Beautiful Info About Income Statement Accounts Are Also Called

Operating revenue non operating revenues and expenses what is not shown in the income statement?

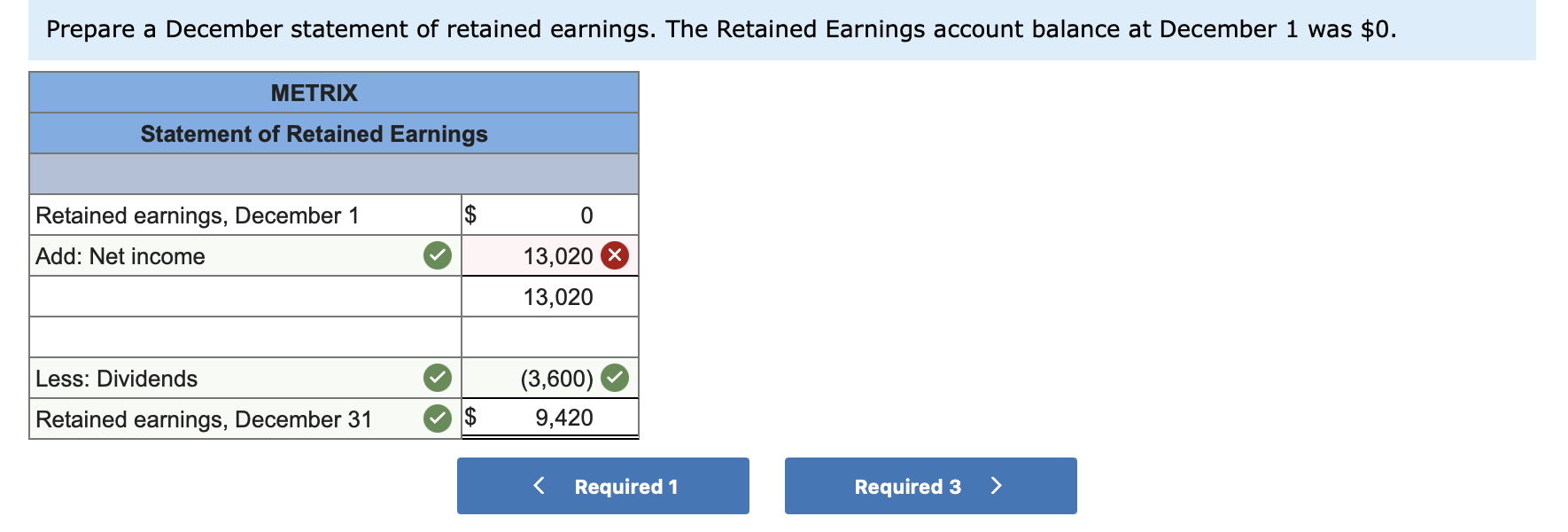

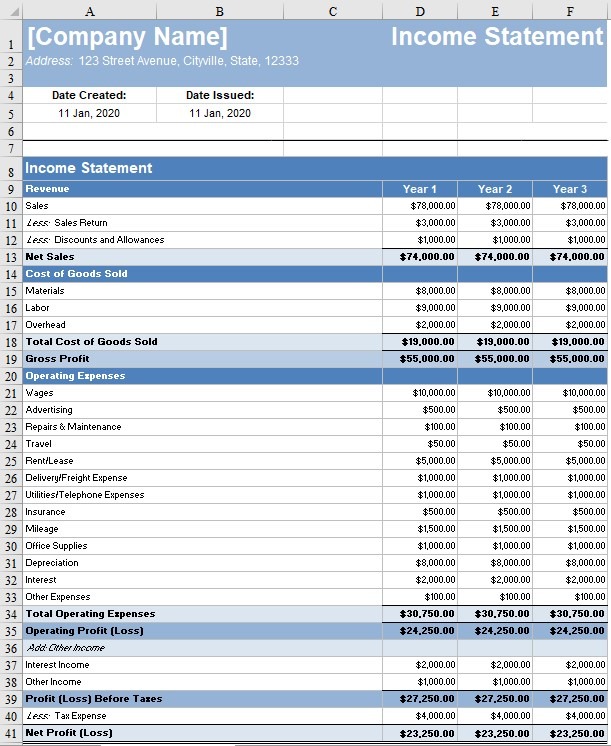

Income statement accounts are also called. The income statement is one of the main four financial statements that are issued by companies: Net income is the profit that remains after all expenses and costs, such as taxes. An income statement showing net profit or loss is also called a profit and loss statement.

