Who Else Wants Tips About Profit And Loss Reconciliation

Reconciliation of movements in shareholders' funds.

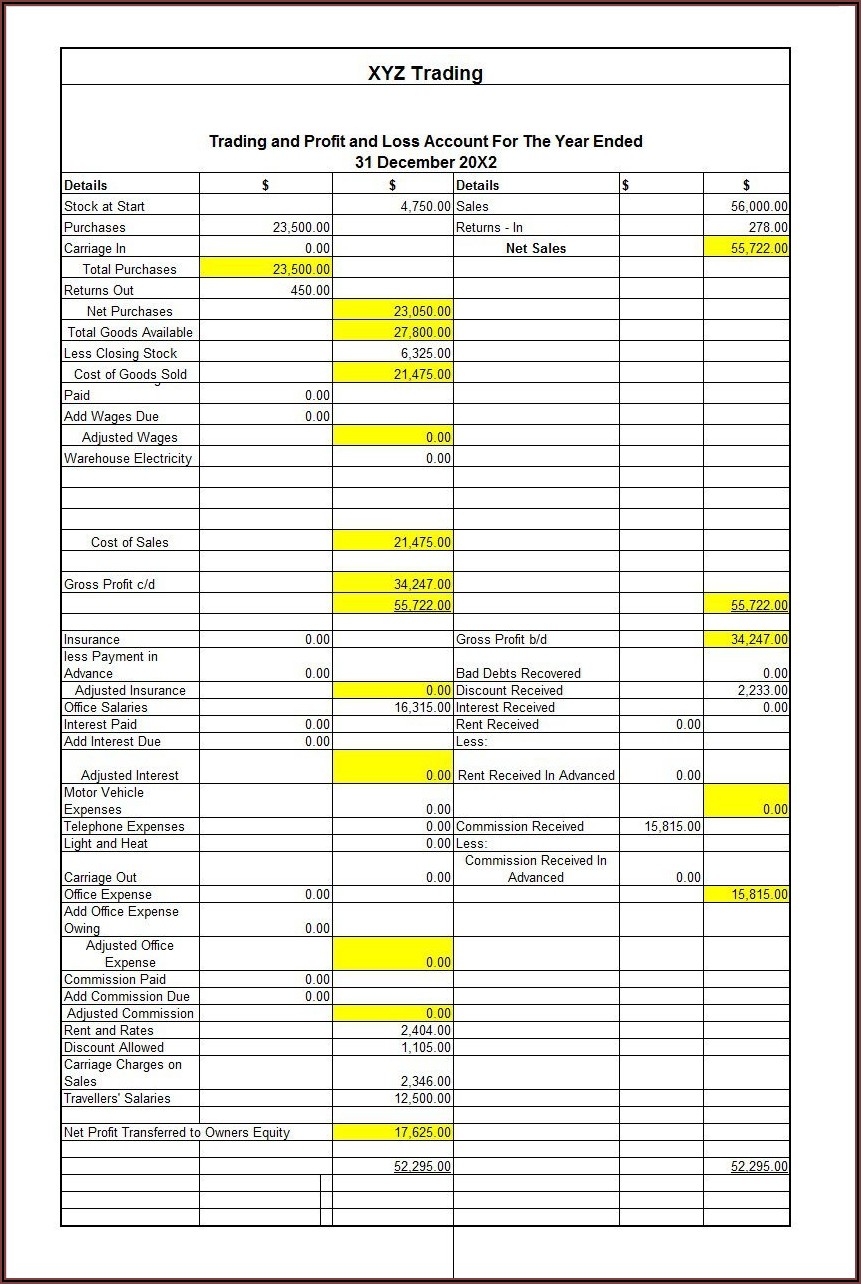

