Breathtaking Info About Bad Debt Expense Statement Of Cash Flows

In this post, we’ll further define bad debt expenses,.

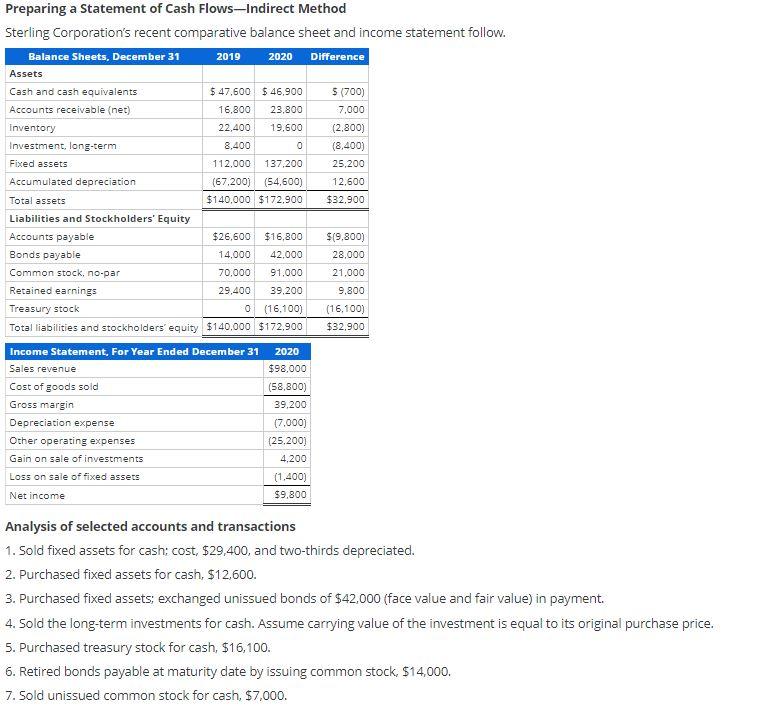

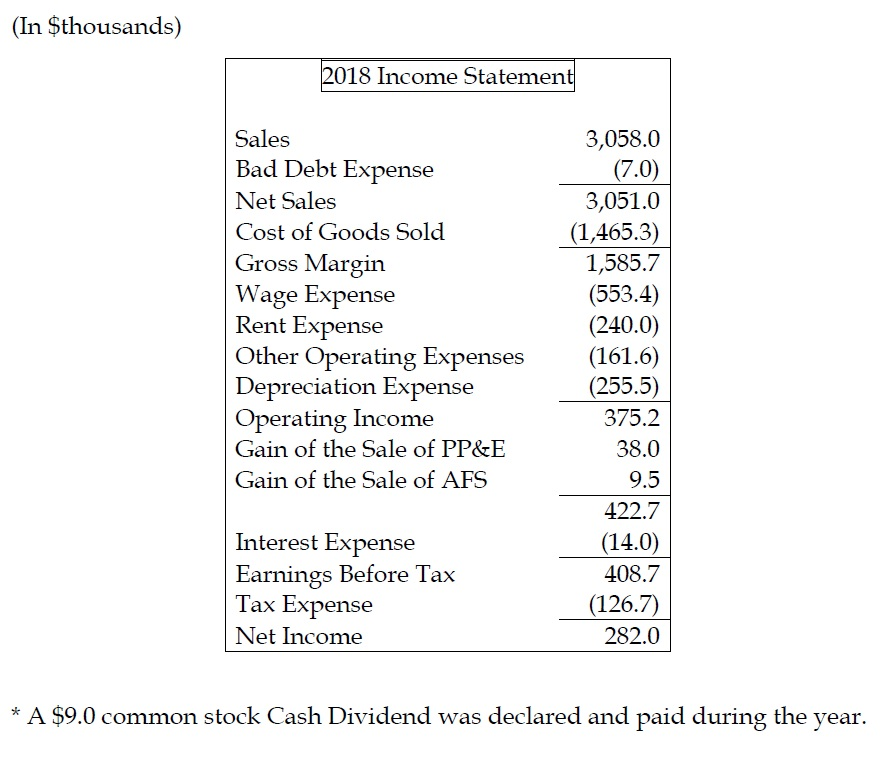

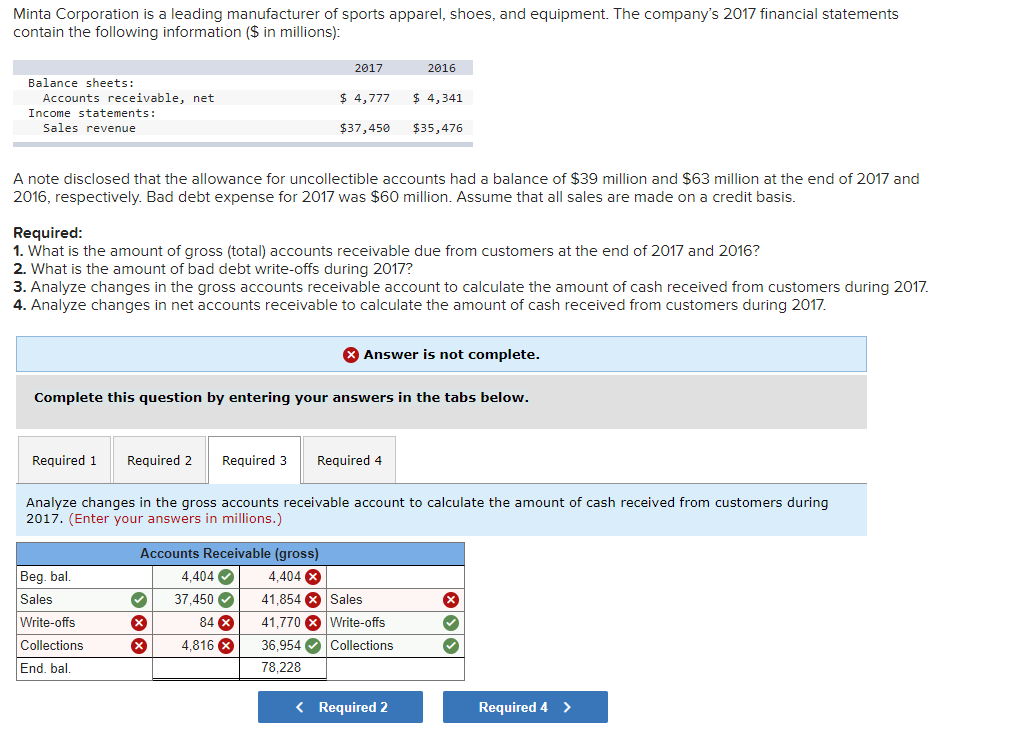

Bad debt expense statement of cash flows. You don't care about accounts receivable, only about money actually received. How bad debt is accounted for depends on whether or not your company uses a bad debt reserve. A cash flow statement tells you how much cash is entering and leaving your business in a given period.