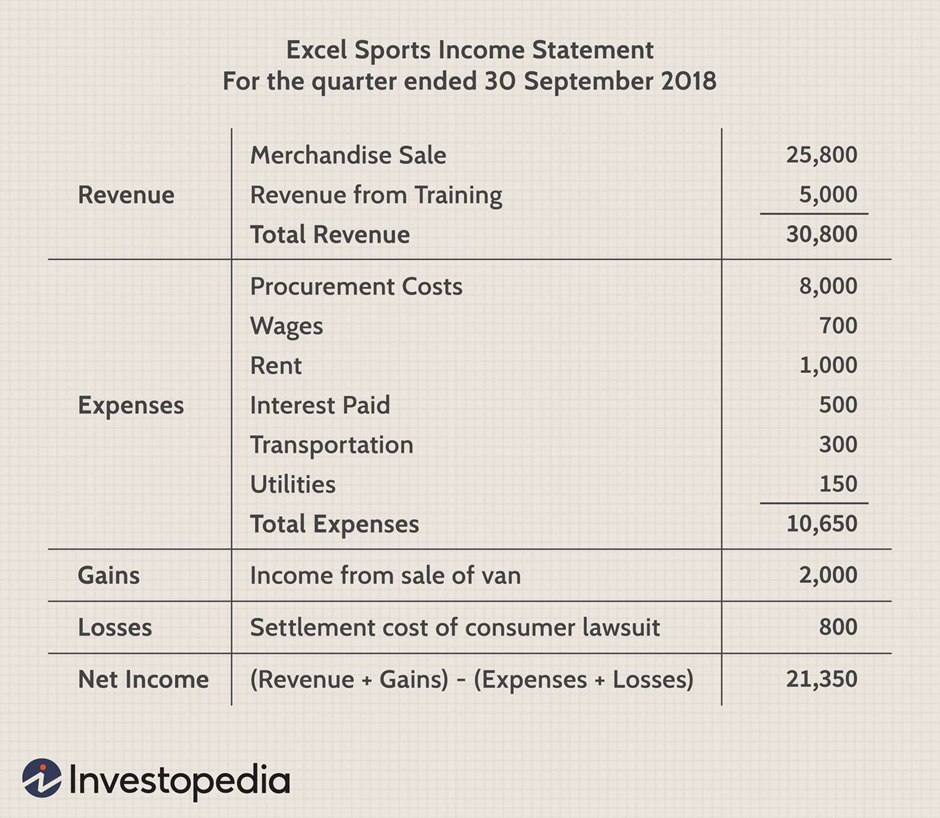

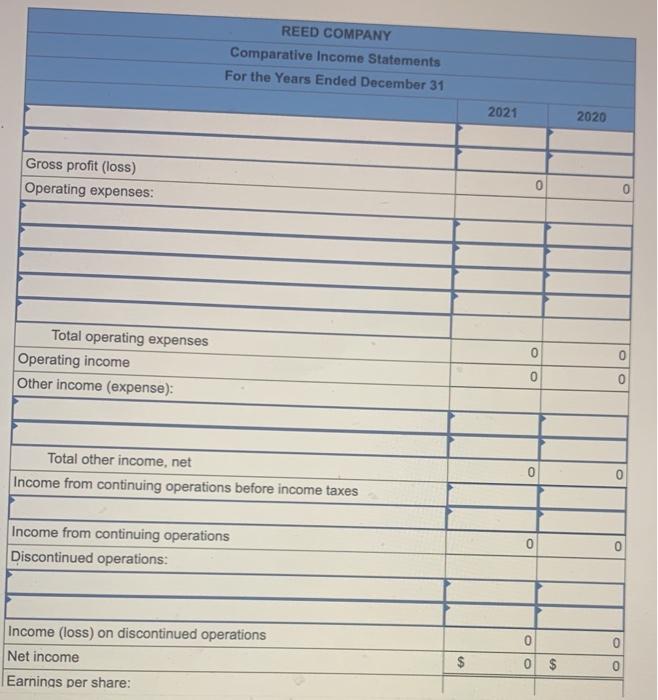

Contains revenue from the sale of products and services. The statement displays the company’s revenue, costs, gross profit, selling and administrative expenses, other expenses and income, taxes paid, and net profit in a coherent and logical manner. An income statement — also called a profit and loss account or p&l statement is a report for income and expenses over a specific time period, usually a quarter or year.

