Ace Tips About Closing Income Summary Account

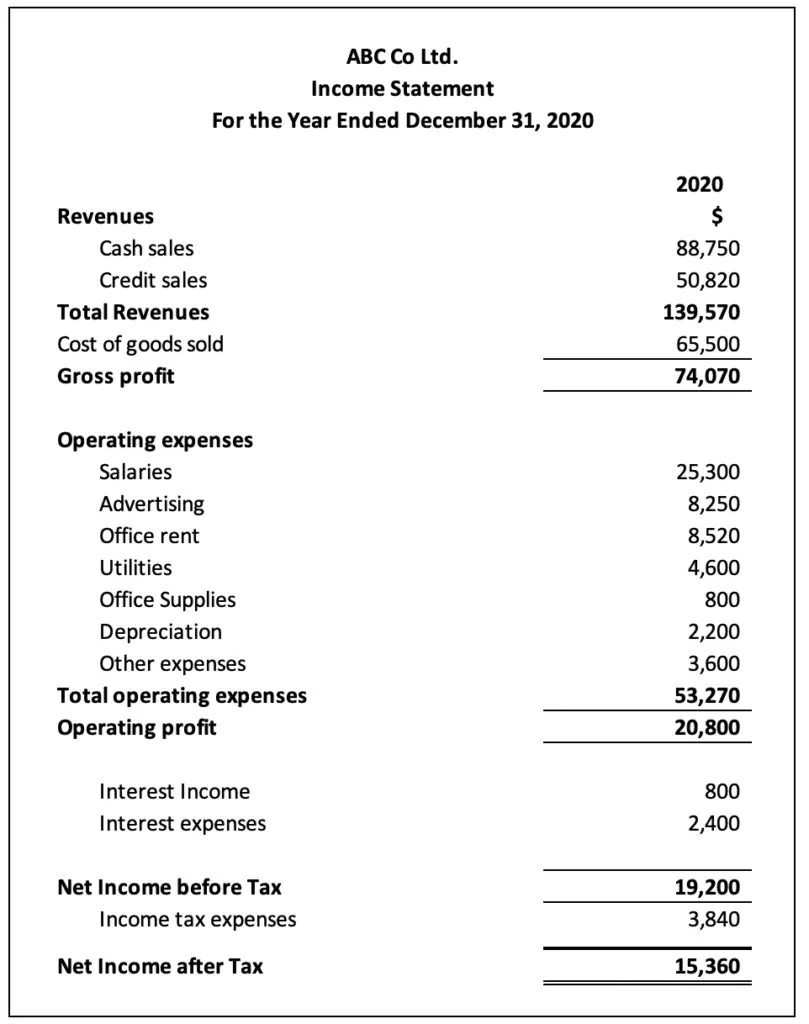

Key takeaways an income summary is a temporary account that consolidates temporary accounts, indicating profit or loss at the end of an accounting.