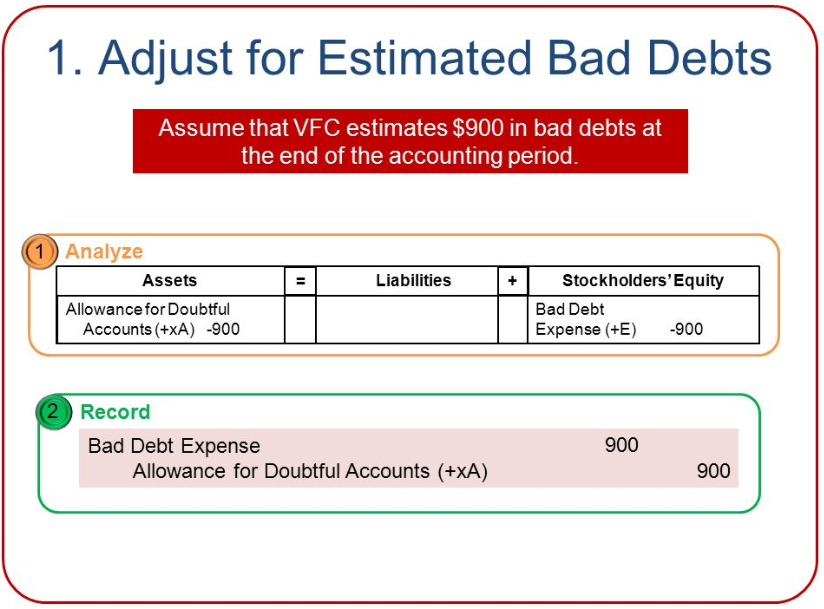

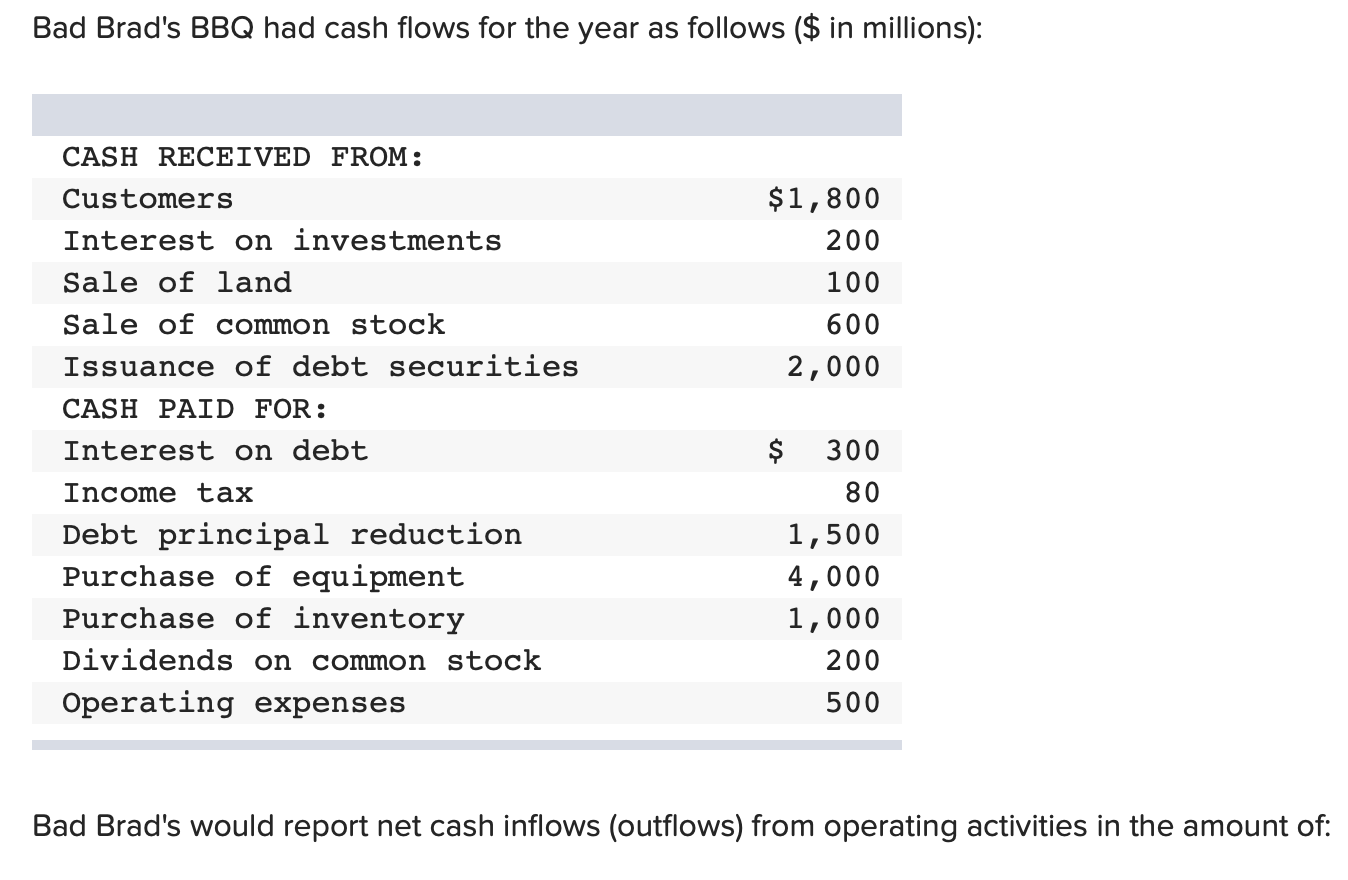

The sharp deterioration took place in the last year after delinquent commercial property debt for the six big banks nearly tripled to $9.3bn. Reporting the bad debts provision as a noncash expense and adding it back to net income to derive cash flows from operations under the indirect method is illustrated in the first. Bad debts are thus included as an expense in the income statement but not included as a line item in the cash flow statement (direct method).