Financial statements refer to a set of specific reports that aim to provide economic information about an entity. The accounting process and income statement for service companies are relatively simple. The income statement, also called the profit and loss statement, is a report that shows the income, expenses, and resulting profits or losses of a company during a specific time period.

The income statement also called a profit and loss statement is a report made by company management that shows the revenue, expenses, and net income or loss for a period. To understand an income statement, consider it in the context of financial statements. We can interpret the new name of this statement simply as it is provided.

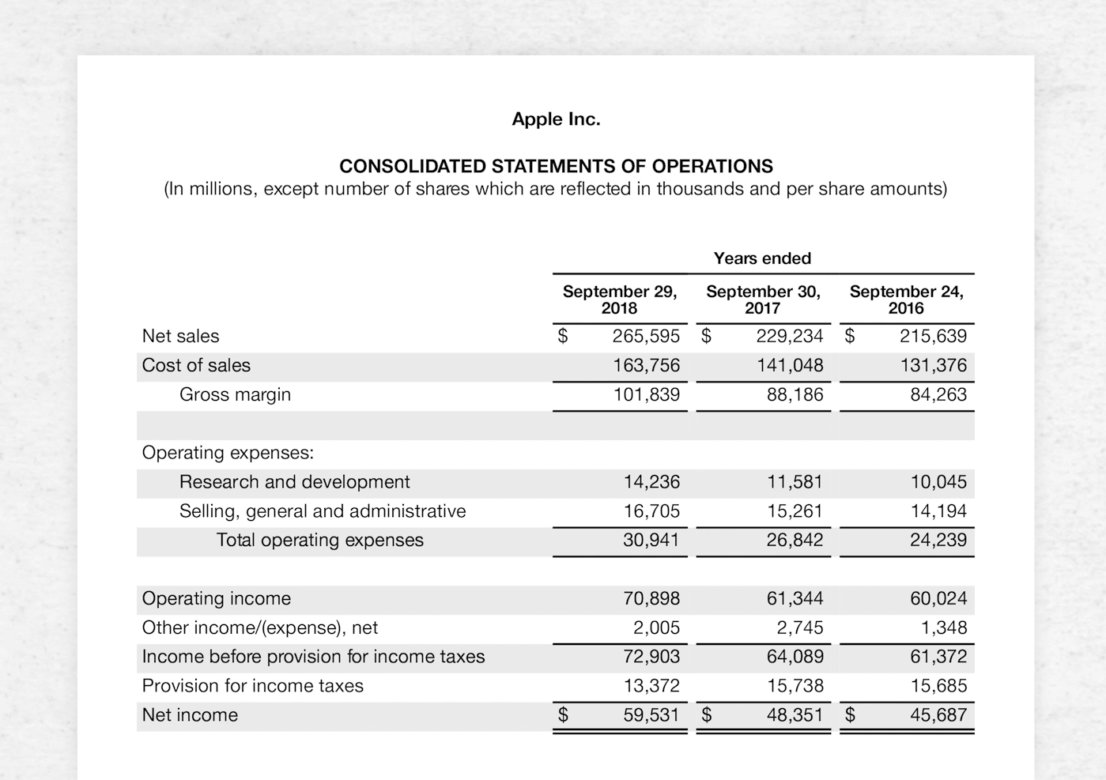

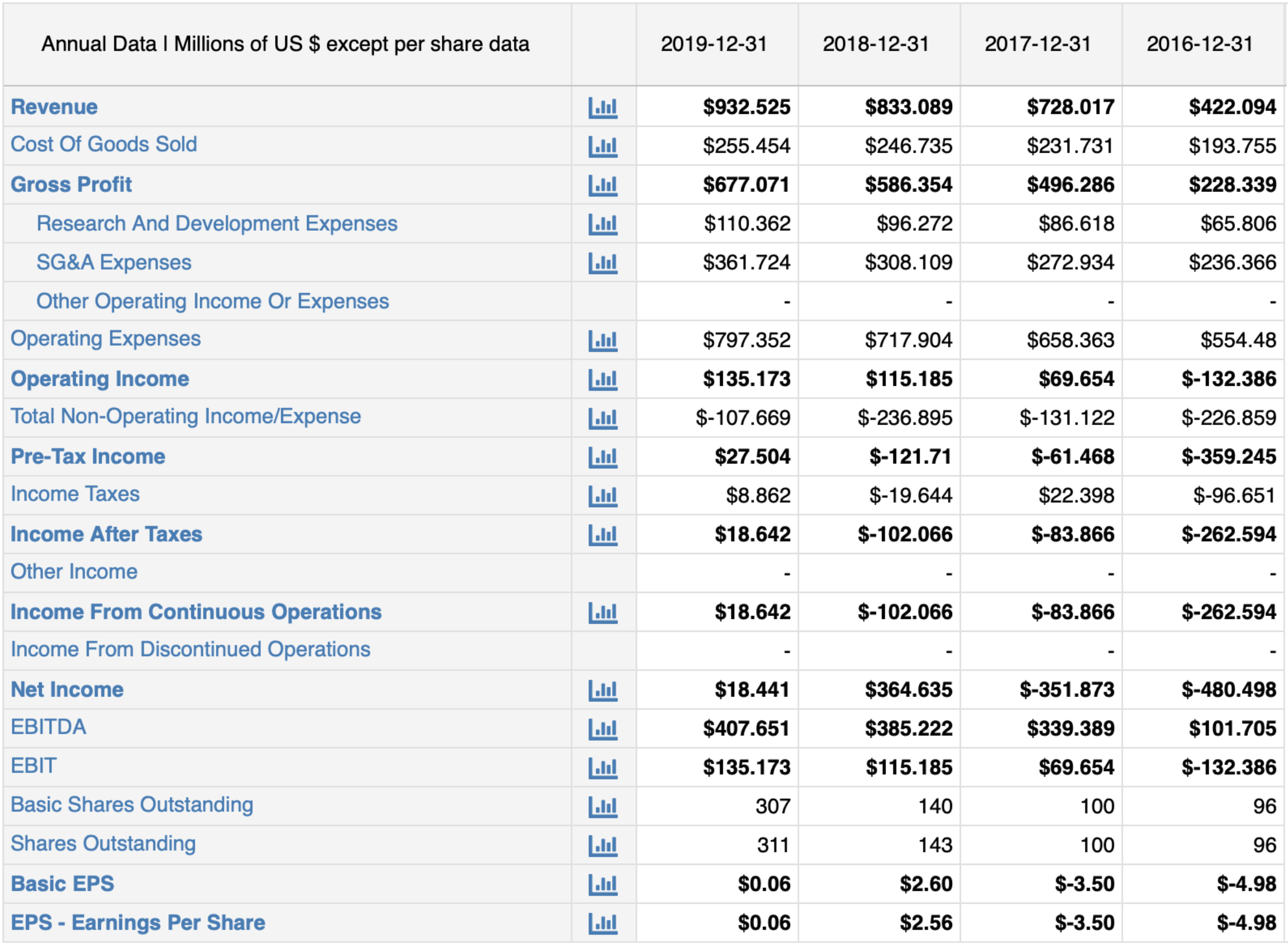

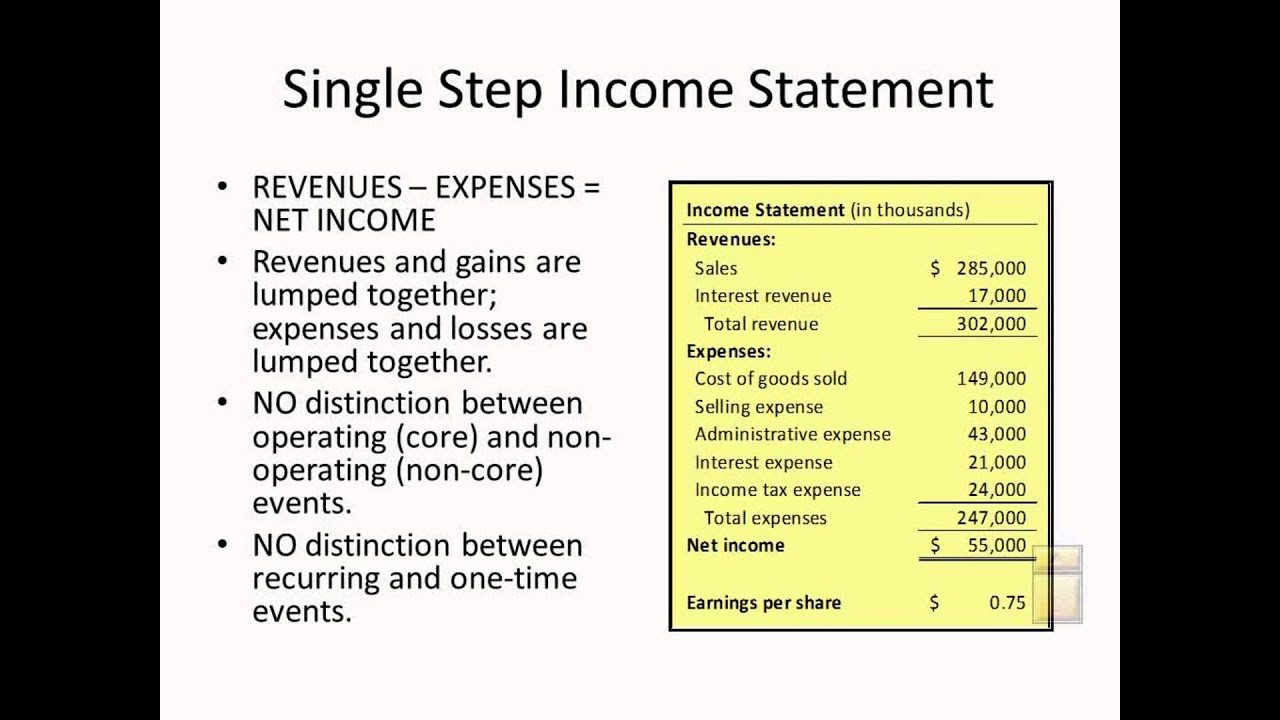

