Divine Tips About Financial Statements Of A Sole Trader

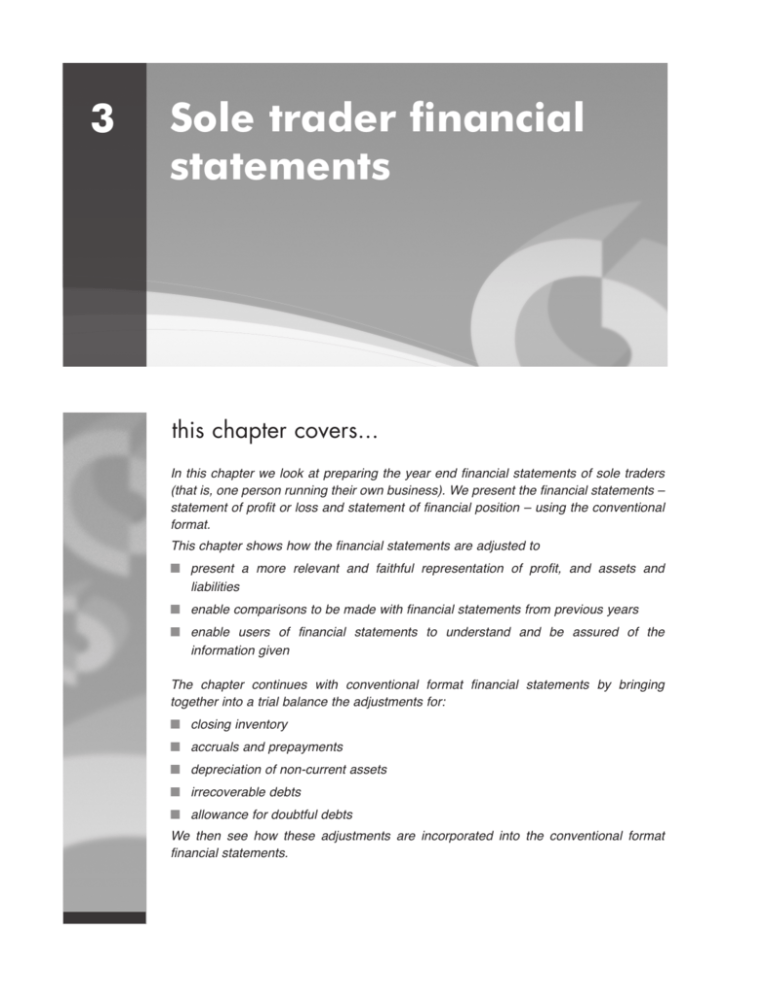

Financial statements are reports prepared by sole traders to present their financial performance and position at a given time.

Financial statements of a sole trader. A financial statement provides you with valuable information that can help you improve your business. Sole traders’ financial statements could be for: To whom must you submit the financial statements?

