Fun Info About Explain The Contents Of Statement Profit Or Loss

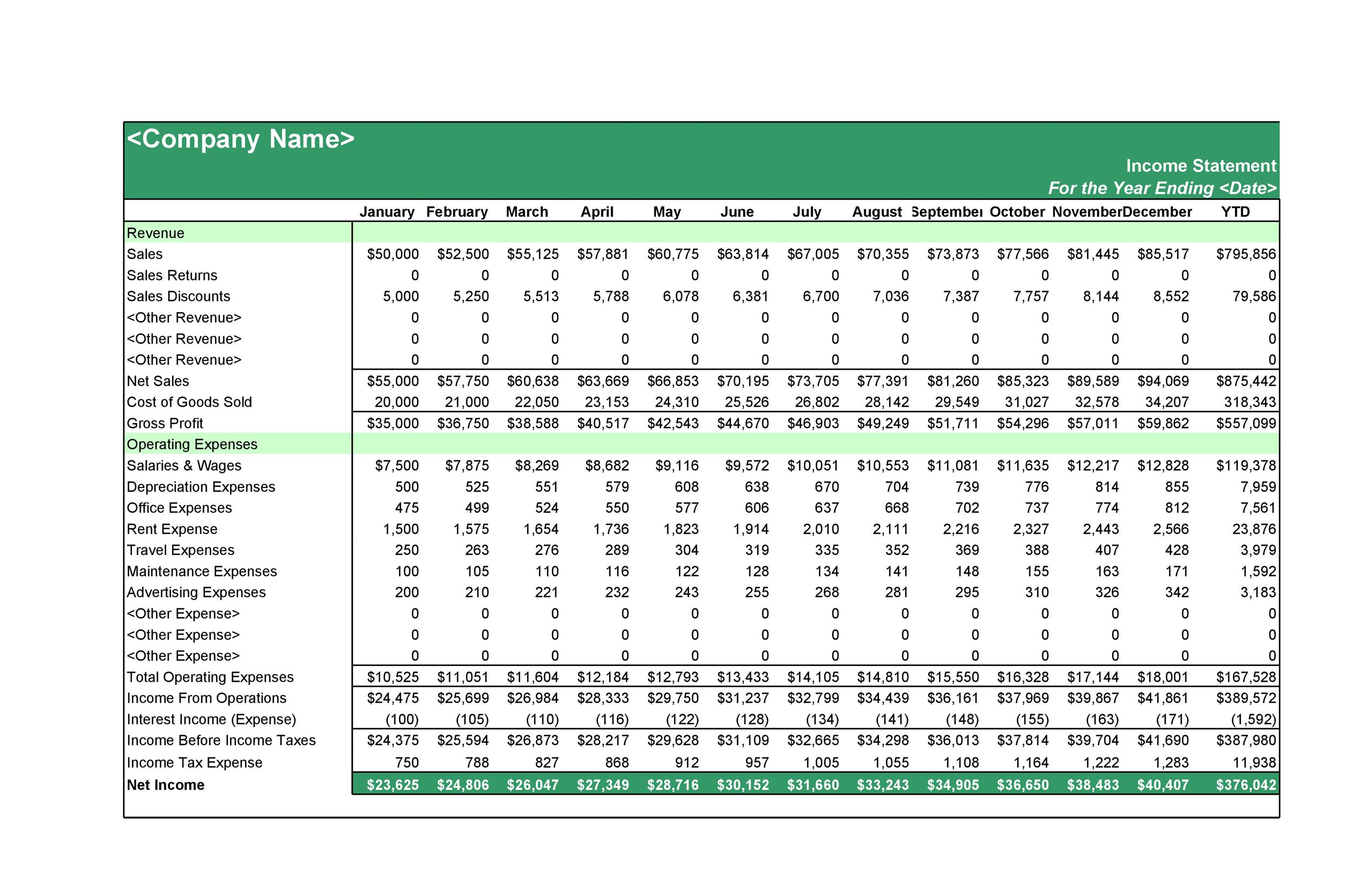

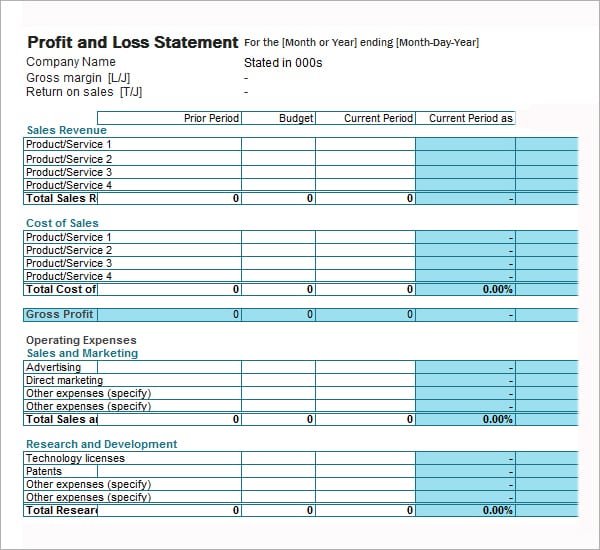

