Peerless Tips About Aoci Normal Balance

Interest rate increases, coupled with soft loan.

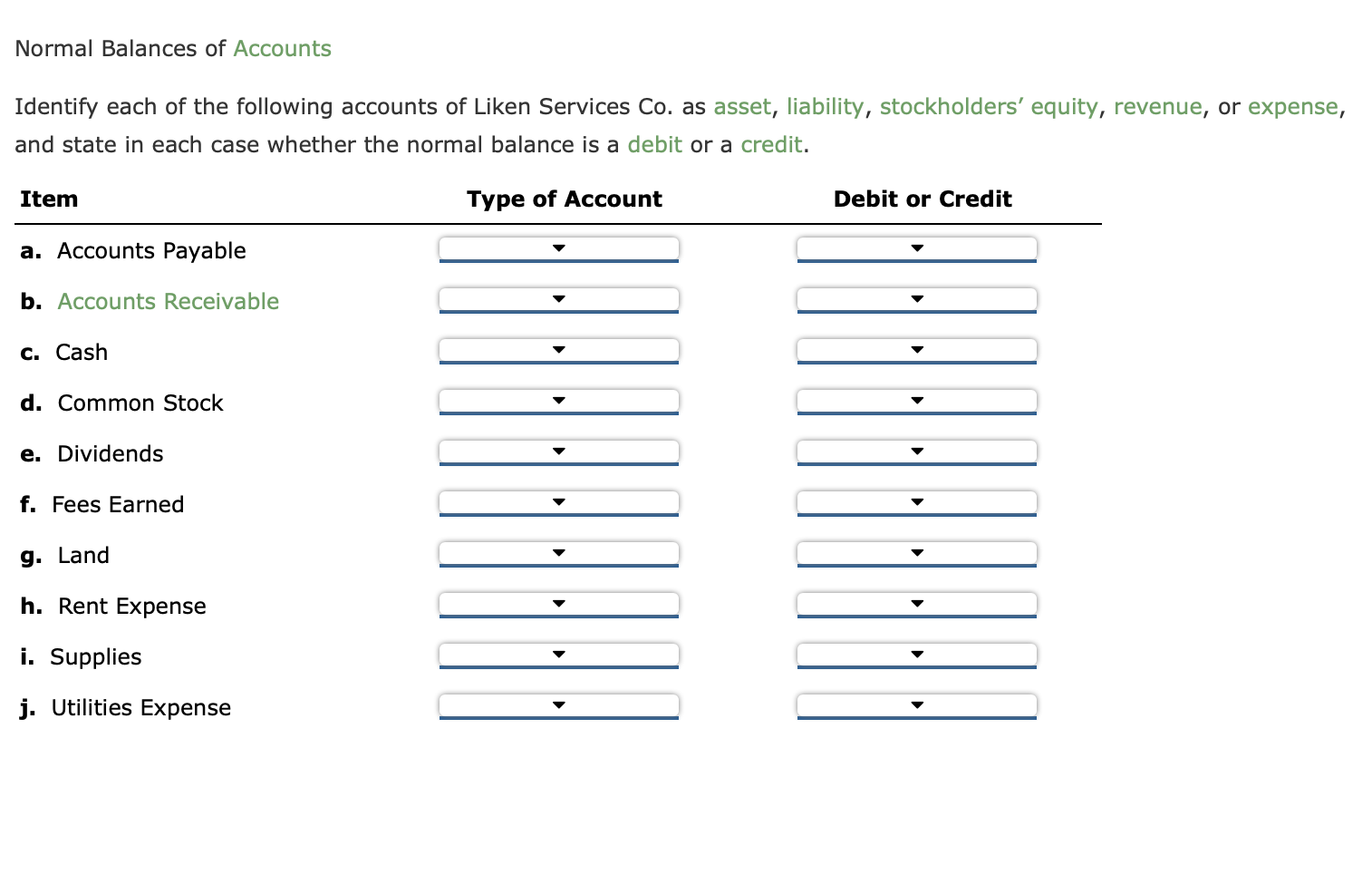

Aoci normal balance. Accumulated other comprehensive income is a separate line within the stockholders' equity section of the balance sheet. A few special types of gains and losses are not shown in the income statement but as special items in shareholder equity section of the balance sheet. Assets + expenses + dividends + losses.

