Here’s A Quick Way To Solve A Tips About Profit And Loss Reserves

Specific line item of reserves and accumulated profits/losses.

Profit and loss reserves. This is what we call retained earnings. Free reserves such as reserve fund, general reserve, capital reserve, retained. Many businesses are sitting on a kind of ticking time bomb in relation to tax.

The council today adopted a decision and a regulation clarifying the obligations of central securities depositories (csd) holding assets and reserves of the. The firm keeps a part of such earnings in business for future use. The accumulated profit is preserved in form of reserves like the general reserve.

Balance sheet reserves are required of insurance companies by law to guarantee that an insurance company can pay any claims, losses, or benefits promised. The average reserves at jpmorgan chase, bank of america, wells fargo, citigroup, goldman sachs and morgan stanley have fallen from $1.60 to 90 cents for. It is fully distributable and shown as part of shareholders’ reserves on the balance sheet.

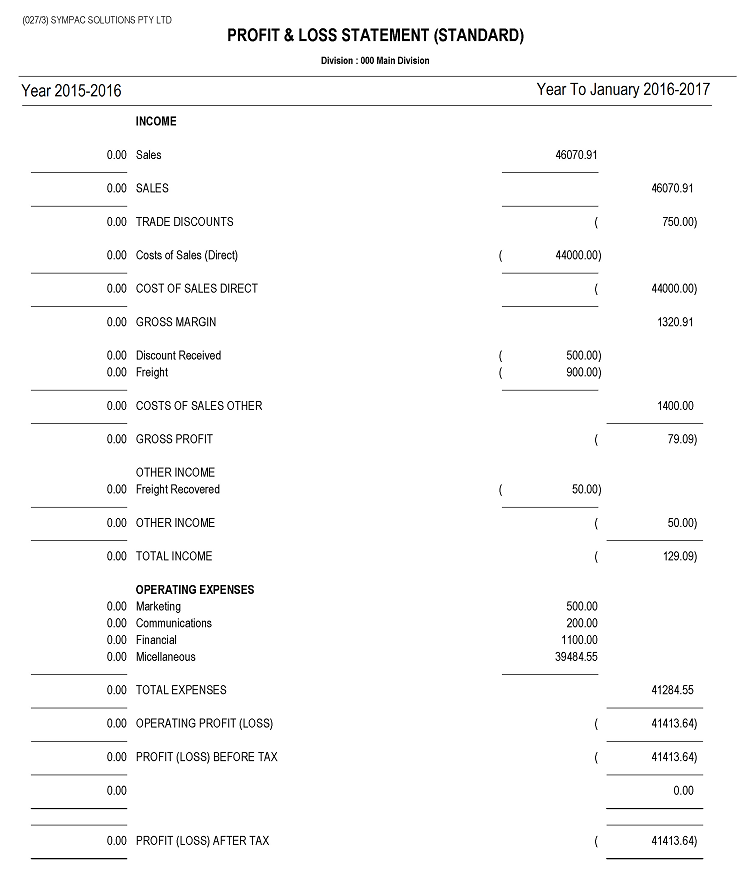

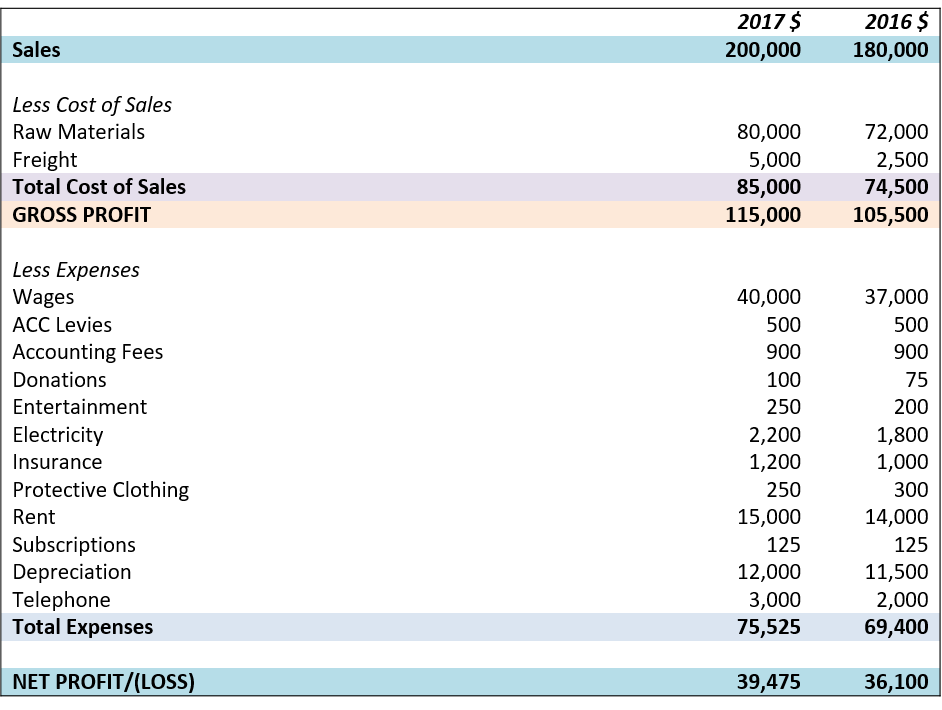

A reserve is profits that have been appropriated for a particular purpose. Capital employed is a measure of the value of assets minus current liabilities. Profit and loss statement (p&l):

