Unbelievable Info About Investment In Subsidiary Ifrs

International financial reporting standards (ifrs) provide a framework for the recognition, measurement, and disclosure of investment in a.

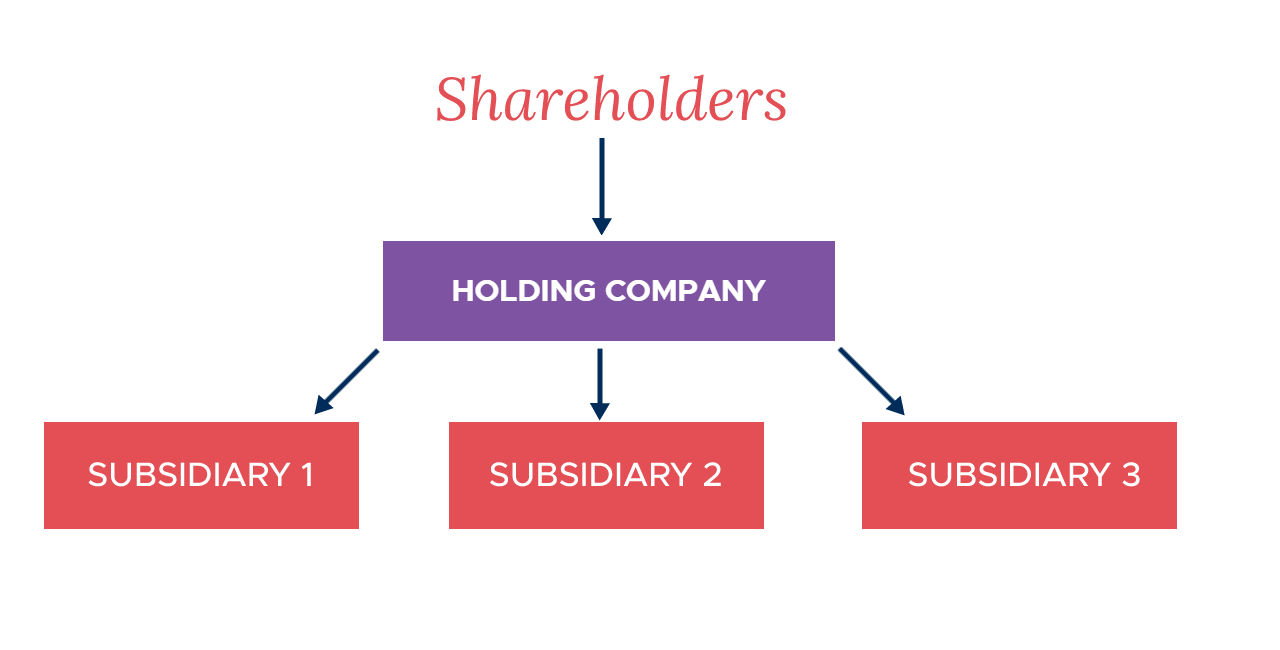

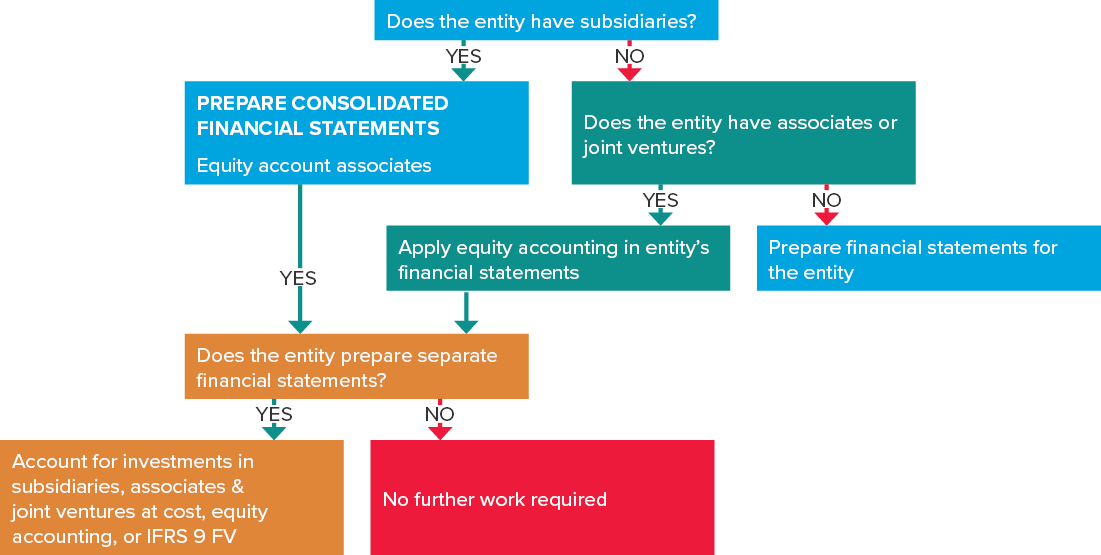

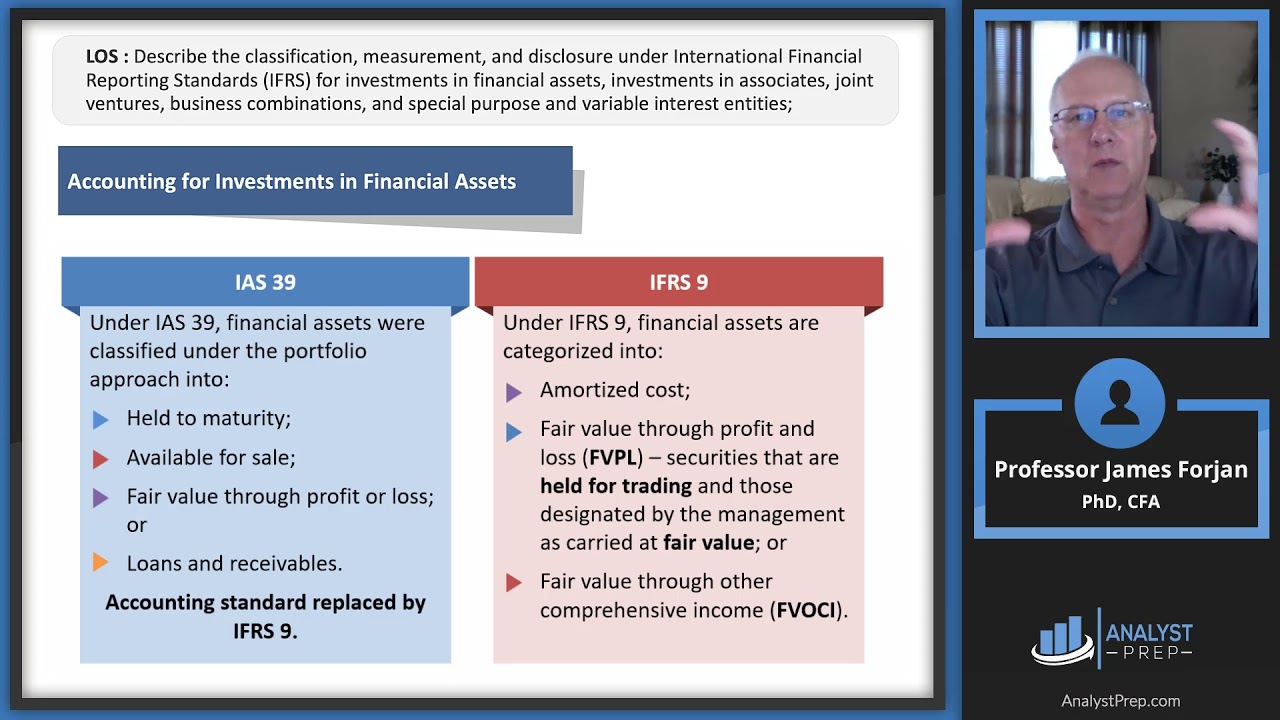

Investment in subsidiary ifrs. Ias 27.10 sets out specific provisions for investments in subsidiaries, joint ventures, and associates. In the fact pattern described in the request, the entity preparing separate financial statements: Investments in subsidiaries held by investment entities that are accounted for at fair value through profit or loss under ifrs 9;

