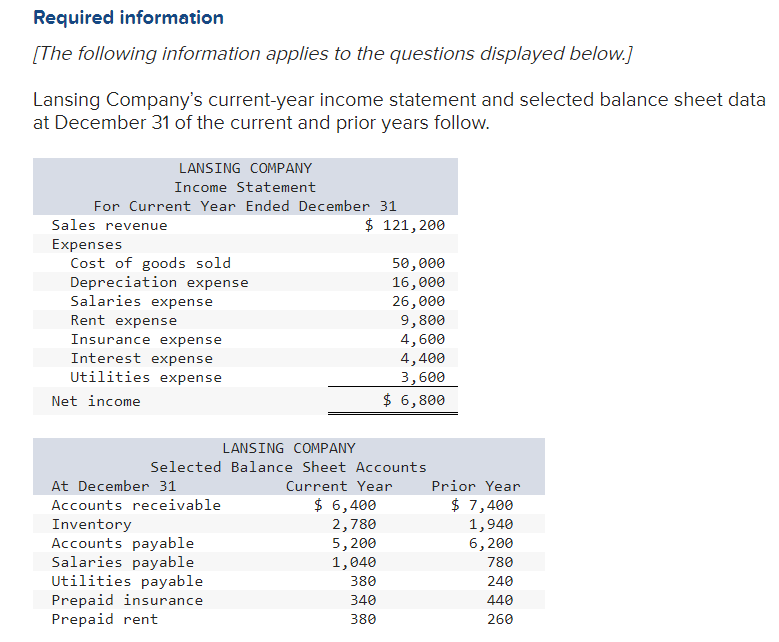

Perfect Info About Adjustments For Prepaid Expenses

Mark farber takes a look at prepaid expenses in this video.

