Awe-Inspiring Examples Of Tips About Freight Out Income Statement

This includes freight charges, which refer to.

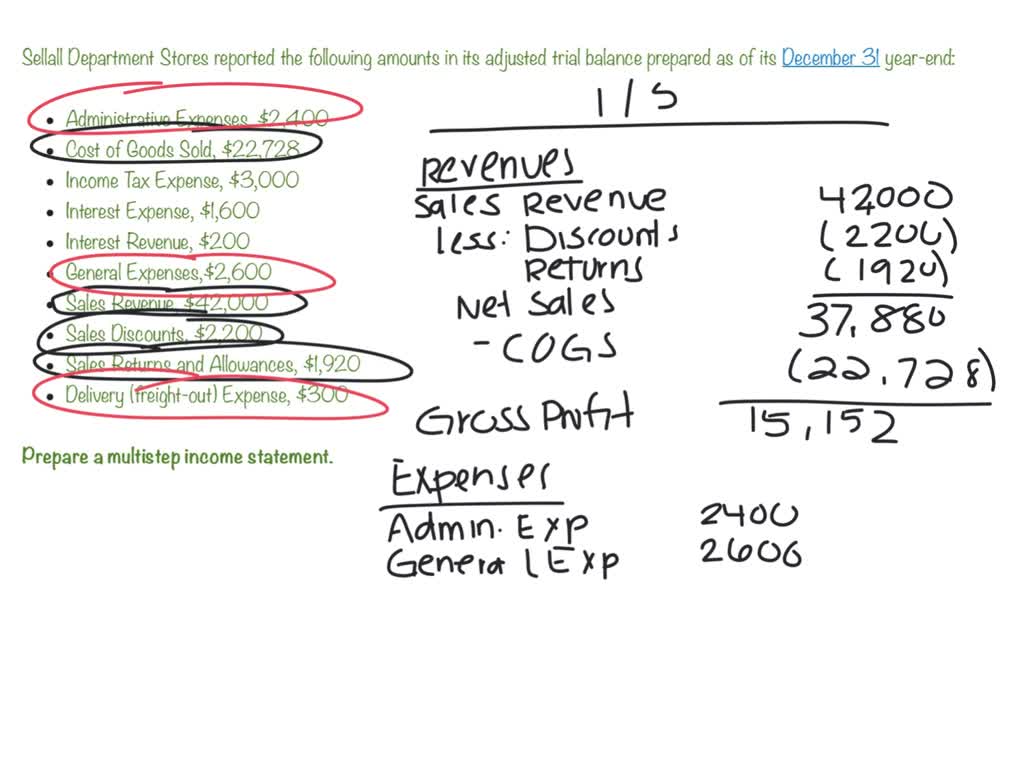

Freight out income statement. Freight out is the transportation cost associated with the delivery of goods from a supplier to its. Delivery expense increases (debit) and cash decreases (credit) for the shipping cost amount of $100. The explanation of each classification of charge, how the cost is tackled, and how we can.

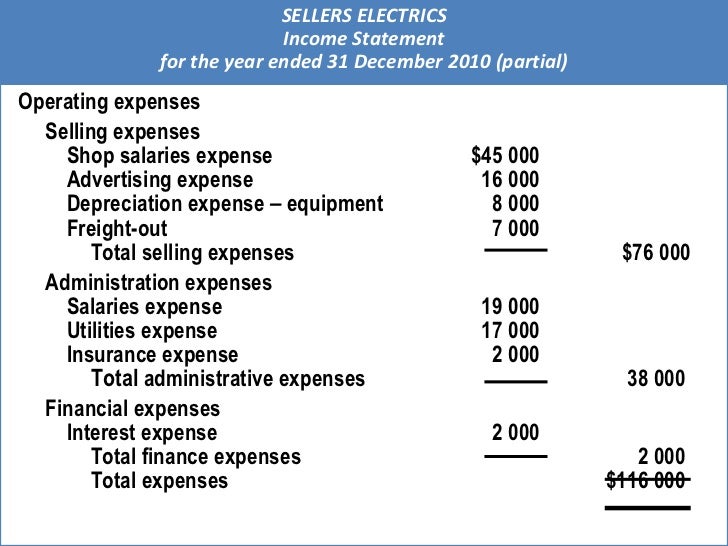

Working capital and liquidity ; Updated march 13, 2023 a company's financial statements contain information that can help them achieve its business objectives. The cost of carriage outwards should be reported on the income statement as an.

What is freight out in income statement? Likewise, in this journal entry, the total assets on the balance sheet decrease while. What is freight out?