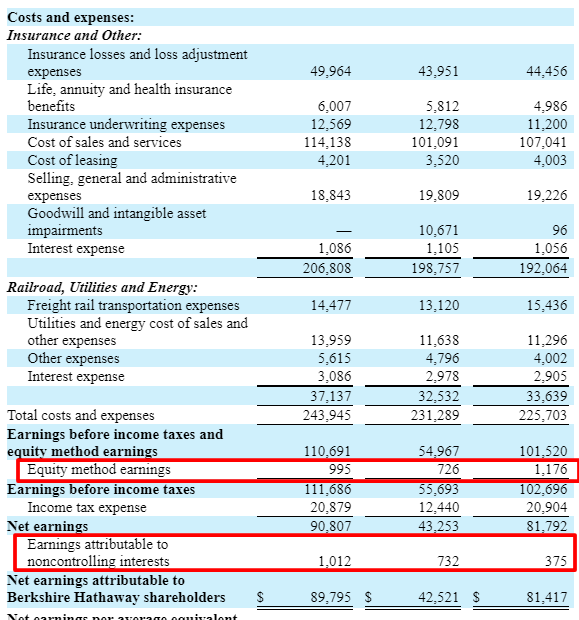

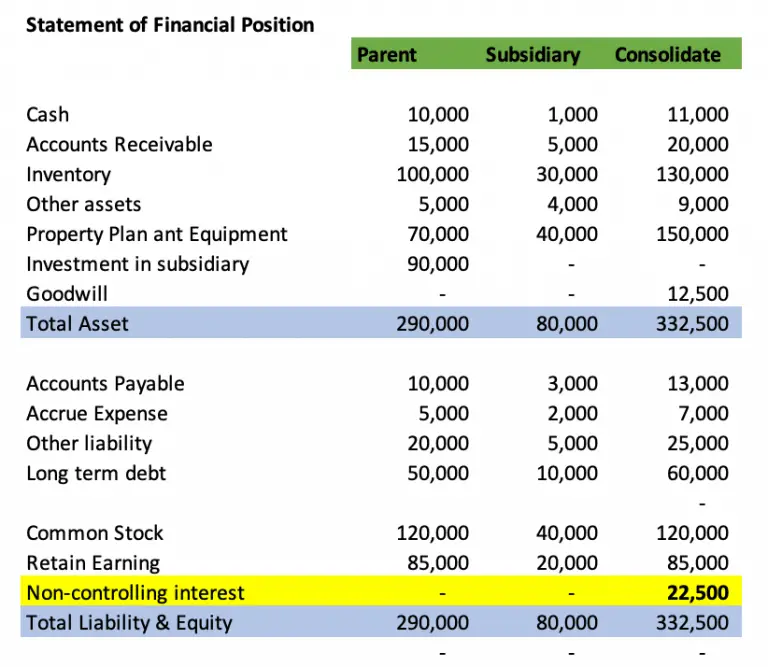

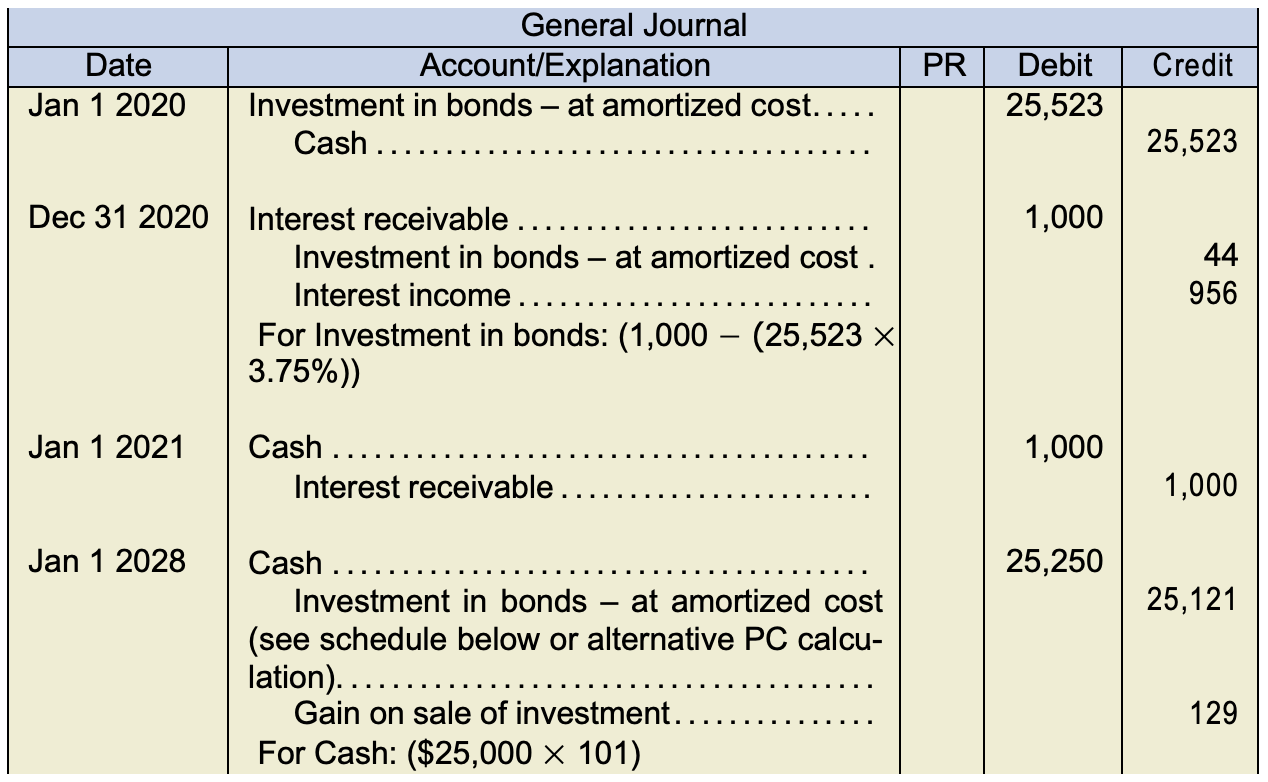

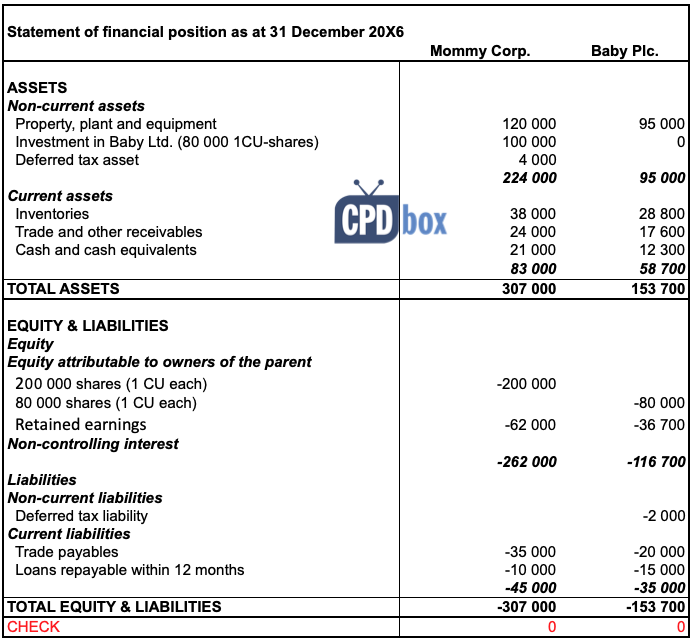

In its parent company financial statements, company a should reflect an investment in subsidiary b of $80, reflecting