Beautiful Tips About Calculate Tax Rate From Income Statement

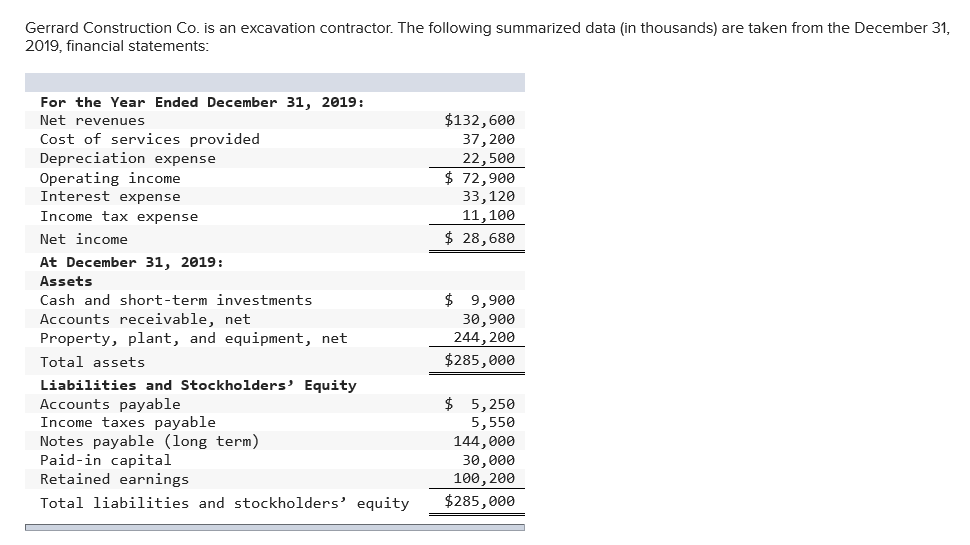

The provision for income taxes on an income statement is the amount of income taxes a company estimates it will pay in a given year.

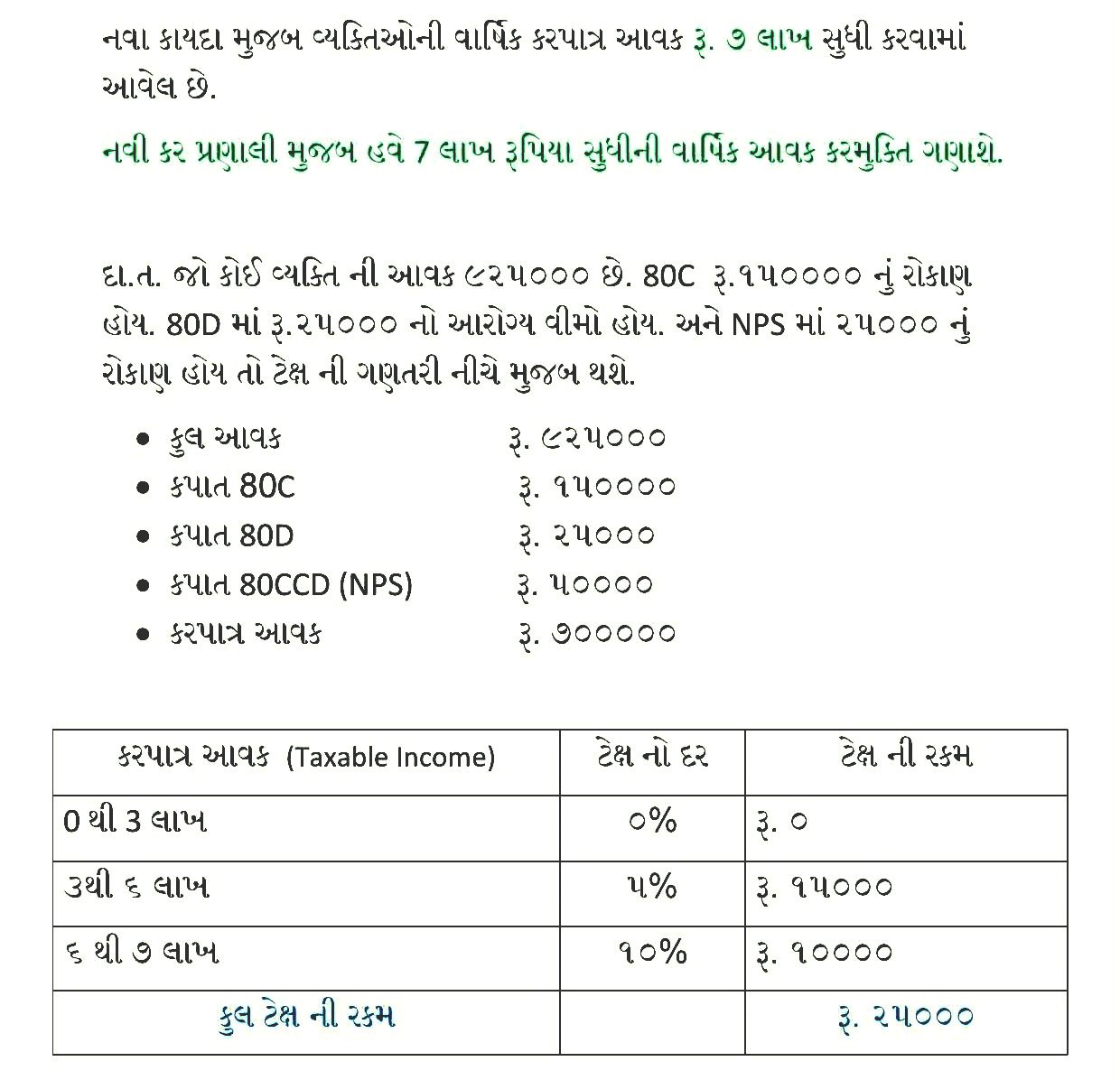

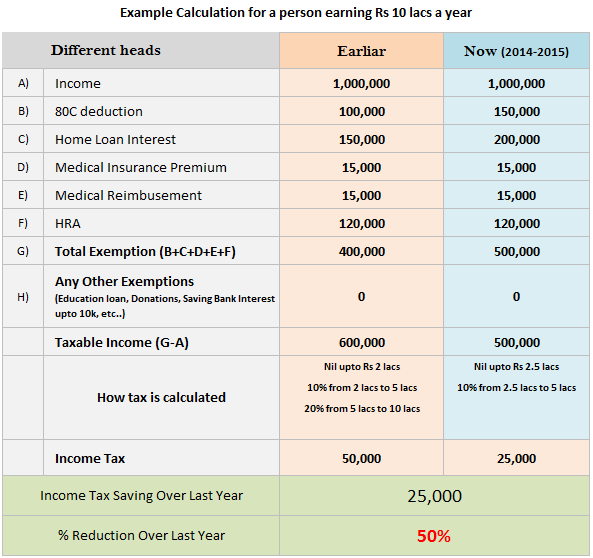

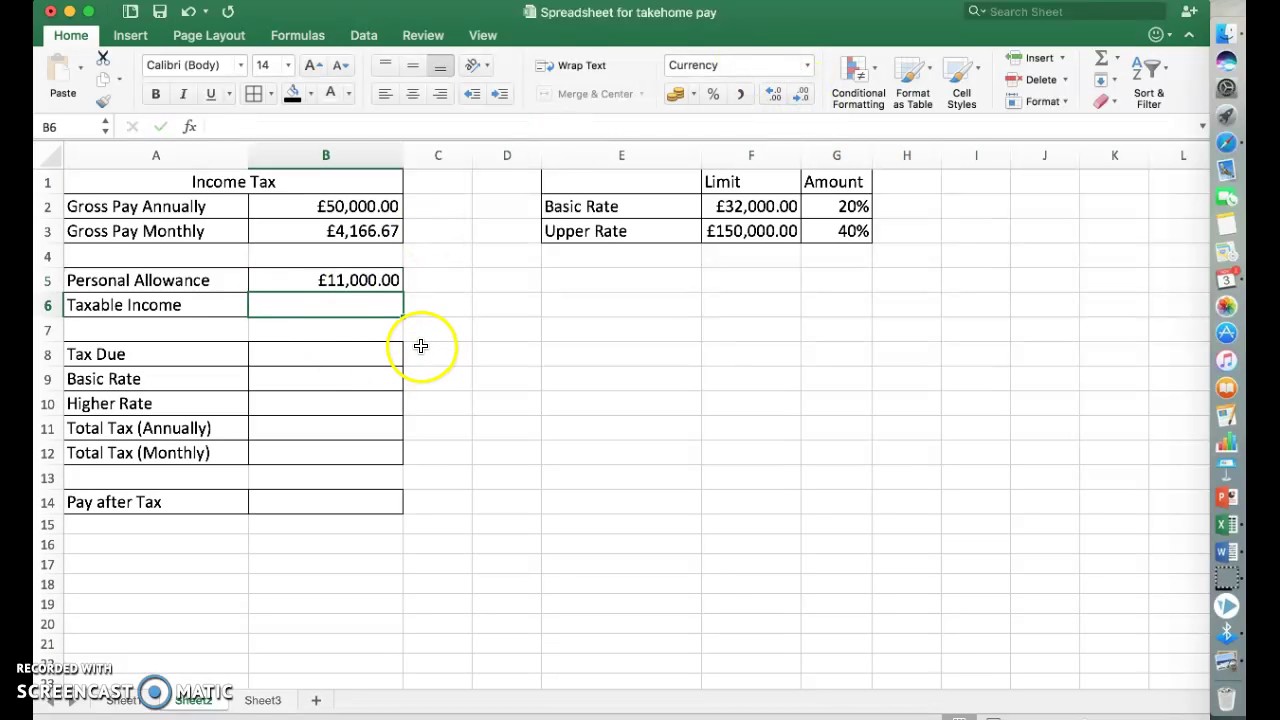

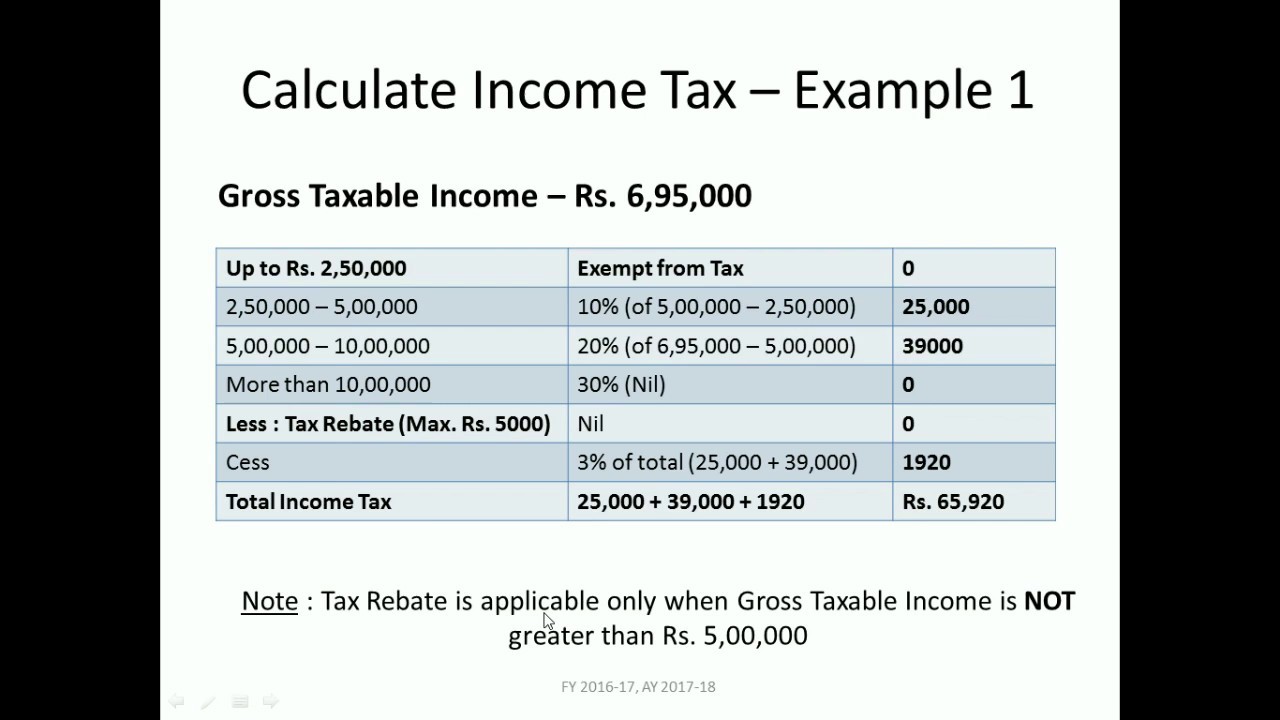

Calculate tax rate from income statement. Explanation the taxable income formula for an individual can be derived by using the following four steps: Tax rate = income taxes/income before income taxes. Then, subtract any eligible deductions.

