Ideal Info About Accounting Principles Of Fiduciary Funds

Principles, modern applications, and illustrations describes in detail the difference between income and principal, defines terminating income.

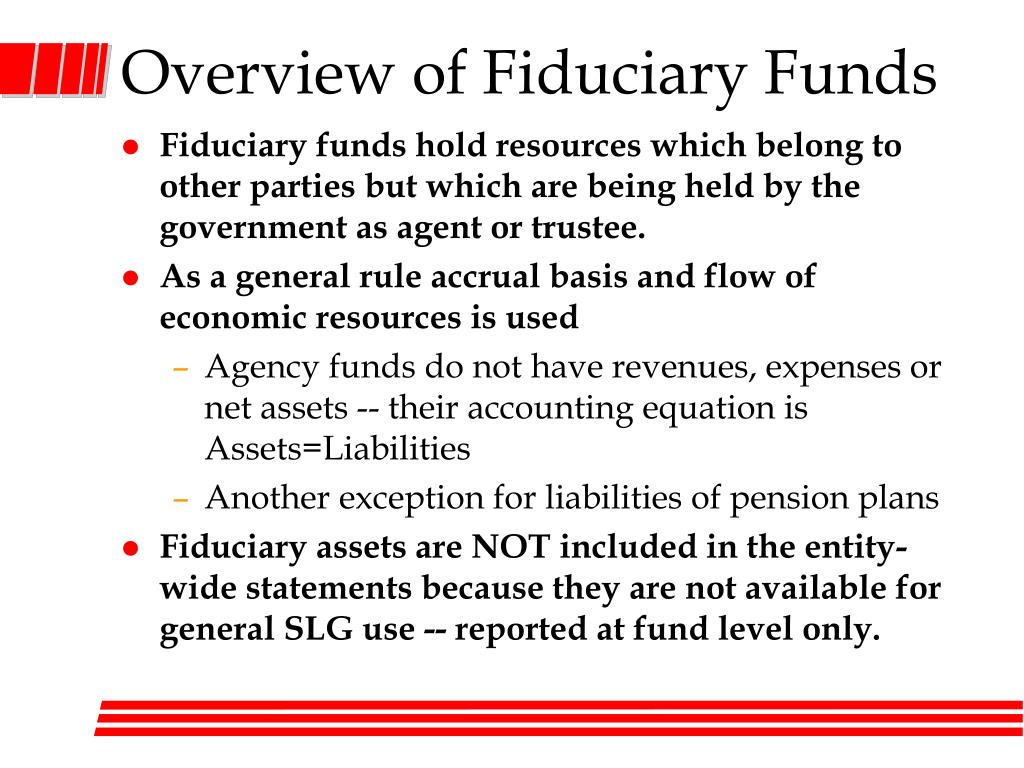

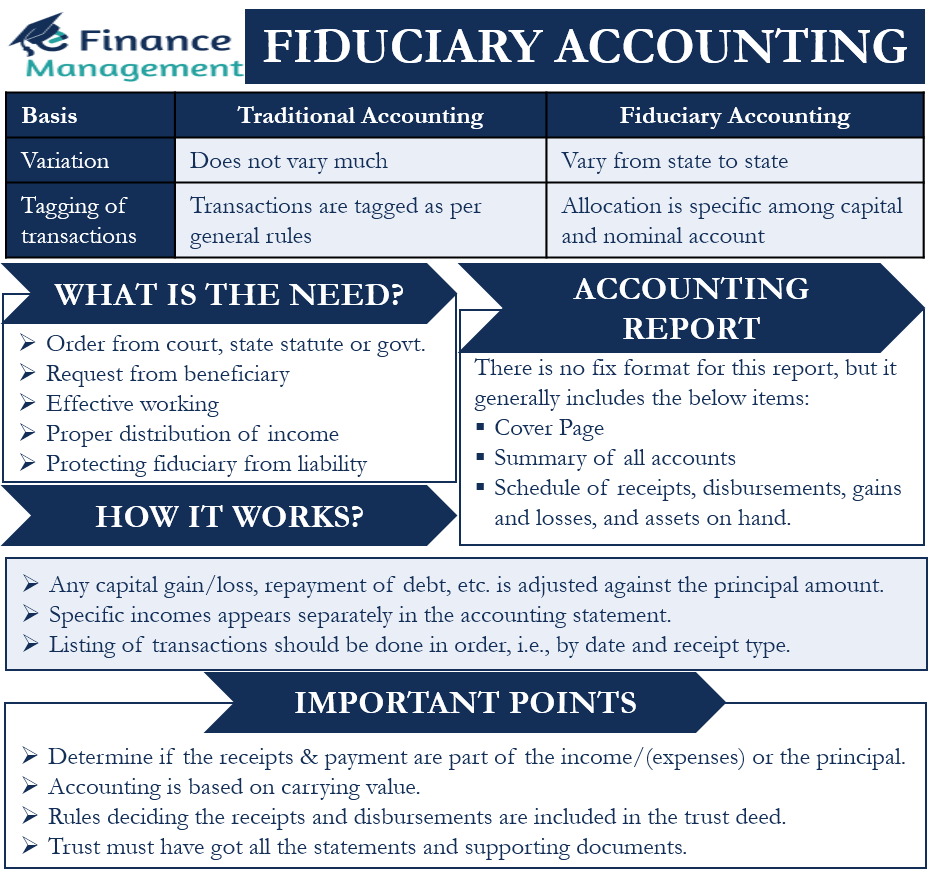

Accounting principles of fiduciary funds. Fiduciary (or trust) accounting and understanding the fiduciary duty are included in the practice guide to help cpas provide better fiduciary accounting. Fiduciary accounting is a specialized area of accounting that deals with the