its proportionate share of subsidiary b’s net assets of. 14 rows learn about the accounting and disclosure requirements for. According to ias 27 standard separate financial statements are defined as those presented by an entity in which the entity could elect to account for its investments in subsidiaries,.

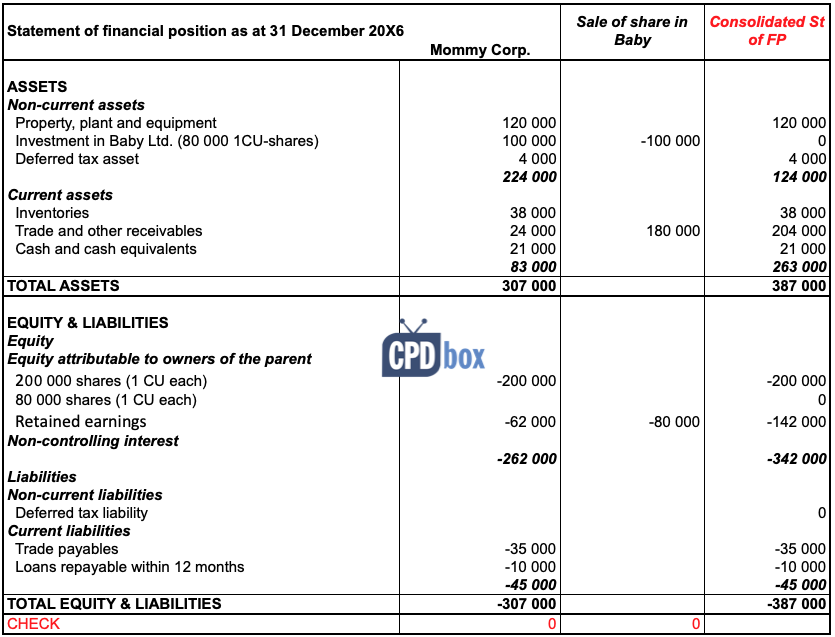

In separate financial statements, these investments should. Have your say by 31 january 2022 * currently, a subsidiary that prepares financial statements. Involving an investment in a subsidiary.