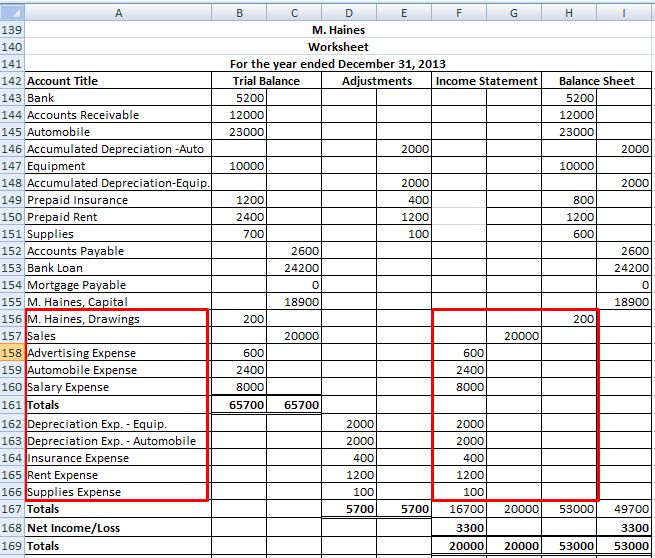

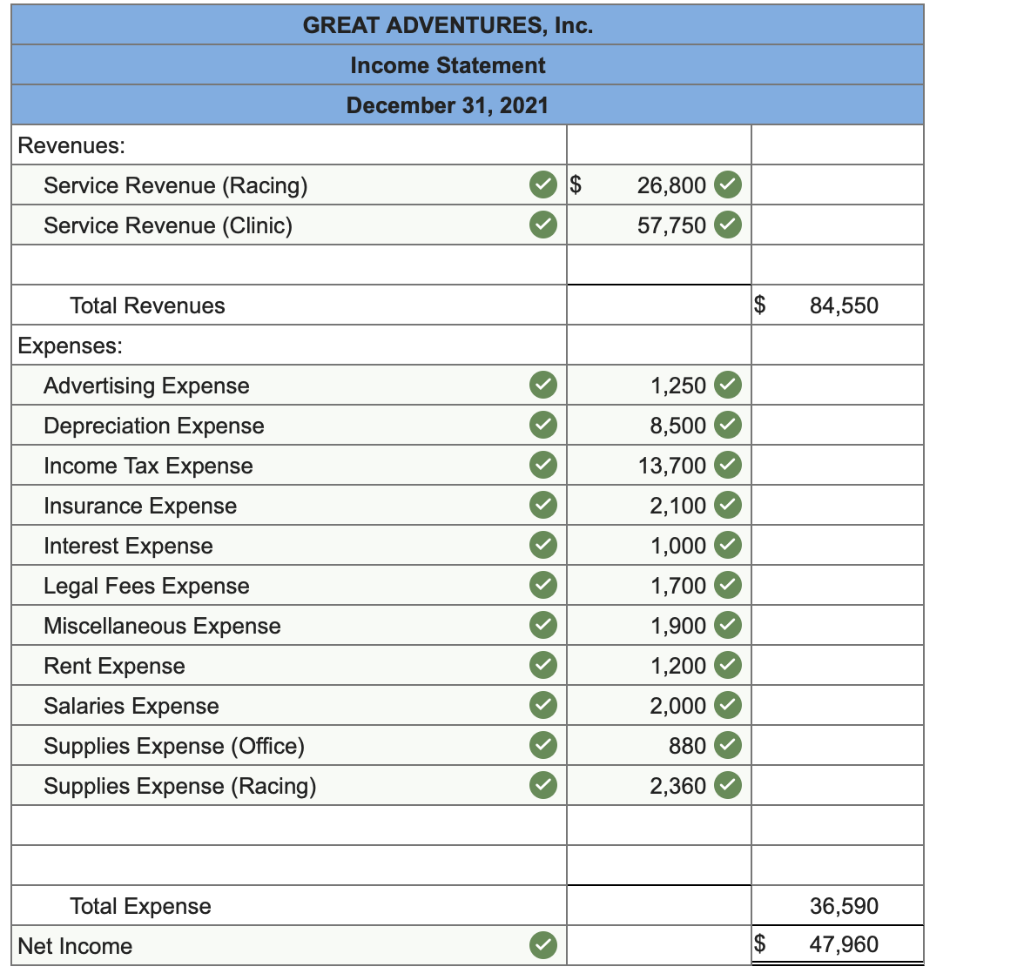

Closing income summary account. What is an income summary account? Read running payroll for details of. Close all revenue and gain accounts all of paul’s revenue or income accounts are debited and credited to the income summary account.

Income summary account is a temporary account used in the closing stage of the accounting cycle to compile all income and expense balances and determine net. The second tranche of the federal. The income summary account is only used in closing process accounting.

