Smart Info About Different Types Of Accounting Ratios

How to calculate different types of accounting ratios.

Different types of accounting ratios. Each of these ratios provides a window into a specific. Importance of accounting ratios 4. A ratio is a relationship between two quantities, attained by dividing one quantity by the other.

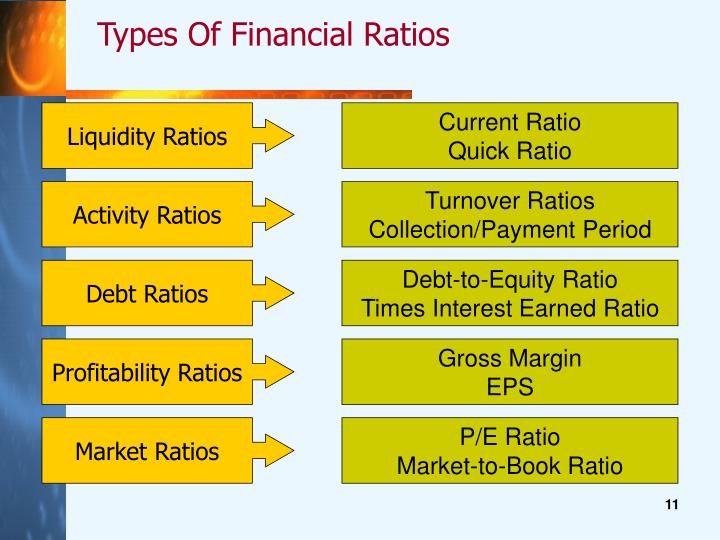

26 rows what are the different types of accounting ratios? The most commonly used accounting ratios include liquidity ratios, profitability ratios, efficiency ratios, and leverage ratios. Cash ratio is the measure for most liquid assets to the current liabilities.