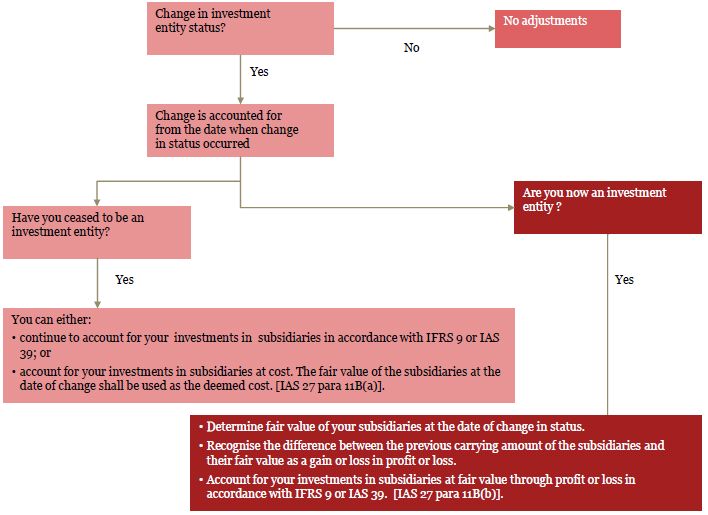

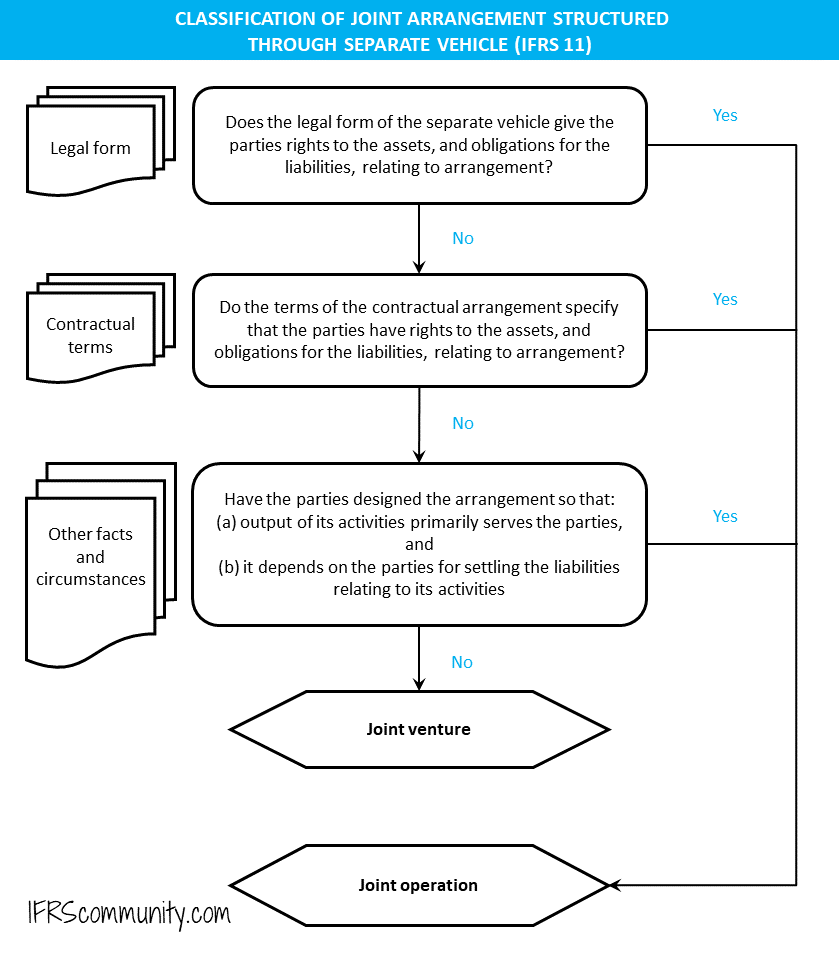

The ifric considered the comment letters received to the proposed amendments to ias 27 separate financial statements and decided not to finalise them. Separate financial statements are presented in addition to consolidated financial statements and to the financial statements of an investor that does not have investments in. Once an investment ceases to fall within the definition of a subsidiary, it should be accounted for as an associate under ias 28, as a joint venture under ias 31, or as an.

Investments in a subsidiary accounted for at cost: Cost of an investment in a subsidiary (amendments to ifrs 1 and ias 27) equity method in separate financial statements (amendments to ias 27) investment entities. Elects to account for its investments in subsidiaries at cost applying paragraph 10 of ias 27.

And investments in associates and. An investment entity needs to account for its investments in subsidiaries at fair value through profit or loss in the separate financial statements, if it is required to. Holds an initial investment in a subsidiary (investee).

In some cases it is difficult to determine the initial cost of an investment in a subsidiary in the separate financial statements of a parent, in accordance with ias 27. Step acquisition (ias 27) final stage.

An investment entity is required to measure an investment in a subsidiary at fair value through profit or loss in accordance with ifrs 9 financial instruments or ias. Investment in a subsidiary accounted for at cost: Partial disposal (ias 27 separate financial statements)—january 2019 the committee received a request about how an.