Out Of This World Tips About Inflow And Outflow Of Cash Flow Statement

It demonstrates an organization’s ability to operate in the short and long term, based on how much cash is flowing into and out of the business.

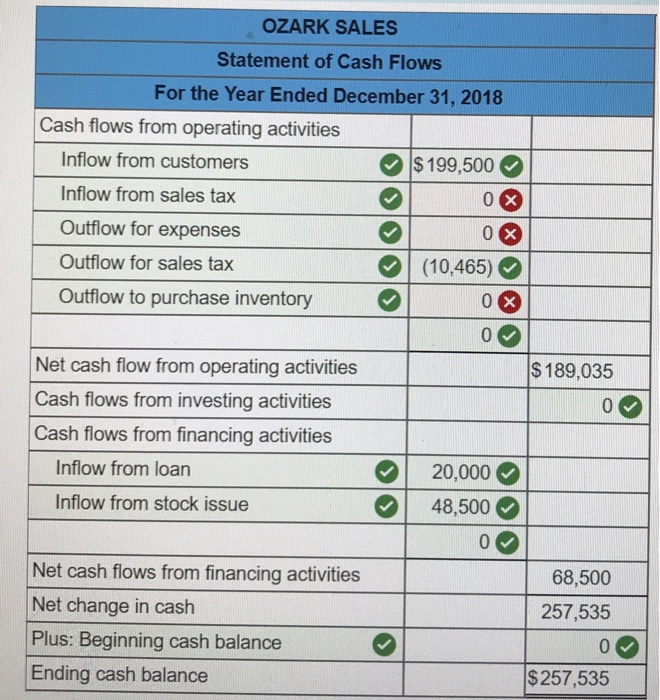

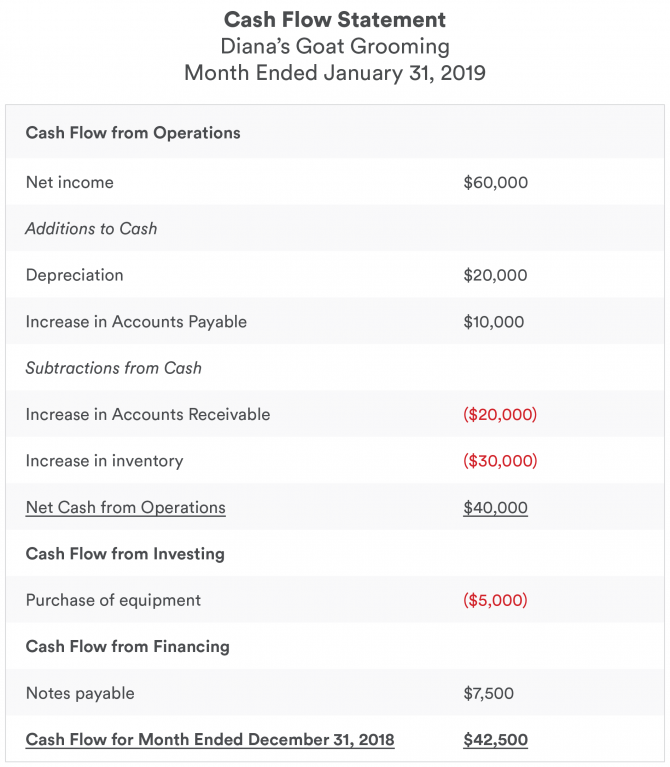

Inflow and outflow of cash flow statement. The cash flow statement (cfs), is a financial statement that summarizes the movement of cash and cash equivalents (cce) that come in and go out of a company. A cash flow statement tells you how much cash is entering and leaving your business in a given period. To forecast your cash flow, you will need to gather and analyze financial data such as sales revenue, expenses, and accounts receivable and payable.

The cfs measures how well a. Along with balance sheets and income statements, it’s one of the three most important financial statements for managing your small business accounting and making sure you have enough cash to keep operating. The statement of cash flows acts as a bridge between the income statement and balance sheet by.

We’ve collated some tips for forecasting: Statement of cash flows definition a statement of cash flow is an accounting document that tracks the incoming and outgoing cash and cash equivalents from a business. A cash flow statement is a financial statement that provides aggregate data regarding all cash inflows and outflows that a company receives.