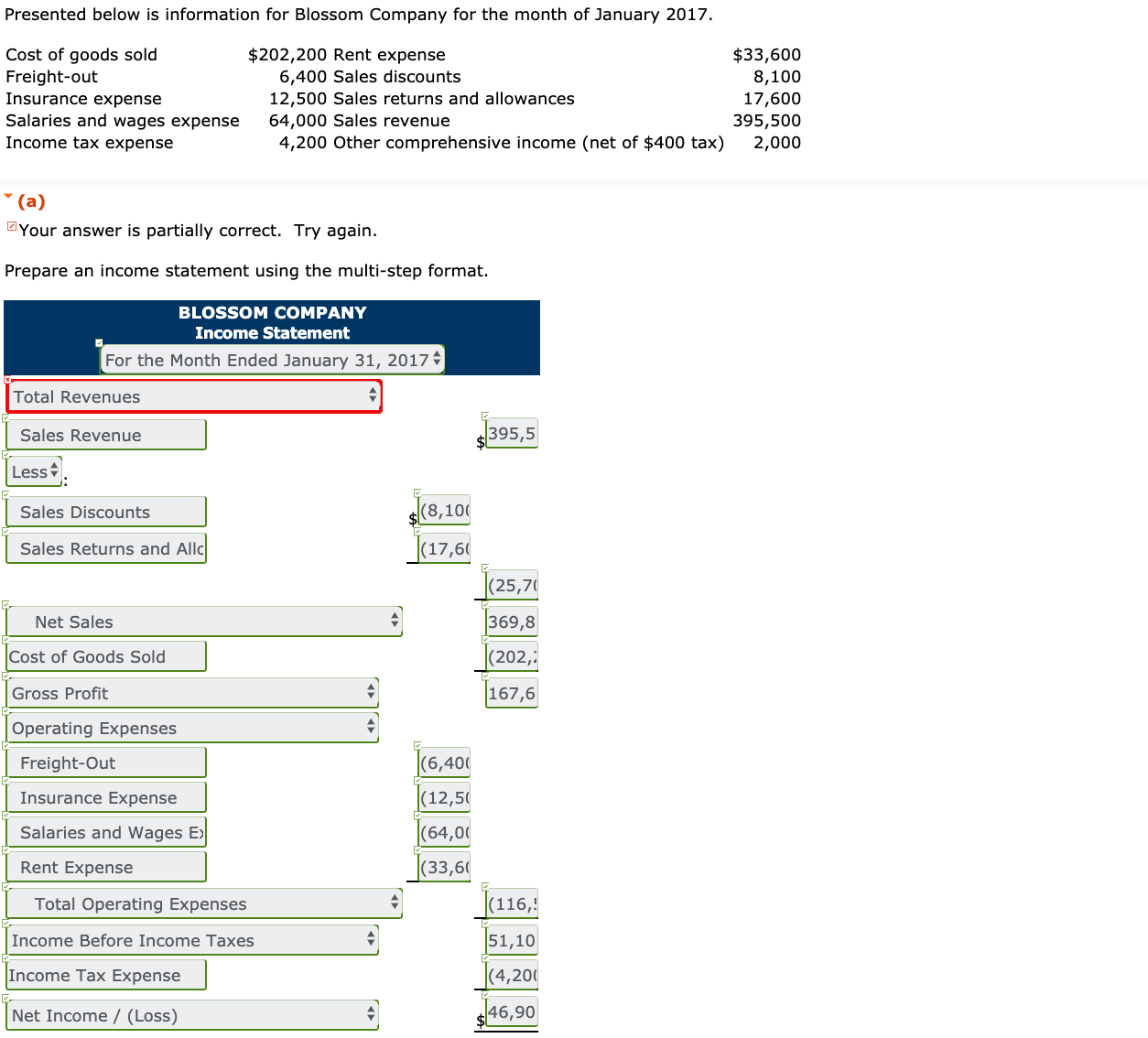

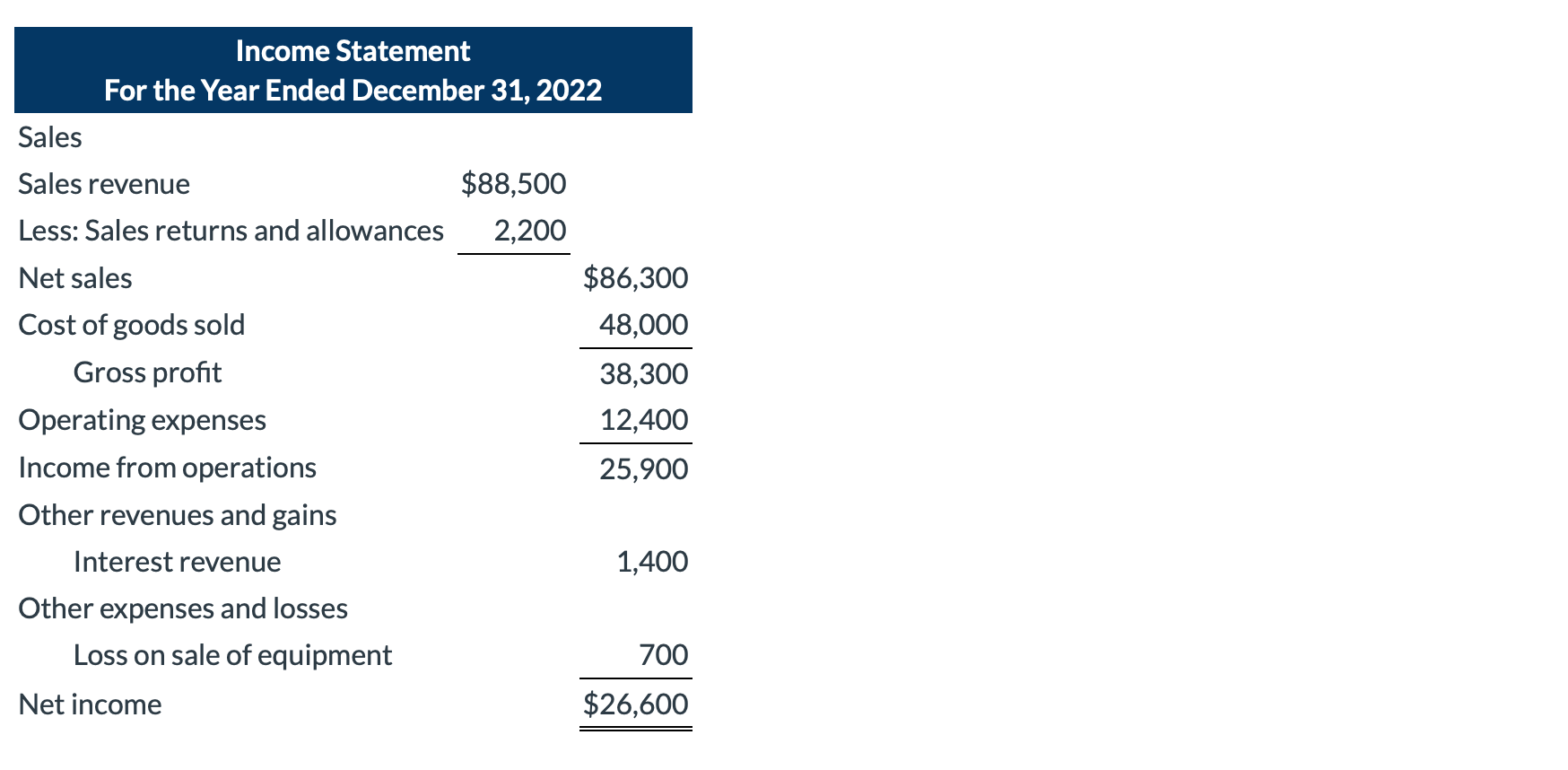

Freight out is the transportation cost associated with the delivery of goods from a supplier to its customers. If you send the freight out cost to the customer, you can record it as an unpaid bill in the income statement next to the freight expense. This way, when the customer pays, the.

