Favorite Info About Balance Cash Flow

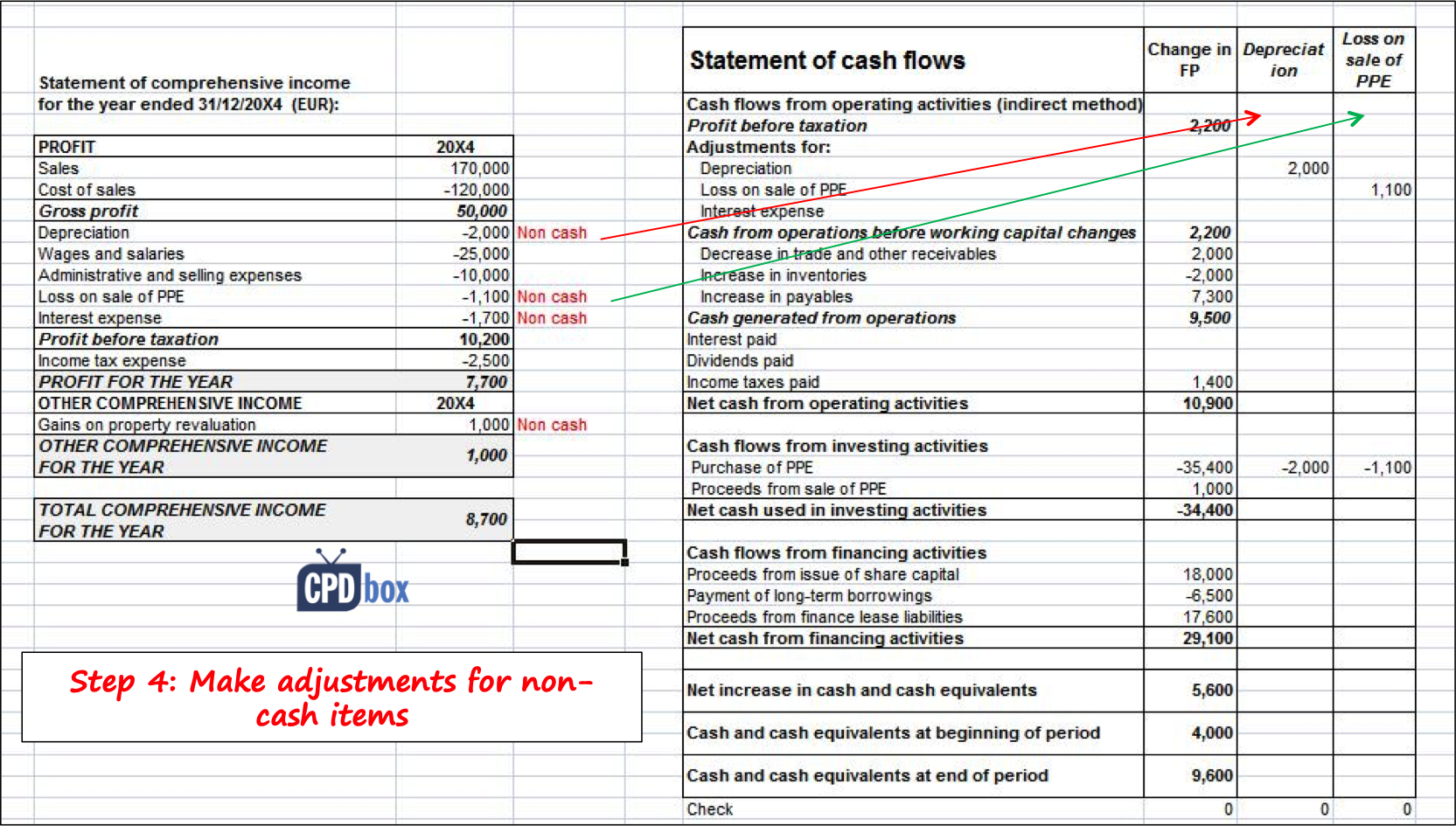

In describe the income statement, statement of owner’s equity, balance sheet, and statement of cash flows, and how they interrelate, we discussed the function of and.

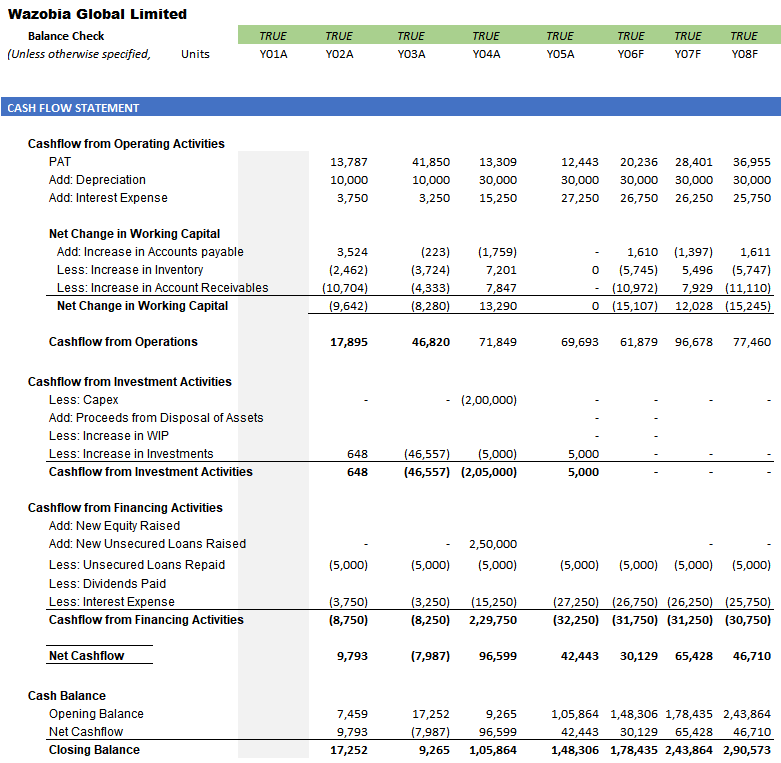

Balance cash flow. Trump cash stockpile at risk. A cash flow statement is one of the quarterly financial reports publicly traded companies are required to disclose to the u.s. (1) the income statement, (2) the balance sheet, and (3) the cash flow statement.

