First Class Tips About Bank Account Balance Sheet

Your balance sheet shows what your business owns (assets), what it owes (liabilities), and what money is left over for the owners ( owner’s equity ).

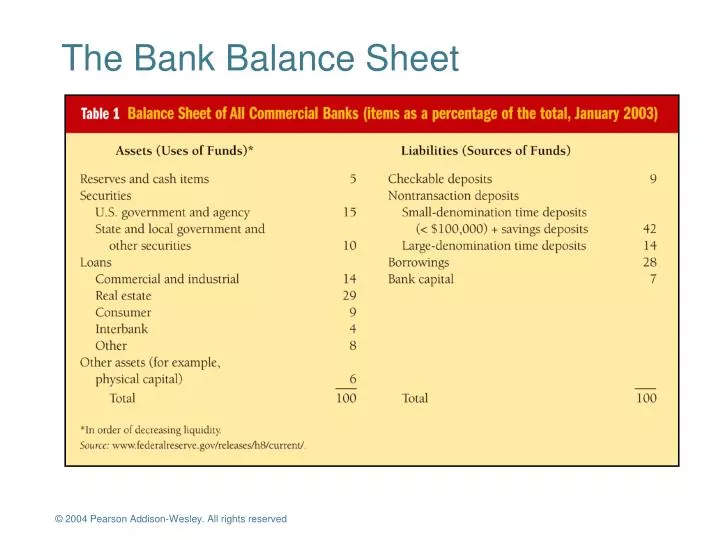

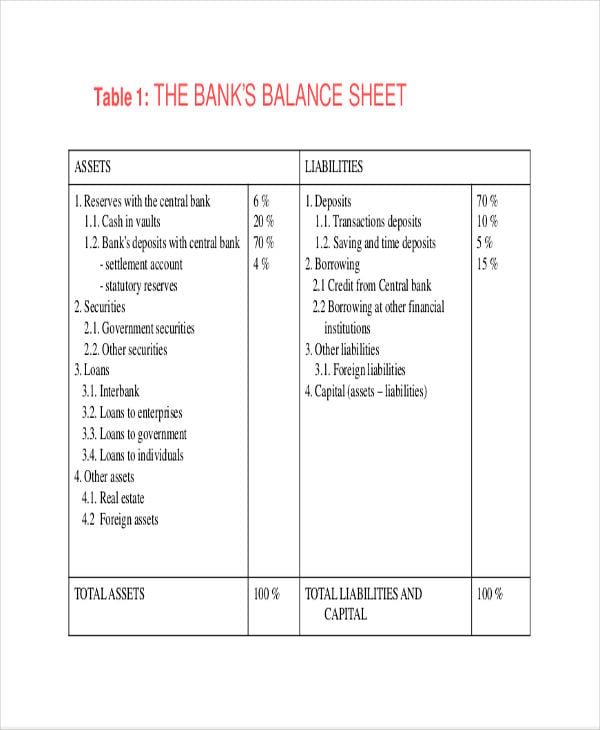

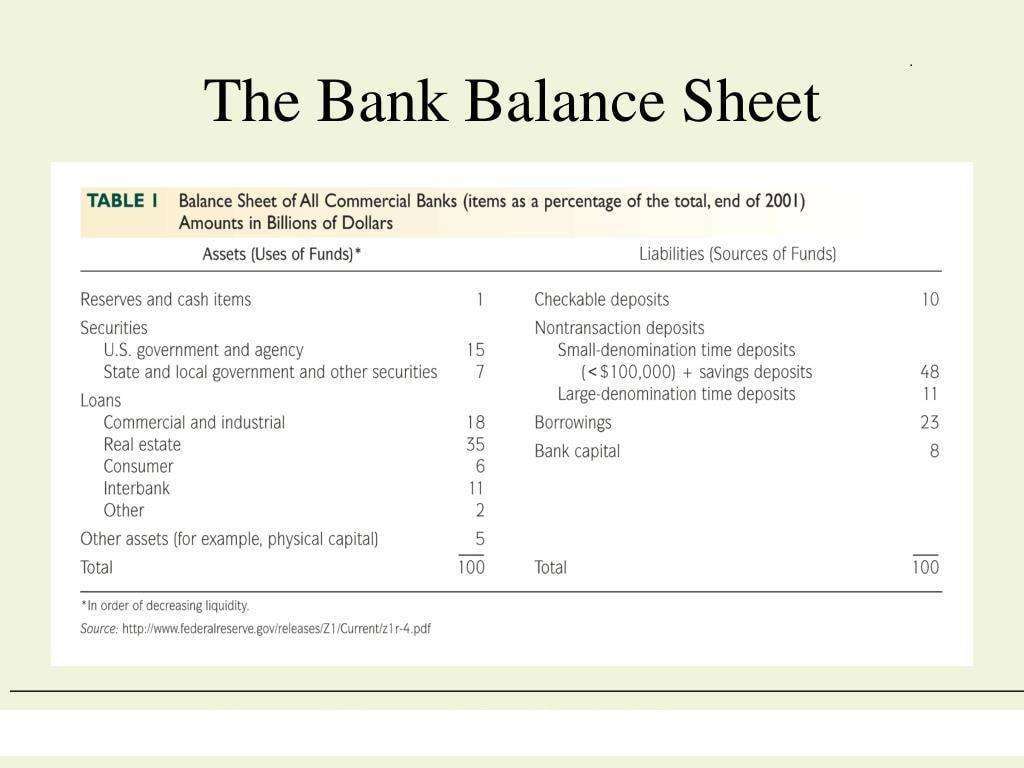

Bank account balance sheet. Banks typically have a significant portion of their assets in the form of loans. A typical balance sheet consists of the core accounting equation, assets equal liabilities plus equity. The balance sheet displays the company’s total assets and how the assets are financed, either through either debt or equity.