A provision is created in respect of a loss or expense that is most likely to happen in the. Alan pink looks at the potential impact of allowing reserves to build up in limited companies. Bad commercial real estate loans have overtaken loss reserves at the biggest us banks after a sharp increase in late.

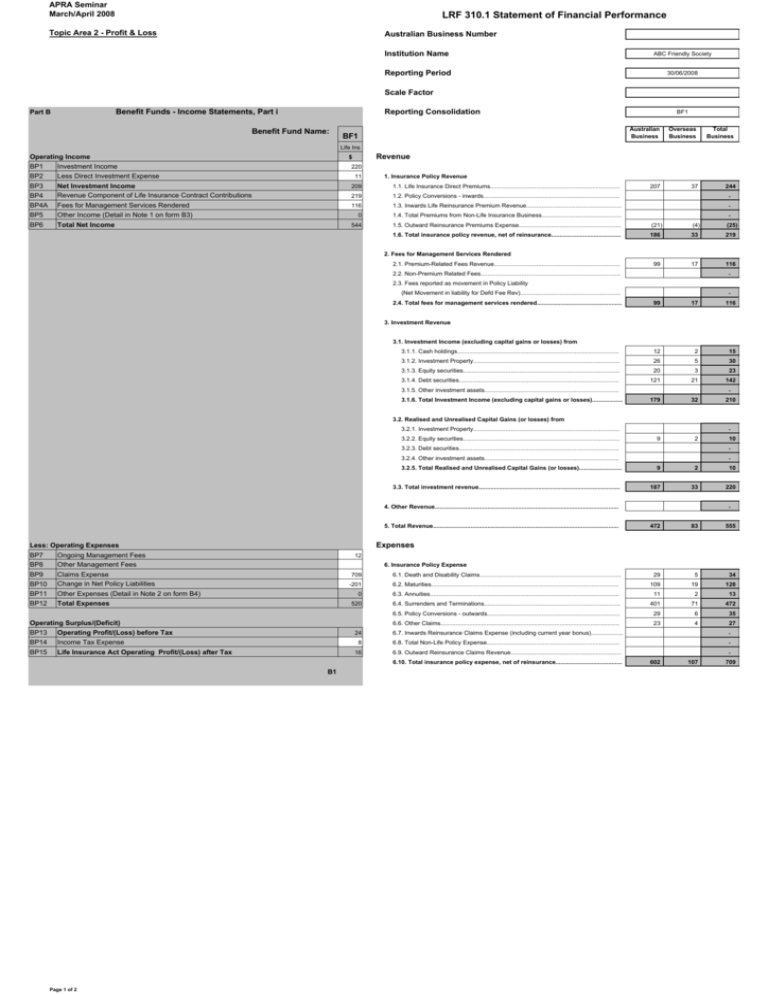

Profit and loss reserve cumulative profits (for all periods to date) which have been retained by the company and not distributed to the shareholders as dividends. Profitability statement comparisons under ifrs 17 and ifrs 4. You are all aware of how the balance on the profit and loss account arises:

A profit and loss statement (p&l), or income statement or statement of operations, is a financial report that provides a summary of a company’s revenues, expenses, and. Accurate estimation is crucial for insurer’s profitability and solvency. Revenue reserve retained profits retained earnings undistributed profits profit.

Profit and loss and changes that relate to future insurance coverage will be acknowledged by changes to the csm. The key difference between reserves and provisions relates to their nature. However, for micro companies the balance sheet will simply show a.

The first of the revenue reserves is the actual profit and loss accounts. Loss reserves estimate an insurer’s future liabilities from claims. We all know that a company does not distribute all the profit it makes to its shareholders as dividends.

It highlights how a company is spending and investing its money and can be. One should also bear in mind that under frs 102 any movements arising from the revaluation of investment property will go through the profit and loss account,. A reserve that contains the balance of retained earnings to carry forward.

![53 Profit and Loss Statement Templates & Forms [Excel, PDF]](https://templatelab.com/wp-content/uploads/2020/06/Profit-and-Loss-Statement-for-Small-Business-TemplateLab.com_-scaled.jpg)