Here’s A Quick Way To Solve A Tips About Important Balance Sheet Ratios

The balance sheet is a very important financial statement for many reasons.

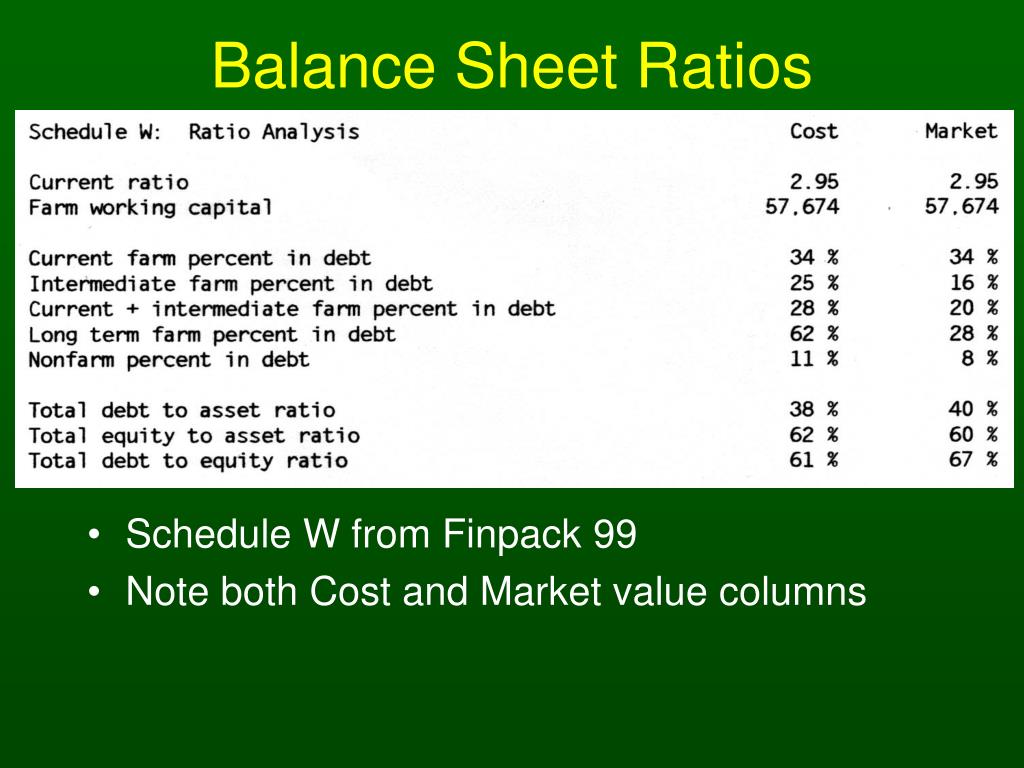

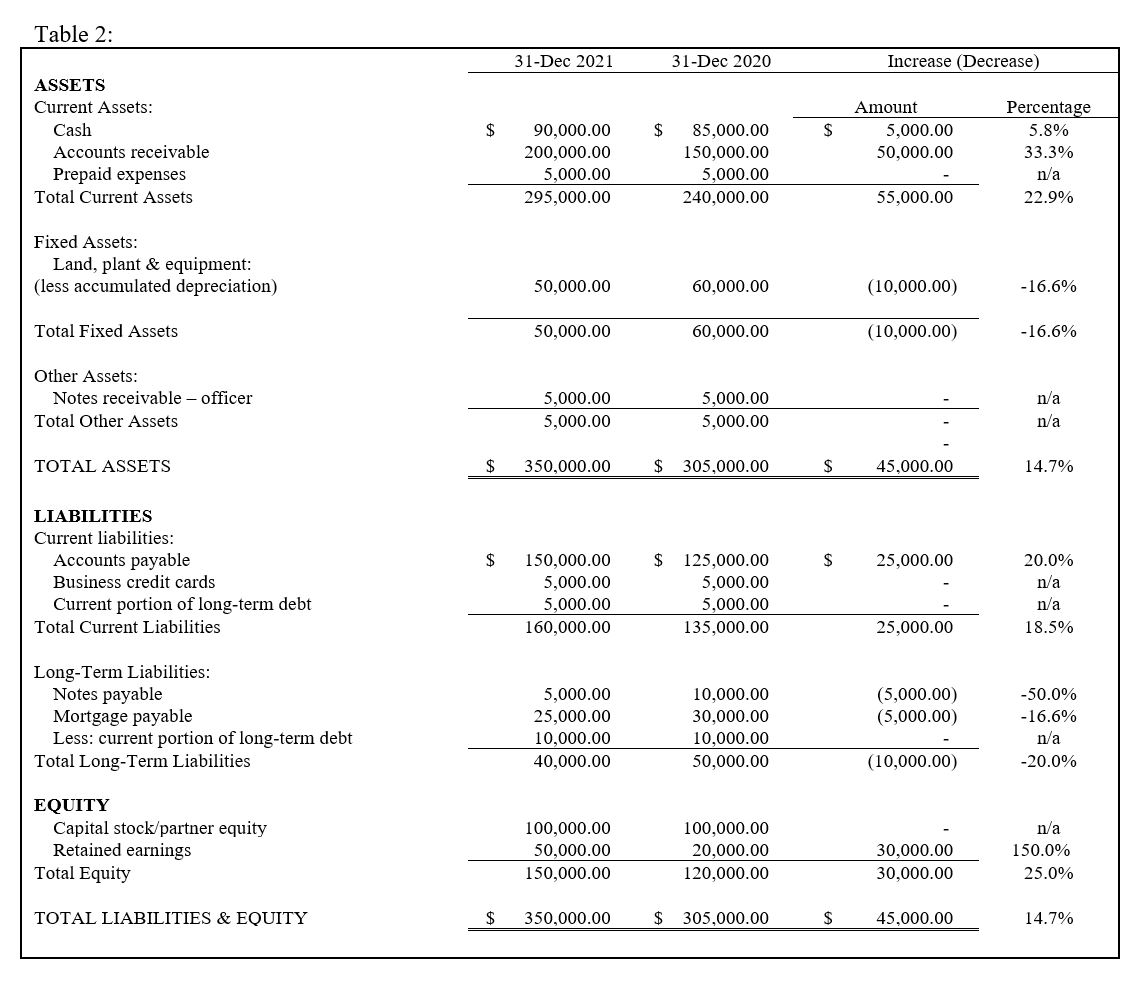

Important balance sheet ratios. So, let’s dive into this amazing post. Most analysts prefer would consider a ratio of 1.5 to two or higher as adequate, though how high this ratio depends upon the business in which the company operates. Fundamental analysts use balance sheets to calculate financial ratios.