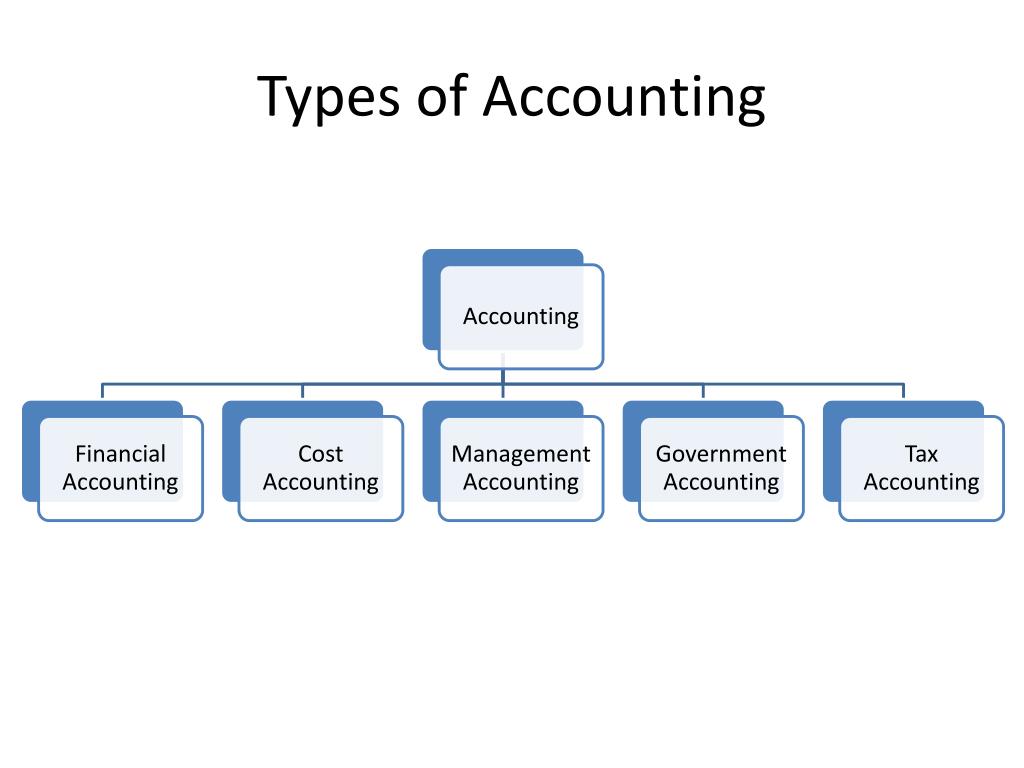

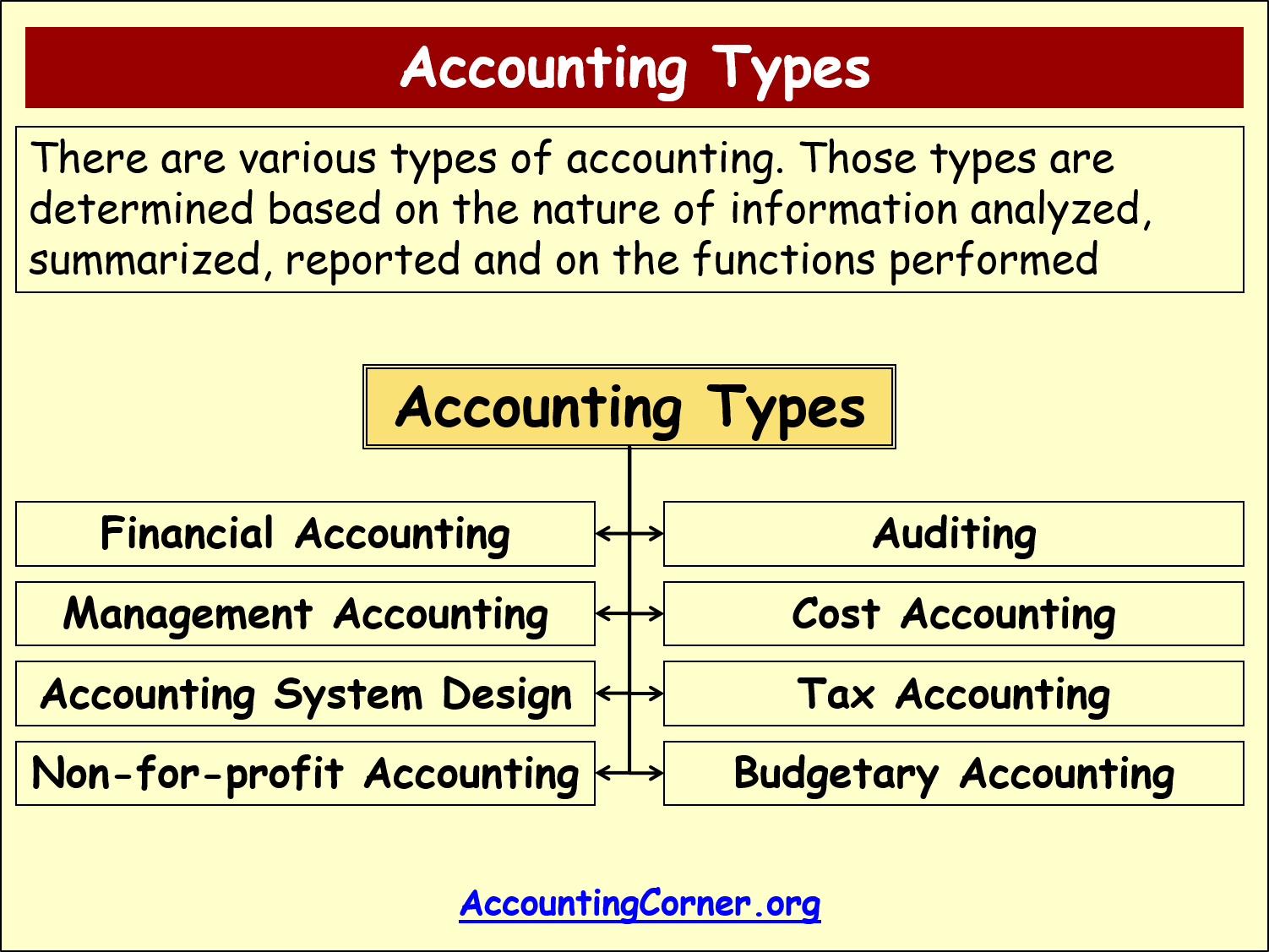

If we explain different types of ratios in accounting or types of ratio in management accounting in detail then there are four types of ratios in accounting. Accounting ratios are financial metrics used to assess the performance, profitability, and solvency of a company. Let’s discuss each different type of accounting ratio in more depth.