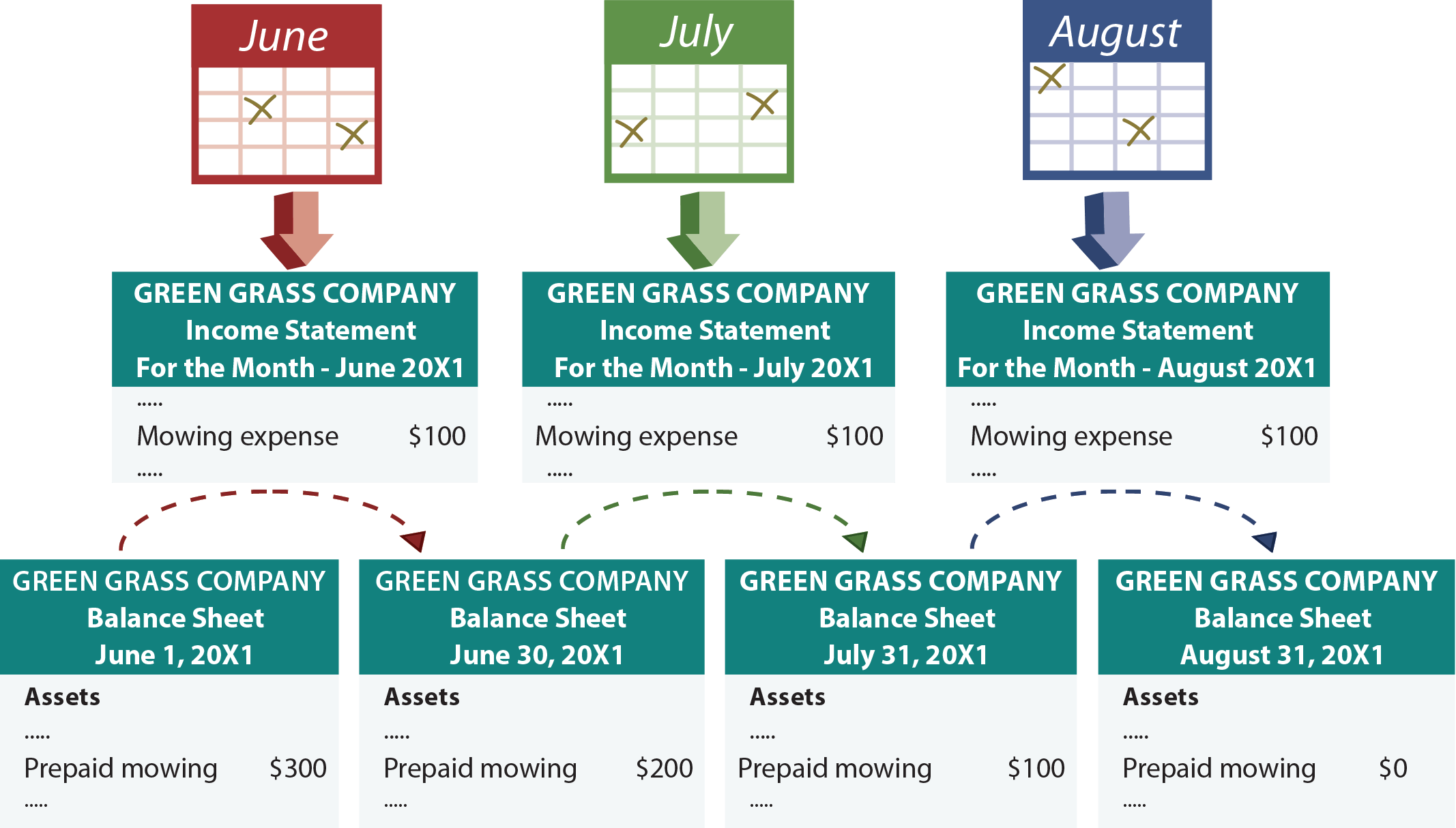

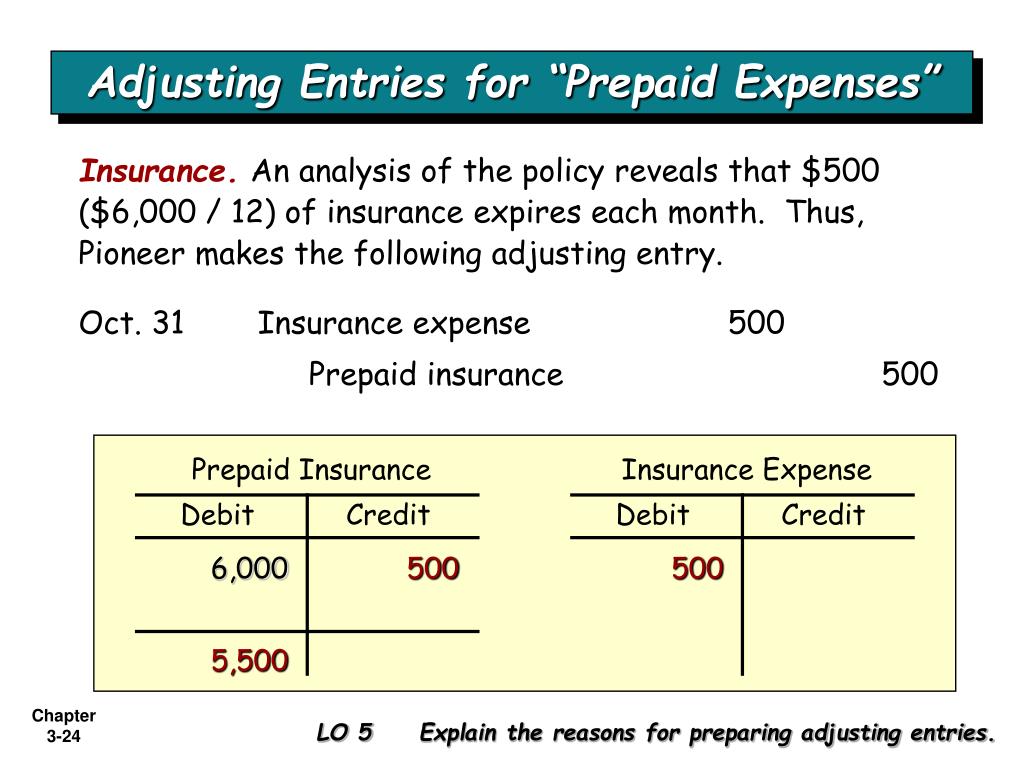

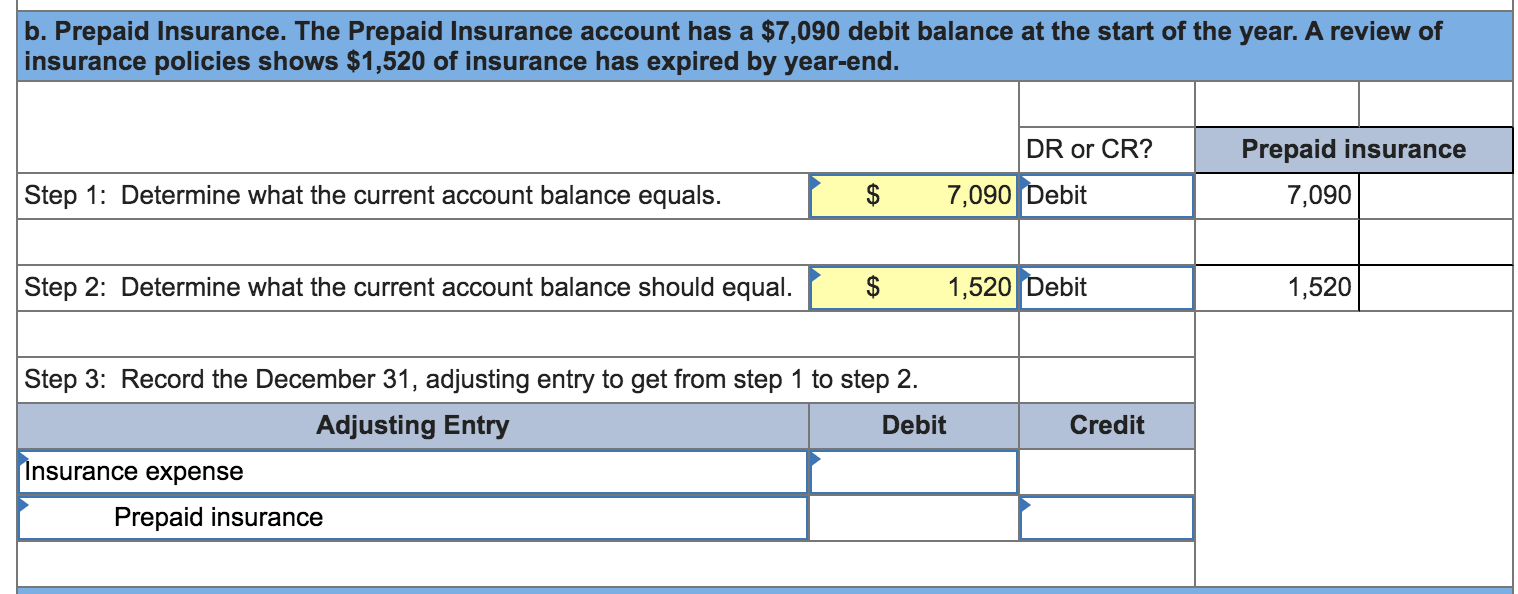

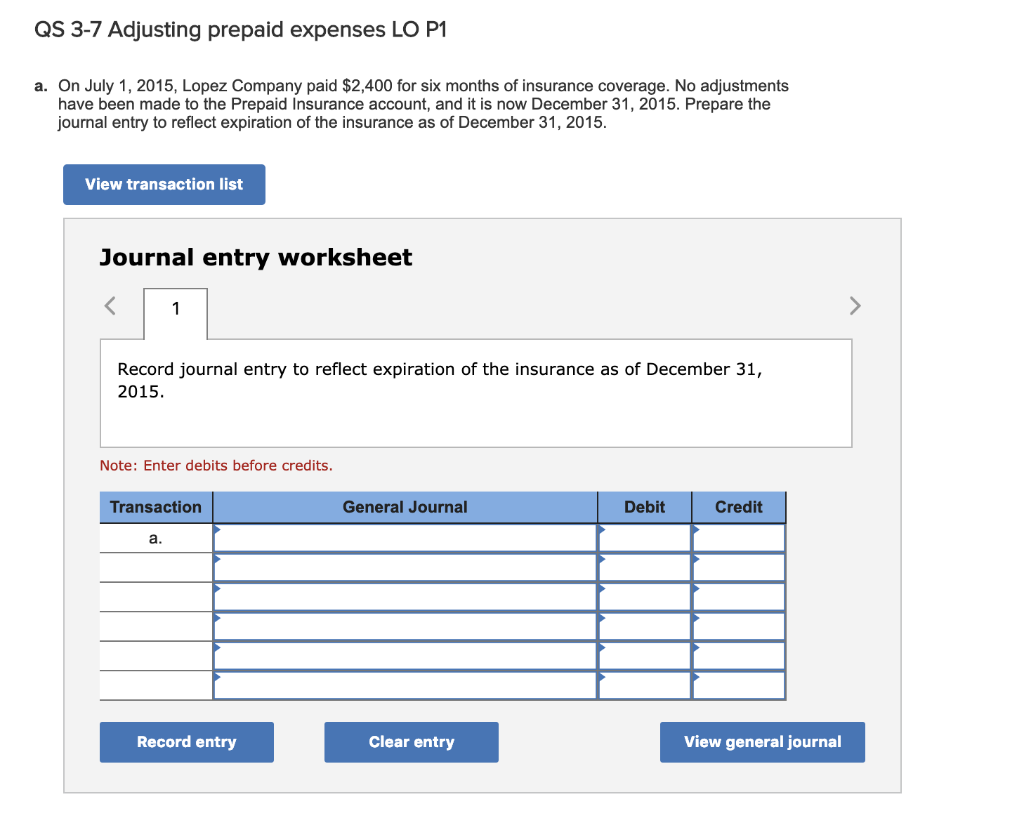

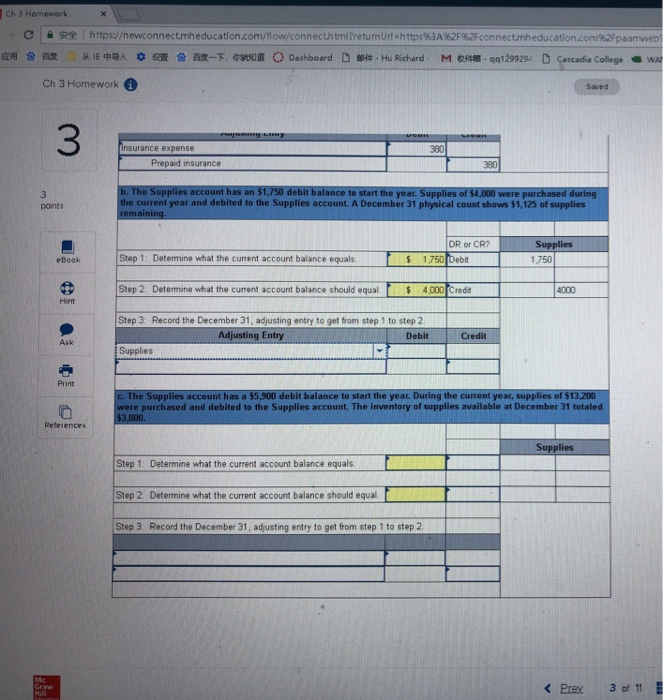

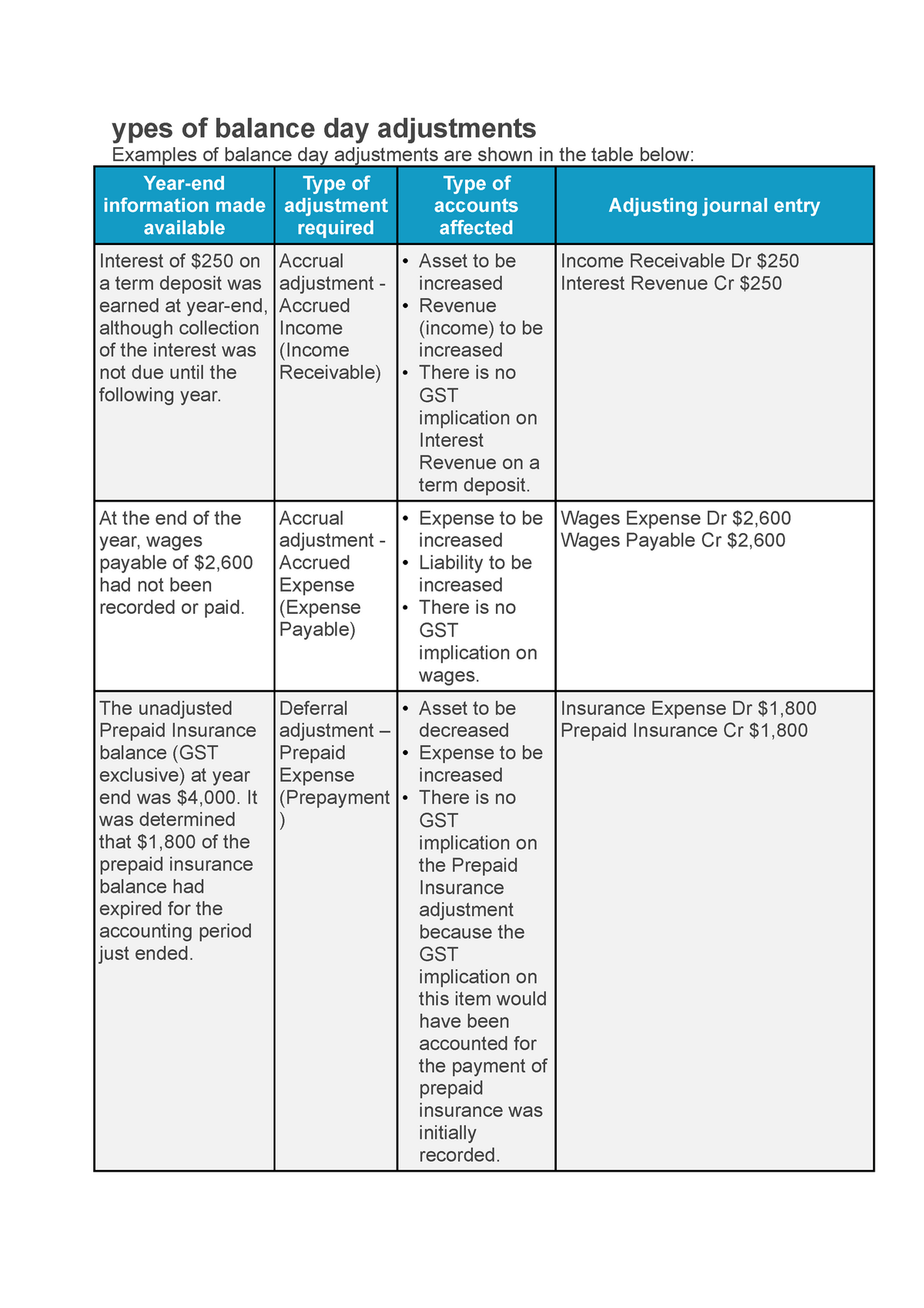

Adjustments for prepaid expenses. To recognize prepaid expenses that become actual expenses, use adjusting entries. Thus, the entry for prepaid rent is a debit to the prepaid expense account and a credit to the cash account. The insurance expense for a year would be $ 6,500 ($26,000/ 4 years), or $ 541.67 per month.

The adjusting entry for prepaid expense depends upon the journal entry made when it was initially recorded. Intermediate financial accounting part 1a 2015fb: Additional points related to the treatment of prepaid expenses in final accounts;