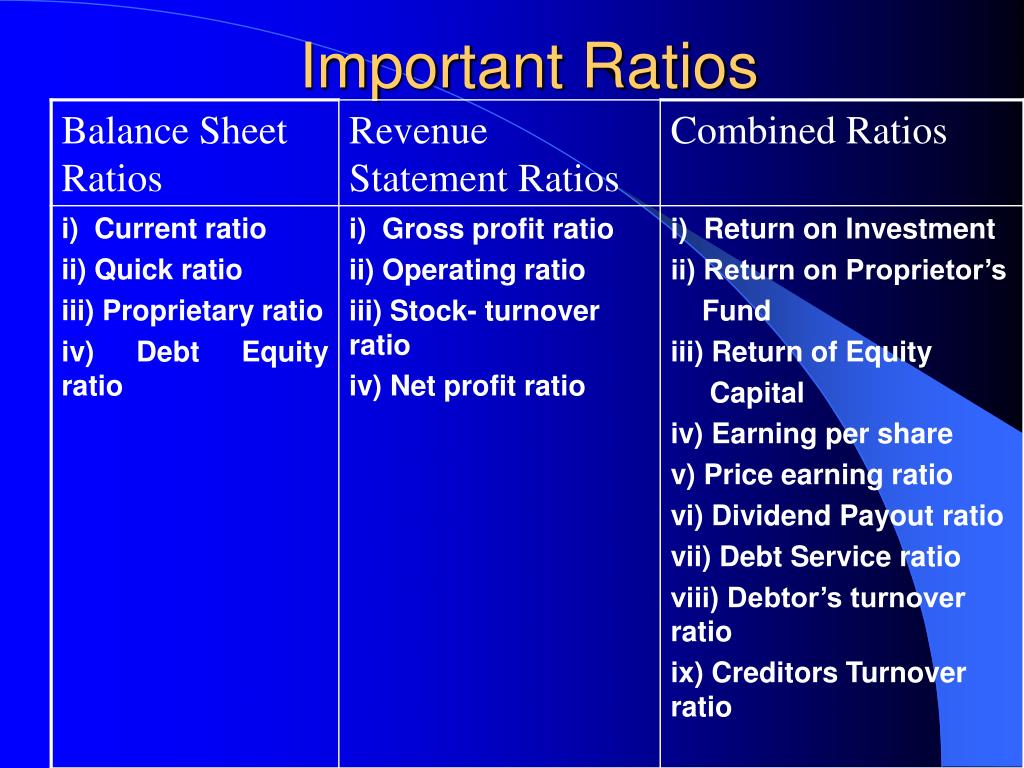

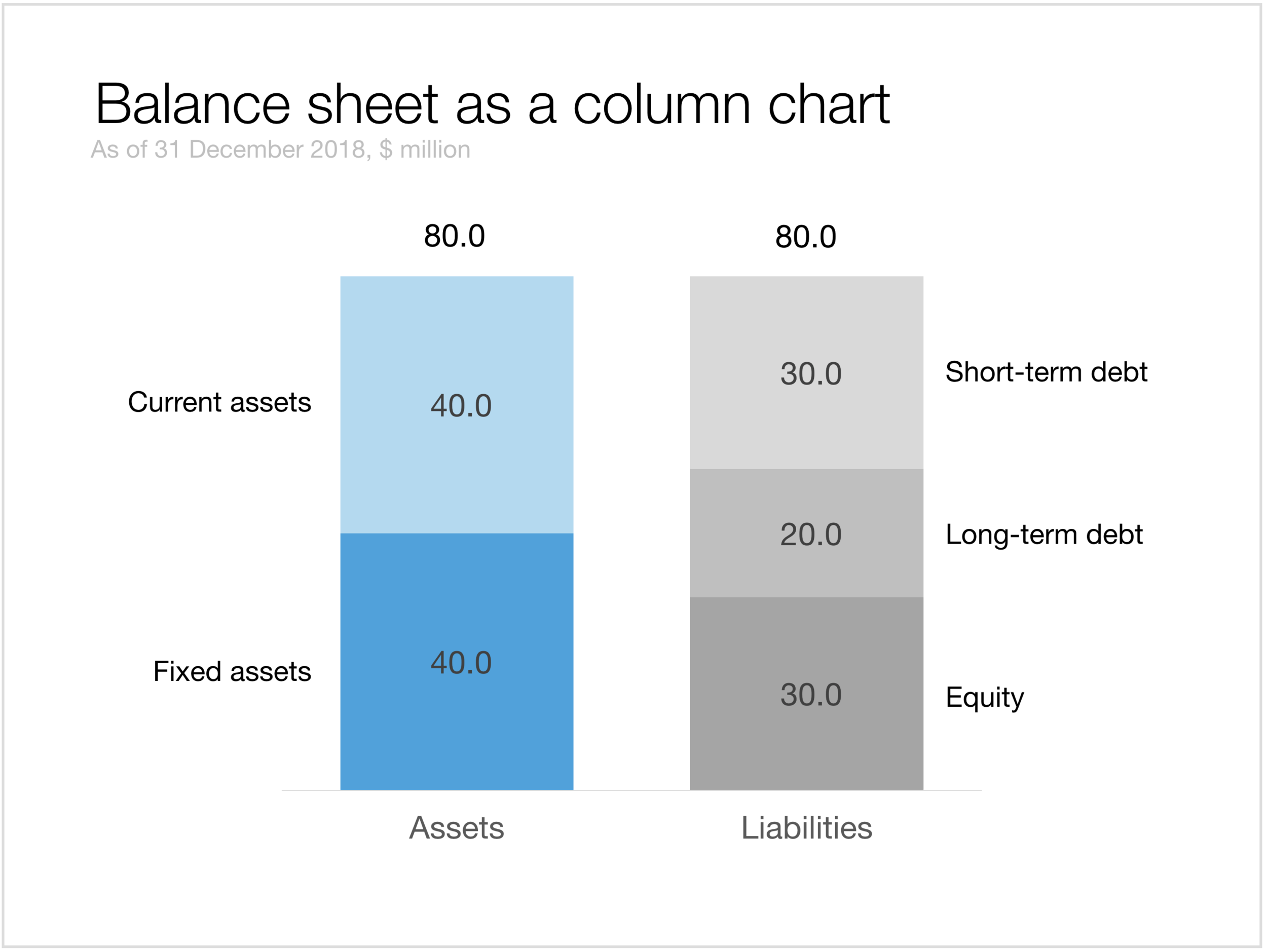

It can be looked at on its own and in conjunction with. Types of ratio analysis the various kinds of financial ratios. Balance sheet ratios.