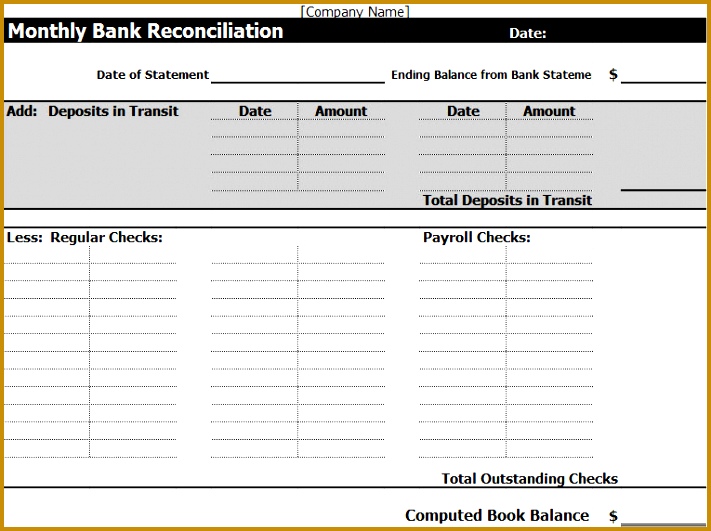

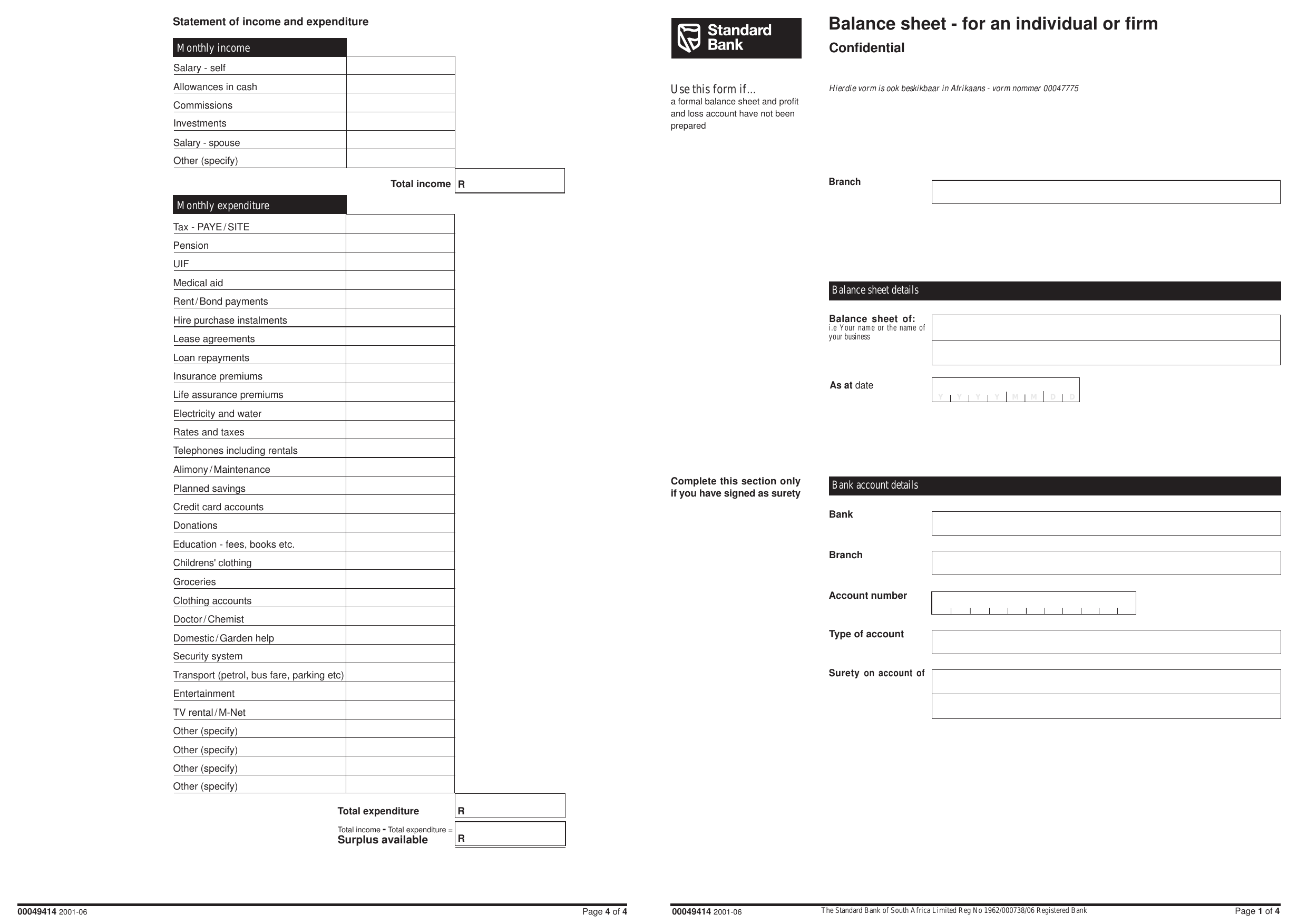

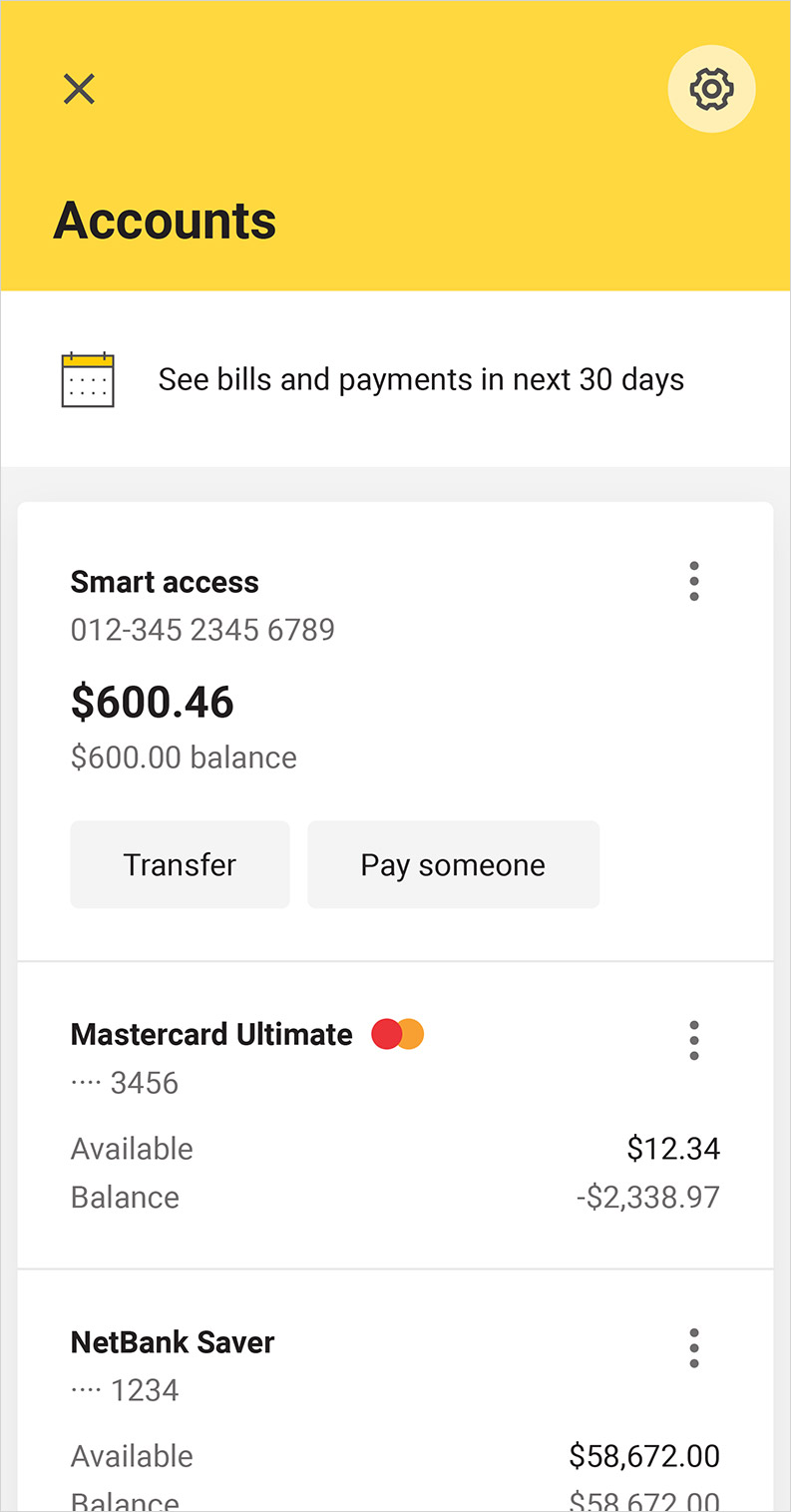

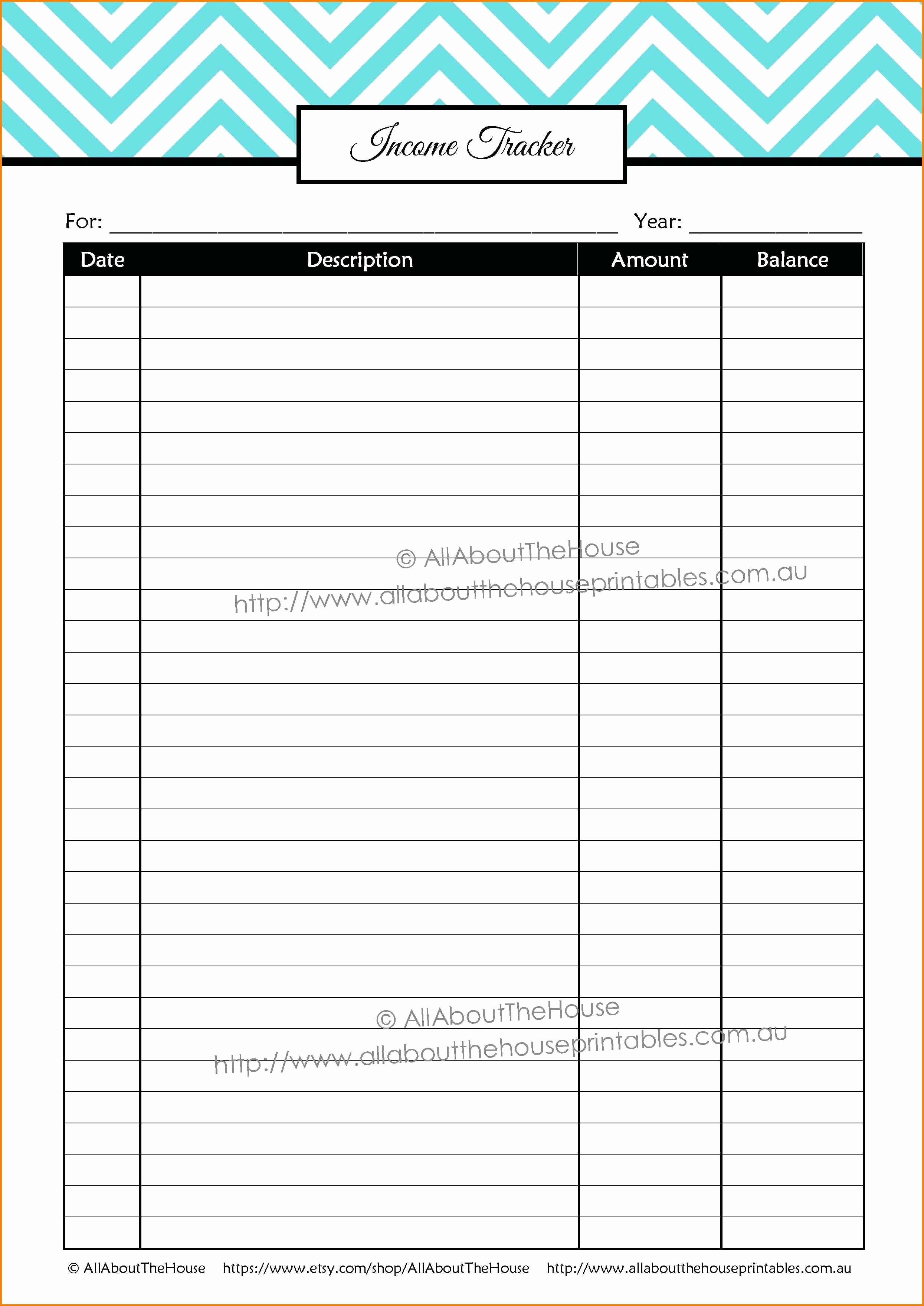

Long term debt in balance sheet The bank of canada could wind down its quantitative tightening program as soon as april and will most likely do so no later than june, an economist at the royal bank of canada predicted in a report this week. At its most basic, your bank account spreadsheet should include columns to track:

Often, the reporting date will be the final day of the accounting period. The balance sheet is split into two columns, with each column balancing out the other to net to zero. A balance sheet is a financial statement that shows the relationship between assets, liabilities, and shareholders’ equity of a company at a specific point in time.