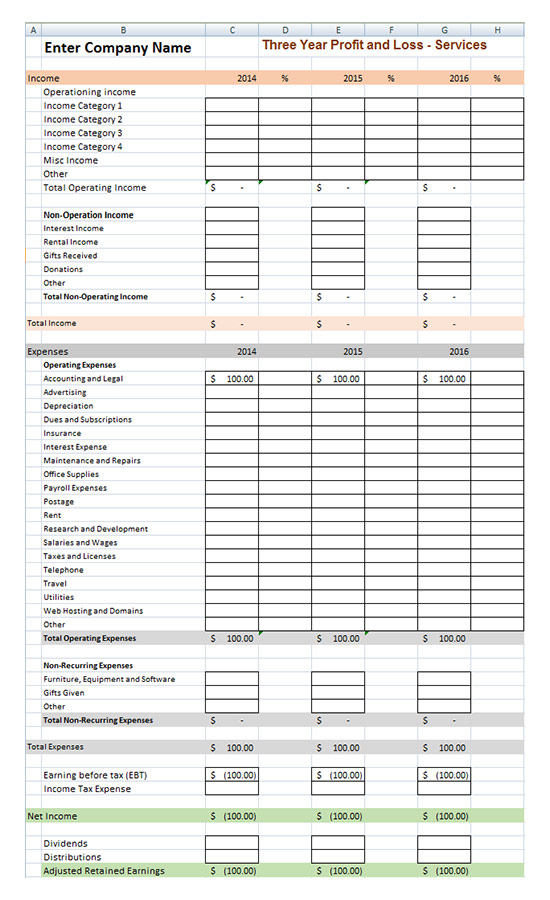

The p&l reporting period can be any length of time, but the most common are monthly, quarterly, and annually.