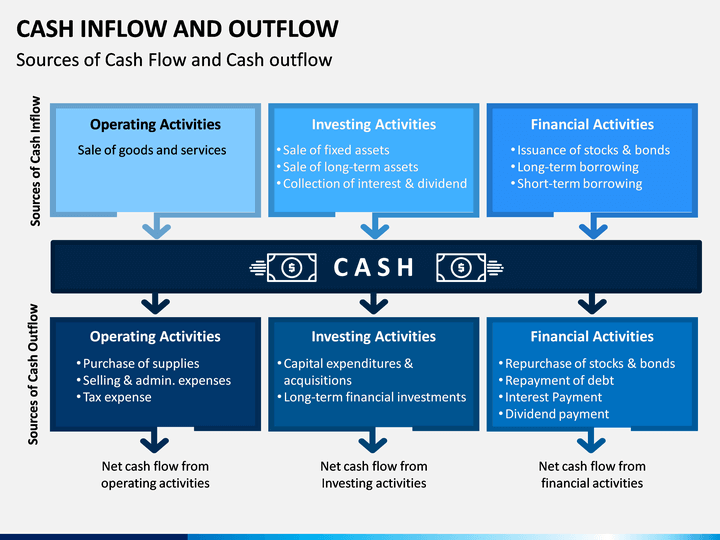

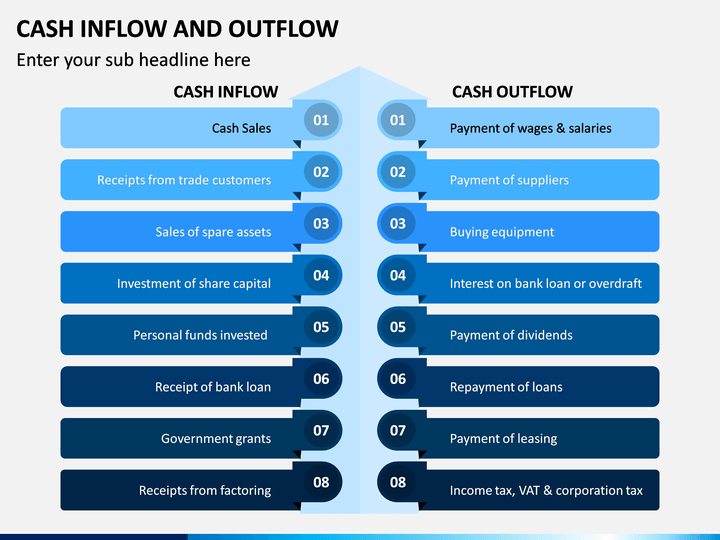

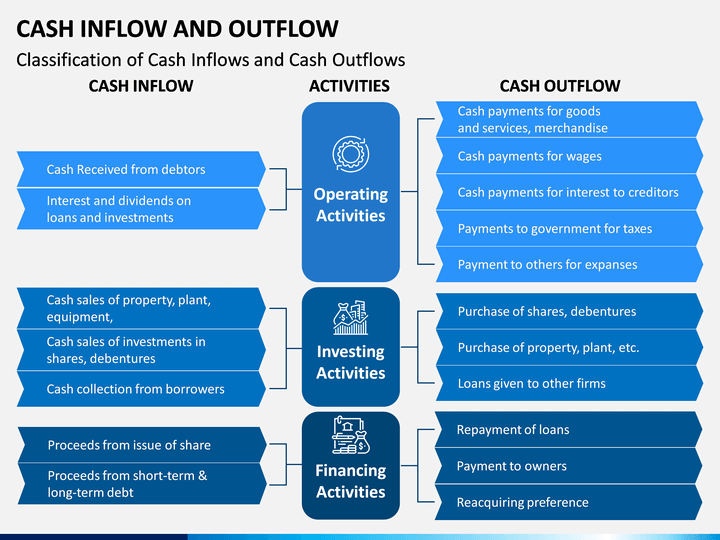

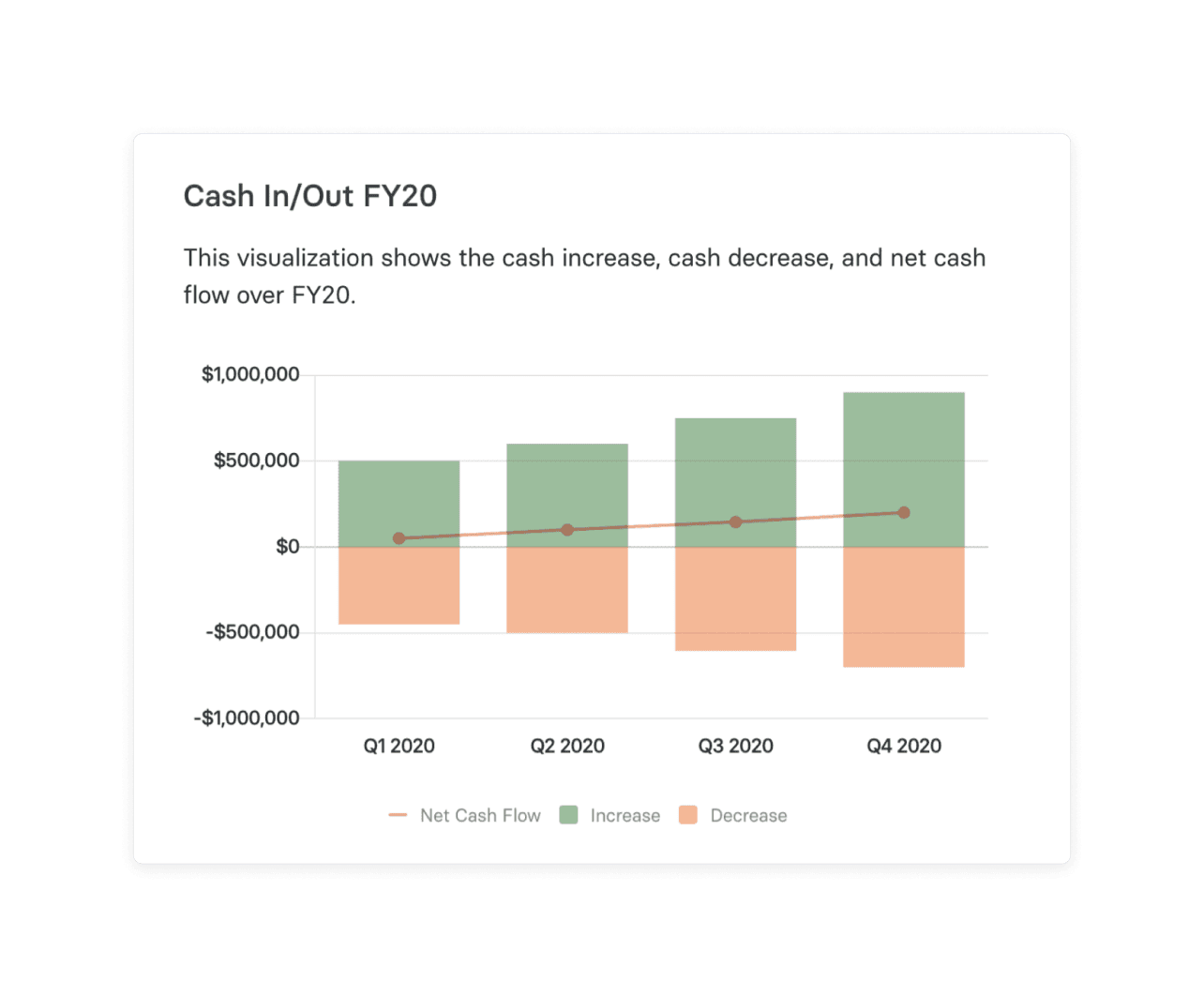

Cash received signifies inflows, and cash spent is outflows. Cash inflows refer to receipts of cash while cash outflows to payments or disbursements. The cash flow statement reports the cash generated and spent during a specific period of time (e.g., a month, quarter, or year).

Your cash flow statement will outline your cash inflow vs outflow and how they compare. Key takeaways cash flow is the movement of money in and out of a company. The statement of cash flows (also referred to as the cash flow statement) is one of the three key financial statements.

Statement of cash flows presents the inflows and outflows of cash in the different activities of the business, the net increase or decrease in cash, and the resulting cash balance at the end of the period. It helps identify the availability of liquid funds with the organization in a particular accounting period.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)