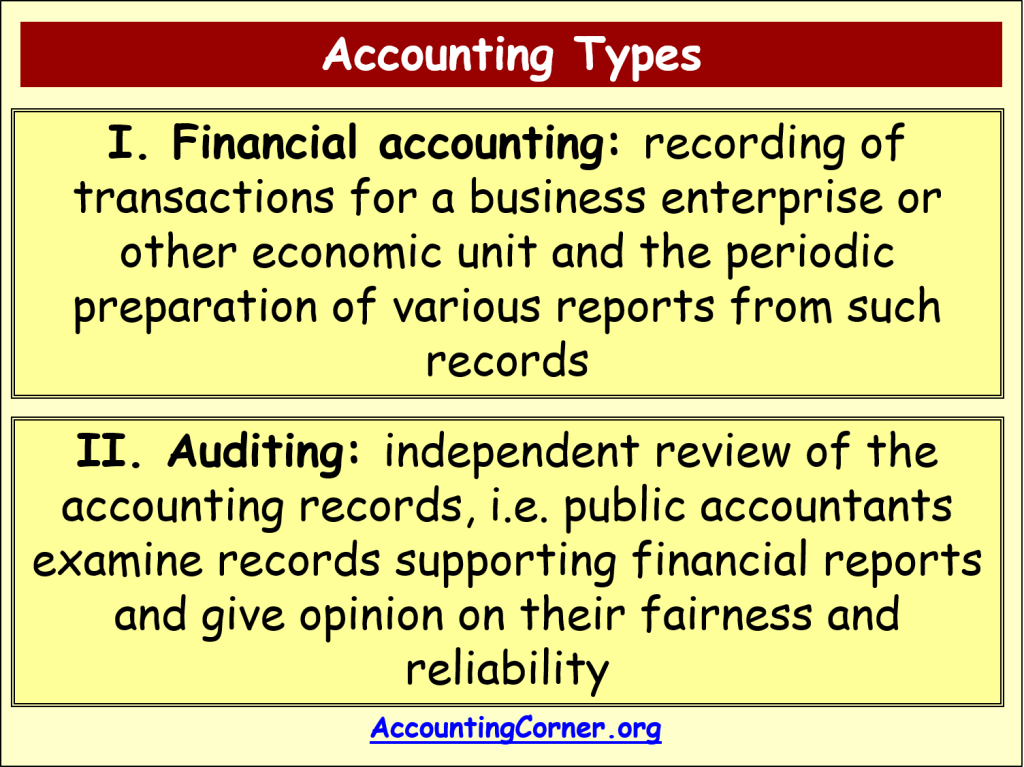

Net annual credit sales divided by average receivables. They typically measure current business liabilities and liquid assets to. Liquidity ratios activity (or turnover) ratios solvency ratios profitability ratios share with friends accounting ratios, also known as financial ratios signify the relationships.

It uses data from a company's sales, expenses and assets. There are mainly 4 different types of accounting ratios to perform a financial statement analysis; Annual cost of goods sold divided by average.