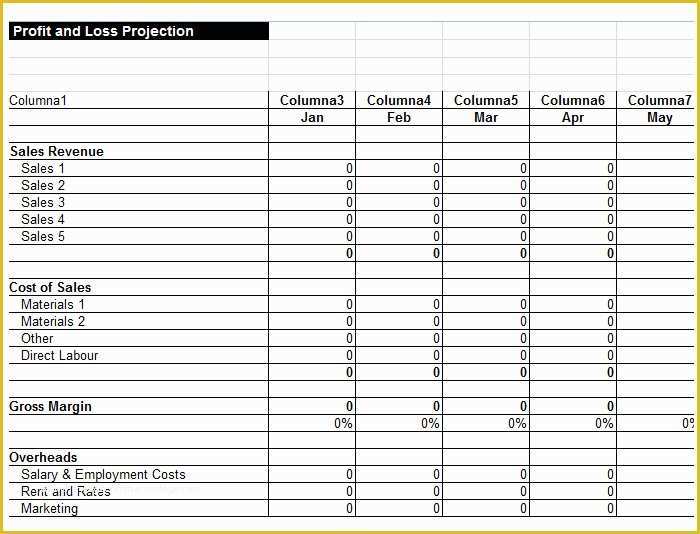

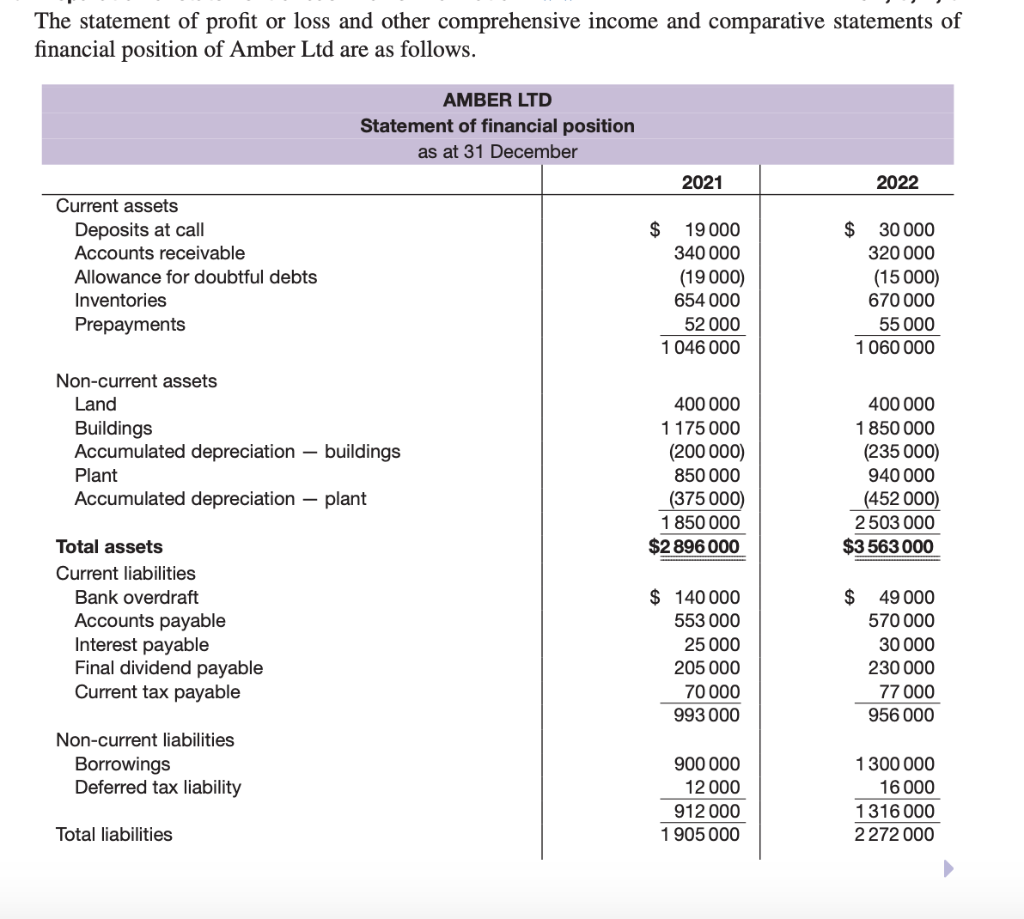

Explain the contents of the statement of profit or loss. It includes expenses, revenues, profits and losses over a specific period of time. It is a snapshot of the company’s overall performance during the financial. You can look at an income.

