Ideal Tips About Cash From Operating Activities

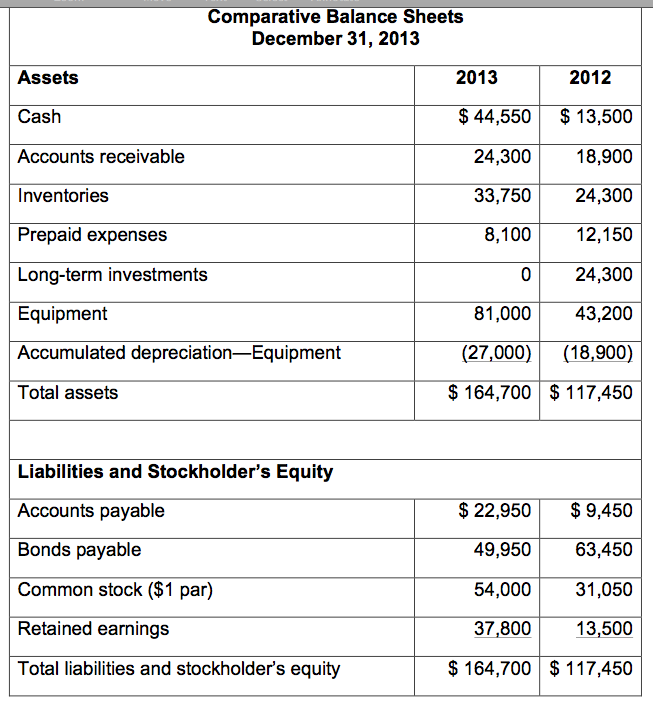

Operating activities operating activities are the transactions that enter into the calculation of net income.

Cash from operating activities. The amount of cash flows arising from operating activities is a key indicator of the extent to which the operations of the entity have generated sufficient cash Q4 net dollar expansion rate was 109%, up from the prior quarter and the highest level in two years. Net cash provided by operating activities was $823 million and free cash flow, defined as net cash flows from operating activities less capital expenditures, was $768 million.

Free cash flow is net cash provided by operating activities less capital expenditures and capitalized software (together, capex). Ebit = earnings before interest and taxes. The cash flow from operating activities is built as follows:

It represents the amount of cash a company spends or earns from carrying out its operating activities over a period. Operating cash flows concentrate on cash inflows and outflows related to a company's main business activities, such as selling and purchasing inventory, providing services, and paying. Net cash provided by operating activities was $543.3mm and net income was $301.6mm in 4q23;

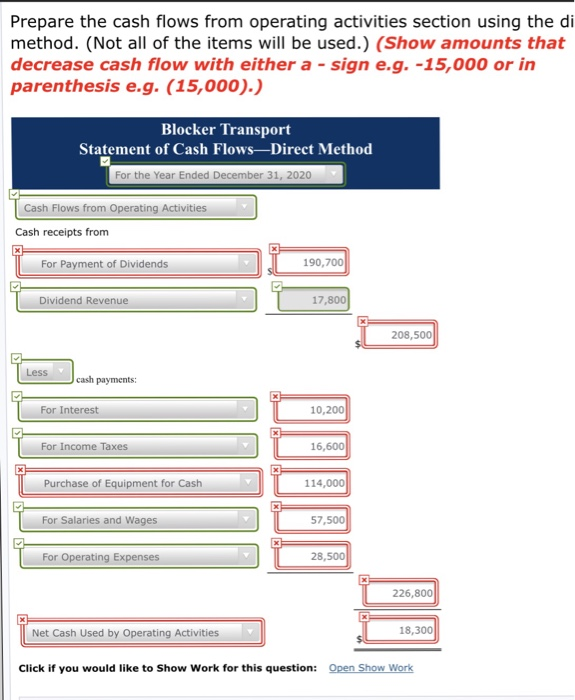

The amount of cash flows from operating activities can be approximately derived with the following formula: Salaries paid out to employees cash paid to vendors and suppliers cash collected from customers interest income and dividends received income tax paid and interest paid Net cash provided by operating activities for the fourth quarter was $79.7 million, a significant improvement from the $25.8 million used in the same period last year.