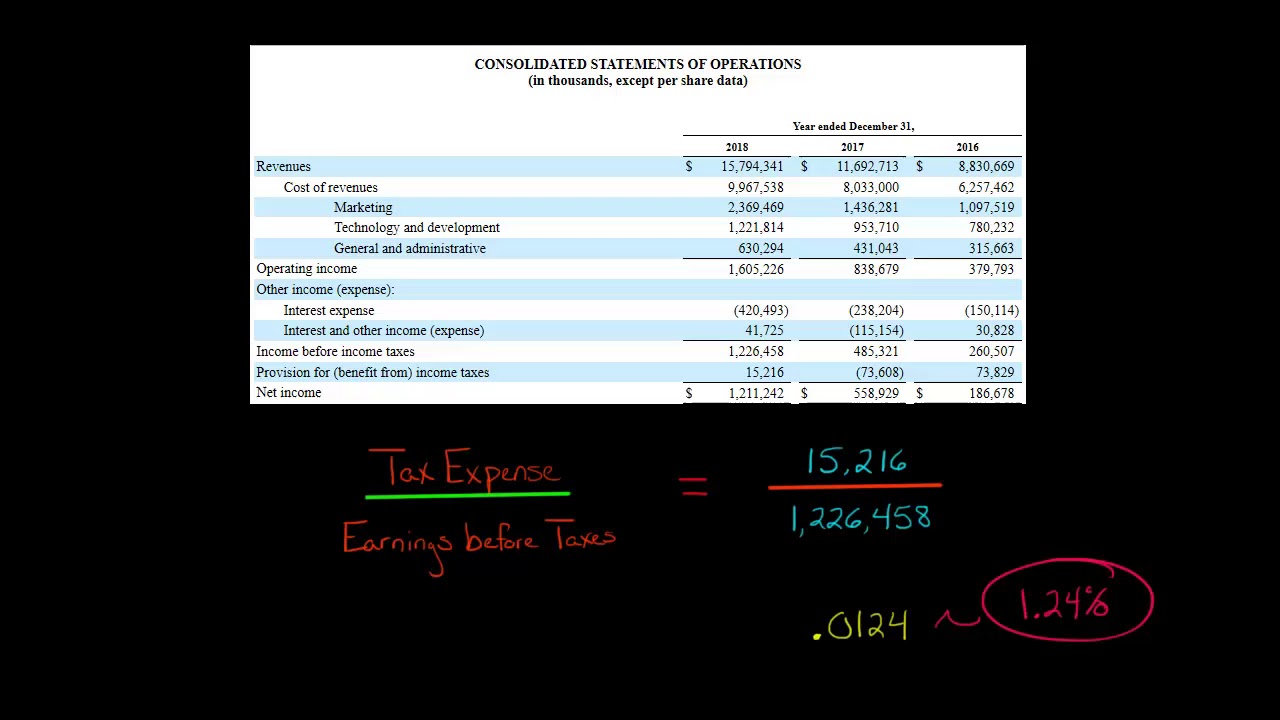

The most straightforward way to calculate effective tax rate is to divide the income tax expense by the earnings (or income earned) before taxes. This formula used to calculate income tax expense is simply the tax rate multiplied by the taxable income of the business or individual. Tax rate (q1 2020) = $921 / $7,757 = 0.1187 =.

The effective tax rate is the overall tax rate paid by the company on its earned income. In the example, $35,000 divided by $100,000 equals an effective tax rate of 0.35 or 35 percent. The formula for calculating net income is:

Firstly, determine the total gross income of the individual. Here’s a look inside donald trump’s $355 million civil fraud verdict. Tax expenseis usually the last line item before the bottom line—net income—on.

The civil fraud ruling on donald trump, annotated. Deferred tax liability (dtl) vs. Simply divide the interest expense by the principal balance, and multiply by 100 to convert it to a percentage.

How to calculate net income? You find the pretax profit margin by dividing the income before taxes by total. A new york judge has ordered donald trump and his companies to pay $355 million.

Calculate the effective tax rate for the same period: Trump was penalized $355 million plus interest and banned for three years from. Learn how to calculate taxable income, tax deductions, and marginal tax.

Next, find your adjusted gross income. Firstly, the taxable income of the individual. To calculate income tax, you add all forms of taxable income earned in a tax year.

Effective tax rate = reported tax expense / reported profit before tax. This will give you the periodic interest rate, or the. It tells you how many cents a company made in profits for each dollar in sales.

Divide taxes paid by net profit to calculate the effective tax rate percentage. Input the appropriate numbers in this formula: This will give you the periodic interest rate, or the.