First Class Tips About Net Cash Provided By Operating Activities Formula

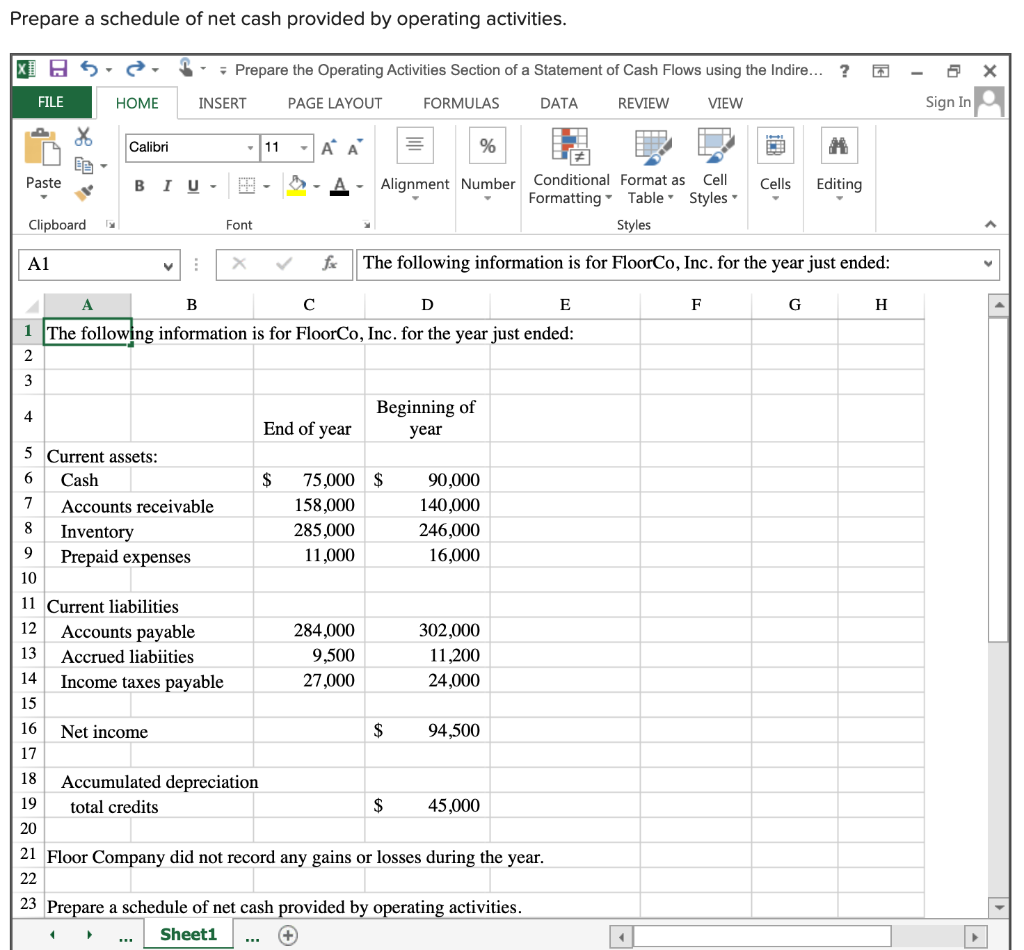