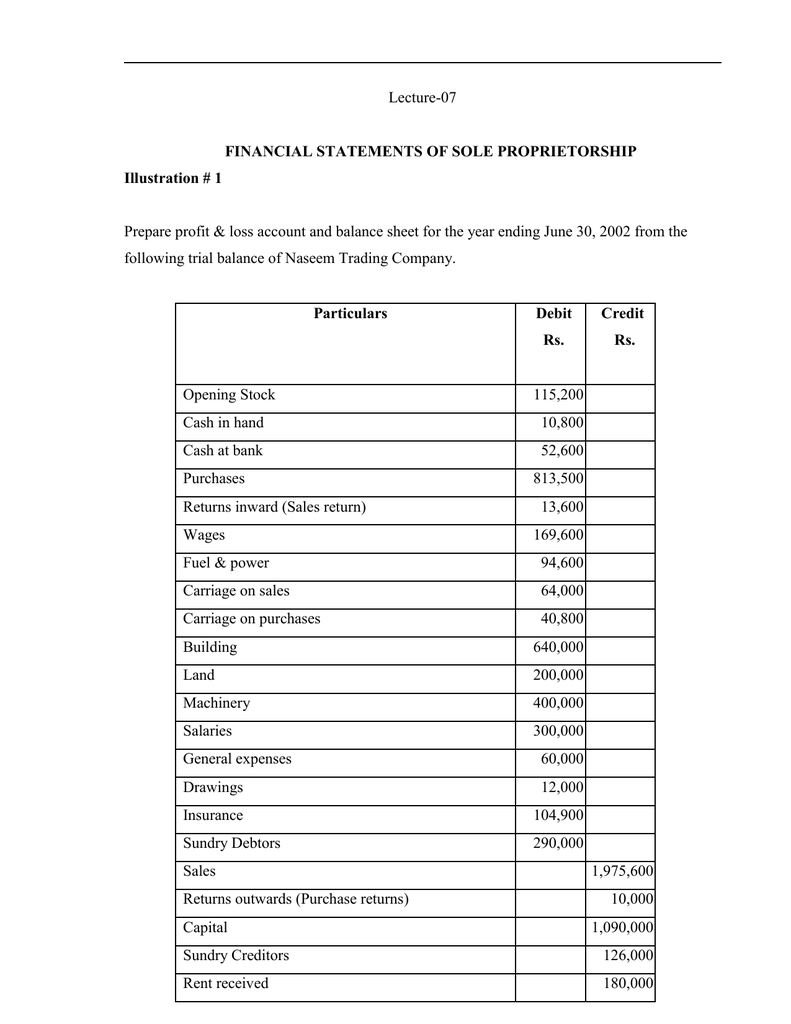

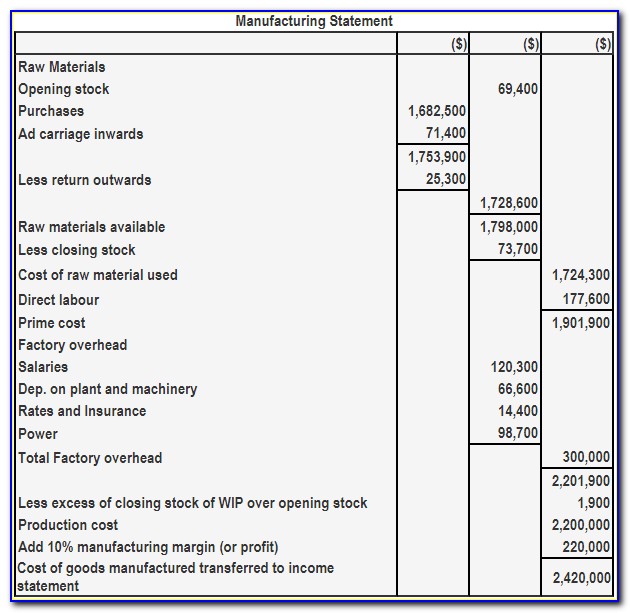

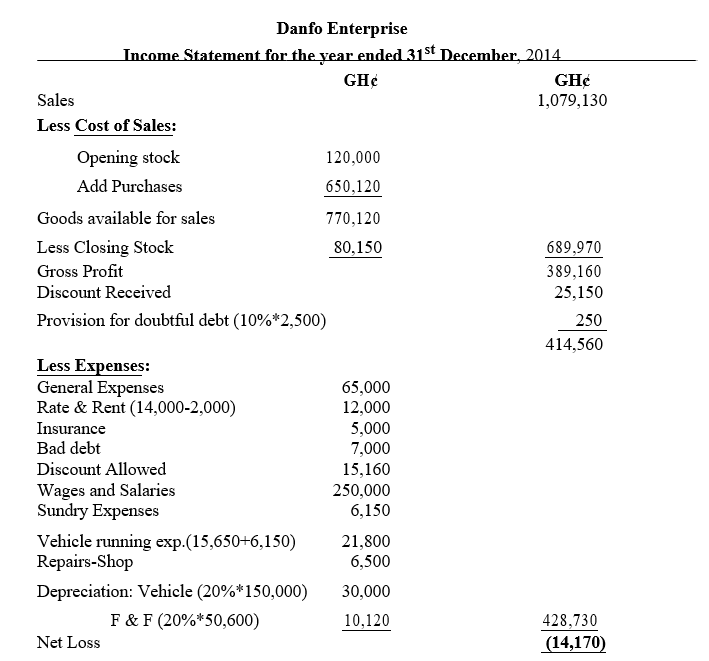

