Fun Tips About Income Statement And Profit Loss

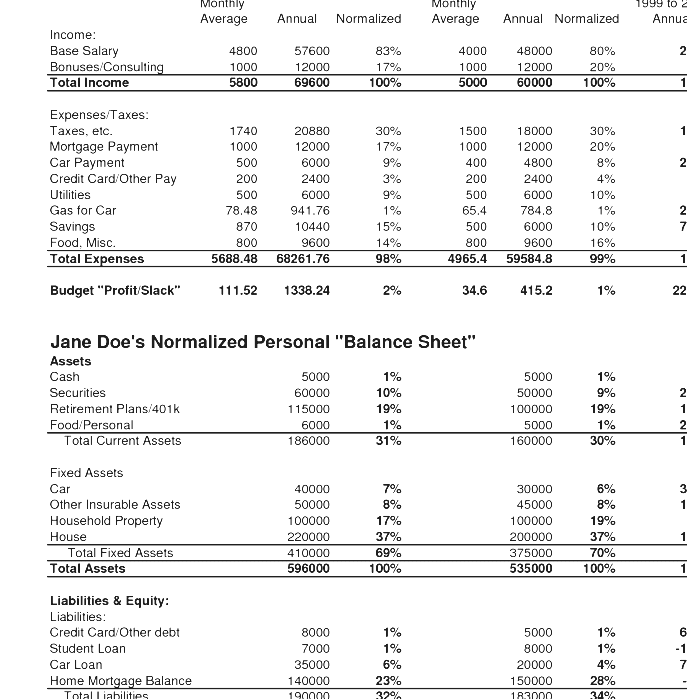

It tells you how much profit you're making, or how much you’re losing.