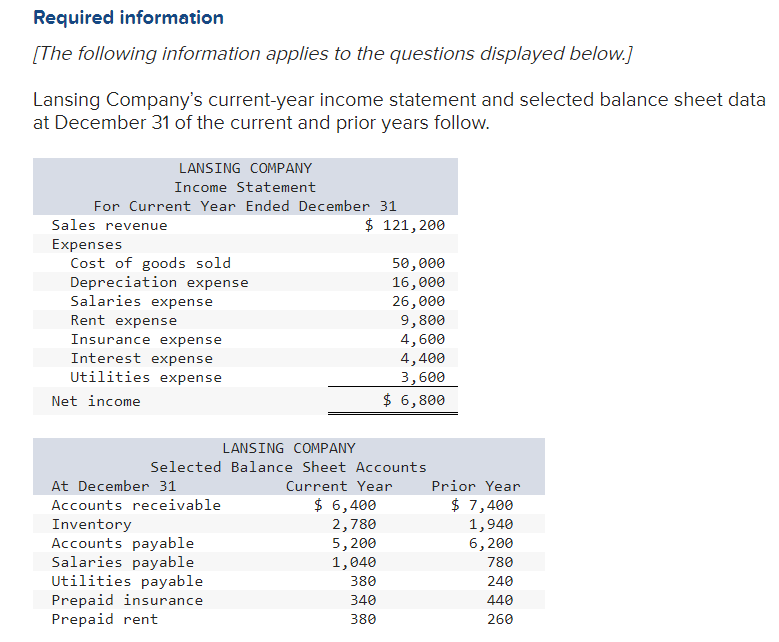

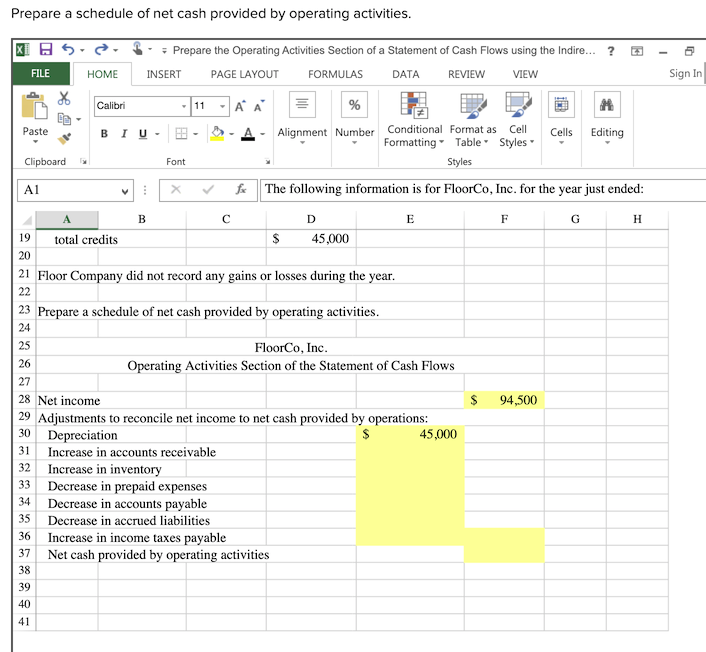

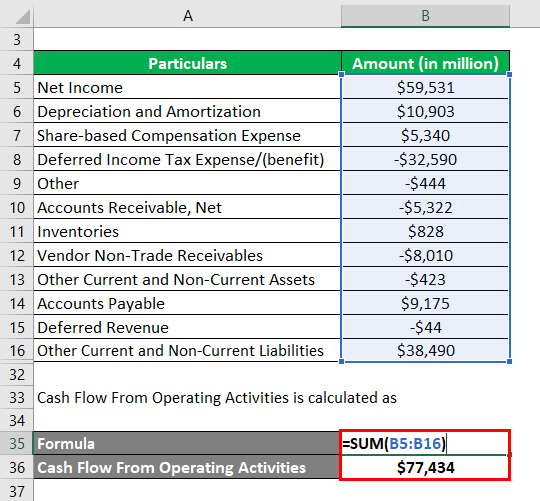

Calculation of net cfo:

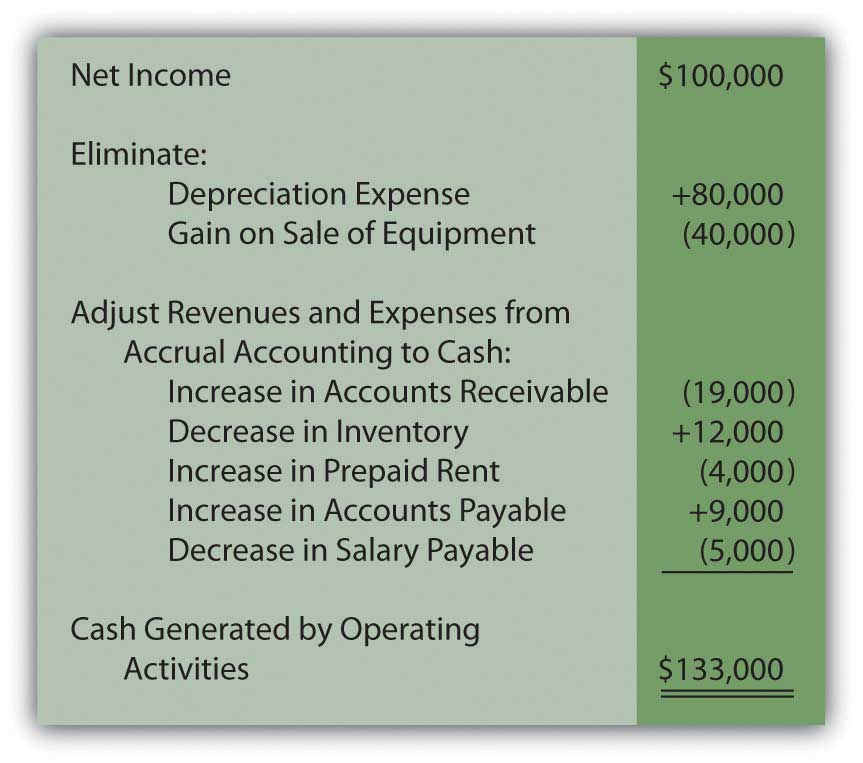

Net cash provided by operating activities formula. Add back noncash expenses, such as depreciation, amortization, and depletion. As such, you can calculate cash flow from operating activities using the following formula: While the exact formula will be different for every company (depending on the items they have on their income statement and balance sheet), there is a generic cash flow from operations formula that can be used:

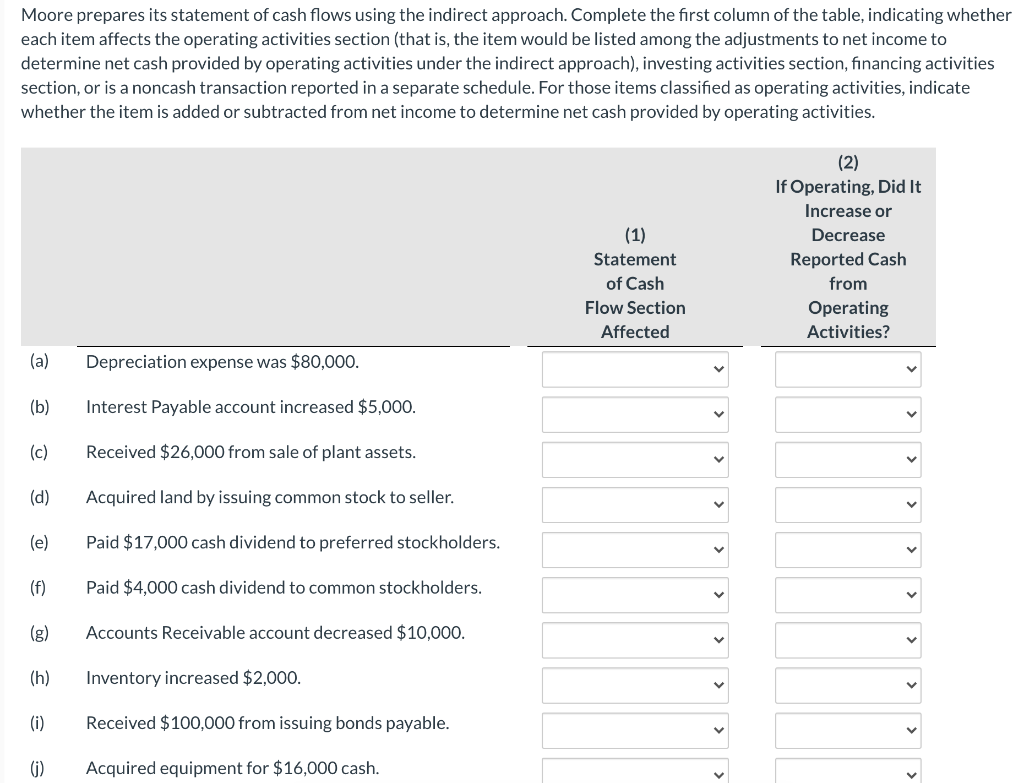

Cash flow from operations is the first of the three parts of the cash flow statement that shows the cash inflows and outflows from core operating the business in an accounting year; Operating cash flow—also referred to as cash flow from operating activities. Under the indirect method, since net income is a starting point in measuring cash flows from operating activities, depreciation expense must be added back to net income.

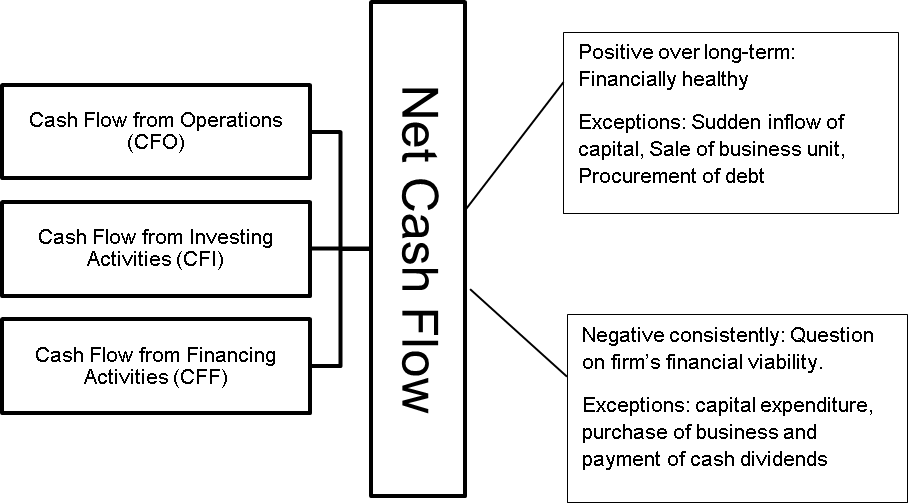

Firstly, determine the cash flow generated from operating activities. The negative balance of $21,000 should be added to find the net cash flow. Net cash flow (ncf) = cash flow from operations (cfo) + cash flow from investing (cfi) + cash flow from financing (cff) the three sections of the cash flow statement (cfs) are added together, but it is still important to confirm the sign convention is correct, otherwise, the ending calculation will be incorrect.

Net cash flow from operating activities definition. Cash flow from operating activities may also be referred to as operating cash flow (ocf) or net cash provided from operating activities. It is calculated by subtracting a company's total liabilities from its total cash.

The formula for net cash flow calculates cash inflows minus cash outflows: However, both are important in determining the financial health of a company. The ocf calculation will always include the following three components:

Begin with net income from the income statement. Net income is the starting point in calculating cash flow from operating activities. Net cash is a figure that is reported on a company's financial statements.

Some examples of cash inflows from investing activities include the sale of investment properties or securities. Cash flow from operating activities is one of the categories of cash flow. Cash flow from operations formula.