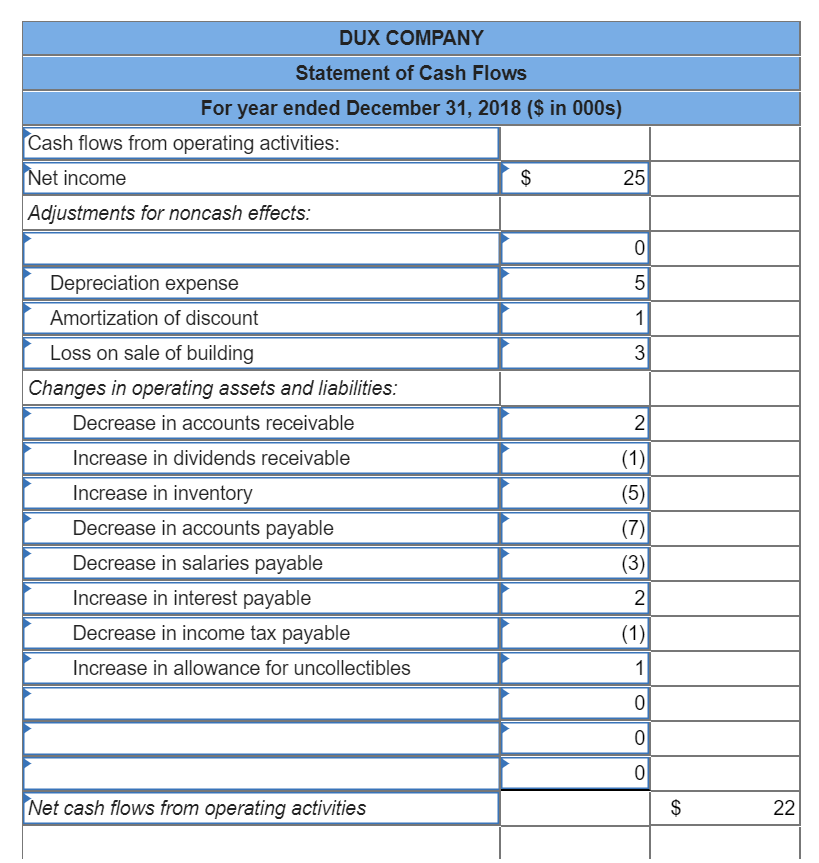

For example, cash flow statements can reveal what phase a business is in: The three net cash amounts from the operating, investing, and financing activities are combined into the amount often described as net increase (or decrease) in cash during. What is the statement of cash flows?

