Great Tips About Accounts Payable Income Statement Corporate Balance Sheet Example

Connecting the income statement and the balance sheet.

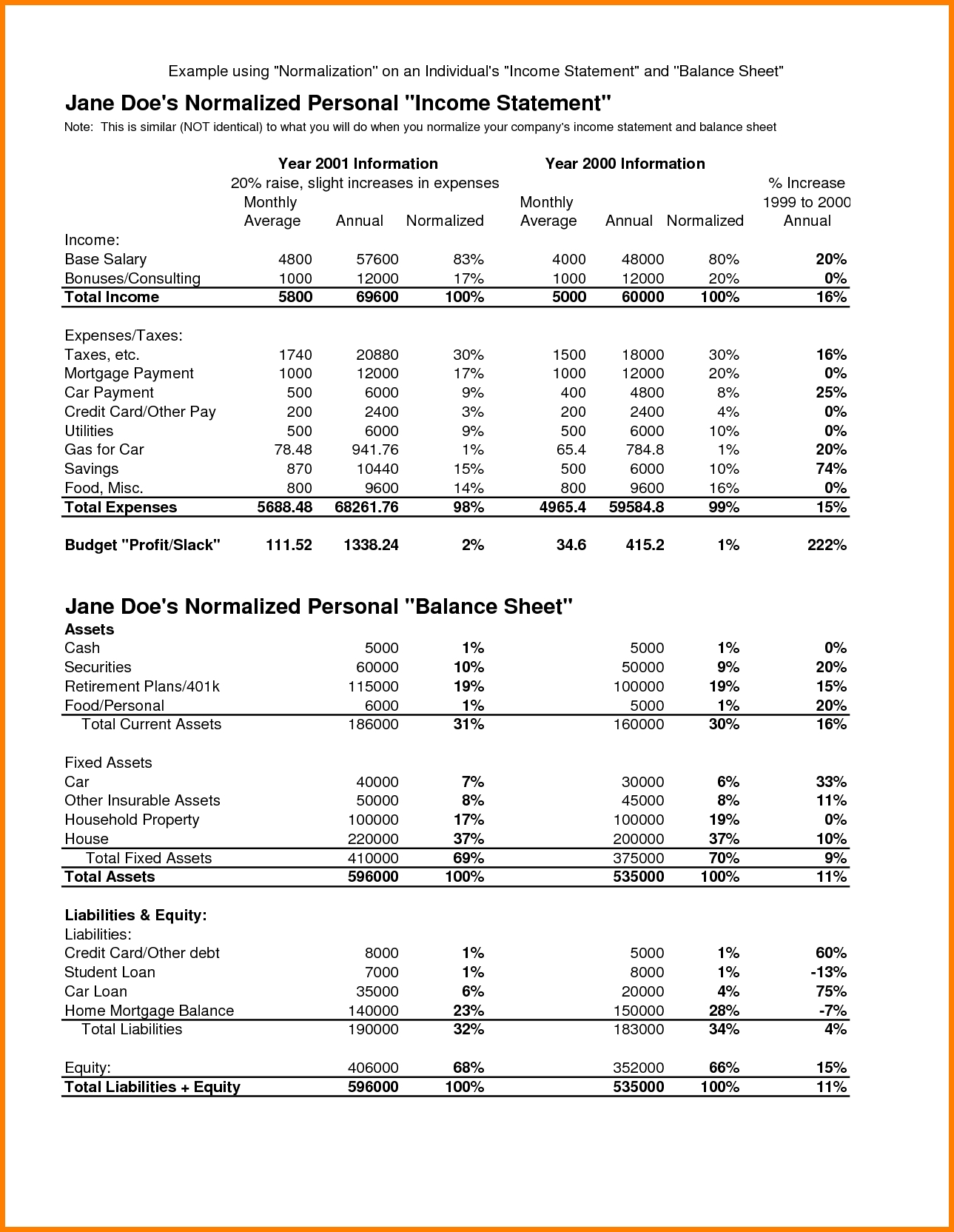

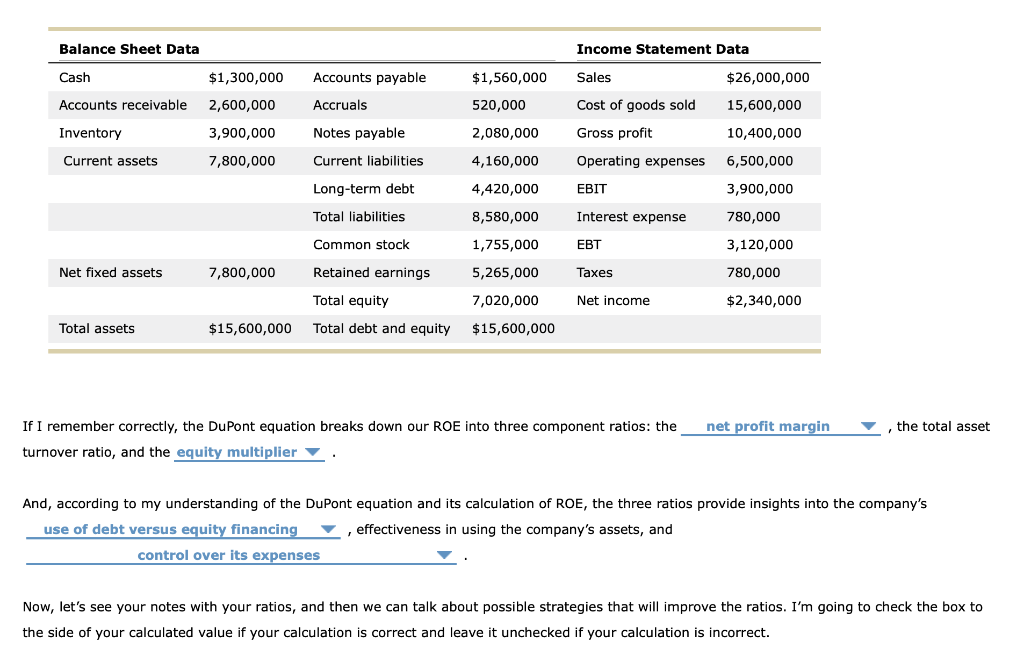

