Awe-Inspiring Examples Of Info About Accounting Standards For Financial Statements

Ifrs® accounting standards together with their accompanying.

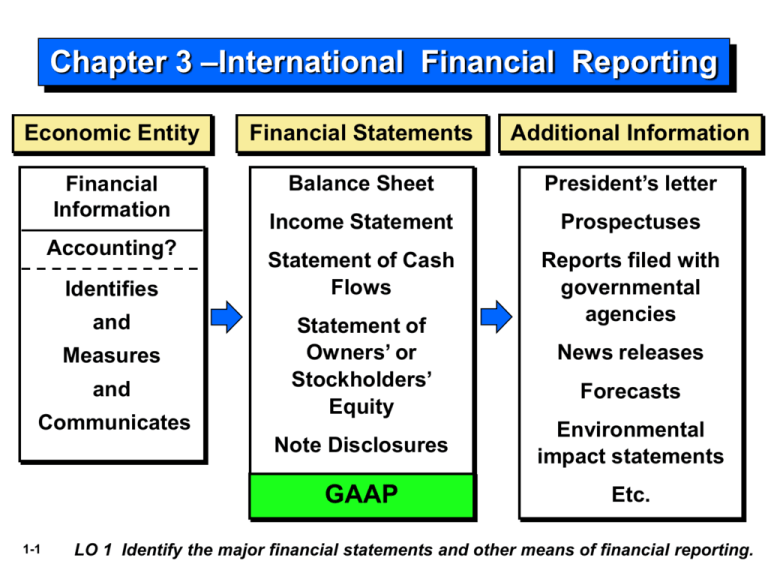

Accounting standards for financial statements. Accounting standards a by illustrating one possible format for financial statements for a fictitious multinational corporation (the group) involved in general business activities. Accounting standards (as) accounting standards (as) are basic policy documents. Control requires exposure or rights to variable returns and the ability to affect those returns through power over an investee.

The standard requires a complete set of financial statements to comprise a statement of financial position, a statement of profit or loss and other comprehensive income, a statement of changes in equity and a statement of cash flows. They do so by standardizing accounting policies and principles of a nation/ economy. All the paragraphs have equal authority.

Fourth quarter highlights. International financial reporting standards (ifrs) are a set of accounting rules for the financial statements of public companies that are intended to make them consistent, transparent, and. They have been fully withdrawn and superseded by more recent standards.

$704 million in dividends and. A statement of financial accounting standards (sfas) gives detailed guidance on how to deal with a specific accounting issue. The rules used by u.s.

Their main aim is to ensure transparency, reliability, consistency, and comparability of the financial statements. Companies are called generally accepted accounting principles, while the rules often used by international companies are international financial reporting standards. Unless otherwise noted, all financial figures are unaudited, presented in canadian dollars (cdn$), and derived from the company’s condensed consolidated financial statements which are based on canadian generally accepted accounting principles (gaap), specifically international financial reporting standards (ifrs) as.

The iasb is supported by technical staff and a range of advisory bodies. Criteria for including assets and liabilities in financial statements (recognition) and. The audit report is a document containing the auditor’s opinion on whether a company’s financial statements comply with accounting standards and are free from material misstatements.

The iasb (international accounting standards board) issued the ifrs, a set of accounting rules standardized across companies of 167 different jurisdictions. Ias 1, 2, 7, 8, 10, 11, 12, 16 to 21, 23, 24, 26, 27, 28, 29, 32, 33, 34, 36 to 41, and ifrs 1 to 13. Aasb 101 is to be read in the context of other australian accounting standards, including.

Jason zezhong xiao acknowledges financial support from the national social science fund of china (23bjy110) and the university. Practical guide to the new and revised psak which are effective for annual reporting periods beginning on or after 1 january 2023. This page contains links to our summaries, analysis, history and resources for:

A new york judge has ordered donald trump and his companies to pay $355 million. Financial reporting standards provide principles for preparing financial reports and determine the types and amounts of information that must be provided to users of financial statements, including investors and creditors, so that they may make informed decisions. Let us take a look.

An accounting standard is a policythat defines the treatment of an accounting transaction in financial statements. This standard prescribes the basis for presentation of general purpose financial statements to ensure comparability both with the entity’s financial statements of previous periods and with the financial statements of other entities. What is a statement of financial accounting standards?

:max_bytes(150000):strip_icc()/Sfas-4189179-FINAL-b0402ec99bf249ec9e3c9100ac408bb9.png)

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-03-aac8341b98da4fd3a4f13ed3ee7fa053.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-02-6a82acc4cf2d4434a77899c09d49e737.jpg)