Brilliant Strategies Of Info About Cash Flow Statement Business Plan

According to the online course financial accounting :

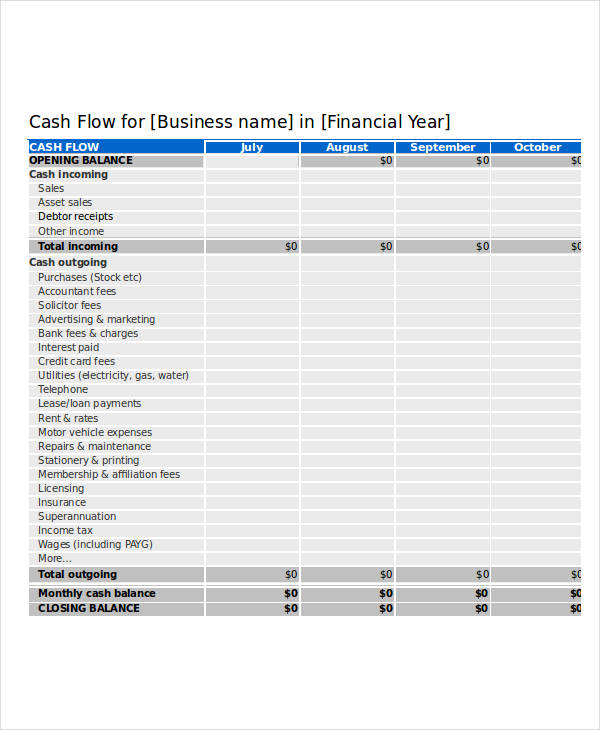

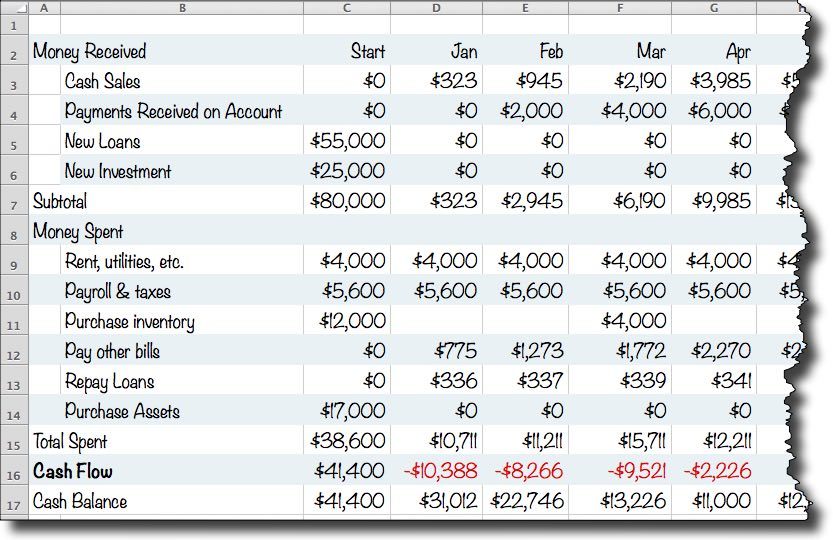

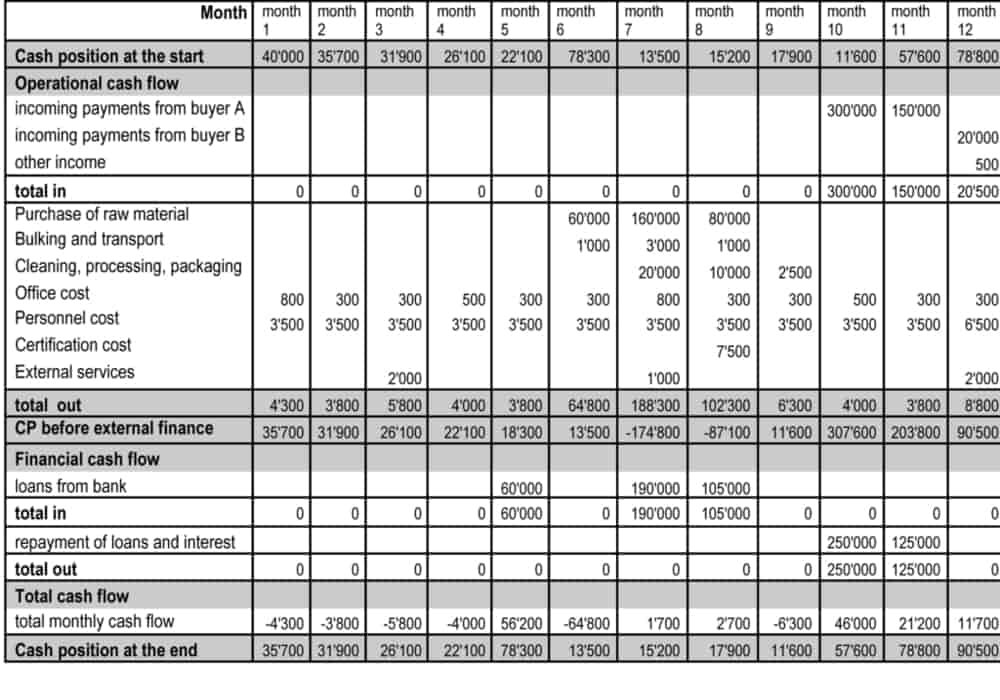

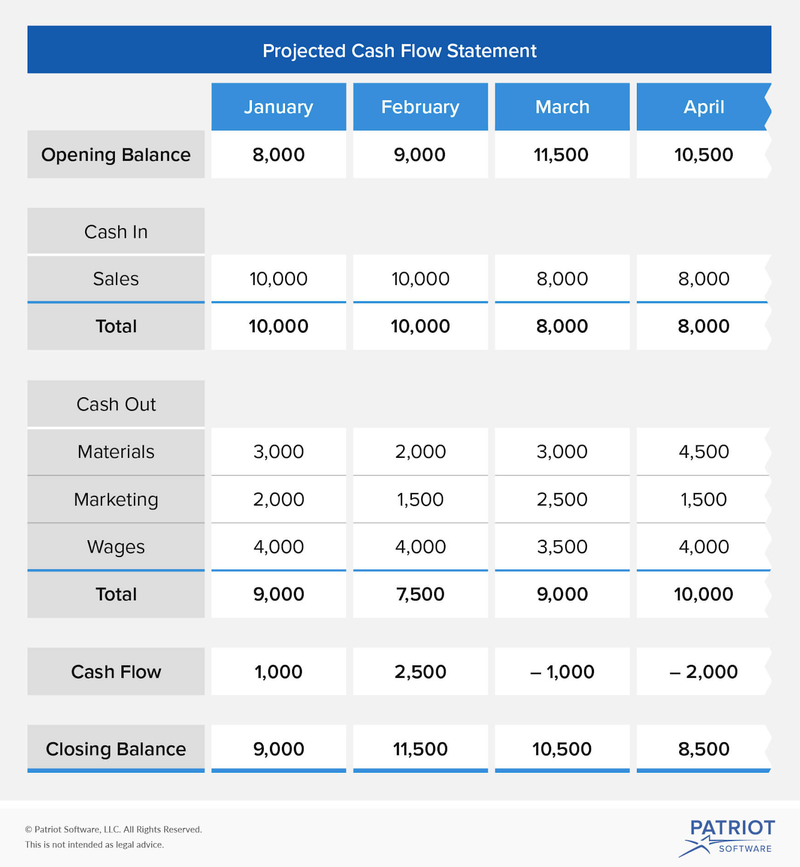

Cash flow statement business plan. 68% of business owners review business expenses. The cash flow statement monitors the flow of cash over a period of time (a year, a quarter, a month) and shows you how much cash you have on hand at the moment. This is the statement that shows physical dollars moving in and out of the business.