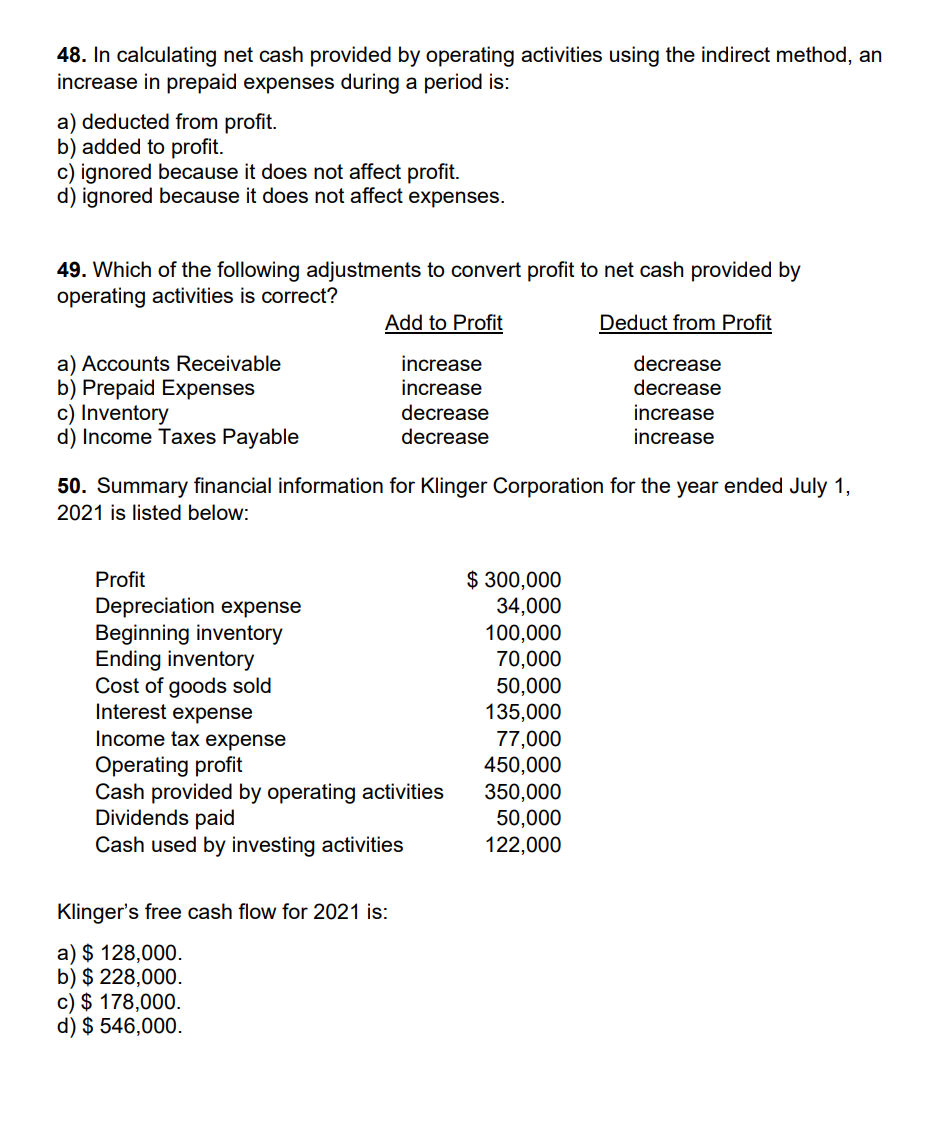

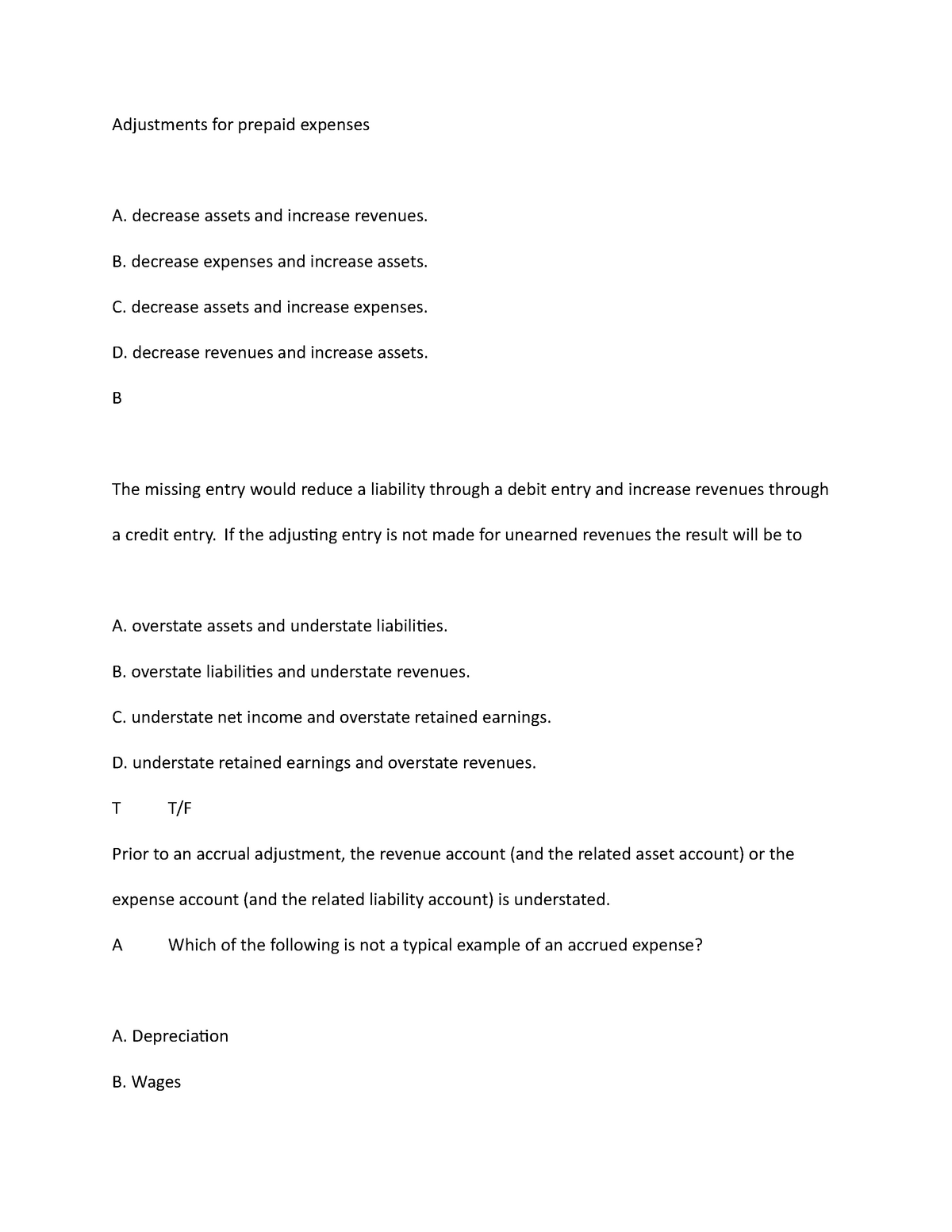

Decrease assets and increase expenses. Decrease assets and increase expenses. Decrease revenues and increase assets.

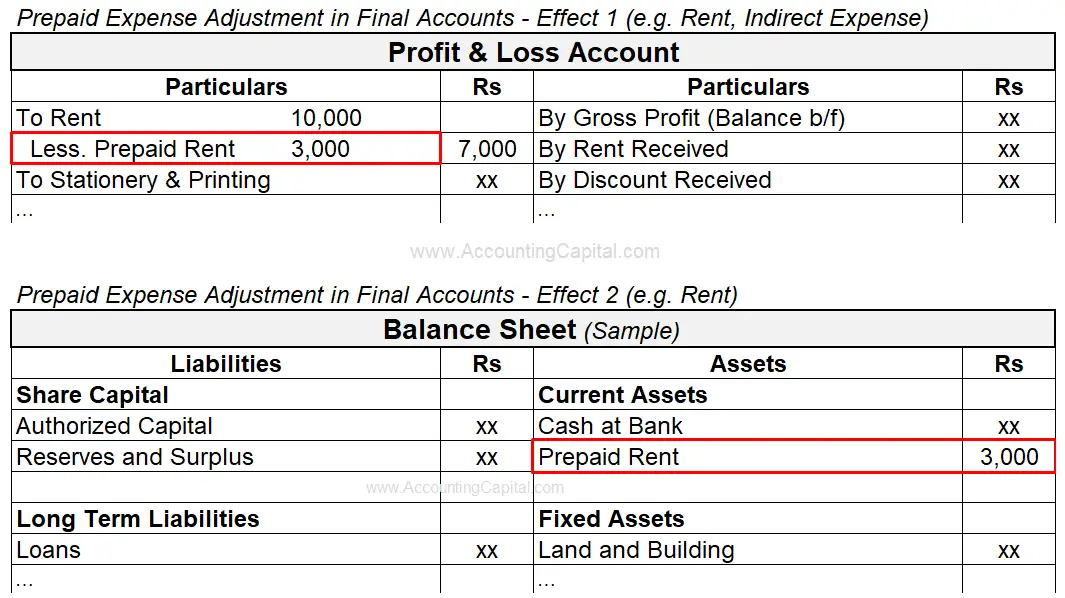

Decrease revenues and increase assets. The adjustment for prepaid expenses is recorded as a decrease in prepaid meals, indicating that the company is deducting the prepaid amount from their expenses. There are two ways of recording prepayments:

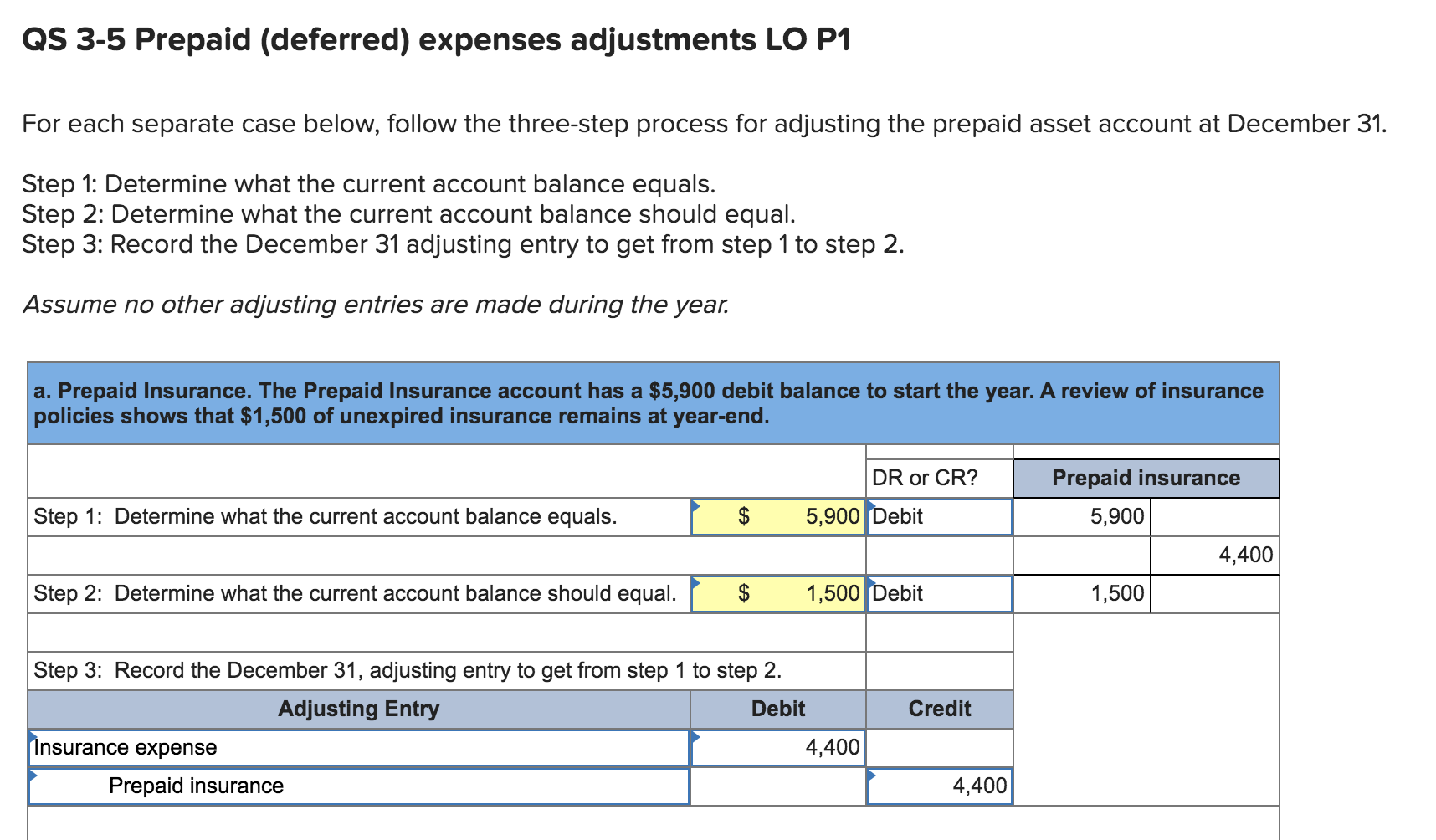

To do this, debit your expense account and. Analysis and income statement presentation 5m. In the second entry, prepaid insurance decreases (credit) and insurance expense increases (debit) for one month’s insurance usage found by taking the total $4,500 and dividing by six months (4,500/6 = 750).

The payment of expense in advance increases one asset (prepaid or unexpired expense) and decreases another asset. Accruals involve recognizing expenses and revenues that have occurred but have not yet been recorded in the. David kindness fact checked by vikki velasquez expenses that are used to make payments for goods or services that will be received in the future are known as prepaid expenses.

Mark goes through an example of what. On december 31, the account prepaid expenses must be adjusted to report a balance of $5,000 since the amount prepaid is decreasing by $1,000 a month. The prepaid portion of the expense (unexpired) is reduced from the total expense in the profit & loss account.