This type of balance sheet ratio analysis is also known as the banker’s ratio. Profitability ratios show the ability to generate income. In this article, you will learn:

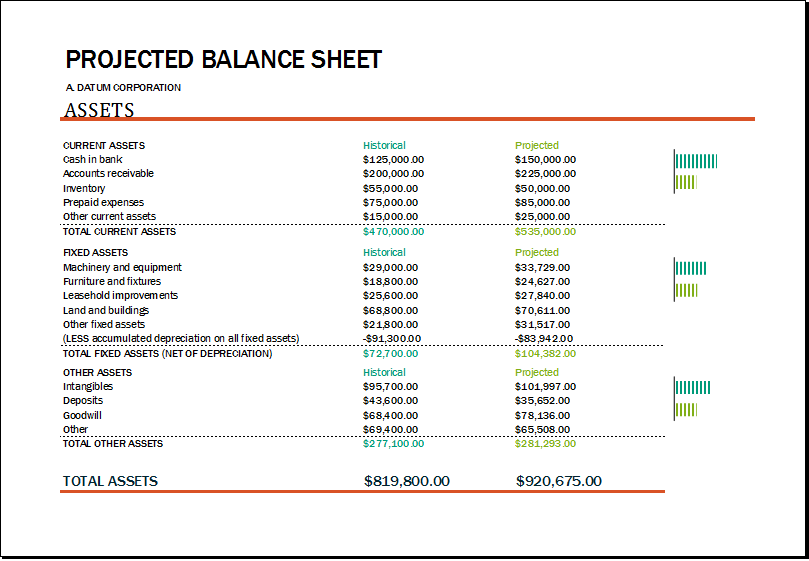

5 important ratios for measuring company health fundamentals, ratios for stocks cameron smith february 5, 2020 fundamentals, ratios for stocks Businesses use financial ratios to determine liquidity, debt concentration, growth, profitability, and market value. Balance sheet ratios are formulas you can use to assess your finances based on your balance sheet information.

Investopedia / katie kerpel how balance sheets work the balance sheet provides an overview of the state of a. Balance sheet analysis: This type of important balance.

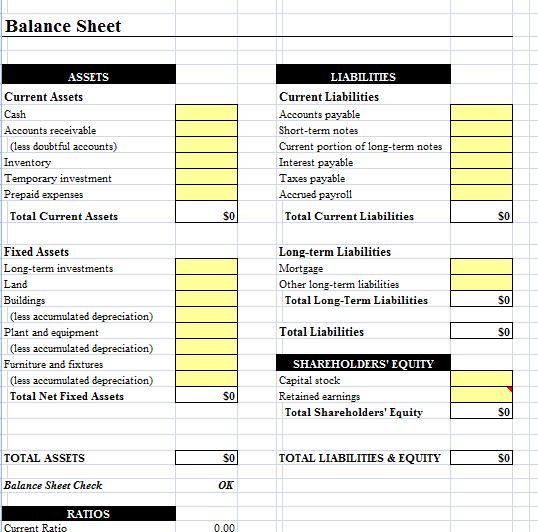

So if you want to, you can check that out. There are two additional financial ratios based on balance sheet amounts. Here are my favorite financial ratios or formulas for balance sheets with detailed instructions on how to use them.

Providing a complete interpretation of a company's results quantitatively, balance sheet. Ratio #3 quick (acid test) ratio. Why are financial ratios so important?

We have covered this in one of our articles in the series. You can learn a lot about a business’s health by looking at its balance sheet and calculating some ratios. The following list includes the most common ratios used to analyze the balance sheet.

This type of balance sheet ratio analysis, i.e., efficiency ratio, is used to analyze how. These ratios provide information on a corporation's use of debt or financial leverage: Balance sheet ratios use balance sheet ratios to further understand your business’s financial standing.

Common financial ratios come from a company’s balance sheet, income statement, and cash flow statement. Financial ratios are created with the use of numerical values taken from financial statements to gain meaningful information about a company. Ratio #2 current ratio.

![12 important Balance sheet ratios [formula and examples] cash flow click](https://www.cashflowclick.com/wp-content/uploads/2023/11/Balance-sheet-ratios.png)