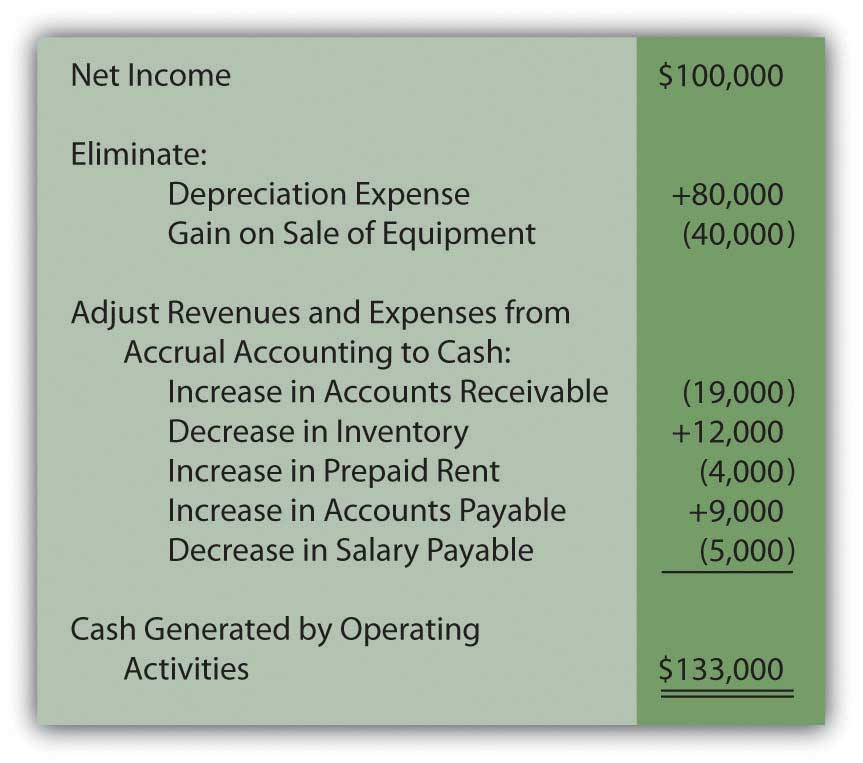

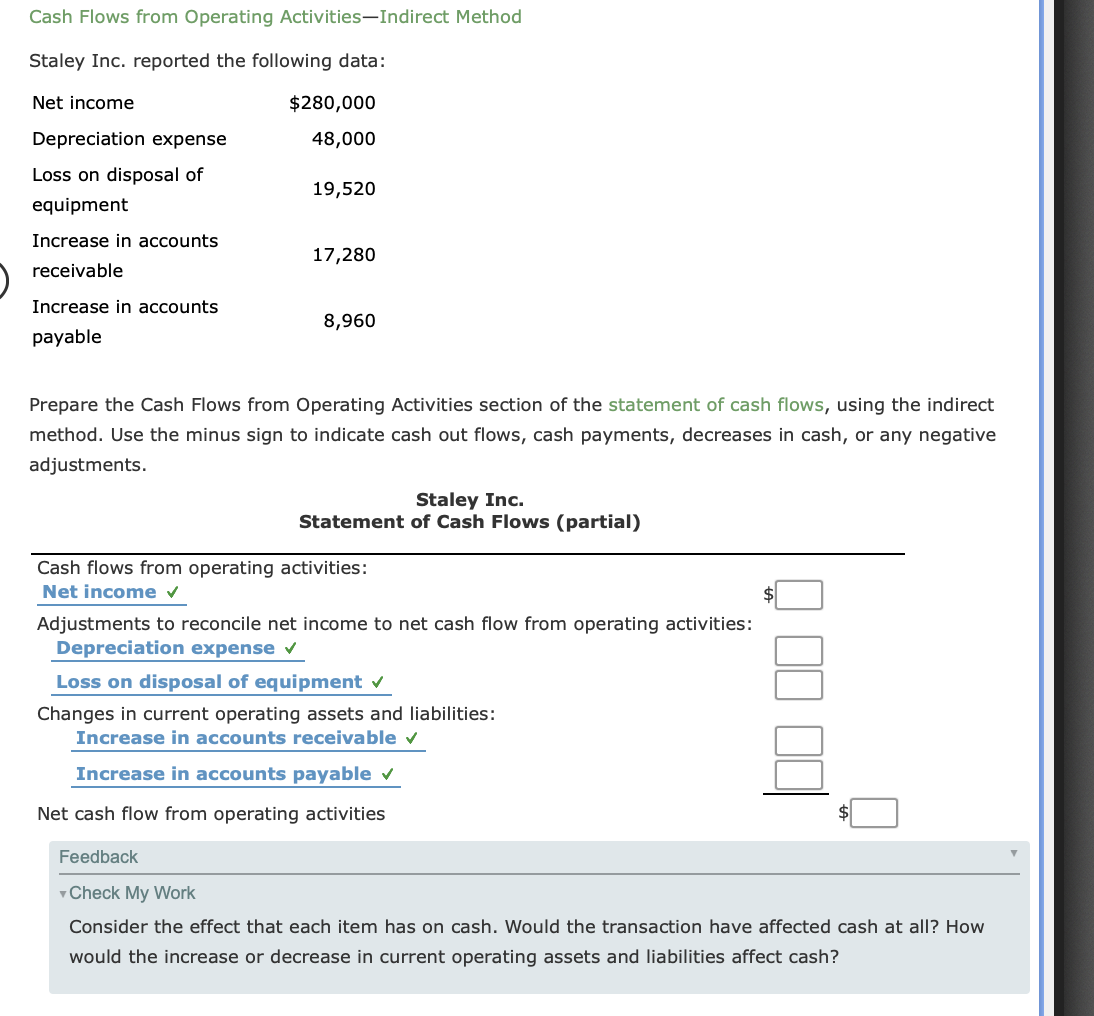

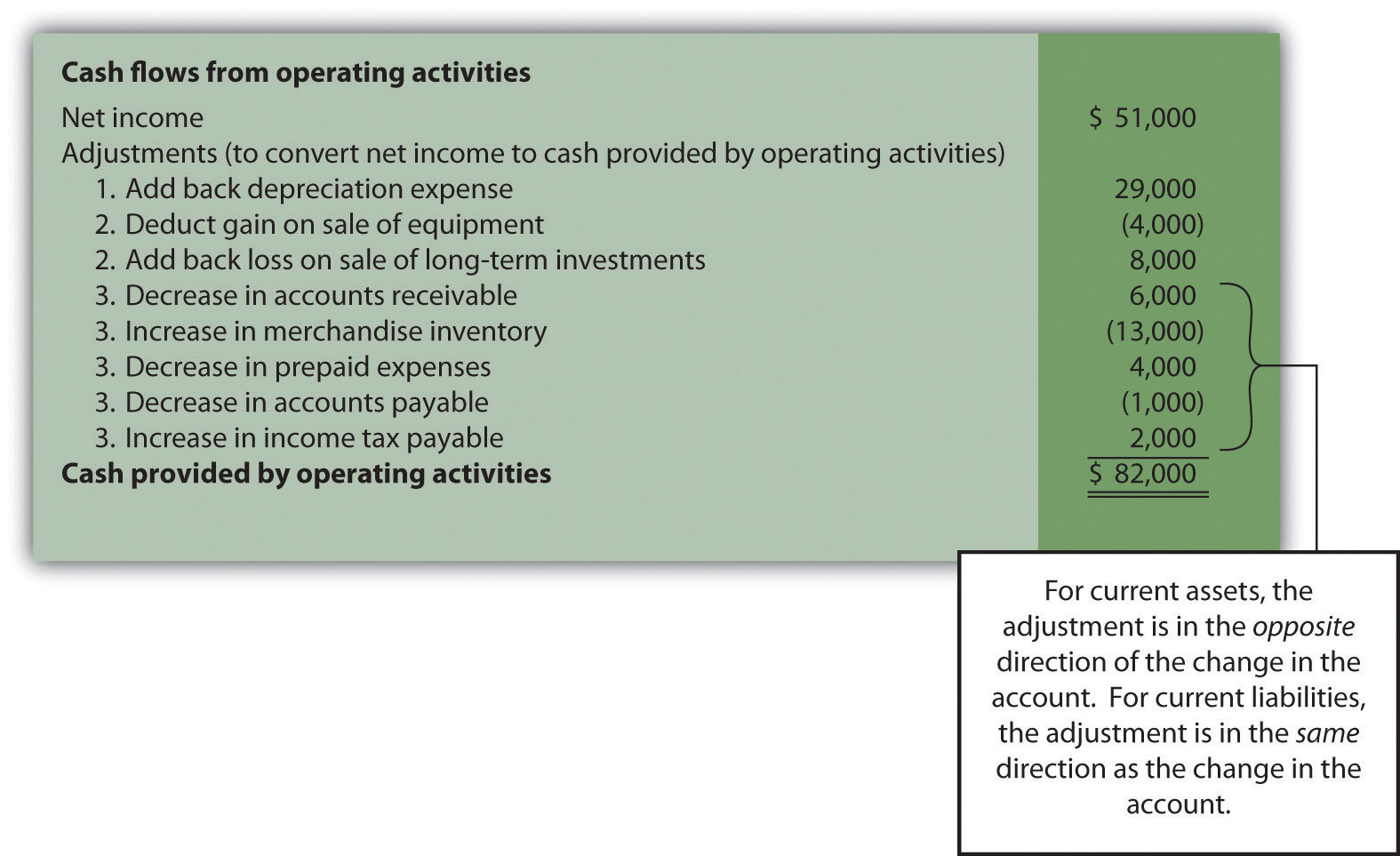

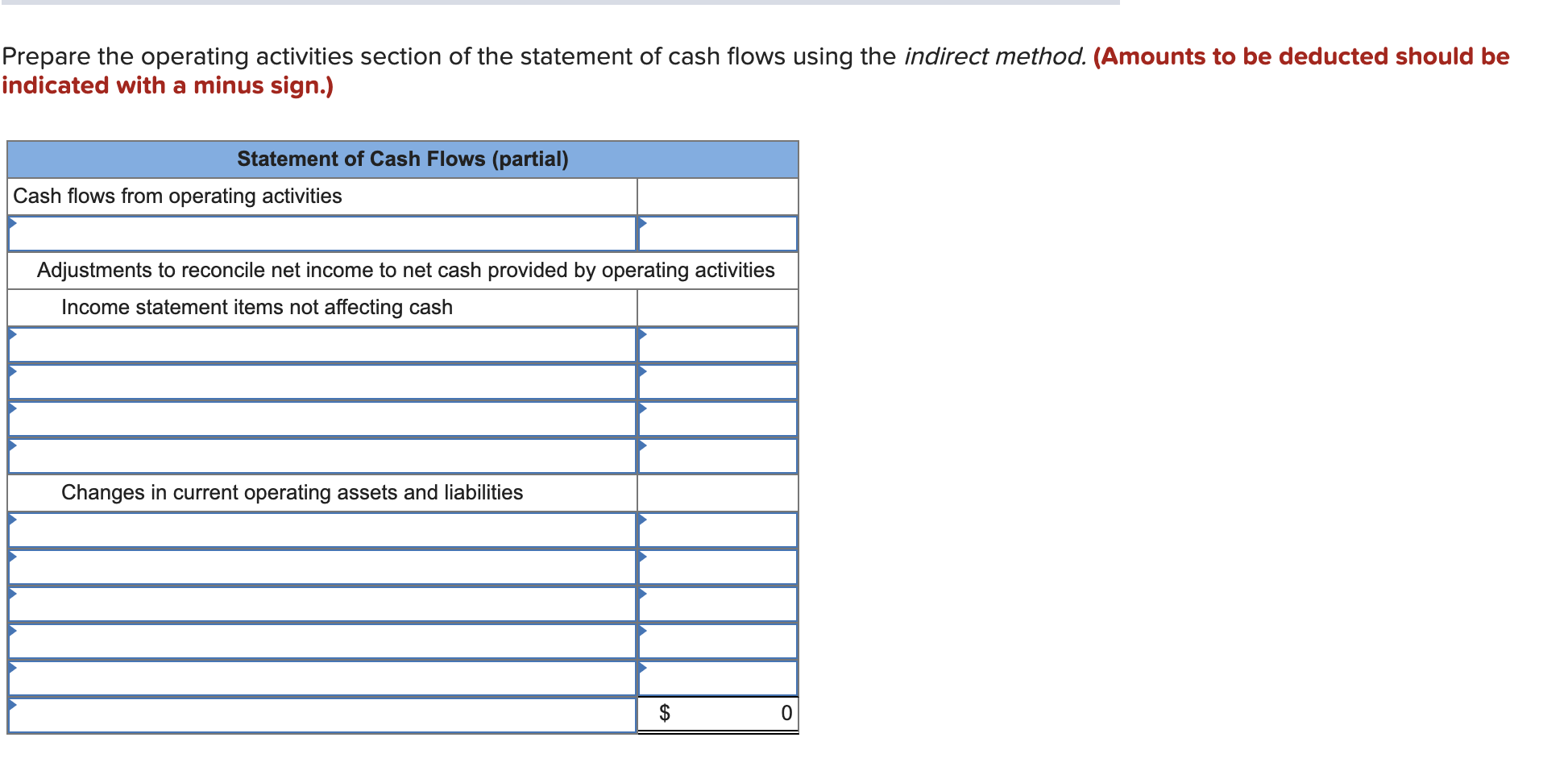

Capital, the interest element may be classified as an operating activity and the capital element is classified as a financing activity. Then, you’ll break down any adjustments you’ve made to reconcile net income to net cash from operating activities. Cash flows from operating activities arise from the activities a business uses to produce net income.