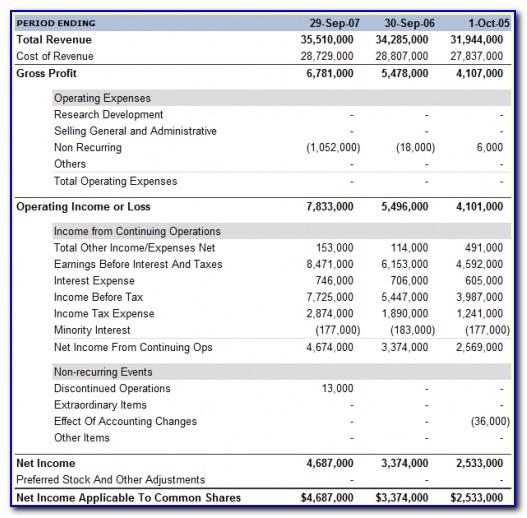

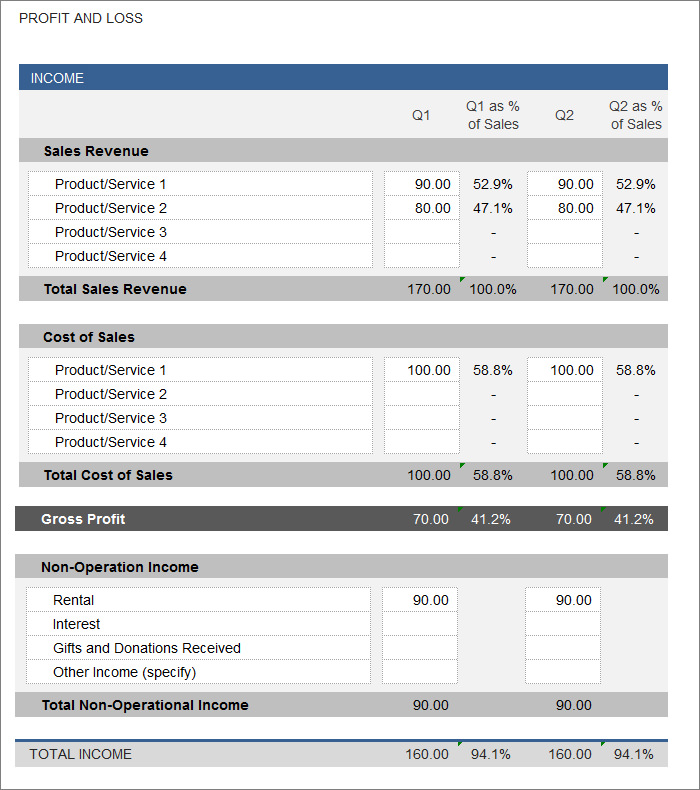

More advanced profit and loss statements also include operating profit and earnings before interest, taxes, depreciation, and amortization (ebitda). The statement of profit and loss account format is an integral part of the financial statement and reporting, which is not only used by the management but also other stakeholders to take important decisions regarding investments and other plans of growth and expansion. Statement of profit or loss and other comprehensive income 81a statement of changes in equity 106 statement of cash flows 111 notes 112.