The income statement is prepared by subtracting all the expenses from the revenues. It may also present basic and diluted earnings per share (eps) and weighted shares outstanding for a corporation with shareholders. Income accounts or income statement accounts can also be called temporary or nominal accounts.

An income statement reports a company’s revenue, expenses and profit or loss during a specific accounting period. Also sometimes called a “net income statement” or a “statement of earnings,” the income statement is one of the three most important financial statements in financial accounting, along with the balance sheet and the cash flow statement (or statement of cash flows). Income statement accounts are also referred to as temporary accounts or nominal accounts because at the end of each accounting year their balances will be closed.

Also known as profit and loss (p&l) statements , income statements summarize all income and expenses over a given period, including the cumulative impact of revenue, gain, expense, and loss transactions. The income statement, also known as profit and loss statement (p&l statement), shows the. Importance of an income statement.

Suzanne kvilhaug what are financial statements? Large companies may have thousands of income statement accounts in order to budget and report revenues and expenses by divisions, product lines, departments, and so on. This takes into account all your expenses—cogs, general expenses, interest payments, and income tax.

Balance sheet , income statement, statement of owner’s equity. These deductions are subtracted from the revenue figure to derive a net revenue number. List of income statement accounts and other line items revenue gains and losses on income statement.

This is a contra account, containing discounts granted to customers from the gross sale price. An income statement is often called profit & loss account. It records your business revenue, expense, profit, and loss transactions within a given period.

:max_bytes(150000):strip_icc()/ScreenShot2022-04-26at10.45.59AM-aab9d8741c8f4ee1aff95f057ca2ab3a.png)