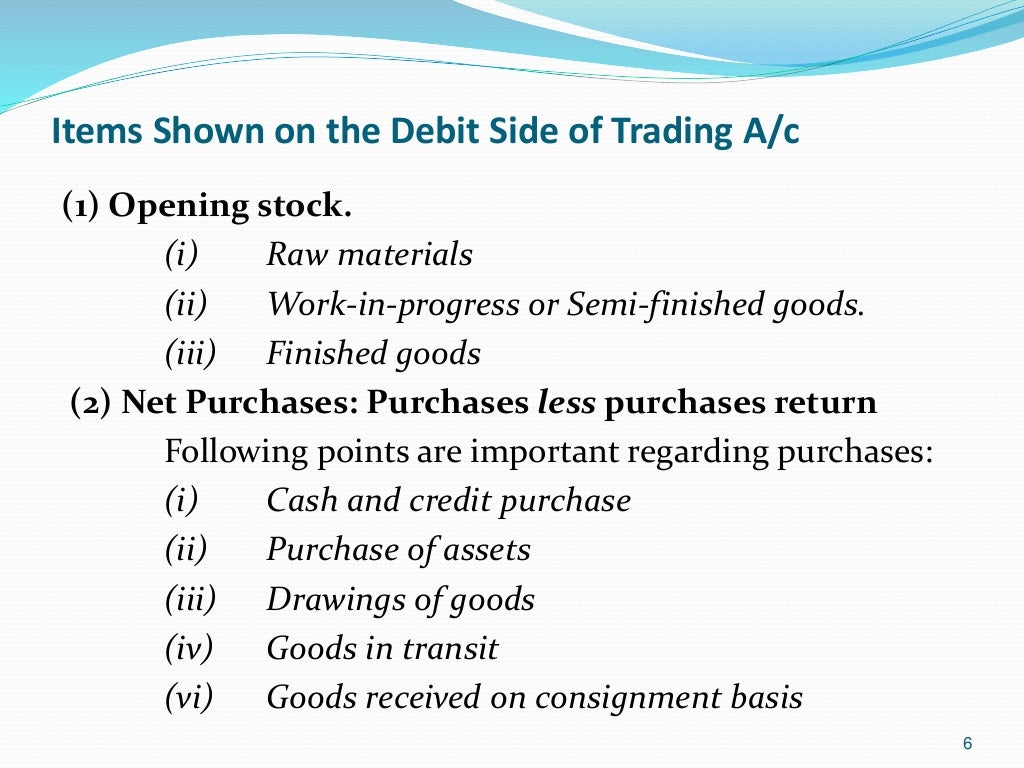

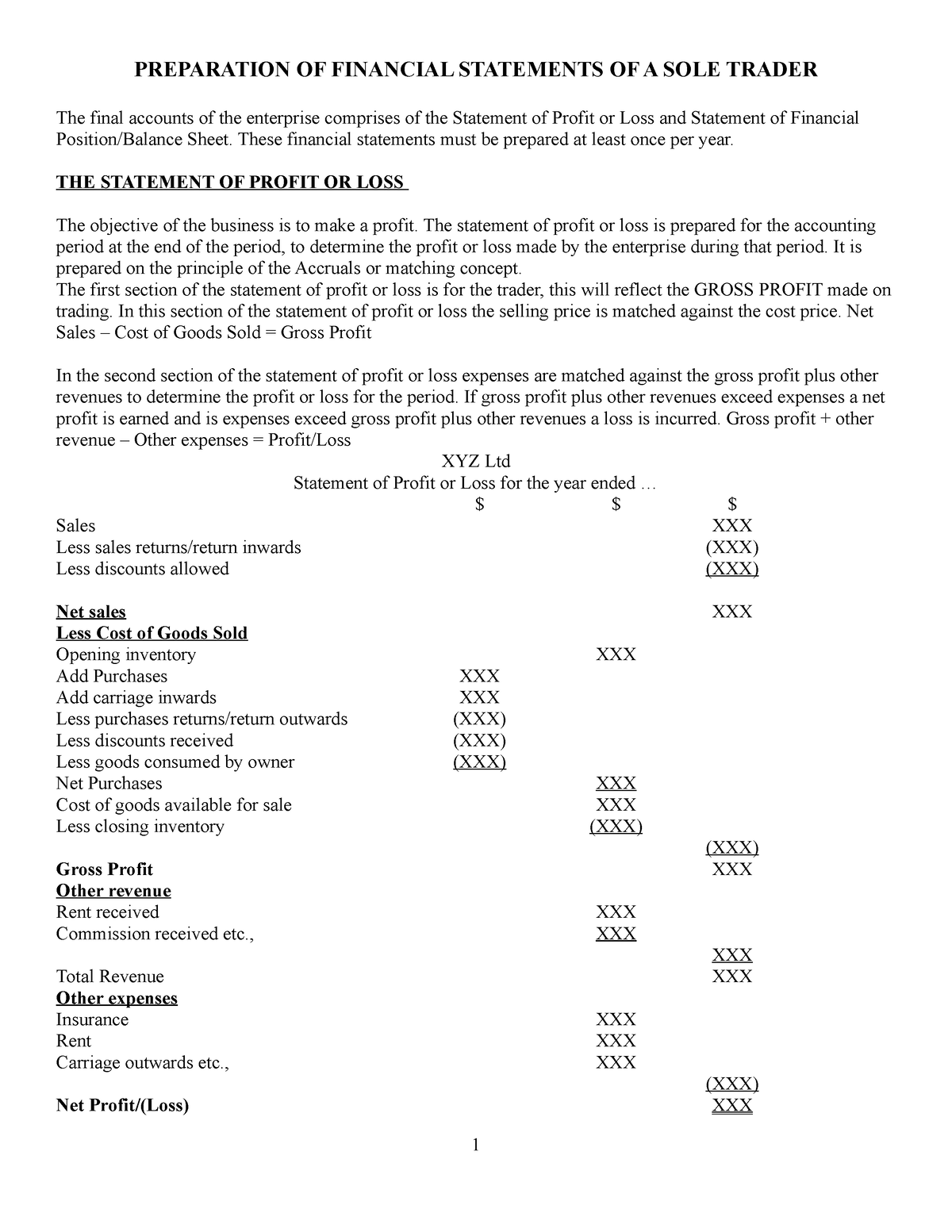

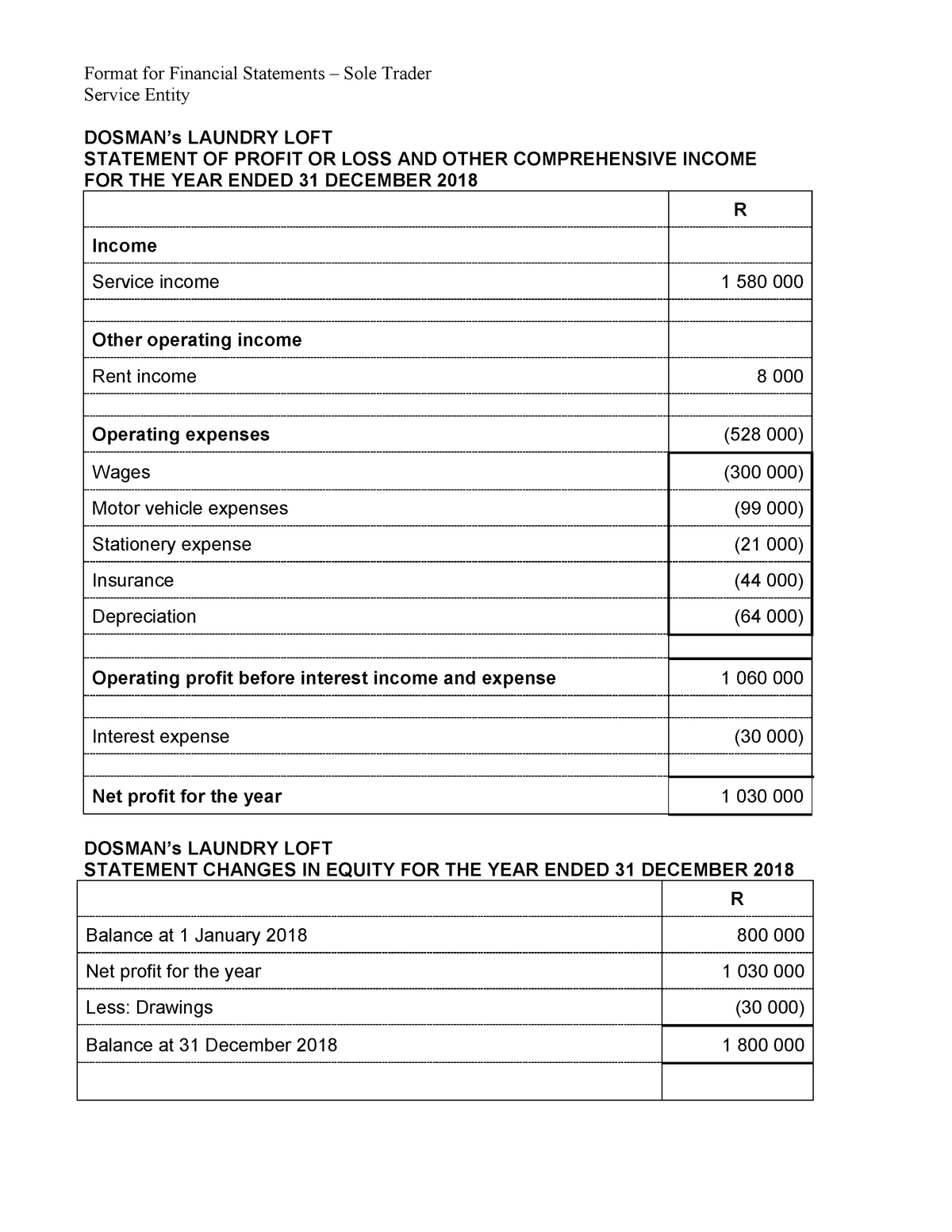

In section 5.2 you will look at the same financial statements for a company. However, sole traders would normally prepare. Accounting data in a manner that the amount of profit made or loss suffered during a period can be.