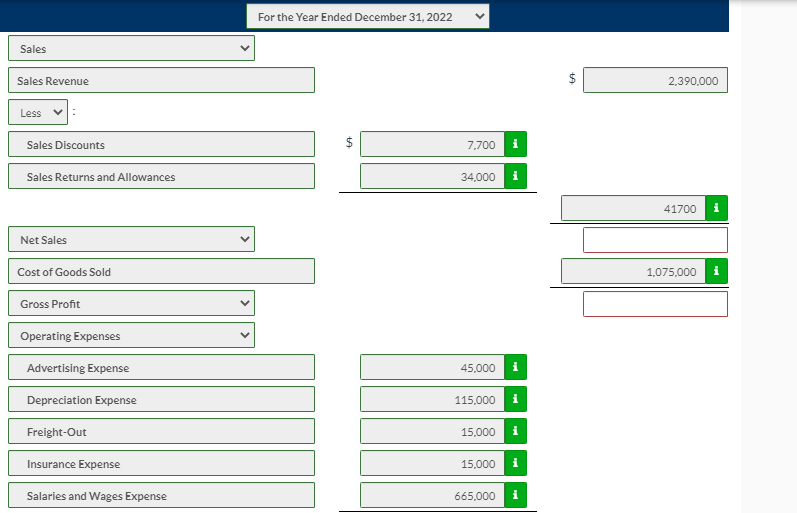

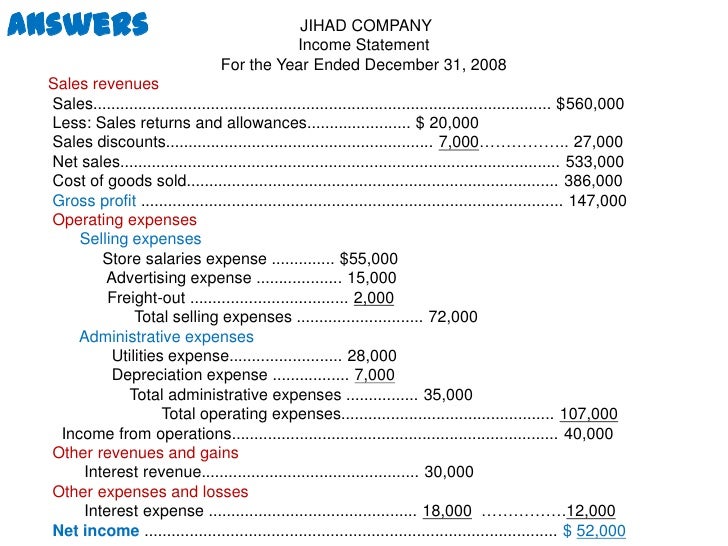

These costs include the cost of. A change in the presentation of shipping and handling costs in the income statement from (or to) costs of revenue would likely be considered a change in accounting policy under. Freight out shipping costs have a direct relation to the number of goods you sell, so they’re categorized as a cost of.

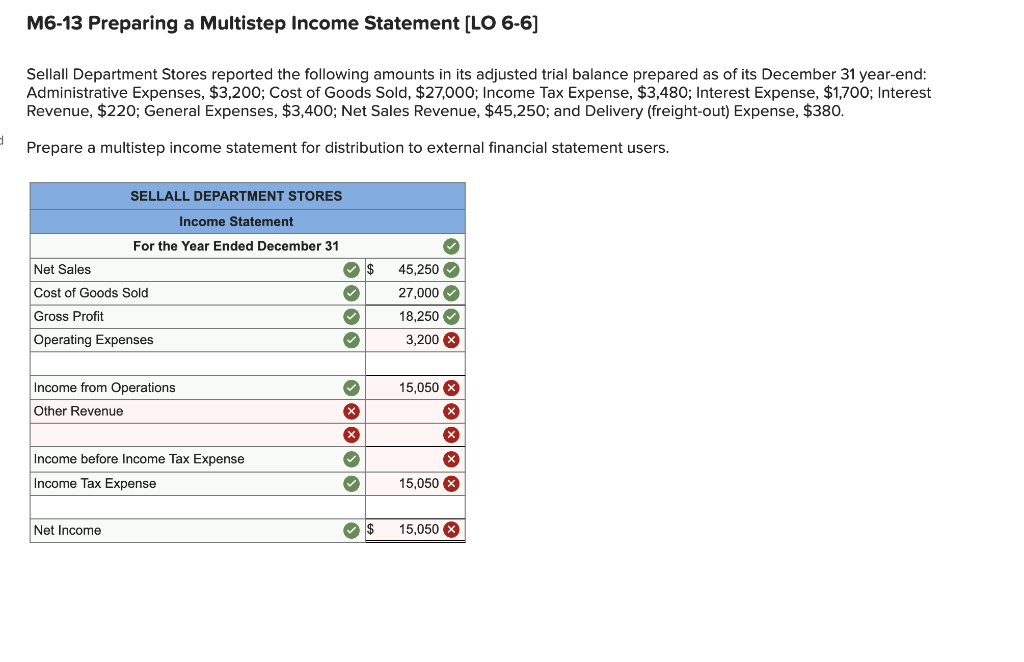

To record this, calculate your freight. Freight out charges are expenses that result from transporting goods or raw materials from suppliers to customers, which can either be companies or private. Transportation costs recorded in the income statement are the costs related to the entity’s transportation of goods to customers or suppliers.

When a company hires a 3rd party transportation. If you send the freight out cost to the customer, you can record it in the income statement as an unpaid bill next to the freight expense. We can classify freight in and out in several ways on the income statement.