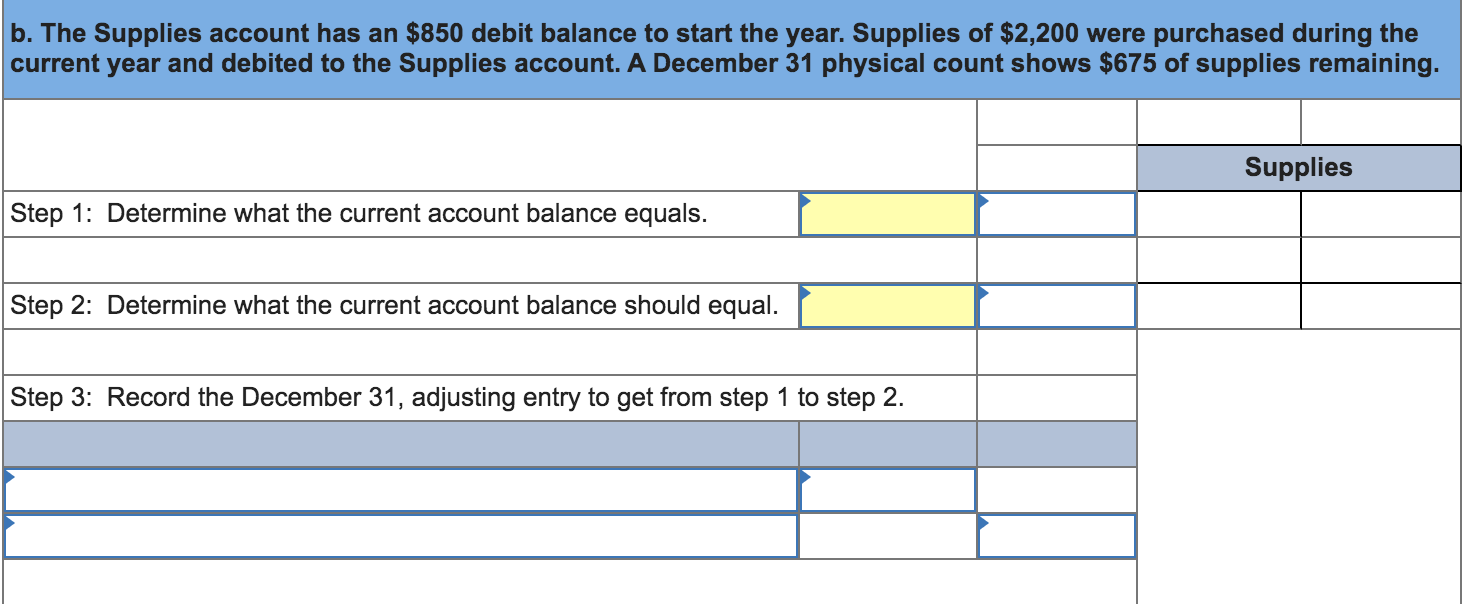

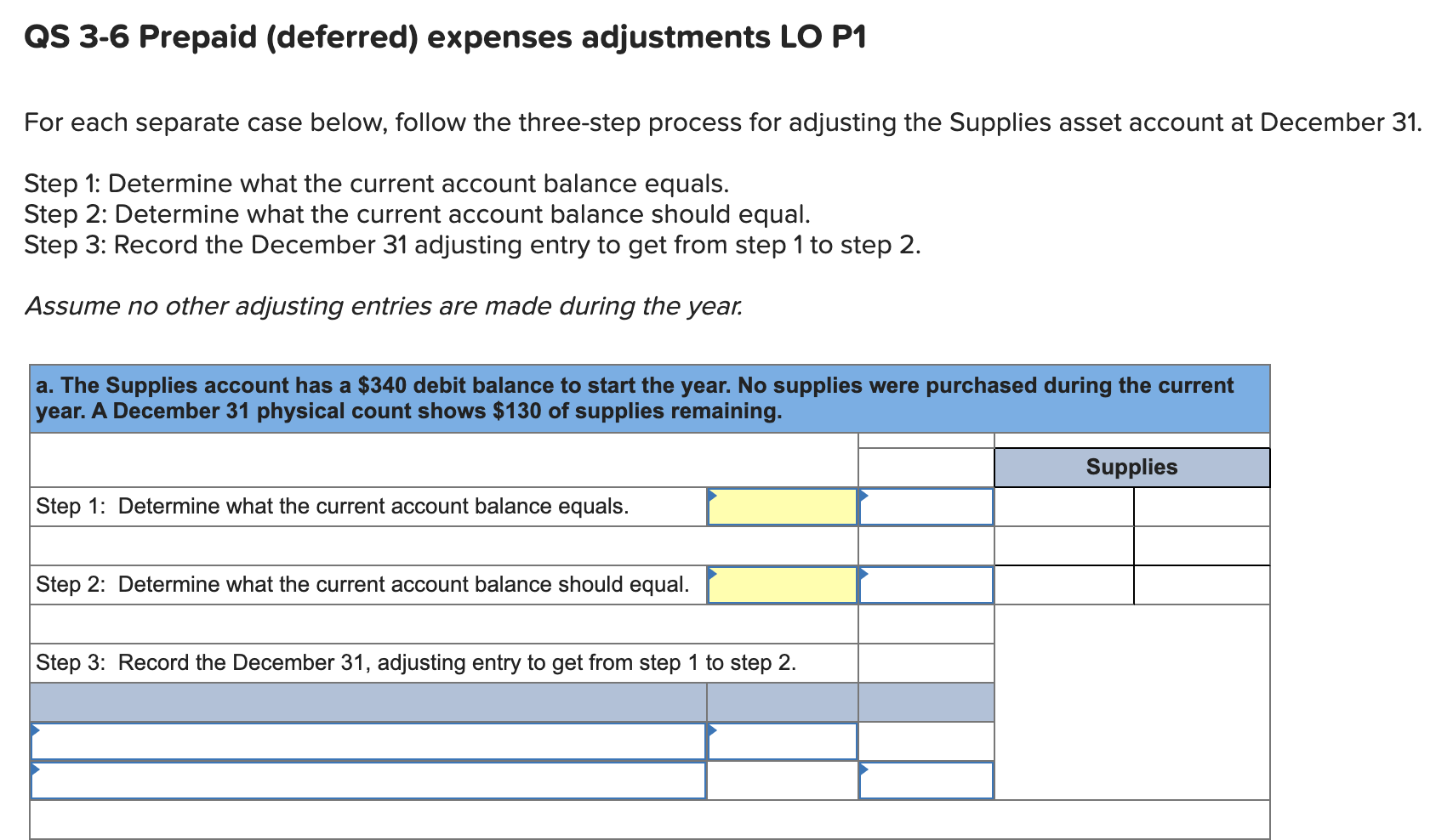

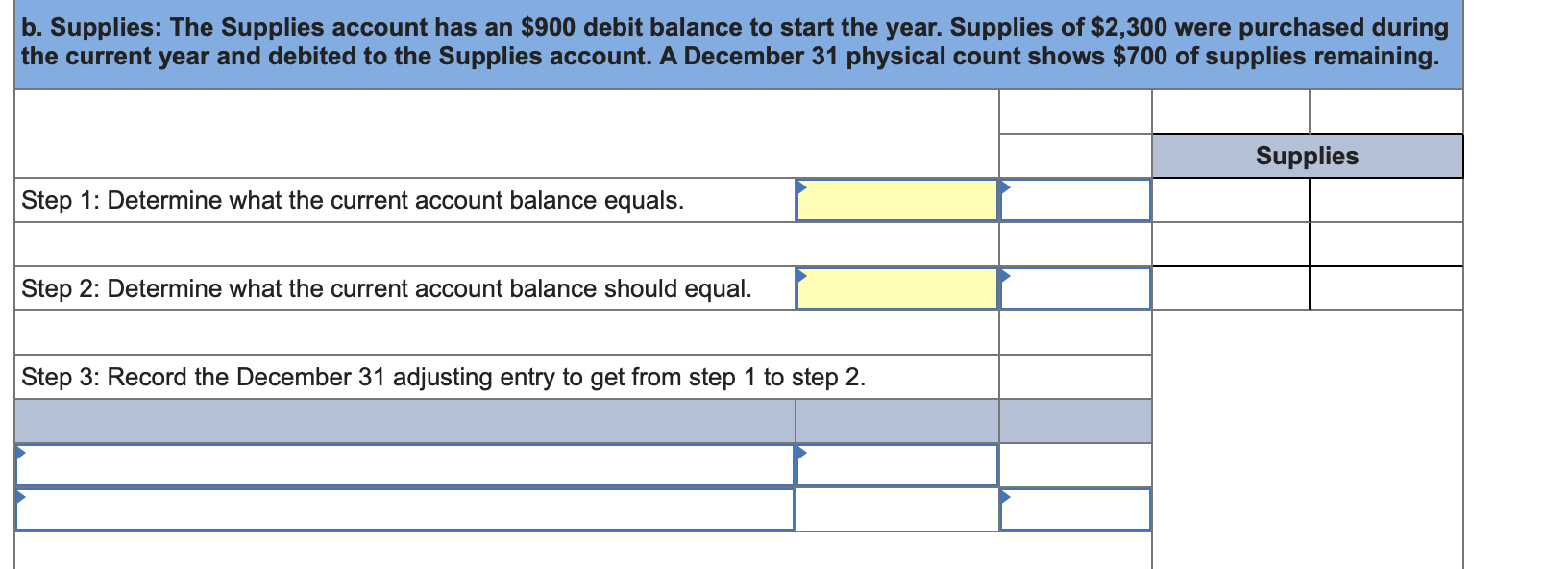

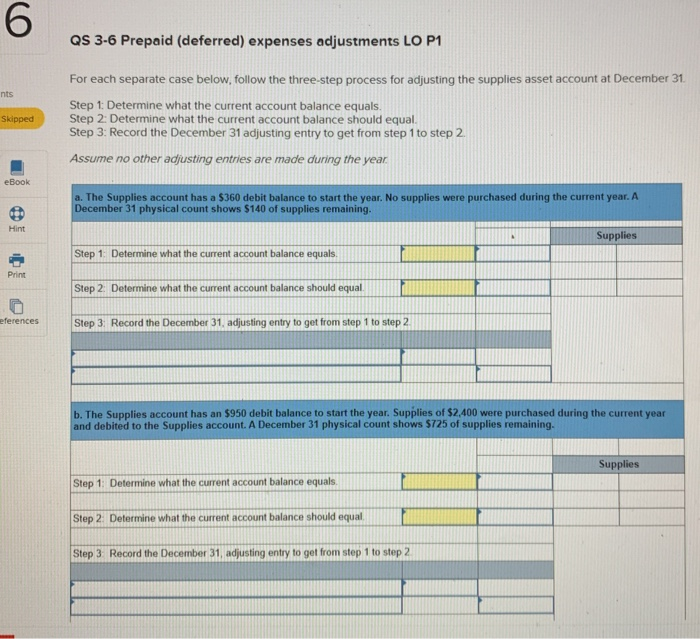

The amount of a prepaid asset to be expensed over its expected life can be expressed: As you use the prepaid item, decrease your prepaid expense account and increase your actual expense account. Adjusting entries for prepaid expenses in accounting are explained, with a focus on office supplies, emphasizing that regardless of the method used, the expired portion is recorded as an expense and the unexpired portion is recorded as an asset.

An expired portion of prepaid expense increases the expense and decreases the asset by making the following adjusting entry at the end of the accounting. Journal entry for prepaid spending. Yay, learn these ways on how to make adjustments for prepaid expense!😇 references:millan, zeus vernon b.

Decrease assets and increase revenues. The prepaid expense is shown on the assets side of the balance sheet under the head “current assets”. The missing entry would reduce a liability through a debit entry and increase revenues through a credit entry.