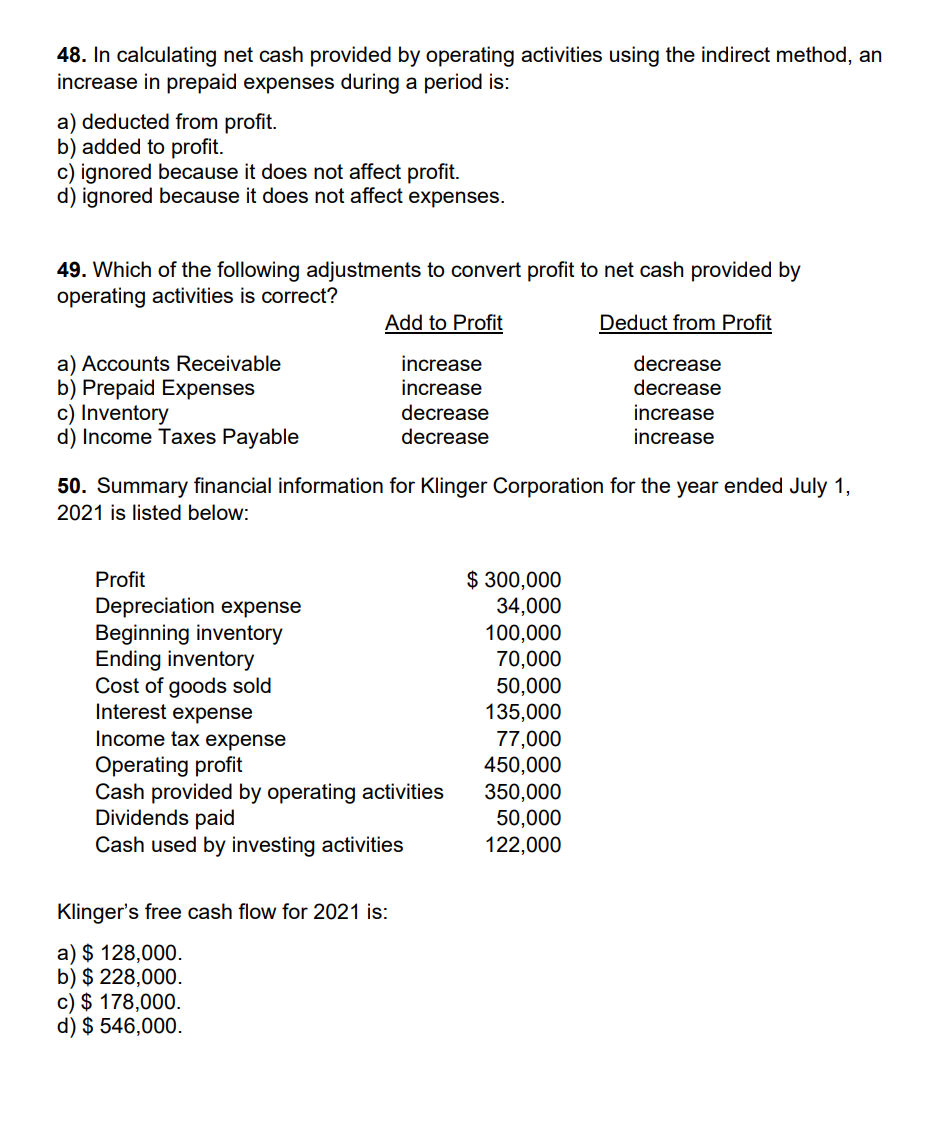

Determine net cash flows from operating activities using the indirect method, operating net cash flow is calculated as follows: The corporation's free cash flow is calculated as follows: Key highlights operating cash flow (ocf) is how much cash a company generated (or consumed) from its operating activities during a period.

Net cash provided by operating activities: Cash flow from financial activities. Learn more about cash flow from financial activities in this article:

The net cash formula can be somewhat limited depending on the complexity of the business. $28.564 billion net cash used in investing activities: What is net cash?

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statements_Reviewing_Cash_Flow_From_Operations_Oct_2020-02-c2254626b9bb4e8eacbfaf47e4e83784.jpg)