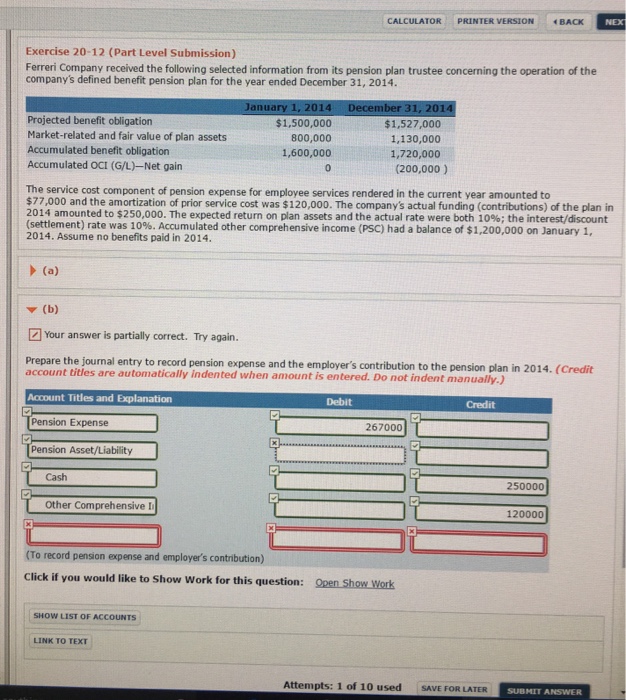

& how is oci related? Accumulated other comprehensive income (aoci) is an accounting term under the equity section of a company’s balance sheet. Accumulated other comprehensive income (aoci) are special gains and losses that are listed as special items in the shareholder equity section of a company’s balance sheet.

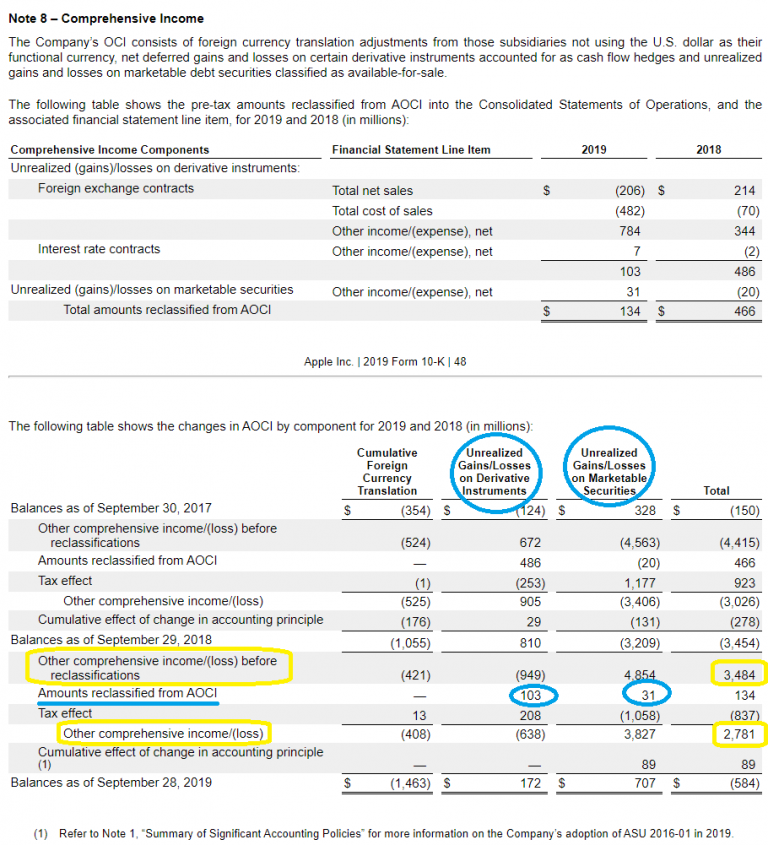

The purpose of this taxonomy implementation guide is to demonstrate the modeling of transactions related to changes in accumulated other comprehensive income (aoci),. It is used to accumulate. Other comprehensive income (“oci”) is part of stockholders equity on the balance sheet and is not part of the income statement.