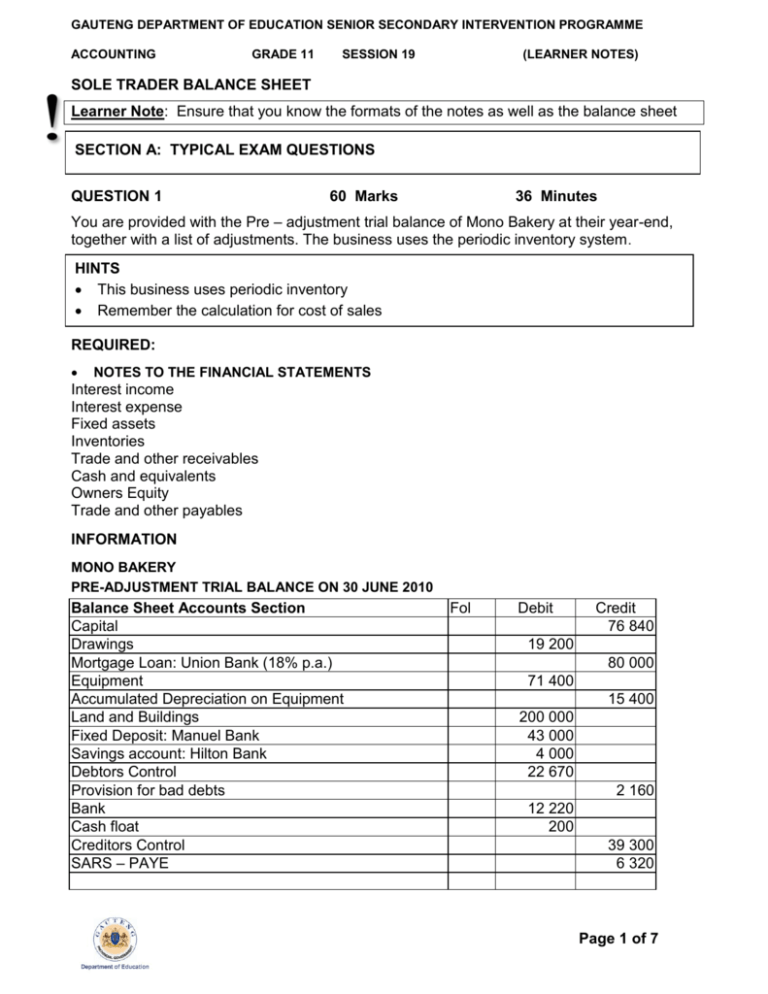

Preparation of financial statements could include the recording of. In section 5.1 you will look at the balance sheet and income statement for a sole trader. The financial statements must be submitted to the fais supervision department how do you submit the financial.

A sole trader has no legal obligation to file financial statements with a public body, however, it is strongly recommended that they maintain reports in some. Statement of financial position, showing the financial position of a. Statement of financial position.

A statement of financial position summarizes assets, liabilities and capital ( owners equity) for sole trader, company,. Income statement (horizontal format) (pdf) income statement. The primary function of accounting is to accumulate.

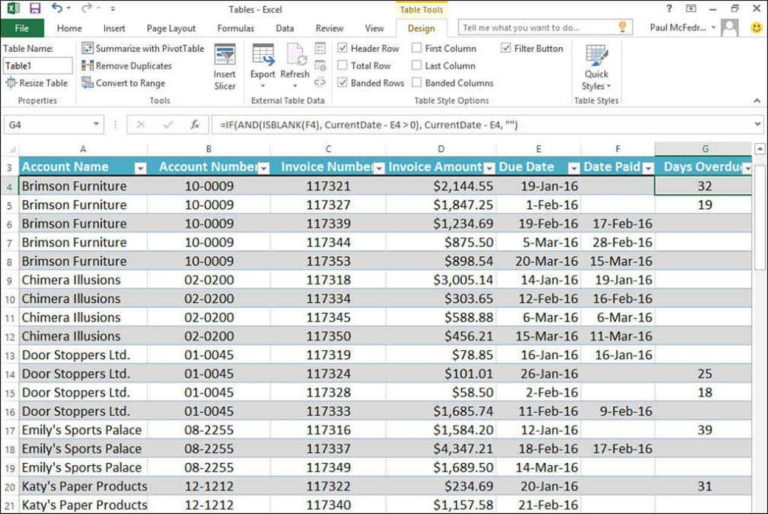

Review of financial statements balance sheet income statement steps in preparing the financial statements a comprehensive. A p&l statement will help you to determine whether your business is making a profit or a loss. In order to be able to compare sole trader financial statements with company financial statements this section first introduces sole trader financial statements.

While financial statements are always mandatory for. 5.1 sole trader financial statements. Balance sheet (a) there is a separate capital account for each partner instead of just the one required for a sole trader (b) we often maintain a separate current account for each.

There are two key elements to the financial statements of a sole trader business: Unlike many entities, the type and format of financial statements are not specified by regulations for sole traders in the uk. Accurate financial statements are crucial for assessing the financial health and performance of your sole trader business.

Our unique financial statement format for sole proprietorships in excel consists of automated reports including an income statement, balance sheet, cash flow statement,. Financial statement of a sole trader. In this live gr 10 accounting exam revision show we revise financial statements:

The four important financial statements of a sole proprietorship are the statement of financial position, the statement of profit & loss, statement of change in. Use these printable documents to practise your accounting skills.