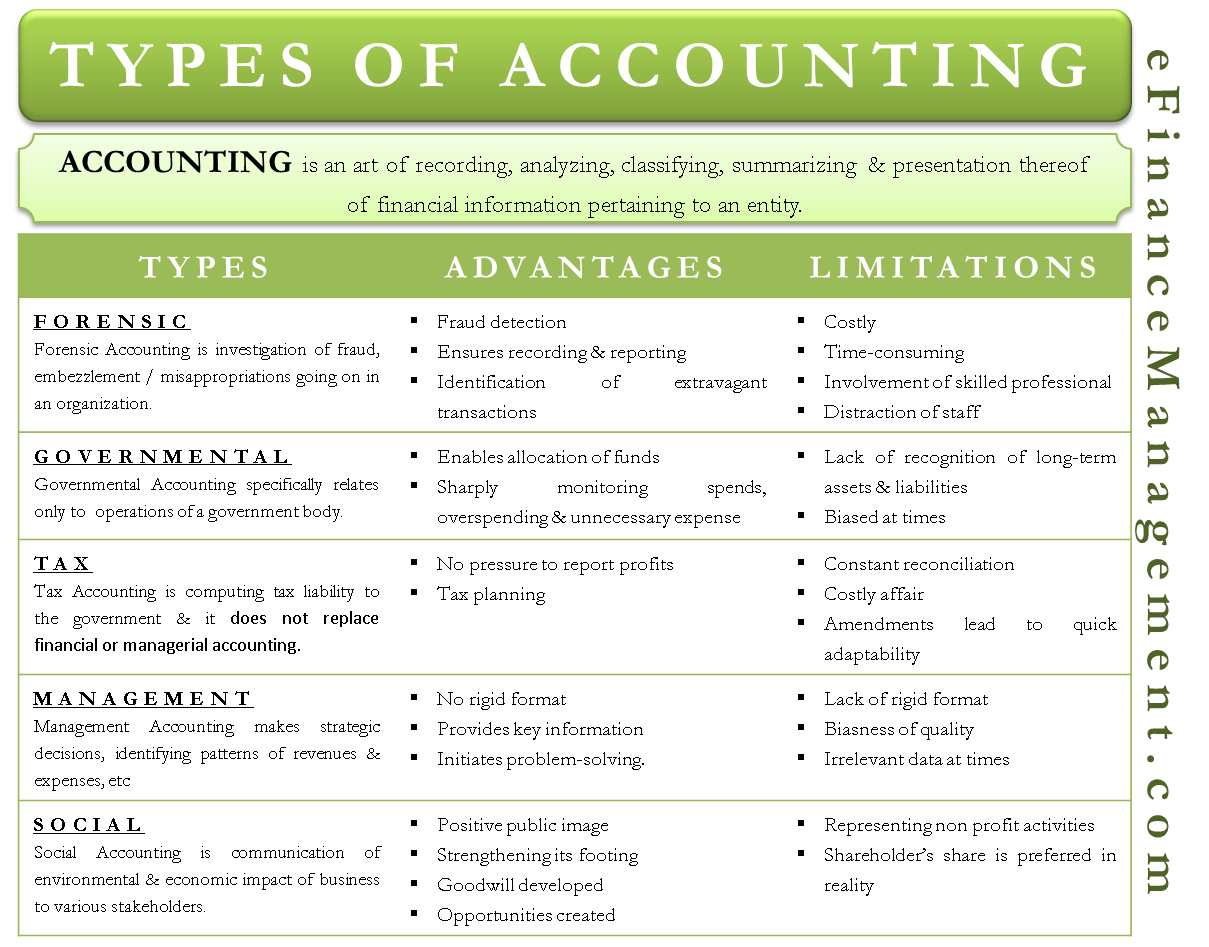

There are several types of accounting ratios,. Various interested stakeholders use various types of accounting ratios to analyze the company’s financial statements. Accounting ratios may be very useful for forecasting likely events in the future since past ratios indicate trends in costs, sales, profit and other relevant facts.

Gross profit ratio, net profit ratio, variable expense ratio, operational efficiency ratio, cash flow to sales ratio, and return on investment are some of the more common profitability. First, i want to explain liquidity,. The three most common types of accounting ratios are debt ratios, liquidity ratios, and profitability ratios.

The accounting ratios or ratios in management accounting have four ratios: Liquidity ratios, activity ratios, solvency ratios, and profitability ratios. Ratios are classified into two types namely.

This is an accounting ratio that shows a company's returns from a specific type of asset. Types of accounting ratios. | 9 min read contents [ show] accounting ratio is the comparison of two or more financial data which are used for analyzing the financial statements of companies.

The liquidity is measured in different forms and ranges by the terms mentioned above. Types of financial ratios 5. Financial ratios are grouped into the following categories:

/GettyImages-1165045615-3989ced2efa44ab28634ac73786b8121.jpg)