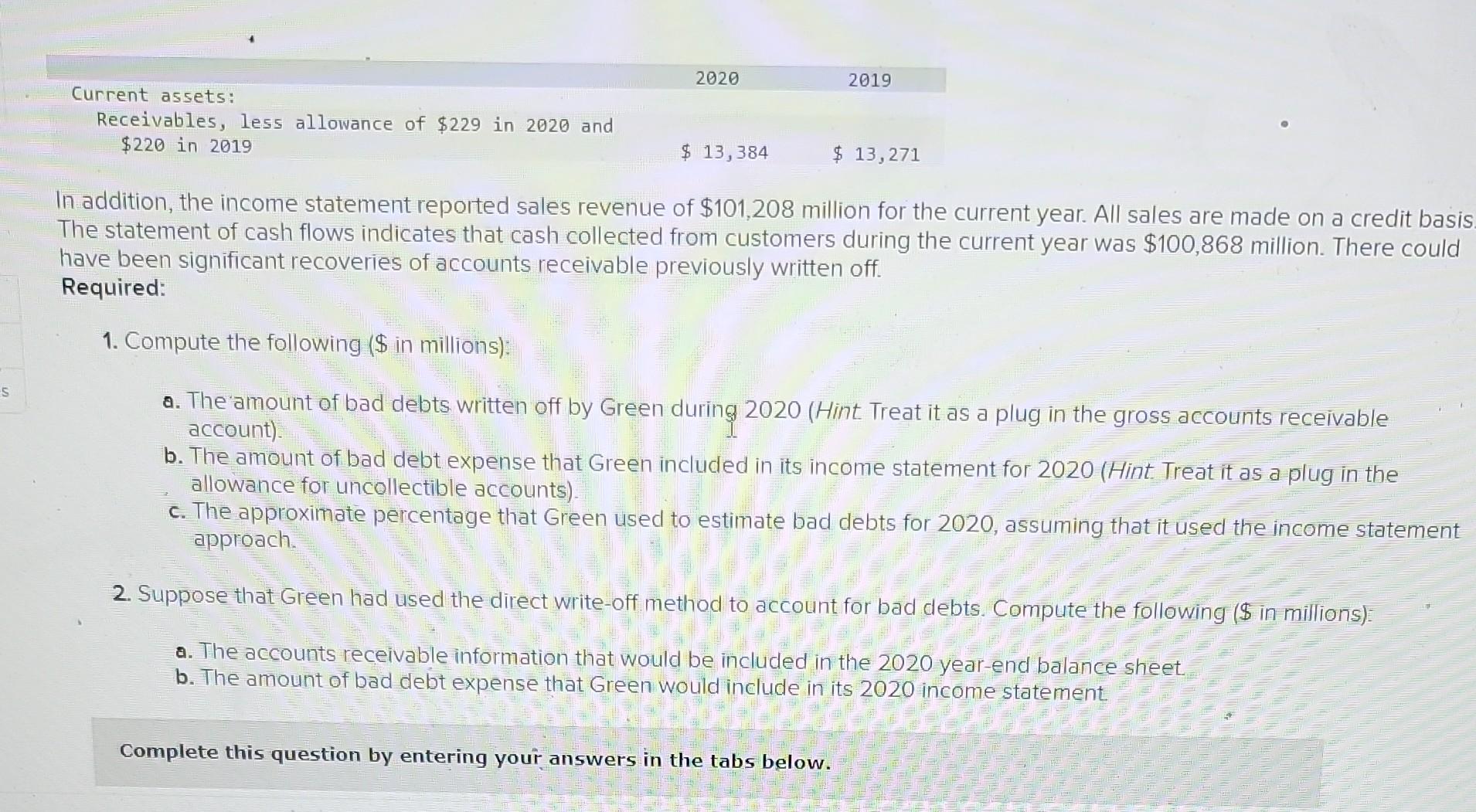

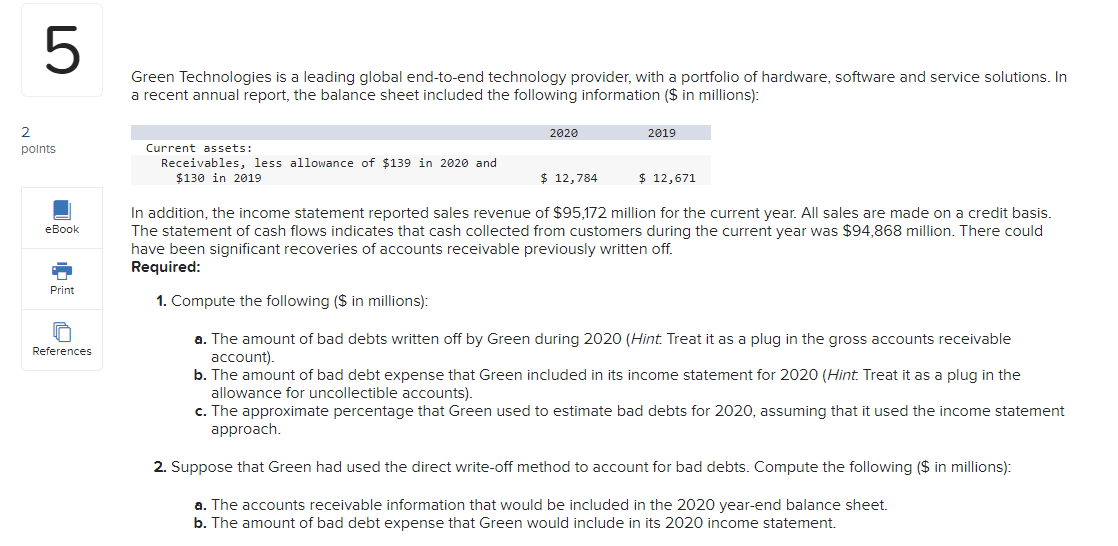

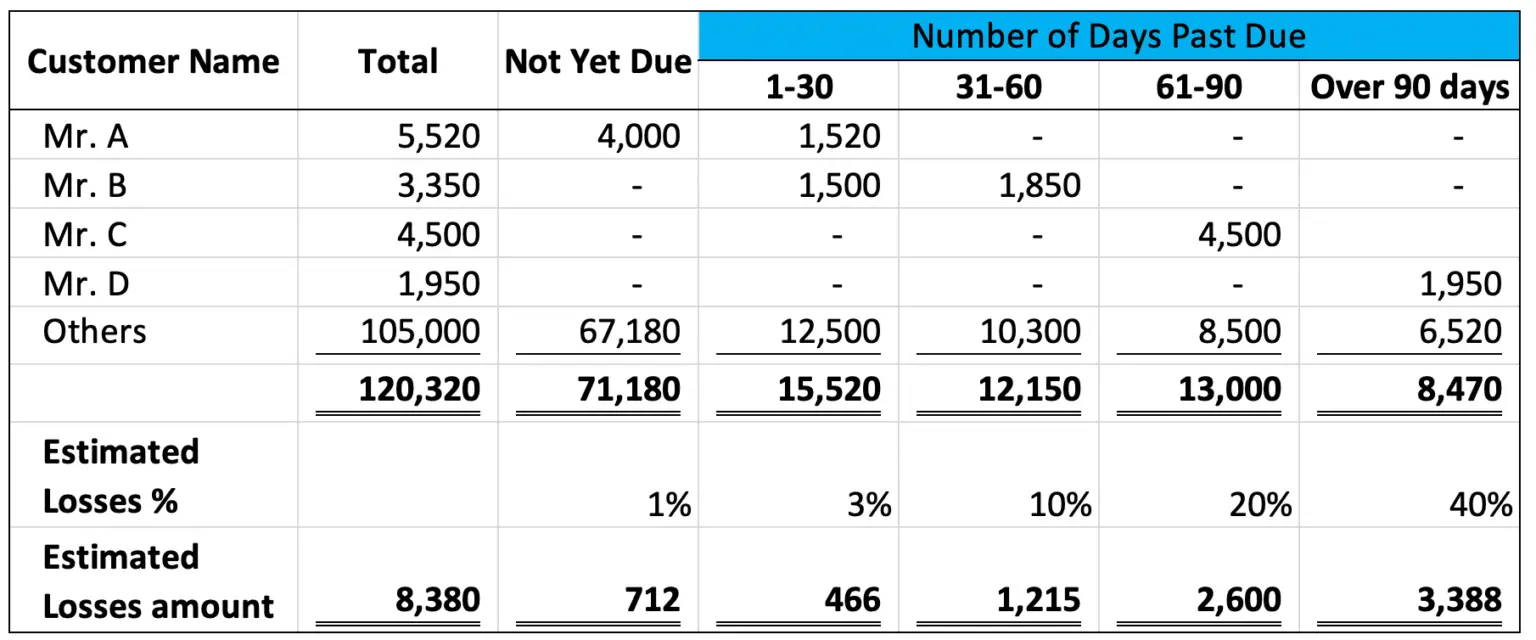

Removal of expenses to be classified. For example, if in 2021 i had receivables of £500,000 with bad debts of £10,000 and allowance for receivables of £50,000, then we are left with an end balance. What is a bad debt expense?

The statement of cash flows (also referred to as the cash flow statement) is one of the three key financial statements. A bad debt expense is a financial transaction that you record in your books to account for any bad debts your business has given up on. The bad debt provision isn't an issue with the direct method.

