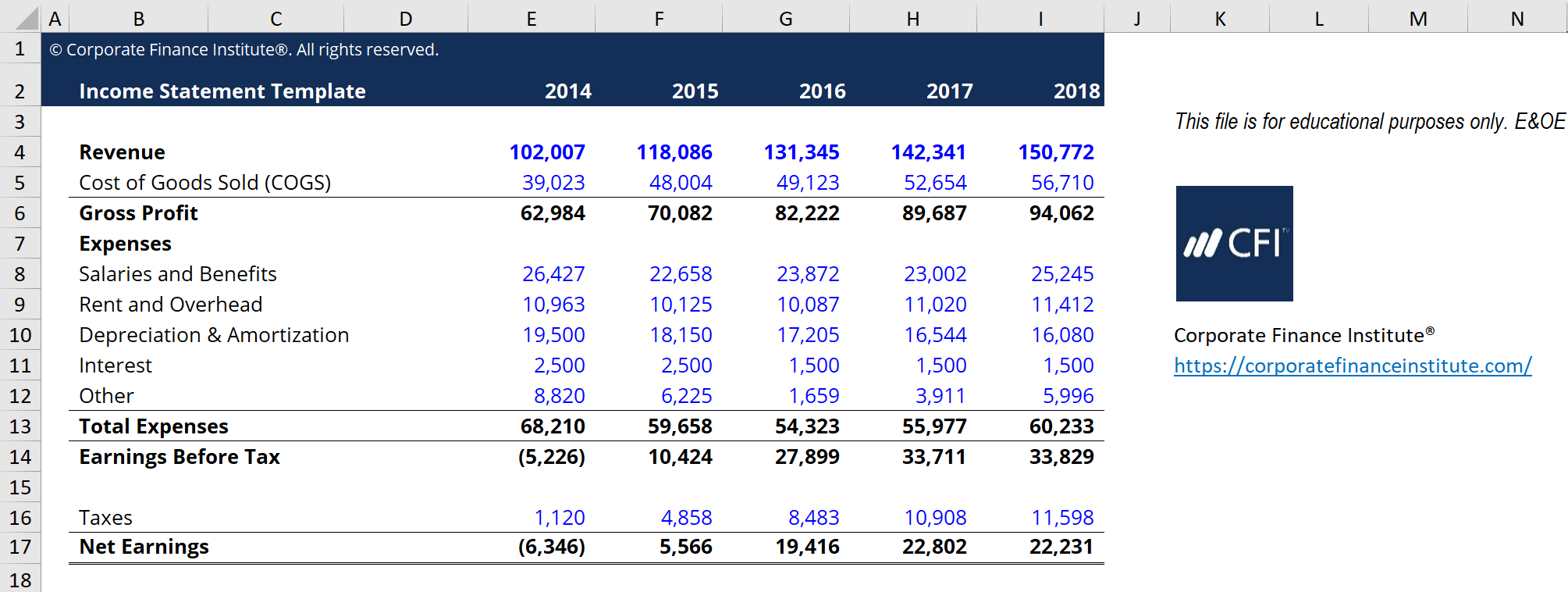

Income statement explanation. The income statement is one of a company’s core financial statements that shows their profit and loss over a period of time. This document gauges the financial performance of a business in terms of profits or losses for the accounting period. The income statement is one of the main financial statements of a business.

The income statement follows a specific format. This is the first statement that appears on the annual financial reports of an organization. An income statement is a financial report that summarizes the revenues and expenses of a business.

Accountants create income statements using trial balances from any two. Profit and loss (p&l) statement; The purpose of an income statement is to show a company’s financial performance over a given time period.

The income statement focuses on four key items: Sales on credit) or cash vs. This information helps you make timely decisions to make sure that your business is on a good financial footing.

It tells the financial story of a business’s operating activities. This calculation shows investors and creditors the overall profitability of the company as well as how efficiently the company is at generating profits from total revenues. It shows your revenue, minus your expenses and losses.

Other names for the income statement include: How to read and understand income statements as a small business An income statement is a financial statement detailing a company’s revenue, expenses, gains, and losses for a specific period of time that is submitted to the securities and exchange commission (sec).

The income statement calculates the net income of a company by subtracting total expenses from total income. At the most basic level, it. Consolidated statement of income (operations, earnings)

What is an income statement? Within an income statement, you’ll find all revenue and expense accounts for a set period. What is the income statement?

:max_bytes(150000):strip_icc()/TermDefinitions_Incomestatementcopy-9fe294644e634d1d8c6c703dc7642018.png)