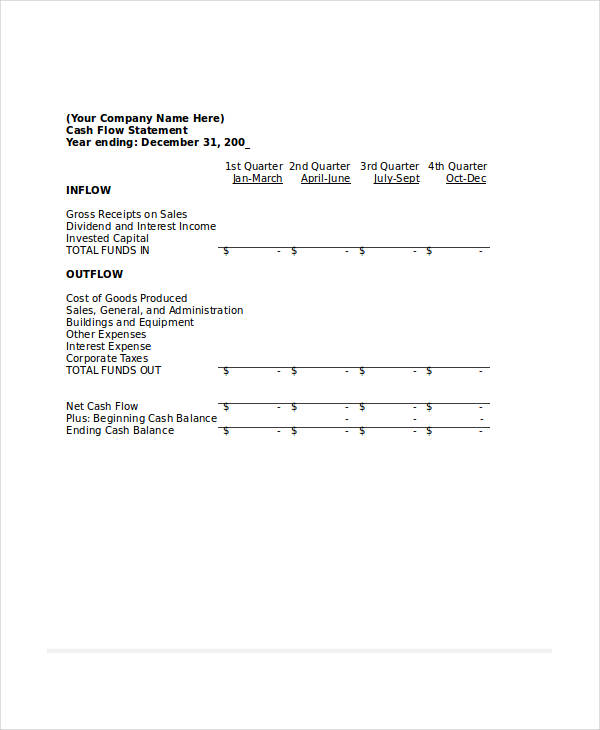

They show how much money is coming in and going out of your business, and they help you understand your business's cash flow patterns. Openai has completed a deal that values the san francisco artificial intelligence company at $80 billion or more, nearly tripling its valuation in less than 10 months, according to. A cash flow statement is a financial report that details how cash entered and left a business during a reporting period.

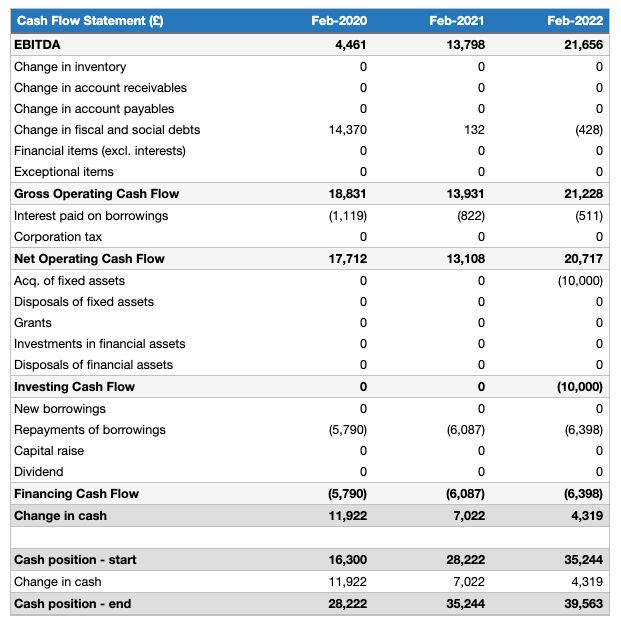

Plan ahead to make sure you always have money to cover payments. It reconciles the profit and loss with the balance. It’s a compass that guides the cfo’s office in making critical decisions for growth, stability, and seizing opportunities—and at what rate.

The purpose of a cash flow statement is to record how much cash (or cash equivalents) is entering and leaving the company. You can use your cash flow statement to:

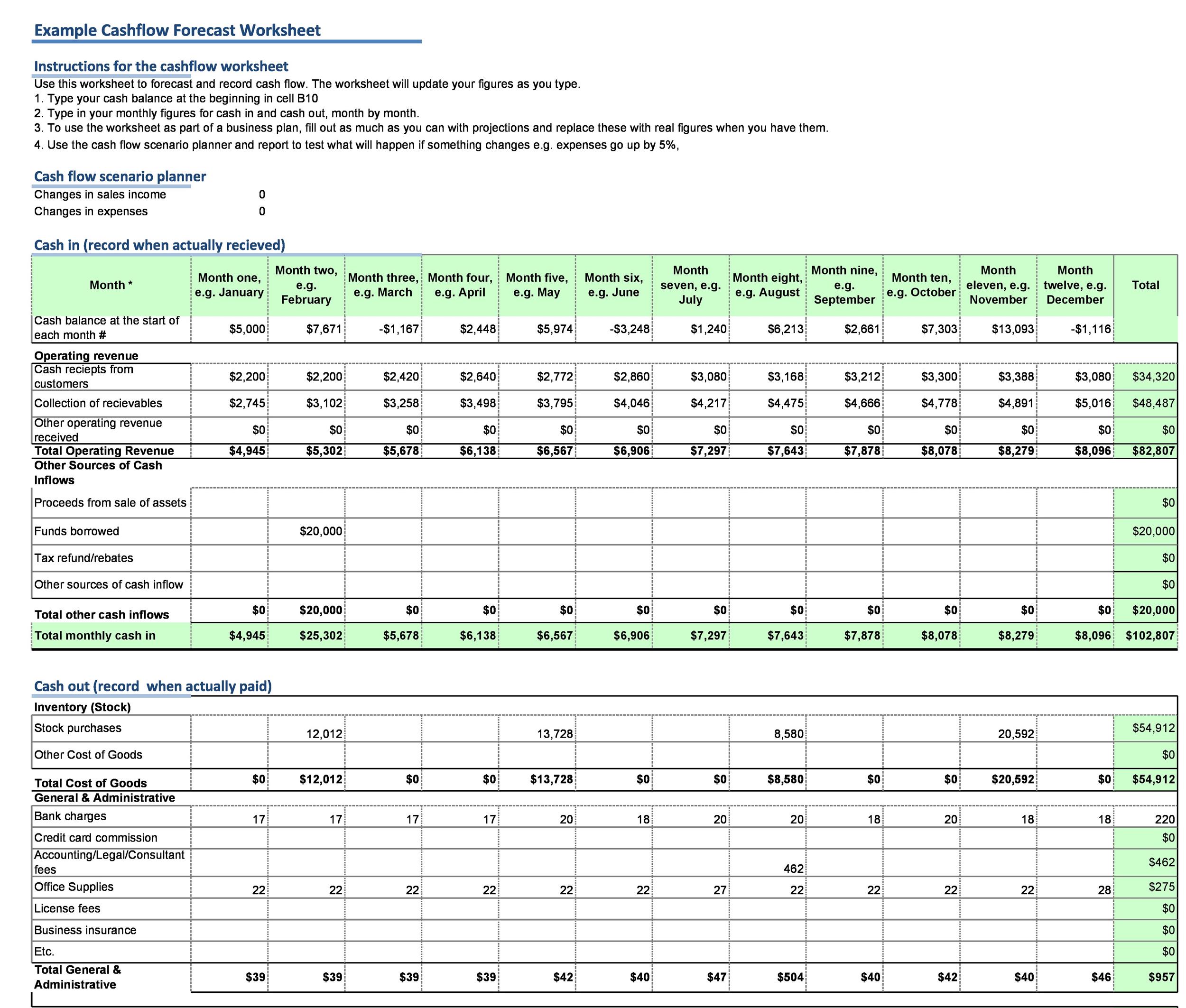

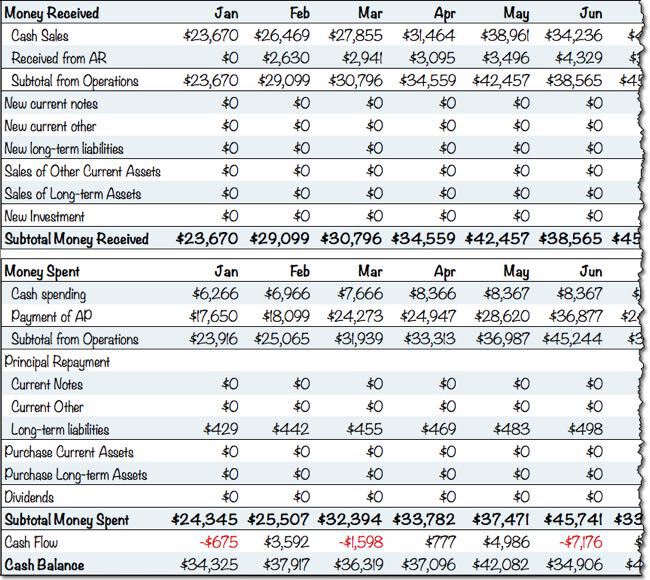

In the direct cash flow forecasting method, calculating cash flow is simple. A cash flow statement is a crucial financial document that details all your sources of cash over a given period of time. While income statements are excellent for showing you how much money you’ve spent and earned, they don’t necessarily tell you how much cash you have on hand for a specific period of time.

Cash flow statements provide insight into your business's financial health. 65% of business owners review revenue. Download startup financial projections template excel | smartsheet income statement templates for business plan

It also breaks down where you've spent that money so you can see if your business is making more money than it spends. The consulting firm industry in the united states, currently valued at over $250 billion, exhibits a robust demand across various sectors, including healthcare, technology, and finance. Written by jeff schmidt what is the statement of cash flows?

For your business plan, you should create a pro forma balance sheet that summarizes the information in the income statement and cash flow projections. The statement of cash flows (also referred to as the cash flow statement) is one of the three key financial statements. A cash flow statement is a financial statement that summarizes the inflows and outflows of cash transactions during a given period of business operations.

Download the sample balance sheet template. In our sample financial statements, we made the assumption that 100% of the previous month’s sales will be collected in the next month, and none of the current month’s sales are collected in the current month. A business typically prepares a balance sheet once a year.

Your cash flow statement takes inputs. How to forecast your cash flow and build a cash flow statement. Many small business owners focus on revenue and profit but lack a clear understanding of the importance of cash flow to the.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)