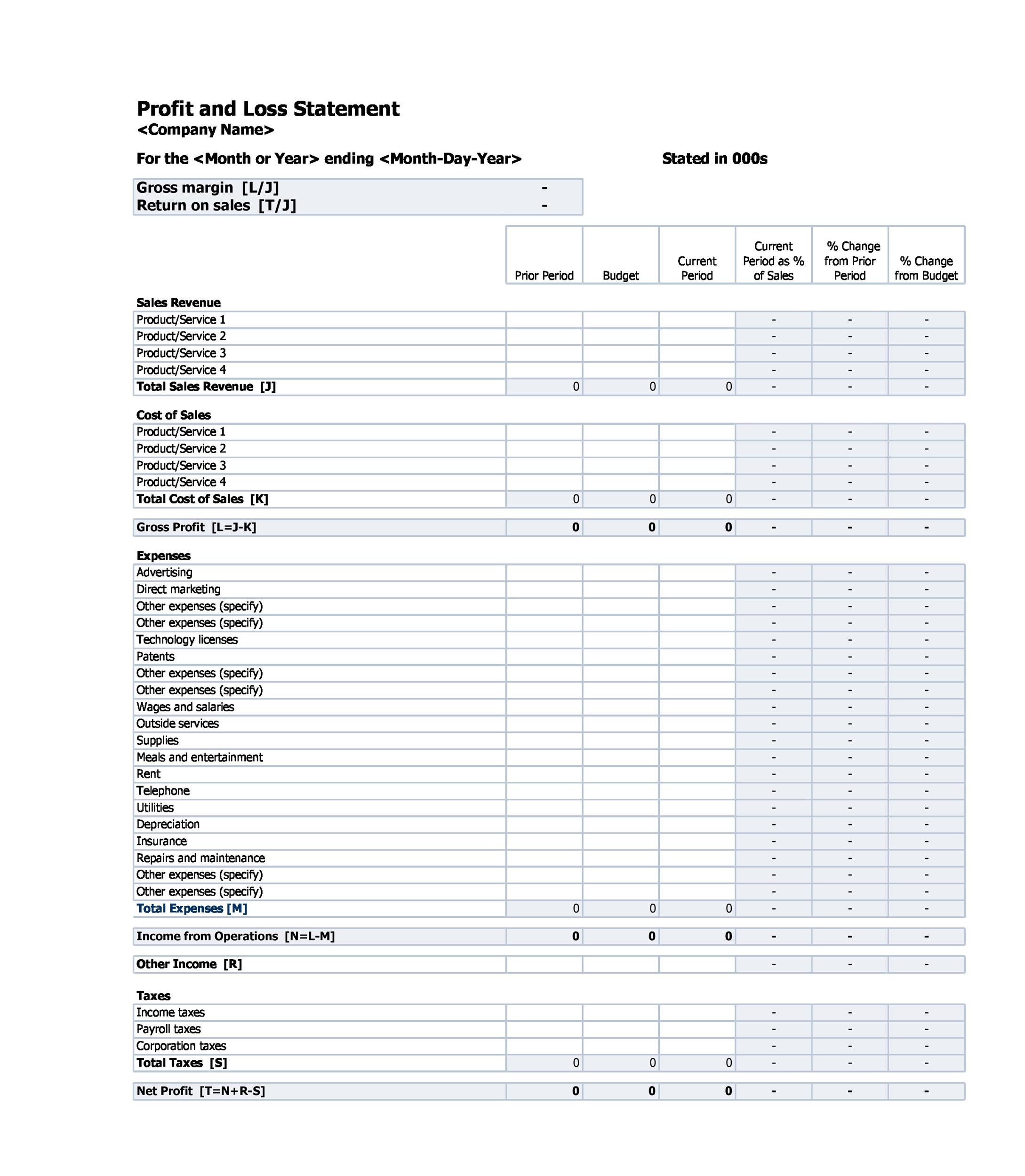

Income statement and profit and loss statement. In short, the profit and loss statement reports a company's revenues, expenses, and most of the gains and losses which occurred during the period of time shown in the statement's. Sales on credit) or cash vs. The p&l statement shows a company’s ability to generate sales, manage expenses, and create profits.