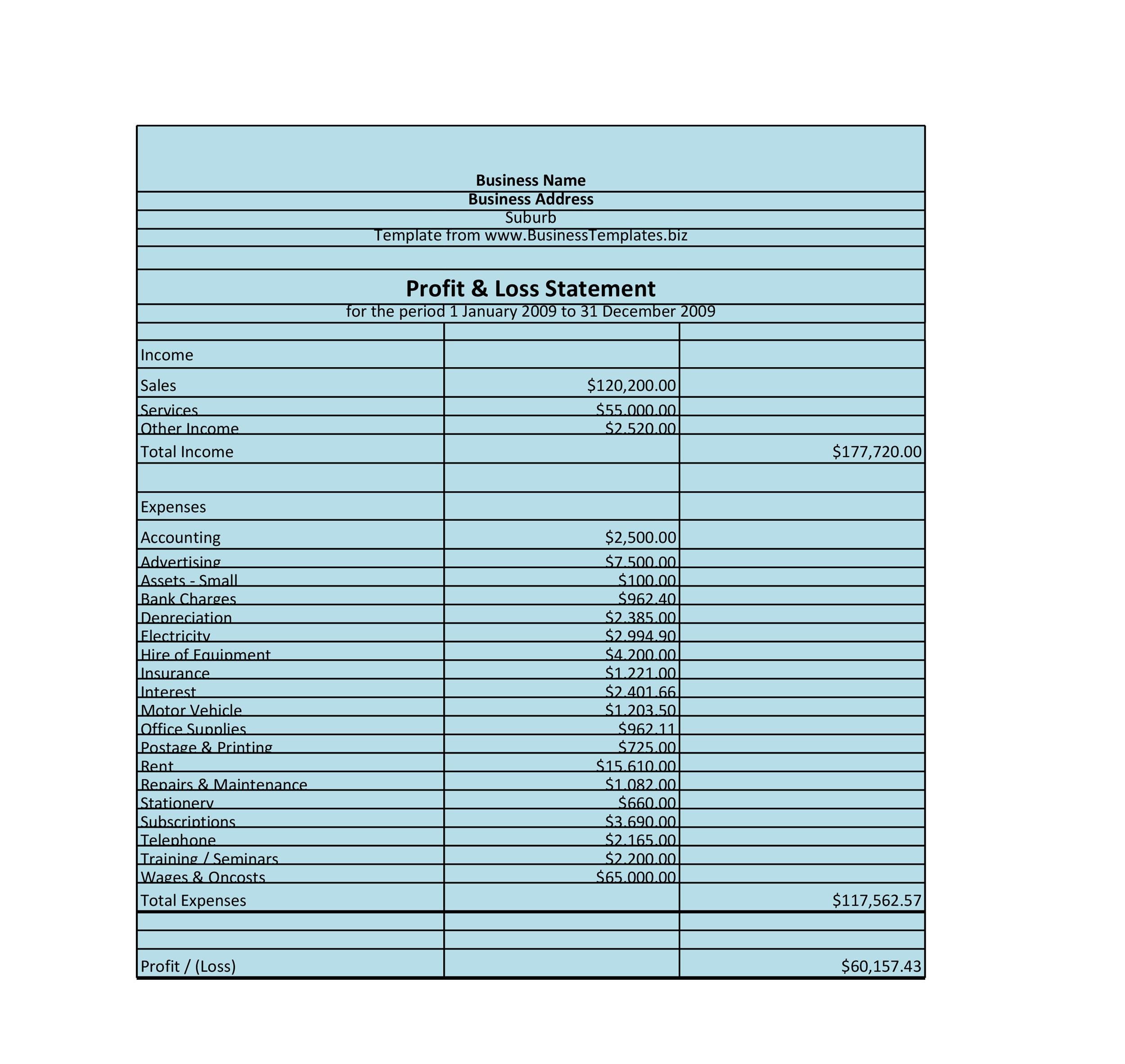

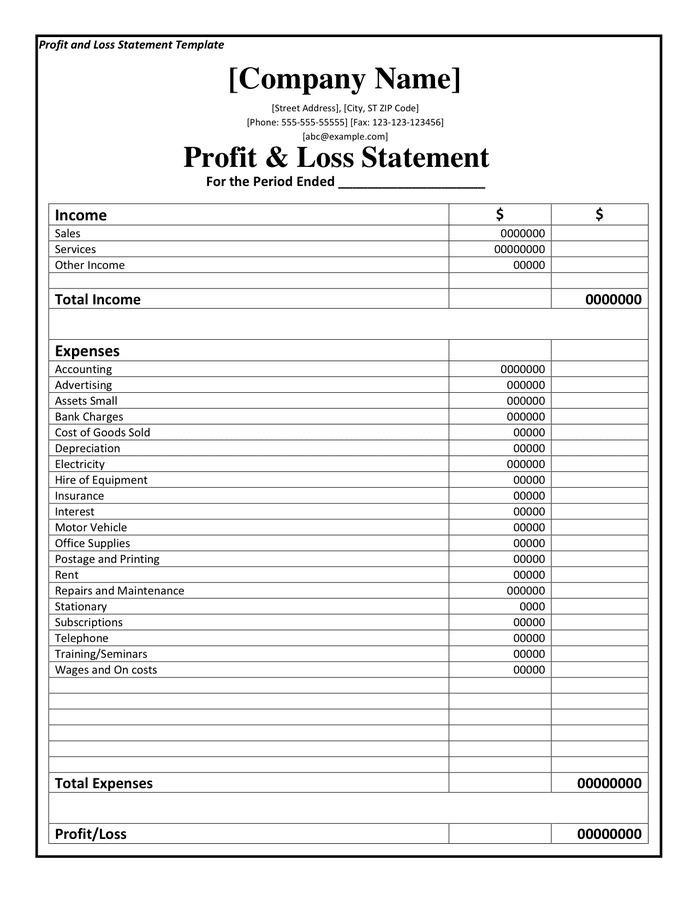

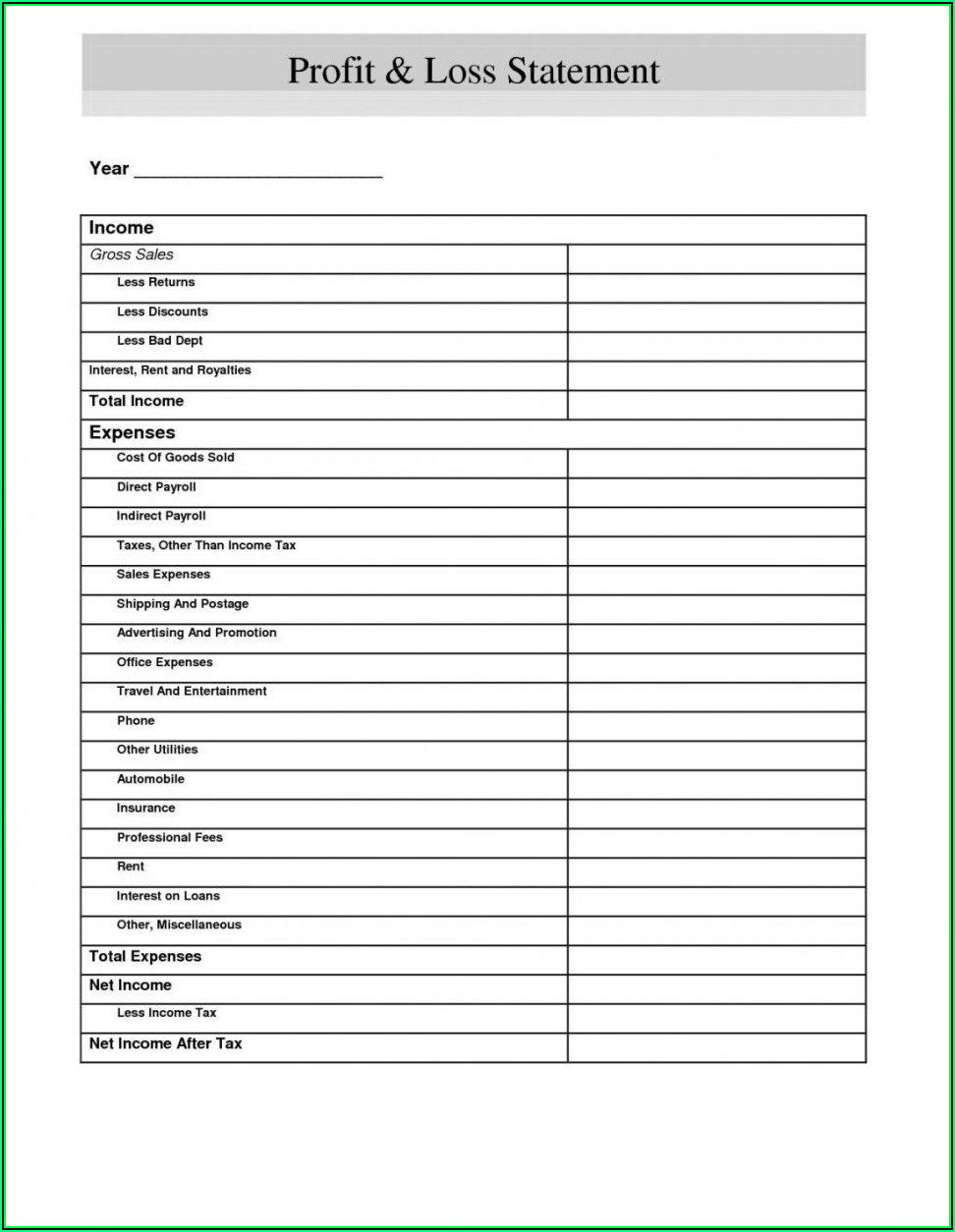

After you find your total cash inflows, such as from sales. The statement can be presented as a detailed statement or a summary statement. A profit and loss statement contains three basic elements:

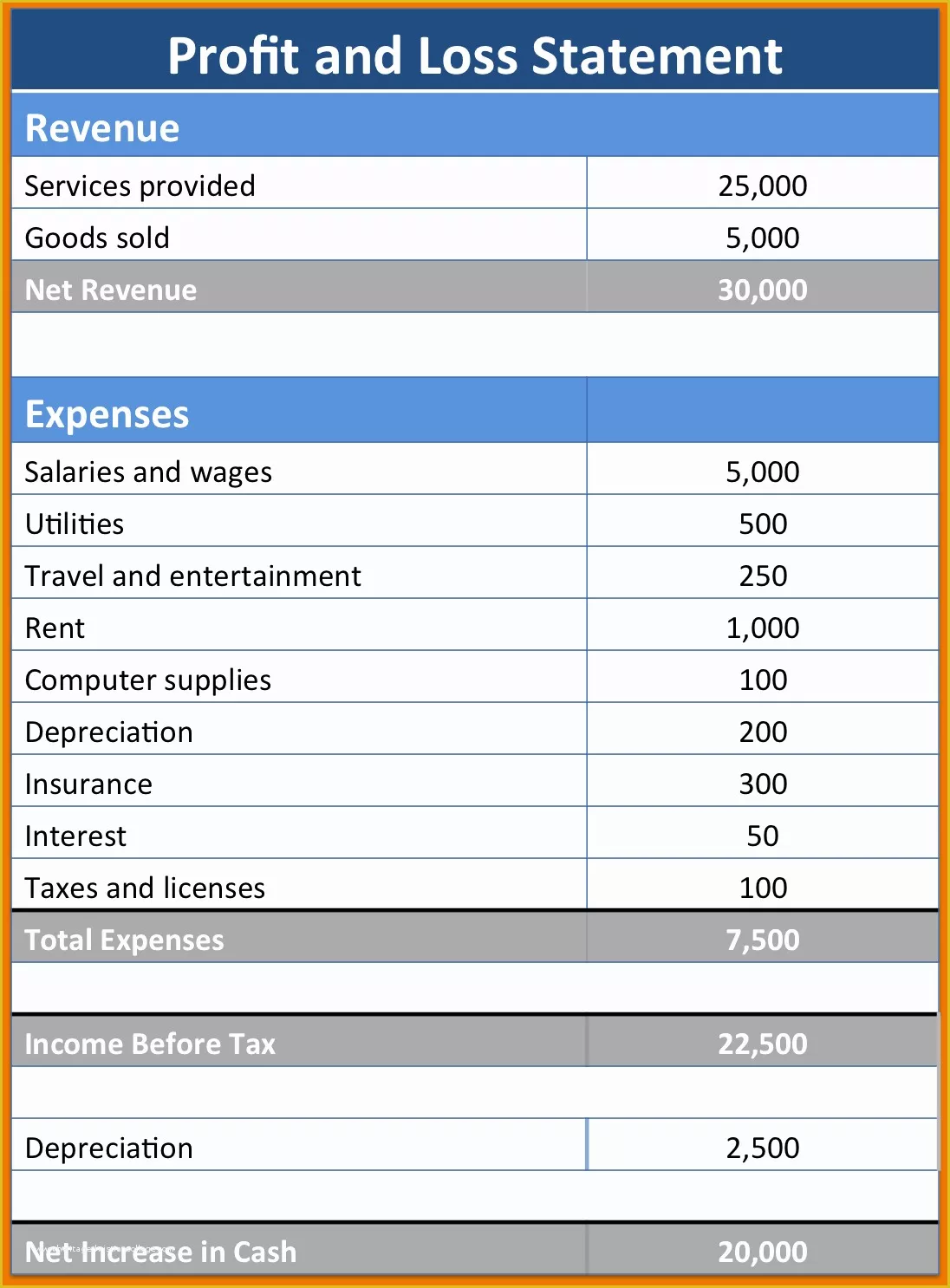

More specifically, it shows the net profit or loss your business has made within an accounting period after deducting all expenditure from the income. The profit and loss statement summarizes all revenues and expenses a company has generated in a given timeframe. These records display a company's ability to generate profit.

This standard does not apply to the structure and content of condensed interim financial statements prepared in accordance with ias 34. An income statement might use the cash basis or the accrual basis. Here's the main one:

A profit and loss statement is the same as an income statement. The p&l statement shows a company’s ability to generate sales, manage expenses, and create profits. The income statement is a useful way to see how a company makes money and how it spends it.

Only indirect expenses are shown in this account. It summarizes revenues, costs, and expenses, allowing stakeholders to evaluate profitability. Revenue, expenses, and net income.

Introduction to profit and loss statement the profit and loss statement is one of the three most important financial statements that reflect any company’s performance and financial standing over a period of time. Net income is a result of revenues (inflows) being greater than expenses (outflows). The p&l statement is one of three.

A profit and loss statement (p&l), or income statement or statement of operations, is a financial report that provides a summary of a company’s revenues, expenses, and profits/losses over a given period of time. The p&l statement can also commonly get referred to as a statement of operations or an income statement. Only indirect expenses are shown in this account.

This summary provides a net income (or bottom line) for a reporting period. Profit and loss statements most common types, examples of profit and loss statements, profit and loss statement templates, tested tips for making better p&l statements, and more. The other two statements are the cash flow statement and the balance sheet.