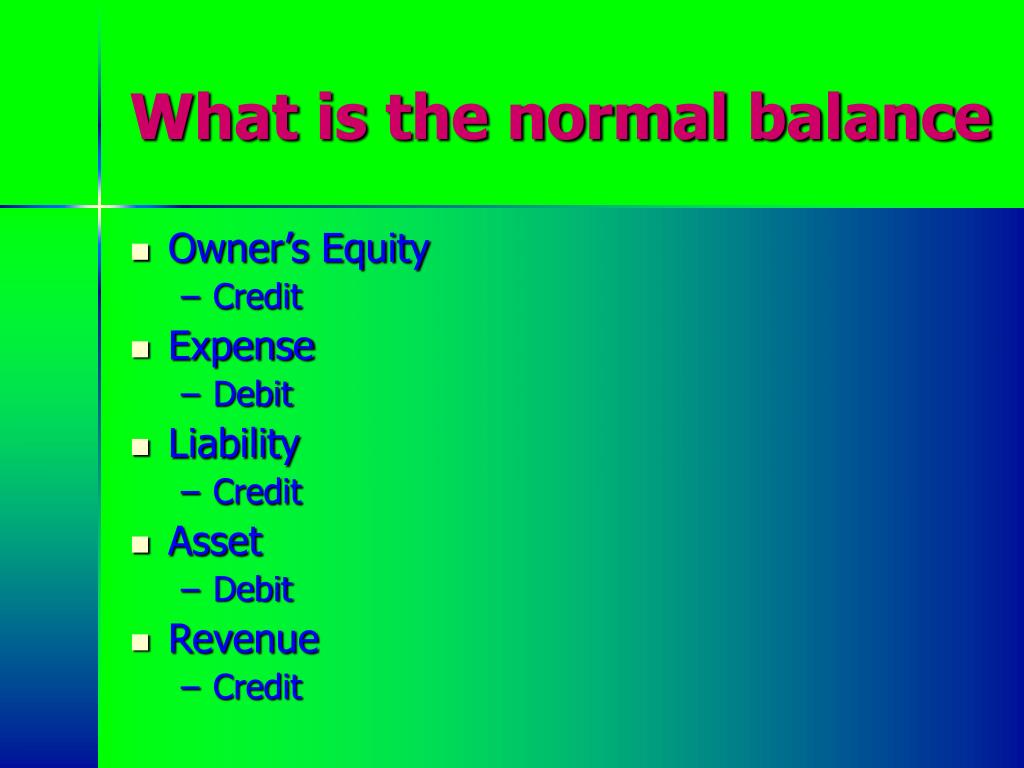

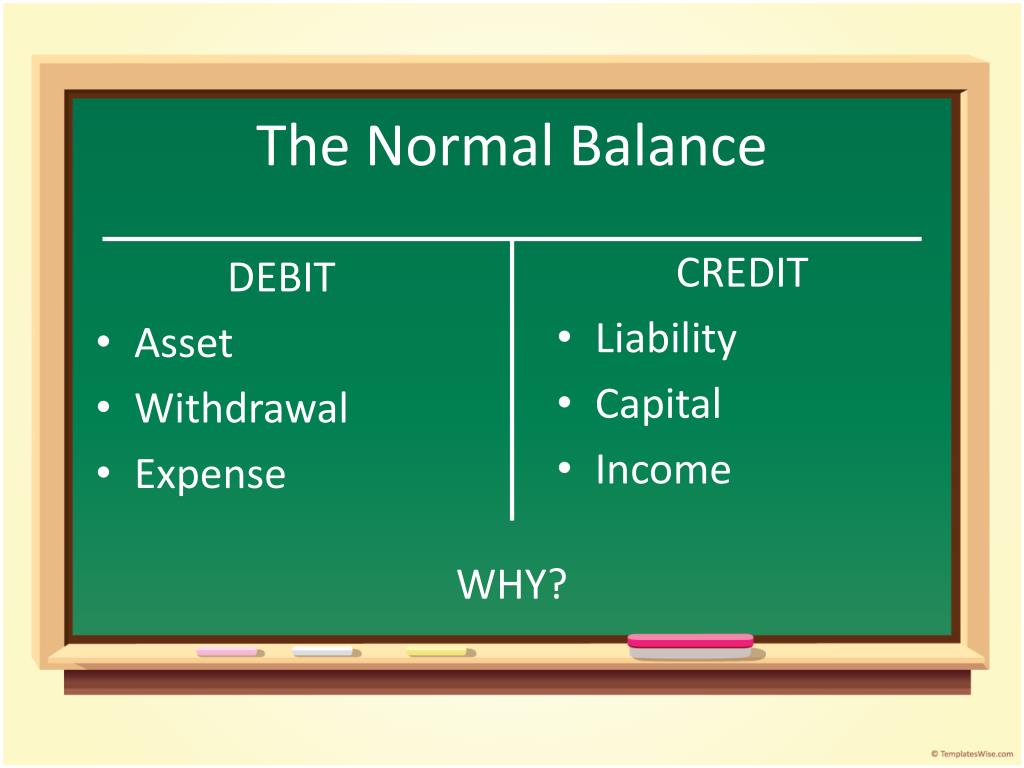

Accumulated other comprehensive income (aoci) accumulates other comprehensive income (oci), which records unrealized and realized gains and losses from certain. This can be developed into the expanded accounting equation as follows. Most of these changes appear in the income statement.

The “other comprehensive income (oci)” line item is recorded on the shareholders’ equity section of the balance sheet and consists of a company’s. Accumulated other comprehensive income (aoci) is a subsection of equity on a company's balance sheet a balance sheet is a financial statement that reports a. The aoci account is the designated space for unrealized profits or losses on items that are placed in the other comprehensive income category.

A credit balance of aoci? In 2014, 20 percent of aoci was counted toward regulatory capital. Normal balance and the accounting equation.

What is other comprehensive income (oci)? Other comprehensive income (oci) consists of items that have an effect on the balance sheet amounts, but the effect is not reported on the company's income. For these banks, the aoci filter has been removed progressively over time.

Accumulated other comprehensive income is displayed on the balance sheet in some instances to alert financial statement users to a potential for a realized gain or. The drastic change in the interest rate environment in 2022 has created the perfect storm for aoci losses to balloon: It is an accumulation of ocis from.

It represents the cumulative total of unrealized. Comprehensive income (ias 1: 1 comment best top new controversial q&a conait • cpa (canada) • 3.

Accumulated other comprehensive income (aoci) represents unrealized gains and losses and is typically presented within the equity section of the balance sheet. This change encompasses all changes in equity other than transactions from owners and distributions to owners. What does it mean to have a debit balance of aoci vs.