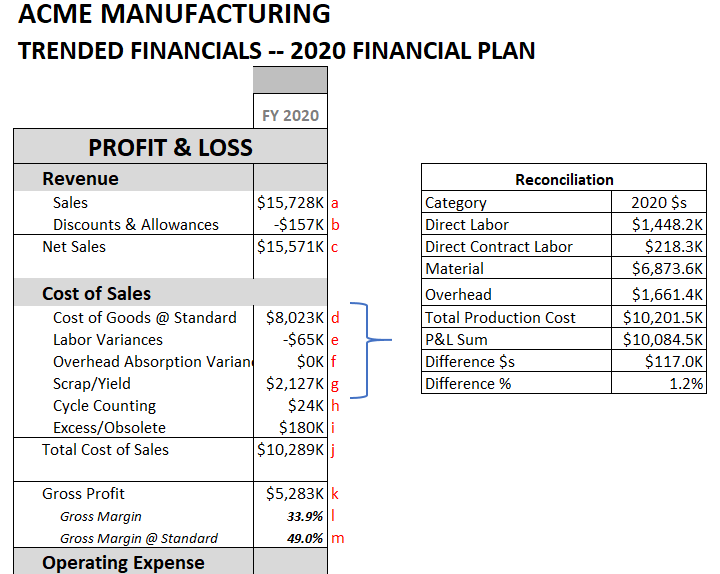

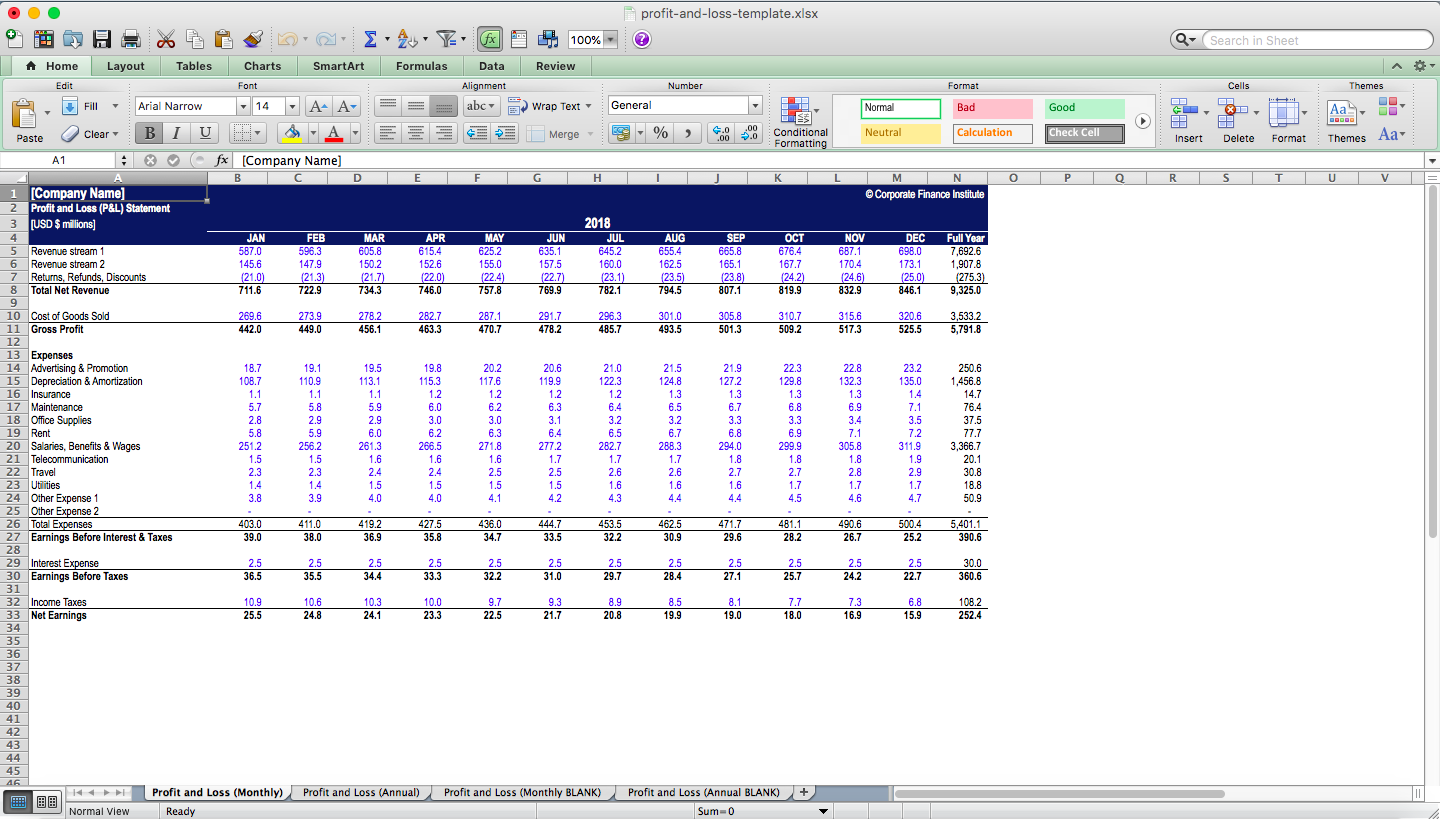

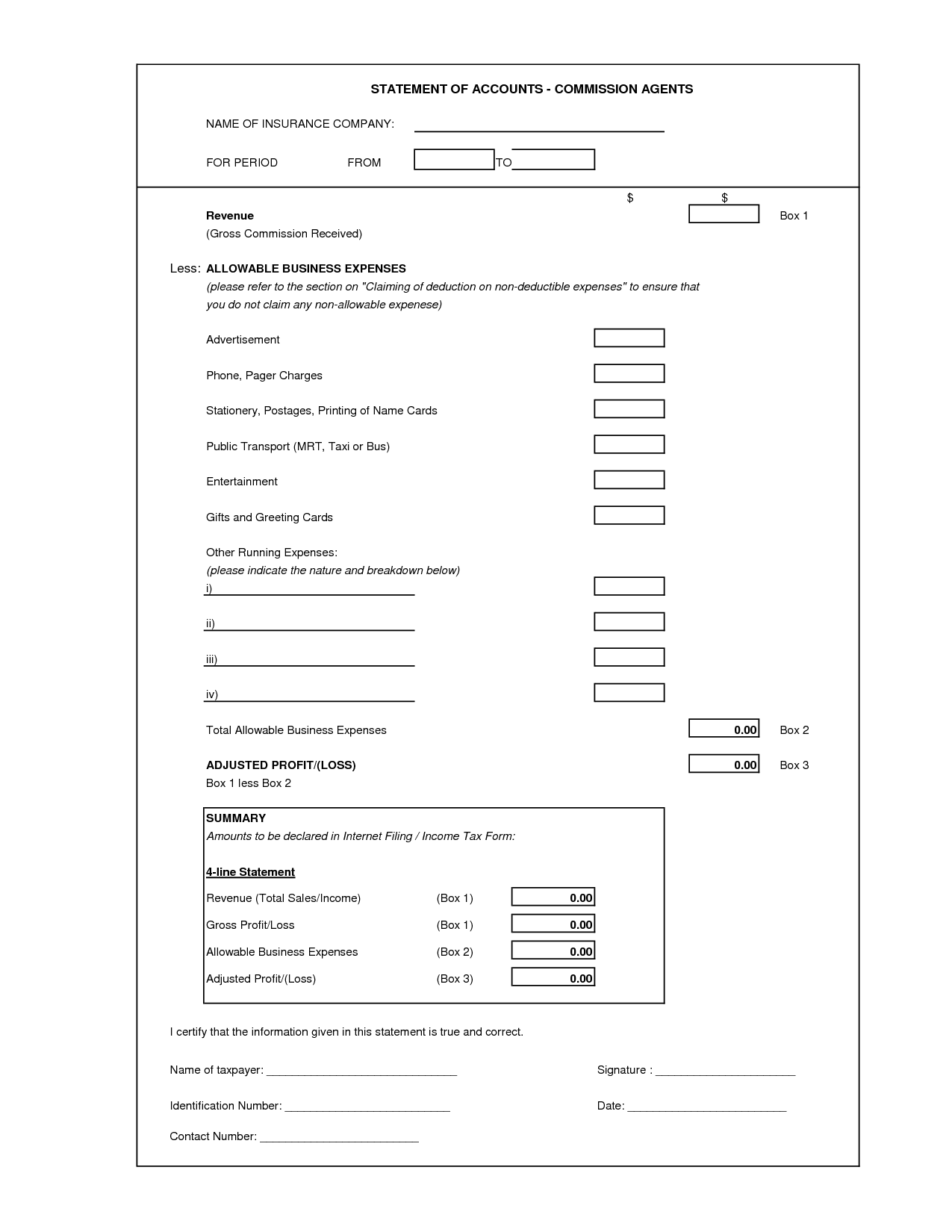