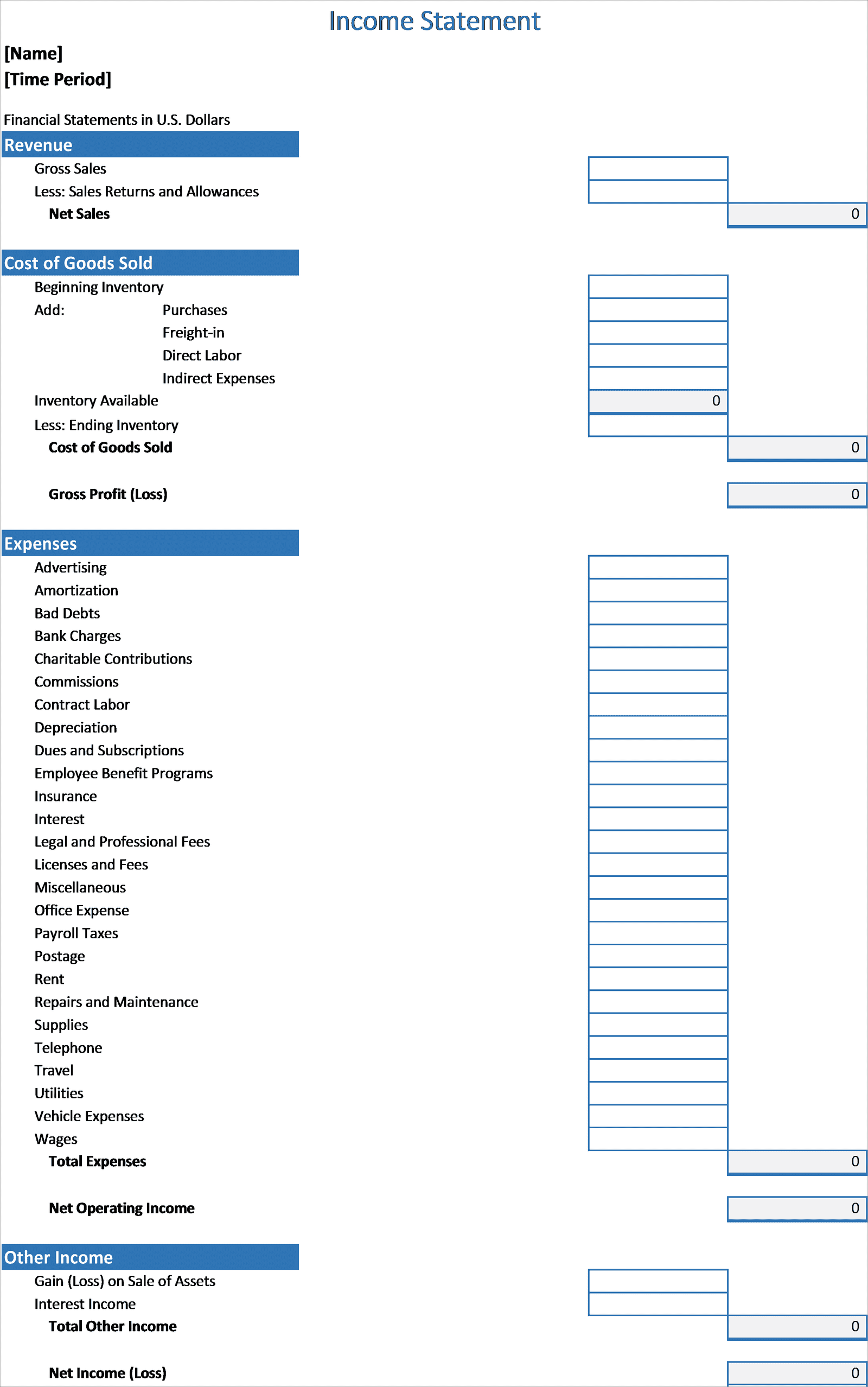

The income statement focuses on four key items: A profit and loss statement (p&l), or income statement or statement of operations, is a financial report that provides a summary of a company’s revenues, expenses, and profits/losses over a given period of time. The p&l statement, also referred to as a statement of profit and loss, statement of operations, expense statement, earnings statement, or income statement, begins by showing how much money your business made from selling goods or services.