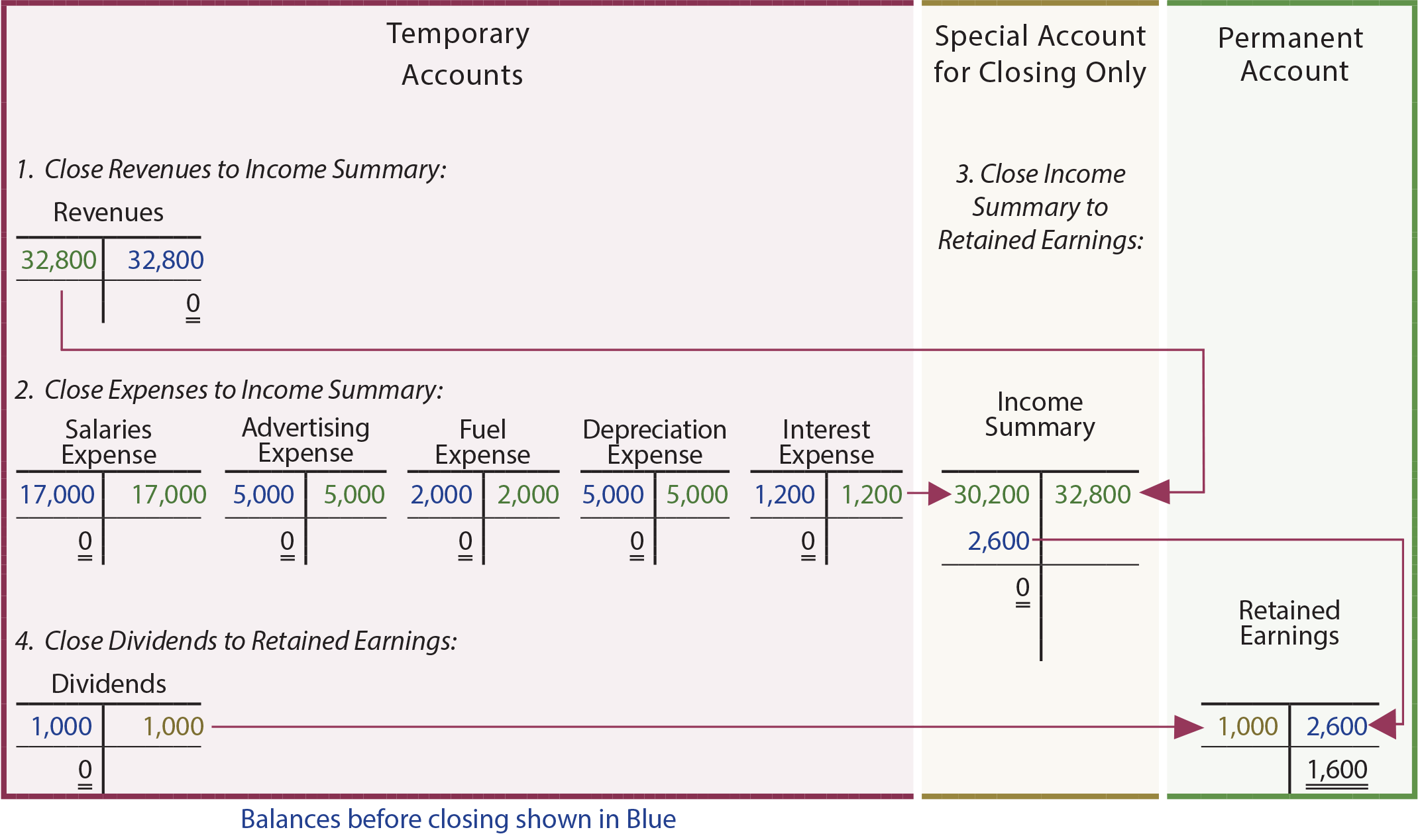

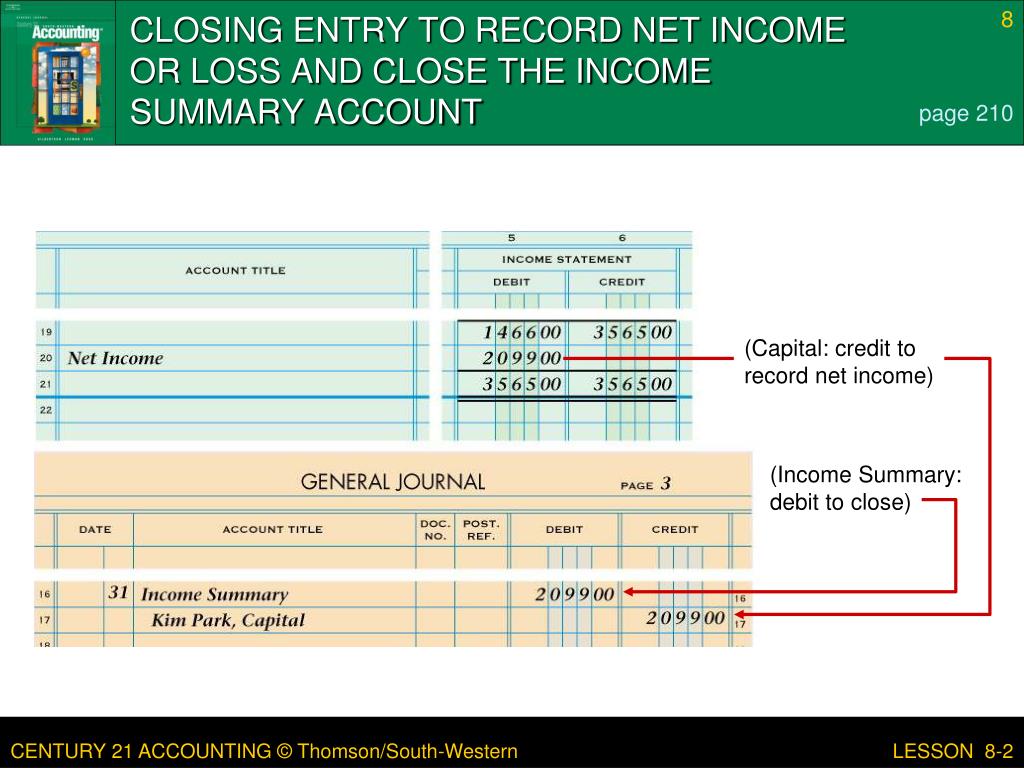

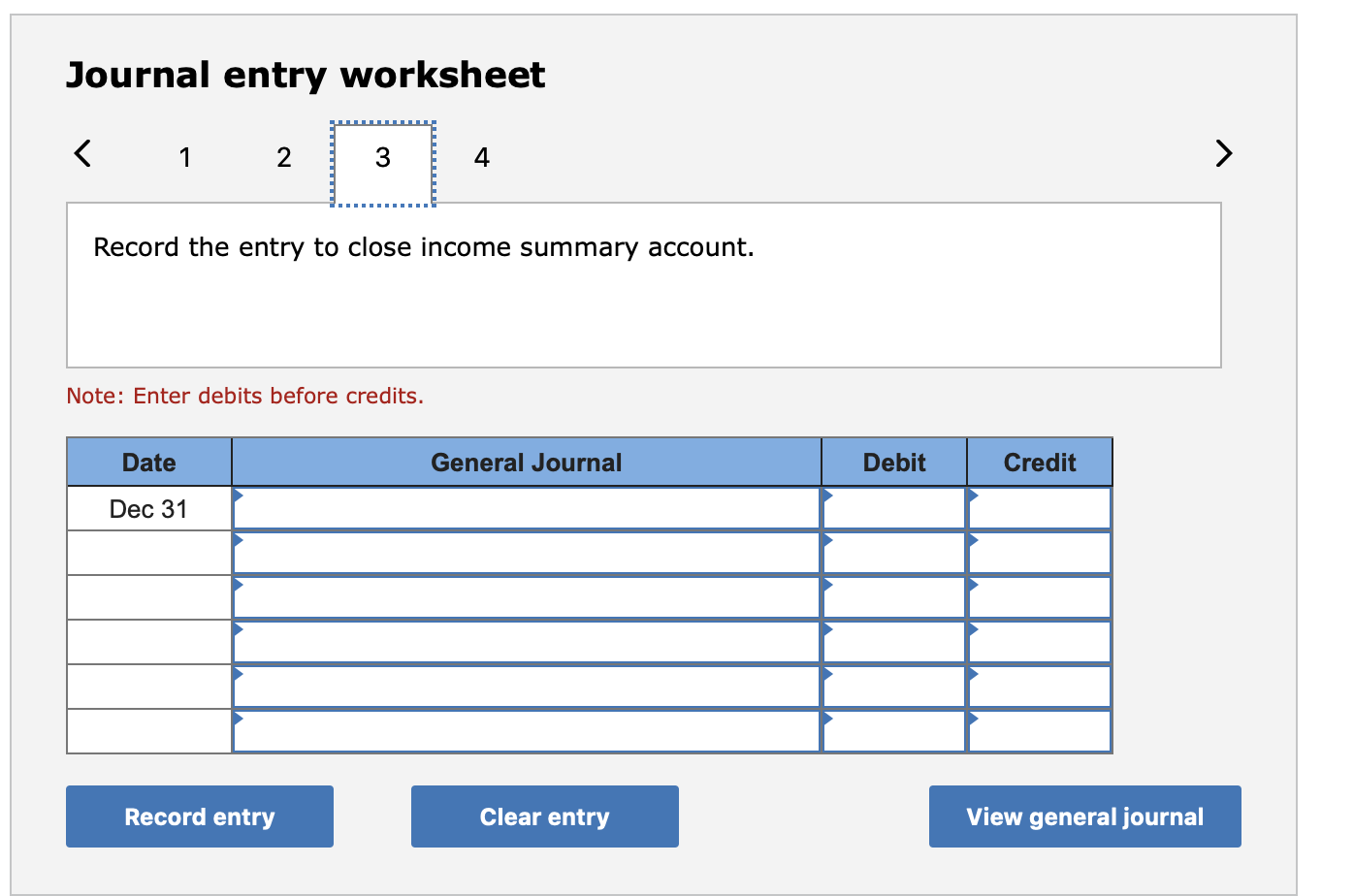

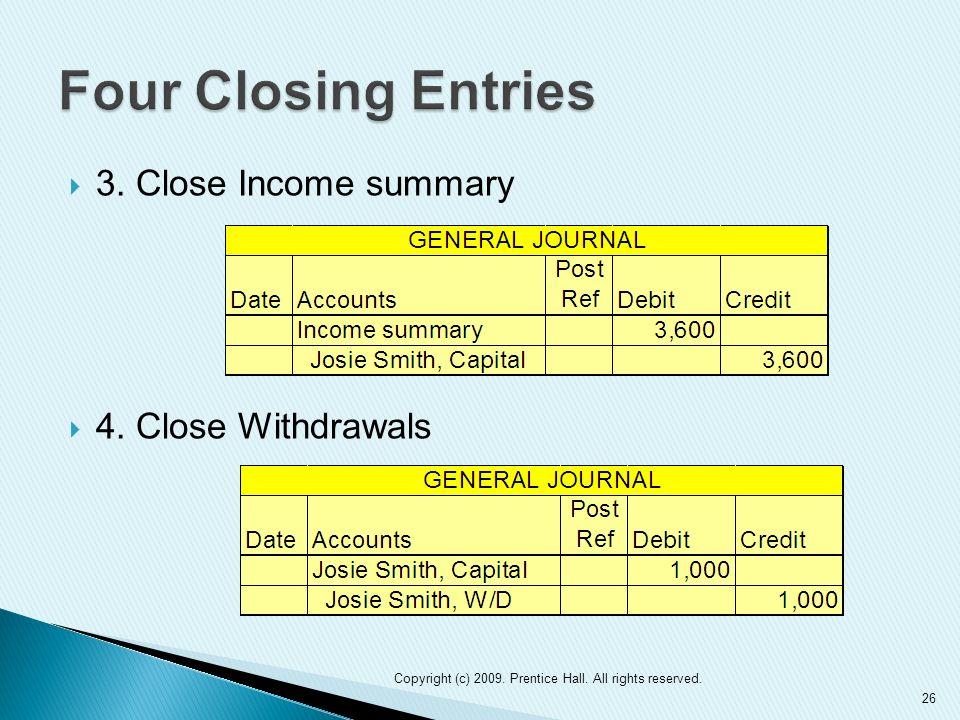

Having a zero balance in these accounts is important so a company can compare performance. Closing the income summary account —transferring the balance of the income summary account to the retained earnings account. The income summary account is a temporary account used with closing entries in a manual accounting system.