What are the three financial statements? Assuming the statement was prepared correctly, the sum should equal the ending cash balance on the balance sheet. The three financial statements are:

In the full statement, we can see that clear lake has net. What is a balance sheet? The cash flow statement.

Ias 7 statement of cash flows in april 2001 the international accounting standards board adopted ias 7 cash flow statements, which had originally been issued by the. To better determine your cash situation, you must prepare a statement of cash flows, one of the key financial statements required for a. However, with the sharp increase in free cash flow generation, cash & equivalents on the balance.

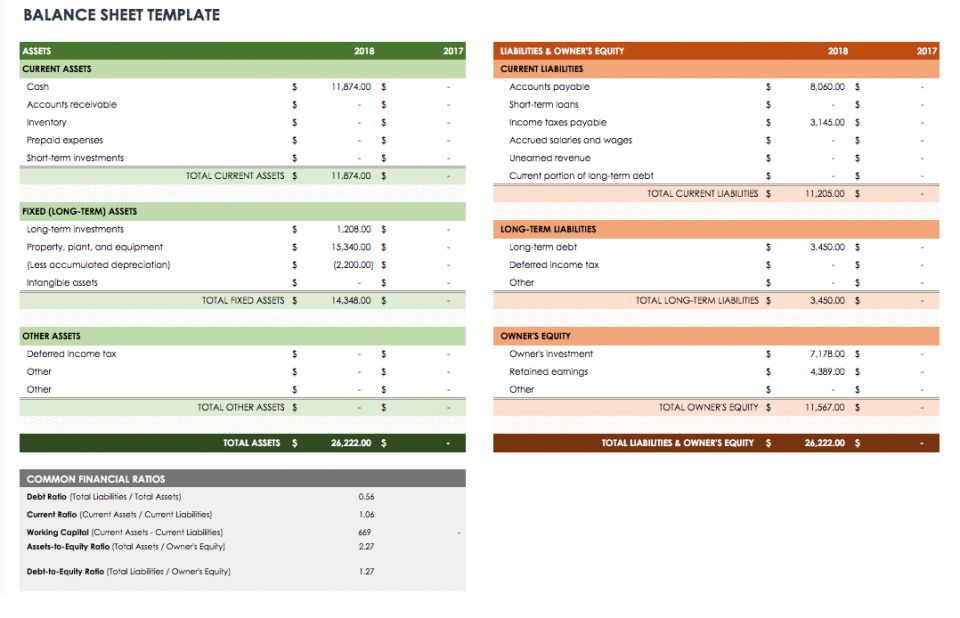

Cash flow statement: A balance sheet gives companies a snapshot of what they own and what they owe, represented by assets, liabilities, and shareholder’s. Striking a balance between cash flow and growth involves using surplus cash strategically to invest in expansion while maintaining financial stability.

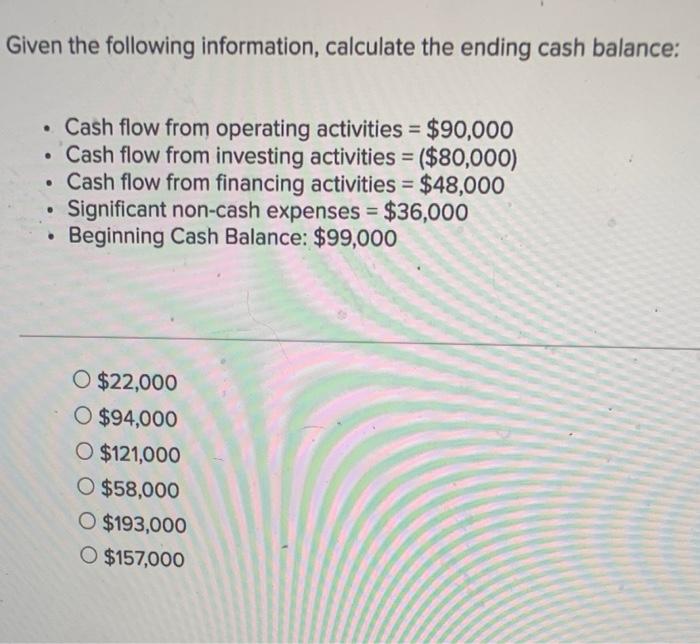

The beginning cash balance is presented from the prior year balance sheet. Total net cash flow added to the beginning cash balance equals the ending cash balance. These three statements are informative tools that traders can use to analyze.

That’s down slightly from the £5.9bn reported at the end of 2022. The income statement, balance sheet, and statement of cash flows are required financial statements. The balance sheet and cash flow statement are two of the three financial statements that companies issue to report their financial performance.

If your net cash flow number is positive, your business is cash flow positive, and accumulating cash in. The financial statements are used by investors, market analysts, and creditors to evaluate a company's financial health and earnings potential.