Operating cash flow is cash generated from the normal operating processes of a business. For example, operating cash flows include cash sources from sales and cash used to purchase inventory and to pay for operating expenses such as salaries and utilities. Cash from operating activities usually refers to the first section of the statement of cash flows.

Operating activities include cash received from sales, cash expenses paid for direct costs as well as payment is done for funding working capital. Some of the cash flows arising from operating activities are as follows: Cash receipts from the sale of goods and rendering services.

As such, you can calculate cash flow from operating activities using the following formula: Examples of the direct method of cash flows from operating activities include: Cash receipts from fees, royalties, commissions, and other revenue.

The ocf calculation will always include the following three components: Cash flow from operating activities formula the “cash flow from operations” is the first section of the cash flow statement, with net income from the income statement flowing in as the first. Add back noncash expenses, such as depreciation, amortization, and depletion.

Cash flow from operations typically includes the cash flows associated with sales, purchases, and other expenses. It is added as cash inflow for cfo, whereas it is actually a cash outflow from the company. Ias 7 statement of cash flows requires an entity to present a statement of cash flows as an integral part of its primary financial statements.

:max_bytes(150000):strip_icc()/terms_c_cash-flow-from-operating-activities_FINAL-e4025a9df8de40059fc1b585394c4b8b.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statements_Reviewing_Cash_Flow_From_Operations_Oct_2020-02-c2254626b9bb4e8eacbfaf47e4e83784.jpg)

:max_bytes(150000):strip_icc()/Non-OperatingCashFlow-9853c6dc478048eaaecf48d3f62c7177.jpg)