The income summary account is defined as the account of temporary or provisional in nature wherein the statement at the end of the accounting period net off all. The $2,500 credits will be available from march 1,. Closing the income summary account—transferring the balance of the income summary account to the retained earnings account.

Close the income summary account to the retained earnings account. (computerized accounting systems may close the. It has a credit balance of $9,850.

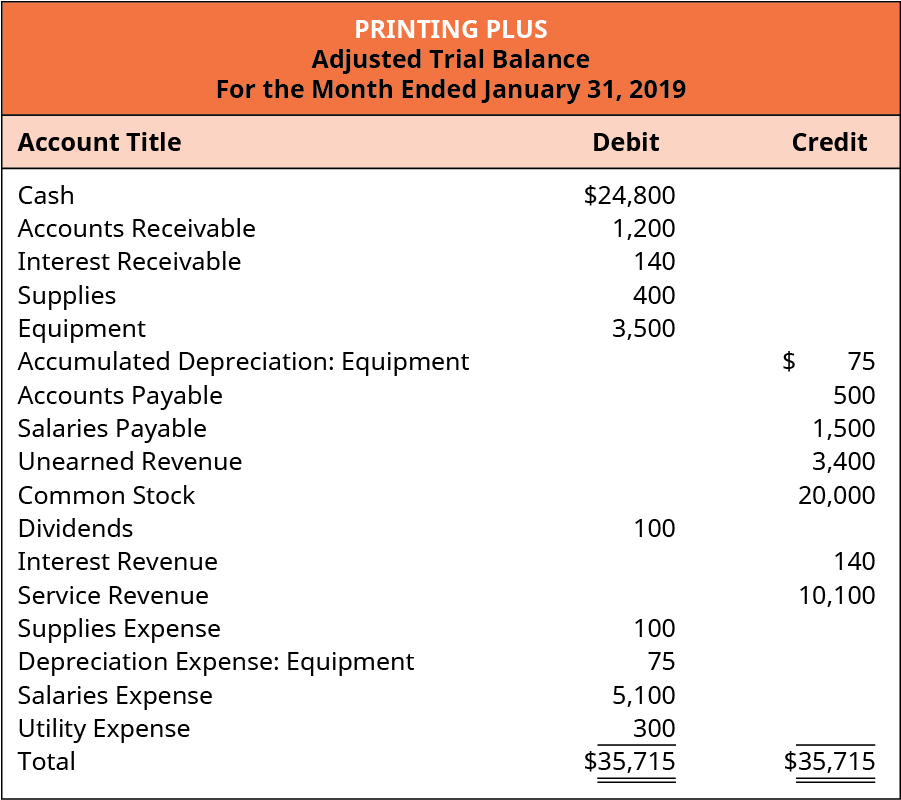

Closing, or clearing the balances, means returning the account to a zero balance. With the closure of special account (sa), cpf contributions that go to the sa currently, as well as any increase in cpf contributions allocated to sa from 1 january 2025, will be. Shift all $10,000 of revenues generated during the month to the income summary account:

Close all income accounts to income summary in the given data, there is only 1 income account, i.e. Let us discuss how to do the. Basically, the income summary account is the amount of your revenues minus.

The income summary account is a temporary account used to store income statement account balances during the closing entry step of the accounting cycle. Jean carroll, that means trump has been fined roughly $438 million over the past four. The income summary account is a temporary account solely for posting entries during the closing process.

So for posting the closing entries in the general ledger, the balances from revenue and expense account will be moved to the income summary account. Closing the income summary account. Quickbooks won't automatically close the account unless you set up the.

After closing the expense and revenue account in the income summary account, the balance of income summary account will. If there was a profit in the period, then this entry is a debit to the income summary. Shift all $9,000 of expenses generated during the month to the.