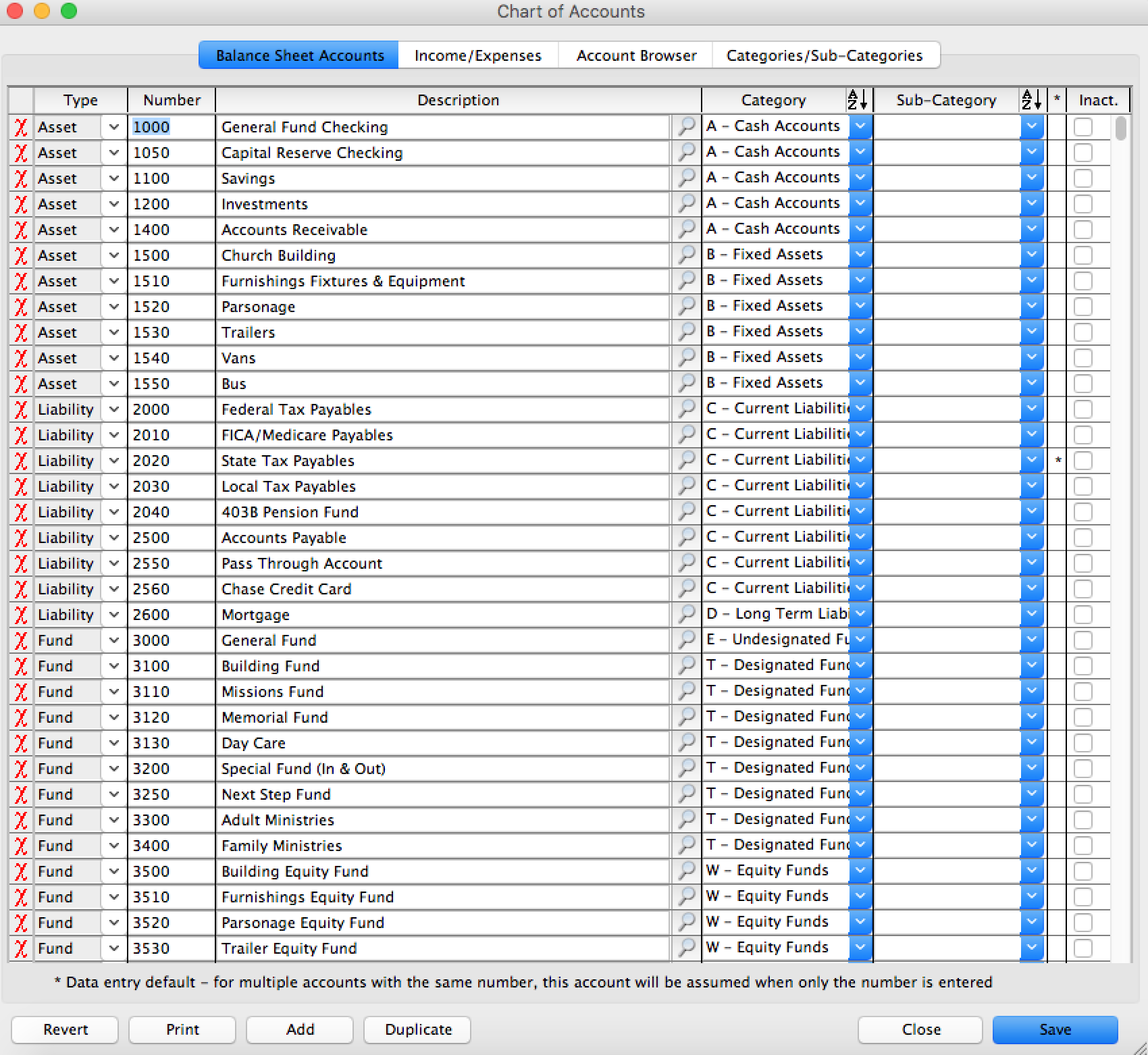

For analytical purposes it may be important to break the balance sheet into more detailed information, i.e currency, maturity, industrial sector. The balance sheet is based on the fundamental equation: Here we also discuss the definition, loans, and advances in bank balance sheets along with the example.

Managing work budget & accounting free balance sheet templates get free smartsheet templates by andy marker | january 7, 2019 (updated april 28, 2023) we’ve compiled free, printable, customizable balance sheet templates for project managers, analysts, executives, regulators, and investors. Because it summarizes a business’s finances, the balance sheet is also sometimes called the statement of financial position. The balance sheet items are average balances for each line item rather than the balance at the end of the period.

A balance sheet is meant to depict the total assets, liabilities, and shareholders’ equity of a company on a specific date, typically referred to as the reporting date. What is a balance sheet? A balance sheet is a financial statement that reports a company's assets, liabilities, and shareholder equity.