management and reporting of funds and assets held in trust by a fiduciary. The most commonly used definition of fiduciary accounting is provided by the.

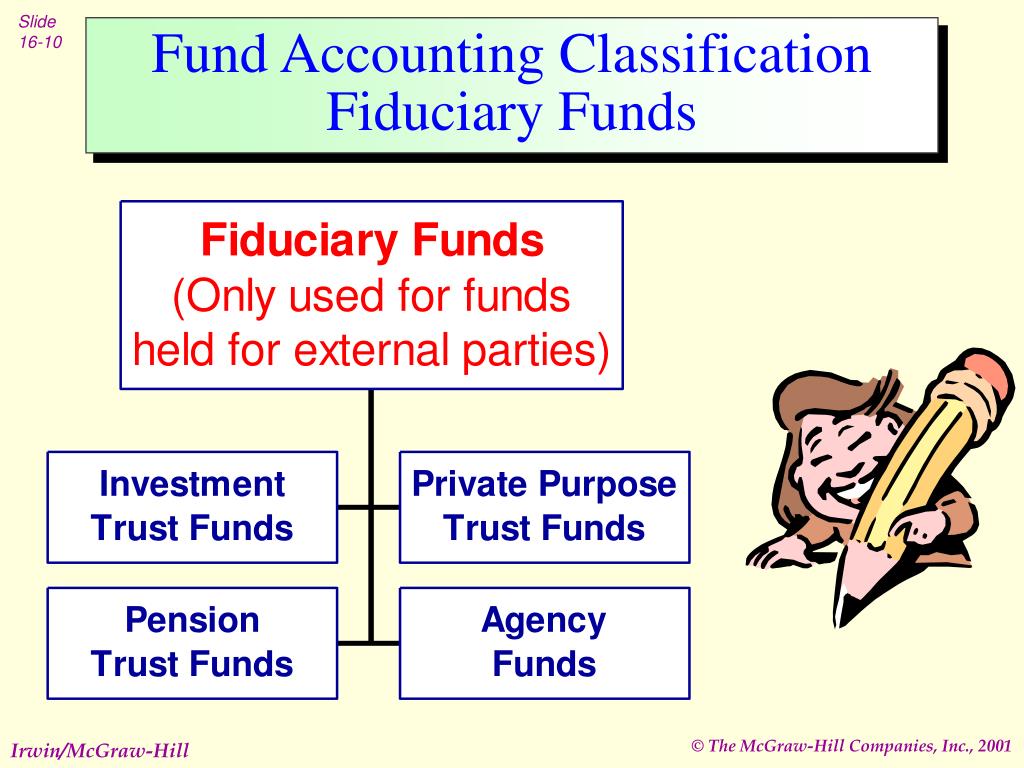

This statement defines fiduciary activity1 and provides accounting and reporting guidance for fiduciary. The funds are reported under gasbs 34 only in fiduciary fund financial statements. The criteria for identifying fiduciary activities primarily focuses on ( a) whether a government controls the assets of the fiduciary activity and ( b) on the beneficiaries.