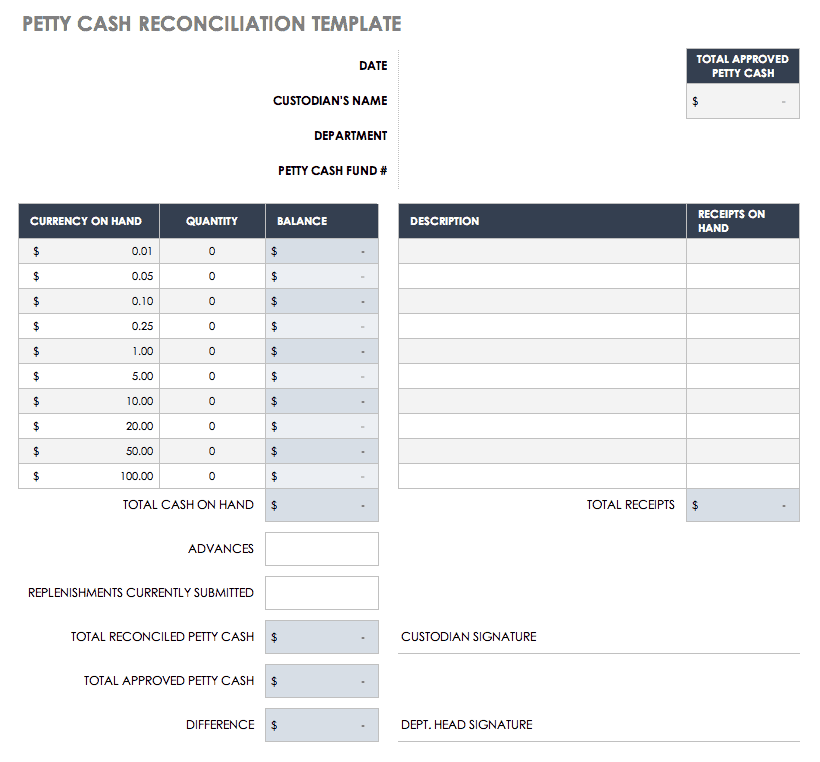

Profit and loss reconciliation. Reconciliation of cost and financial statements items accounted for differently in cost accounting and financial accounting. 07/09/2023 | simon terry. There are two primary profit and loss (p&l) reconciliations performed by product control.