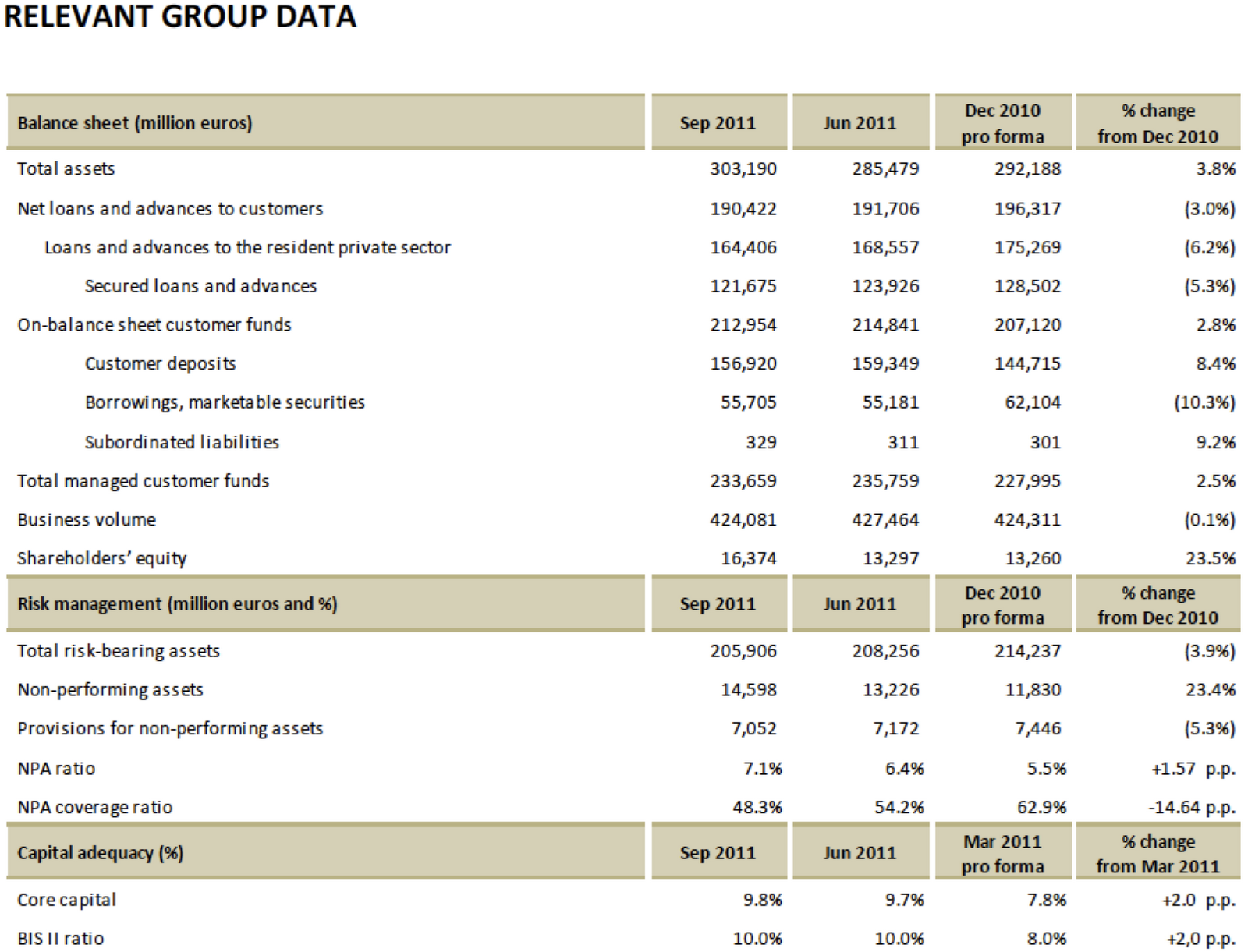

Antonio luis san frutos velasco A bank balance sheet is a key way to draw conclusions regarding a bank’s business and the resources used to be able to finance lending. The challenges in compilation of national and regional balance sheet.

Assets = liabilities + owners’ equity The volume of business of a bank is included in its balance sheet for both assets (lending) and liabilities (customer deposits or other financial instruments). Assets = liabilities + shareholders’ equity

A balance sheet summarizes your firm’s current financial worth by showing the value of what it owns (assets) minus what it owes (liabilities). It consists of assets, representing what the bank owns, and liabilities, describing what it owes to its depositors and other creditors. The balance sheet is one of the three core financial statements that are used to.

The balance sheet gives useful insights into a company’s finances. A balance sheet (aka statement of condition, statement of financial position) is a financial report that shows the value of a company's assets, liabilities, and owner's equity on a specific date, usually at the end of an accounting period, such as a quarter or a year. Businesses typically prepare and distribute their balance sheet at the end of a reporting period, such as monthly, quarterly or annually.