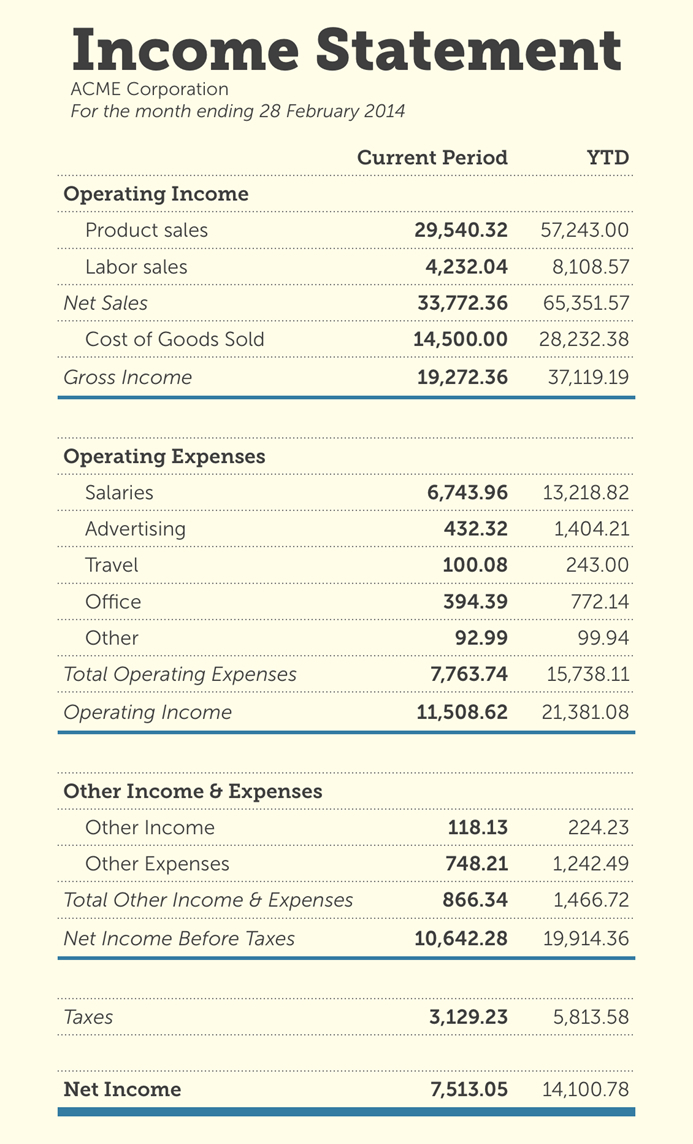

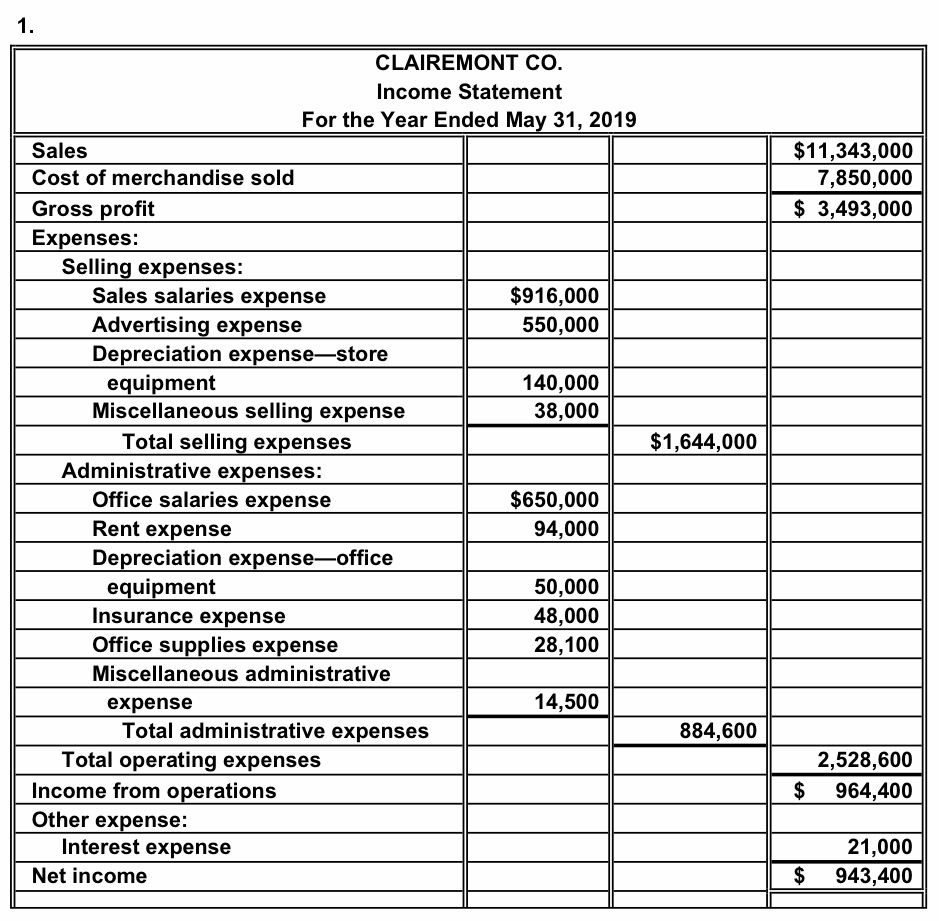

Accounts payable income statement corporate balance sheet example. For example, an annual income statement issued by paul’s guitar shop, inc. The balance sheet displays the company’s total assets and how the assets are financed, either through either debt or equity. The information you can get about a company from both the income statement and balance sheet is useful.

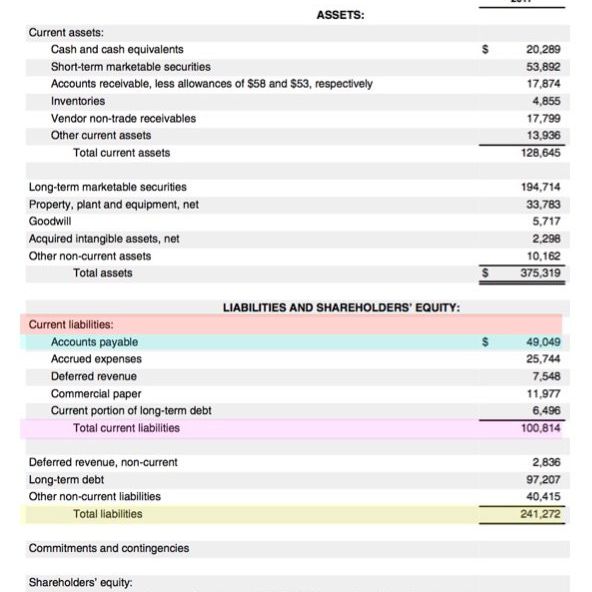

Accounts payable are liabilities on the balance sheet. The first liability account listed in the records is accounts payable for $650. Accounts payable balance sheet examples.

Accounts payable is a liability found on the balance sheet, normally a current liability. The term balance sheet refers to a financial statement that reports a company's assets, liabilities, and shareholder equity at a specific point in time. Find the best finance statement templates for.

We will present examples of three balance sheet formats containing the same hypothetical amounts. Accounts payables turnover is a key metric used in calculating the liquidity of a company, as well as in analyzing and planning its cash cycle. The expense incurred caused the payable, but it is distinctly separate from the payable (see figure 5.12 ).

It can also be referred to as a statement of net worth or a statement of financial position. Specifically, we will discuss the following: This section focuses on current.

The first section of this example explores the assets of the company. It will be helpful to revisit the process by summarizing the information we started with and how that information was used to create the four financial statements: And expenses have similar subcategorization between the two types of gaap (us gaap and ifrs) as described.

Investors and analysts will read the balance sheet alongside the income statement and cash flow statement, to evaluate the company’s overall financial position. Accounts payable forms a part of the current liabilities in your company’s balance sheet. Accounts payable (ap) is an account in a company's general ledger.

Accounts payable is a liability since it is money owed to creditors and is listed under current liabilities on the balance. Explanation, components, and examples by jason fernando updated jan 31, 2024 profit and loss statement meaning, importance, types, and examples by jason fernando updated dec. Here is an example of a company's balance sheet created using this complimentary template from bill.

Click below to download a free sample template of each of these important financial statements. Updated april 24, 2021 reviewed by margaret james fact checked by michael logan companies produce three major financial statements that reflect their business activities and profitability for. Ratio #11 days' sales in receivables (average collection period) ratio #12 inventory turnover ratio.

For example, steam had a profitable year (from the income statement) and their assets outweigh their liabilities (from the balance sheet) which puts them in a strong financial position. A related metric is ap days (accounts payable days). You can see that it follows the formula of “assets = liabilities + shareholders’ equity.”.

:max_bytes(150000):strip_icc()/dotdash_Final_Balance_Sheet_Aug_2020-01-4cad5e9866c247f2b165c4d9d4f7afb7.jpg)

:max_bytes(150000):strip_icc()/phpdQXsCD-3c3af916d04a4afaade345b53094231c.png)