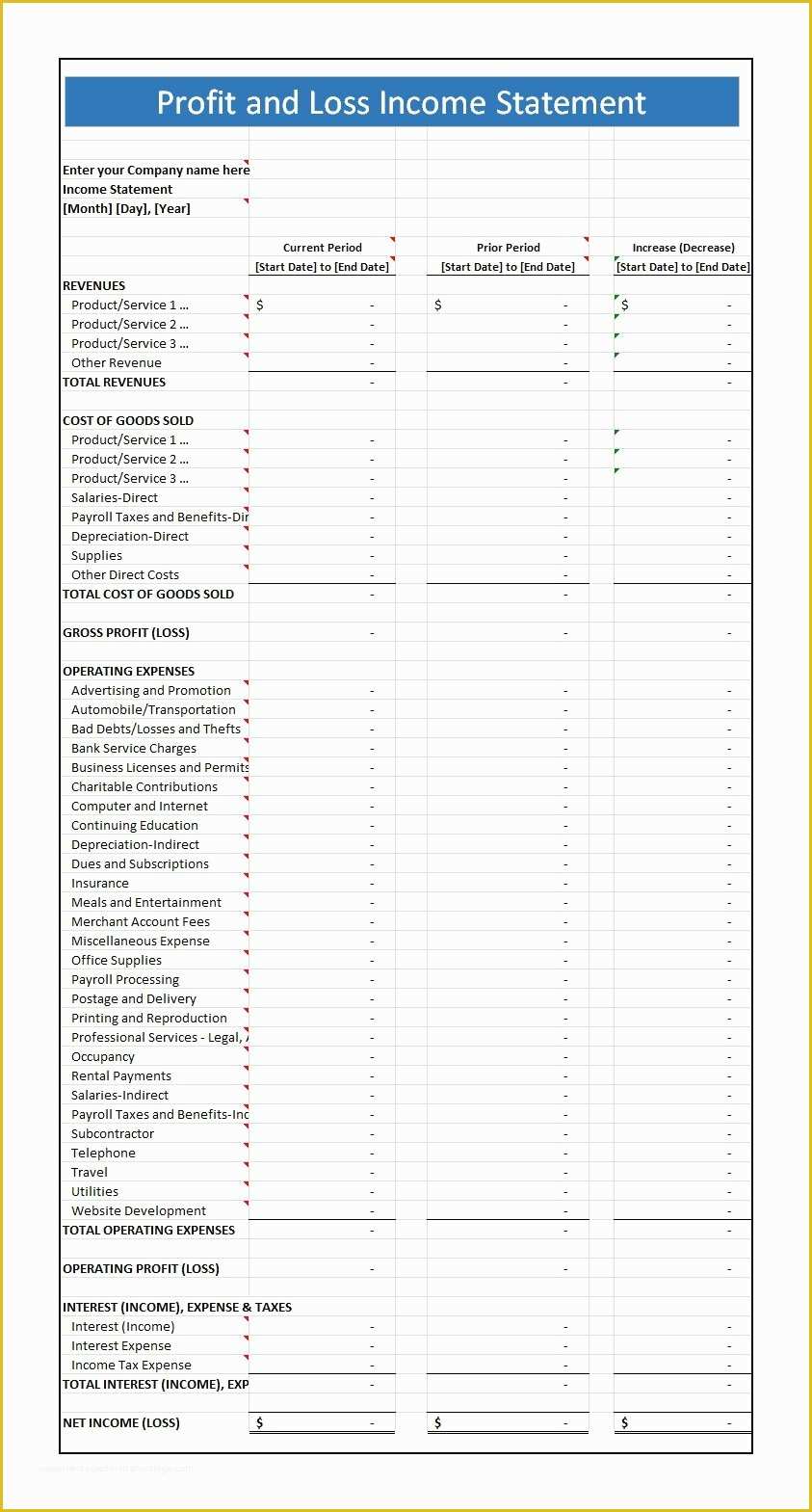

Quickbooks online offers a range of features designed to streamline bookkeeping processes for bus. Including the adjustments outlined in the reconciliation table at the end of this release, the company recognized adjusted ebitda 1 of $613 million and adjusted. Reconciling net income to operating cash flow involves adding or subtracting these noncash items.

In order to ensure that a company’s financial position is properly reflected, the month end reconciliation process is required. These are the comparison of the front office estimate to product control's. On the other hand, if you'll not delete those duplicate entries after reconciliation, your profit and loss statement displays erroneous or incorrect data.

(see below for an example of the reconciliation outcomes you should be presented with.) the trial. Statement of total recognised gains and losses; A p&l statement (sometimes called a statement of operations) is a type of financial report that tells you how profitable your business was over a given period.

A reconciliation statement is a statement which is prepared to reconcile the profit as per cost accounts with the profit as per financial accounts by suitably treating the causes for. To get started, enter all of the noncash expenses shown on the. Provision for bad and doubtful debts.

The final figure will show the financial. The profit and loss account reconciliation input statement summarises the tax categorisation of the profit or loss per the accounts amounts and reconciles them to the. A profit and loss statement (p&l), or income statement or statement of operations, is a financial report that provides a summary of a company’s revenues, expenses, and profits/losses over a given period of time.

Note of historical cost profits and losses; Depending on the size and complexity of a business’. Click on the allocate profit/loss button.

The p&l statement shows a company’s ability to generate sales, manage expenses, and create. A p&l statement provides information. These are the comparison of the front office estimate to.

Table of contents what is a profit and loss statement? It shows all the company’s income and expenses incurred over a given period. Statement of total recognised gains.

The financial accounts deal with the classification, recording, and summarization of. Excess depreciation on plant, buildings, etc., (with a view to creating secret reserves). A profit and loss (p&l) statement summarizes the revenues, costs and expenses incurred during a specific period of time.

![53 Profit and Loss Statement Templates & Forms [Excel, PDF]](https://templatelab.com/wp-content/uploads/2015/11/Profit-and-Loss-27-790x1231.jpg)

![50+ Bank Reconciliation Examples & Templates [100 Free]](https://templatelab.com/wp-content/uploads/2017/04/Bank-Reconciliation-Template-32-790x1022.jpg)

![53 Profit and Loss Statement Templates & Forms [Excel, PDF]](https://templatelab.com/wp-content/uploads/2020/06/Profit-and-Loss-Statement-for-Small-Business-TemplateLab.com_-scaled.jpg)