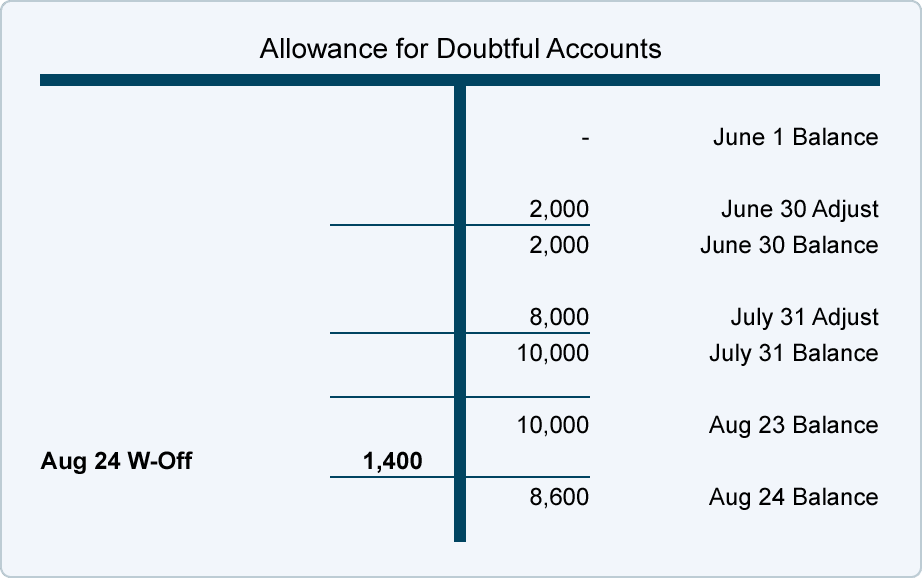

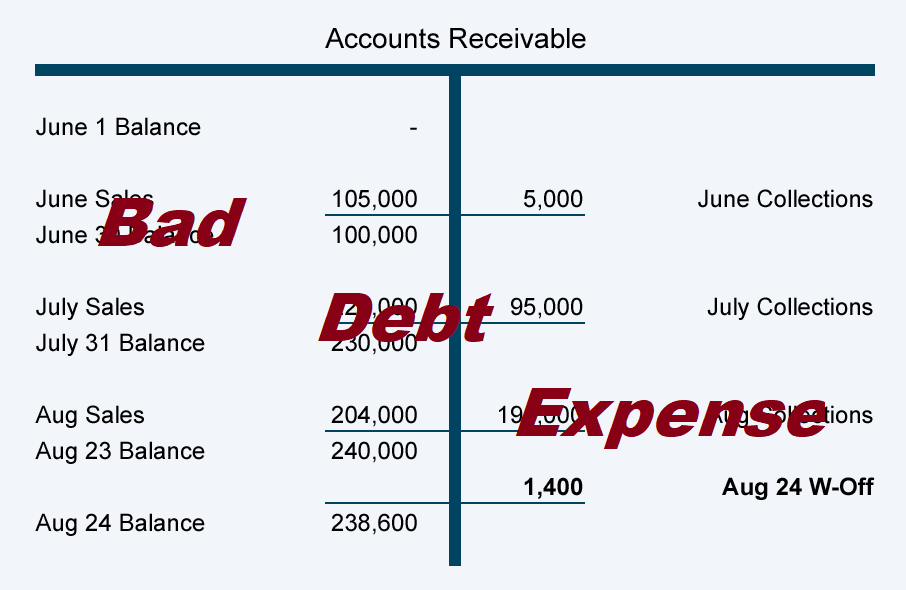

The operating section of your cash flow statement records adjustments for bad debt. Bad debt expenses are outstanding accounts that, after some time going unpaid, are deemed uncollectible. Along with balance sheets and income statements, it’s one.

If provision for doubtful debts is the name of the account used for recording the current period's expense associated with the losses from normal credit sales, it will appear as an. It should be noted that bad debts. Examples of financing cash flows include the cash received from new borrowings or the cash repayment of debt as well as the cash flows with shareholders in the form of cash.

Determine net cash flows from operating activities using the indirect method, operating net cash. Implicitly, the bad debts provision is viewed as a revenue deduction like sales discounts, returns, and allowances, rather than as a noncash expense; Depreciation, amortization, impairment losses, bad debts written off, etc).

The statement of cash flows is prepared by following these steps: Misclassifying the three categories of cash flows.

![[Solved] Dell Technologies is a leading global end](https://media.cheggcdn.com/media/05d/05d7101a-11d3-4fd2-90df-170dfac44a29/phpsypMGR)

![[Solved] Green Technologies is a leading global endtoend](https://media.cheggcdn.com/study/919/919d7852-14cd-45cb-aac4-e3fca10b9a27/image)