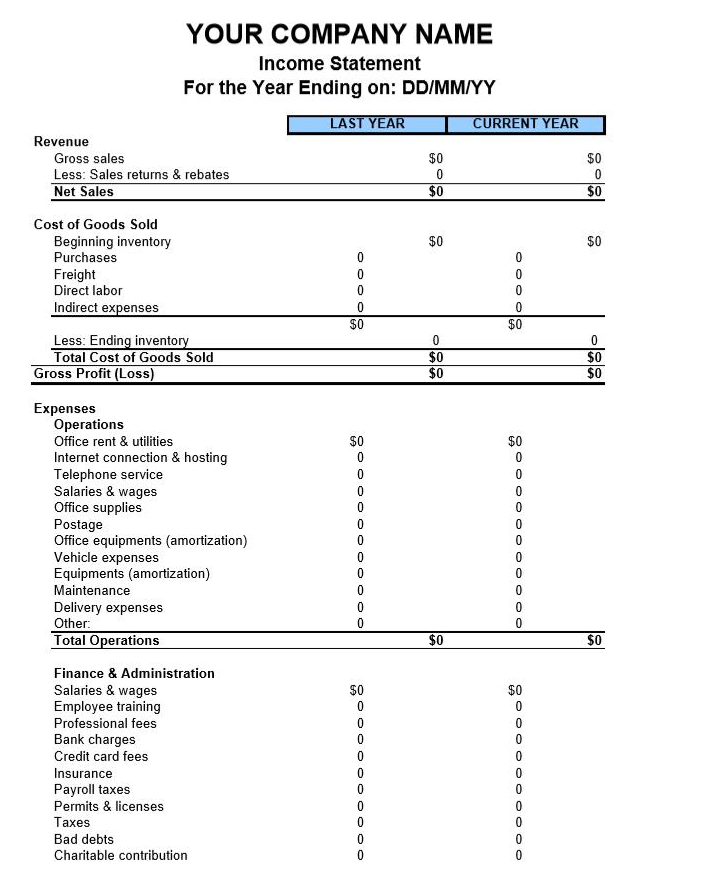

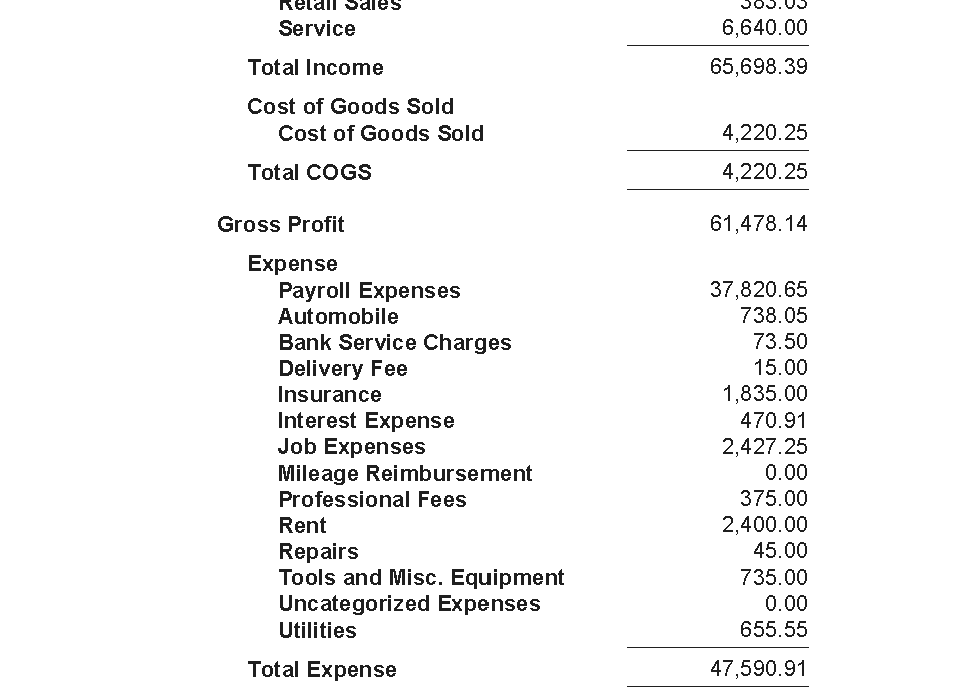

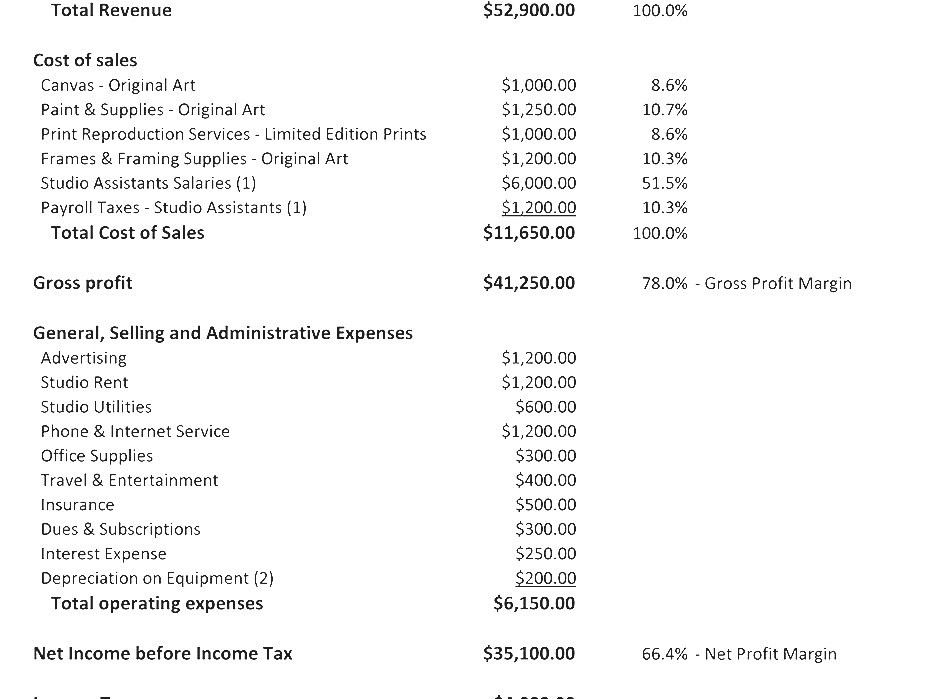

A profit and loss statemen t is a financial document that details your business’s revenue, expenses, and net income over a month, quarter, or year. Revenue minus expenses equals profit or loss. P&l is short for profit and loss statement.

The main difference between the two is that an income statement is more comprehensive than a profit and loss statement. Add up the income tax for the reporting period and the interest incurred for debt during that time. On the bottom of the income statement is the net profit or loss.

An income statement or a profit and loss statement outline a company's earnings and expenses to determine its net income over a specific time. The profit and loss statement, or p&l, is sometimes used to mean a company's income statement, statement of income, statement of operations, or statement of earnings. The profit and loss (p&l) statement is a financial statement that summarizes the revenues, costs, and expenses incurred during a specified period.

Income statement and profit and loss mean the same thing and can be used interchangeably. What is an income statement? A p&l statement (sometimes called a statement of operations) is a type of financial report that tells you how profitable your business was over a given period.

Less cost of goods sold. A business profit and loss statement shows you how much money your business earned and lost within a period of time. P&l statements tend to follow a standard format:

An income statement is another name for a profit and loss statement (p&l). You usually complete a profit and loss statement every month, quarter or year. Revenue is money a business generates through its primary activities, such as selling products.

A p&l statement explains the income and expenses that lead to a company’s profits (or losses). A profit and loss (or income) statement lists your sales and expenses. It captures how money flows in and out of your business.

The income statement is one of a company’s core financial statements that shows their profit and loss over a period of time. The income statement is a useful way to see how a company makes money and how it spends it. It shows your revenue, minus expenses and losses.

![53 Profit and Loss Statement Templates & Forms [Excel, PDF]](https://templatelab.com/wp-content/uploads/2020/06/Rental-Property-Profit-and-Loss-Statement-Template-TemplateLab.com_-scaled.jpg)

![53 Profit and Loss Statement Templates & Forms [Excel, PDF]](https://templatelab.com/wp-content/uploads/2020/06/Yearly-Profit-Loss-Statement-Template-TemplateLab-scaled.jpg)