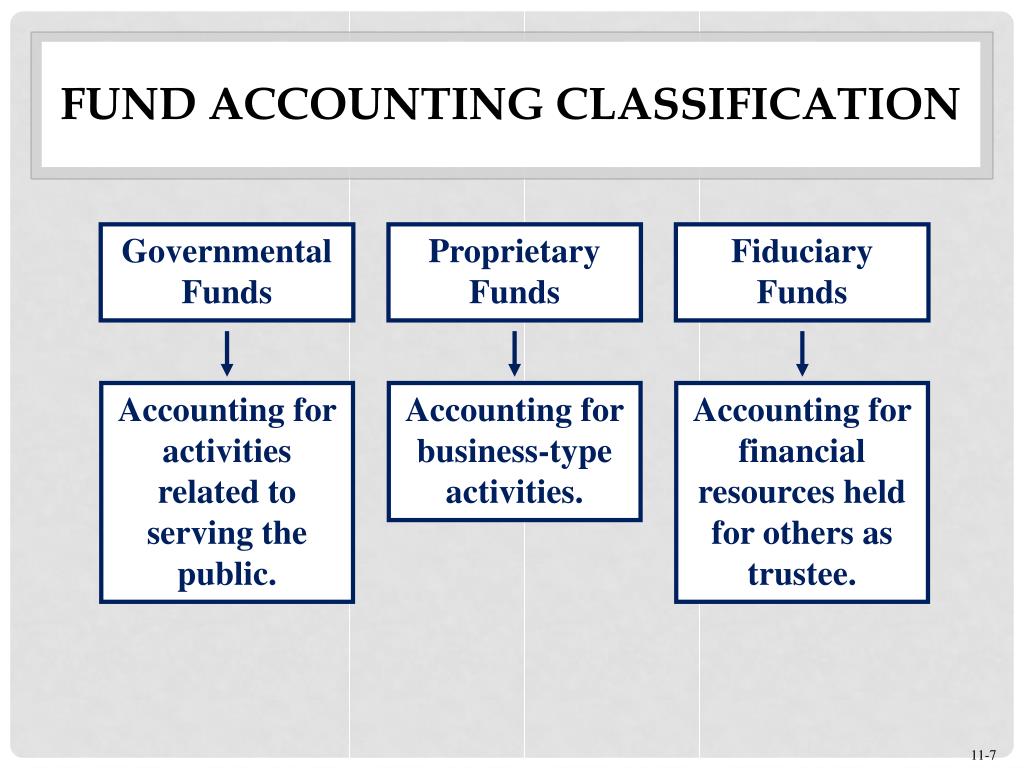

These funds are a part of the governmental accounting process performed by entities. Fiduciary funds are used to account for assets held in trust by the government for the benefit of individuals or other entities. Most states have adopted a form of one of the three uniform principal and income acts.

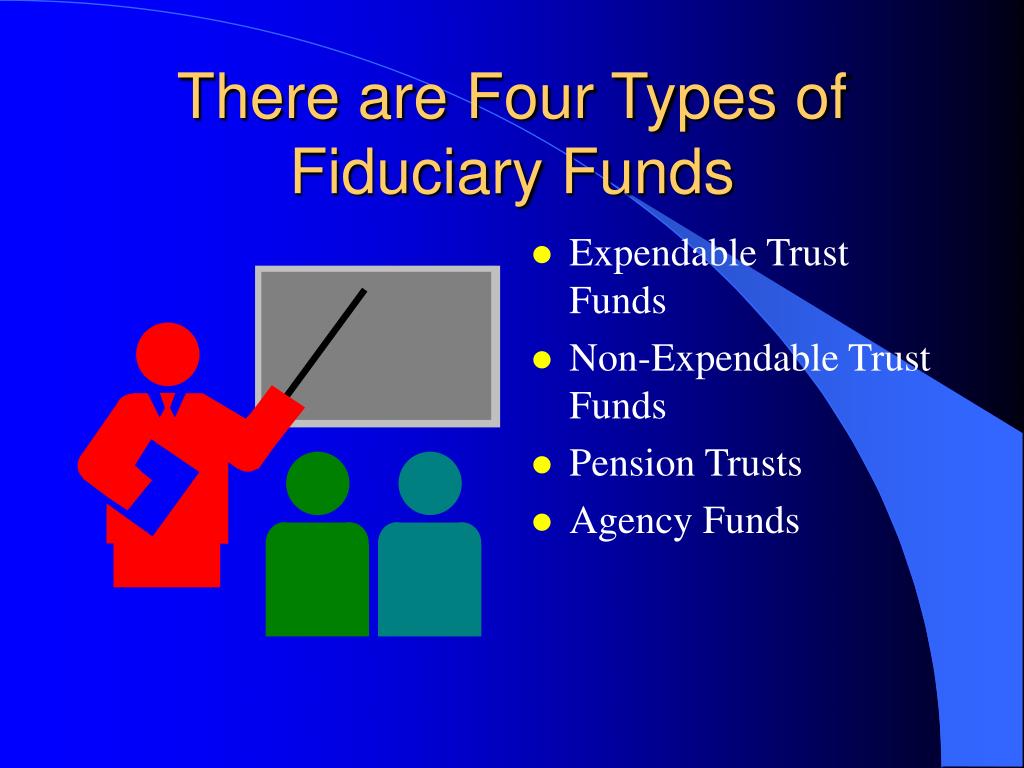

Nc adopted the ‘97 version. The goal of fiduciary accounting is to ensure maximum clarity, full disclosure and complete description of all events in standards that are. There are four main types of fiduciary funds that are accounted for.

Thereof for the fiscal year then ended in accordance with accounting principles generally accepted in the united states of america. Pension (and other employee benefit) trust funds, investment trust funds, private purpose trust funds, and. Pension (and other employee benefit) trust funds are used to accumulate resources to fund pension and.

A fiduciary fund is used in governmental accounting to report on assets held in trust for others. There are four classifications of fiduciary funds: If there is any capital gain, we add it to the.

Gasb 84 defines four generic types of fiduciary funds: What is a fiduciary fund? Accounting for fiduciary activities october 24, 2006 introduction 1.

It shows preliminary and final. 5 (“upia”) fiduciary accounting rules vary from state to state. We did not audit the financial statements of.

The funds are reported under gasbs 34 only in fiduciary fund financial statements. The term fiduciary accounting has different meanings depending on the context in which it is used.

The types of fiduciary funds are mentioned below: