Sensational Tips About Balance Sheet Non Current Liabilities

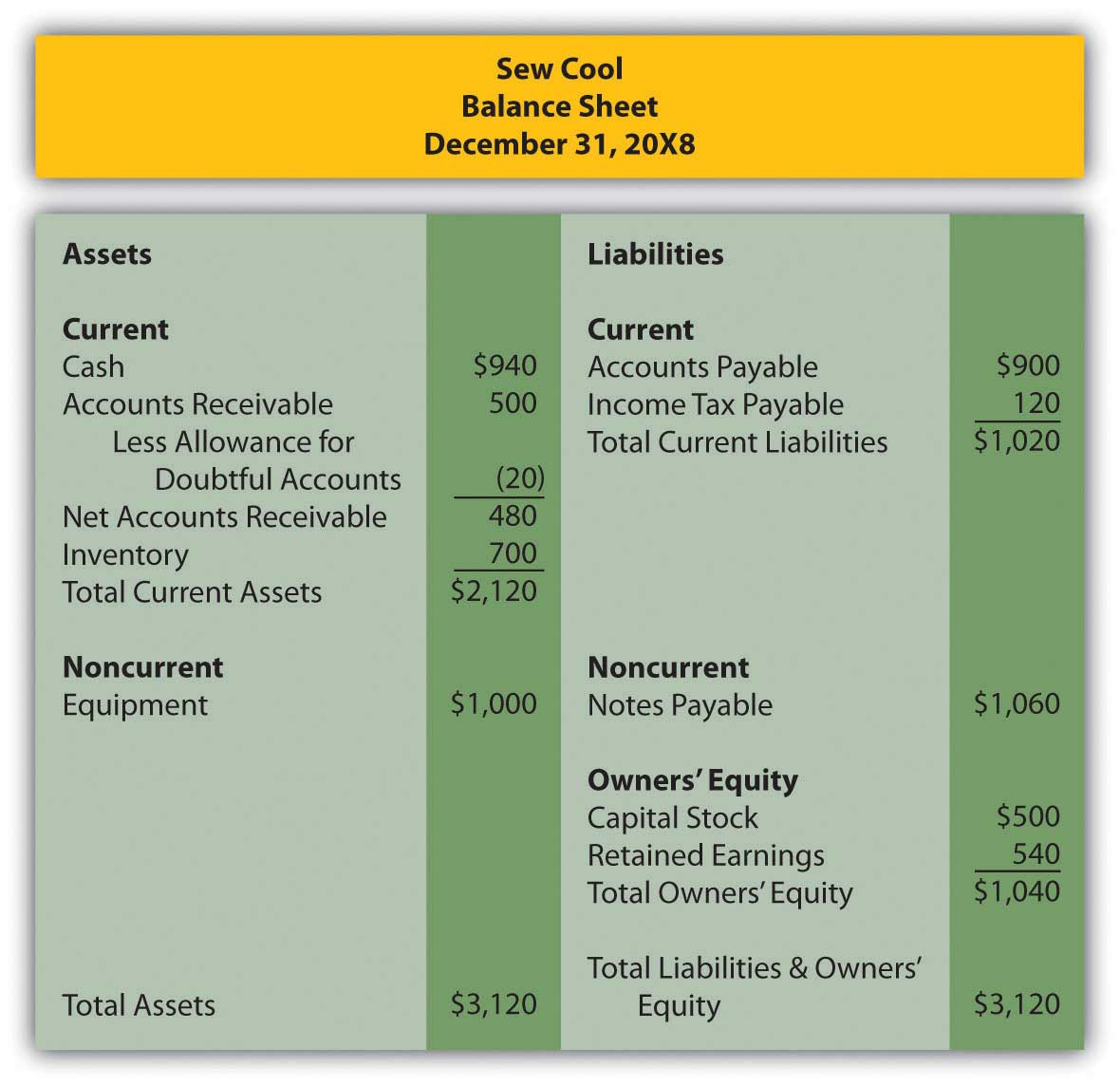

Current liabilities — coming due within one year (e.g.

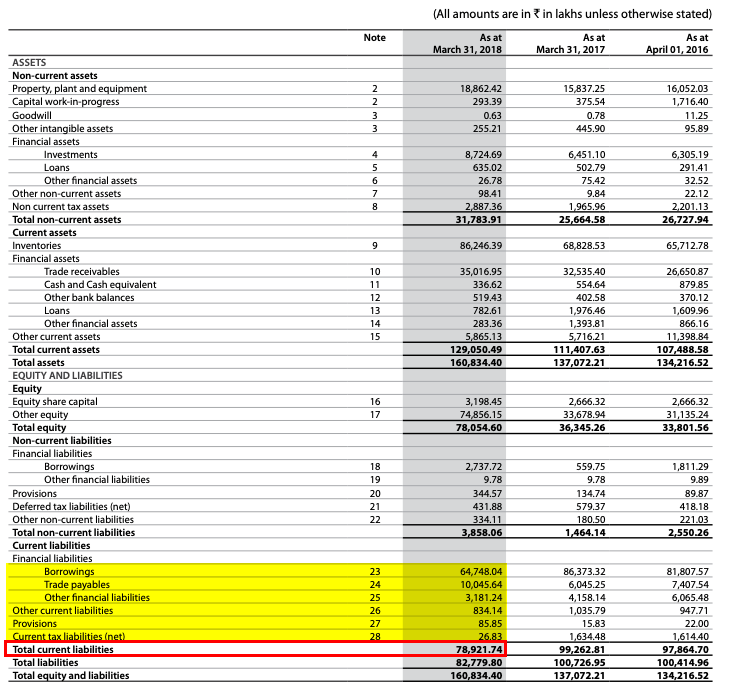

Balance sheet non current liabilities. The liability is due for settlement within twelve months after the reporting period; Current liabilities are owed within a year and might include: Content verified by subject matter experts explore our app and discover over 50 million learning materials for free.

Current liabilities are a company's debts or obligations that are due within one year, appearing on the company's balance sheet and include short term debt, accounts payable , accrued liabilities. This deferral can arise from timing differences between tax accrual and payment, or differences in net income calculation methods for financial and tax purposes. These are also known as long term liabilities.

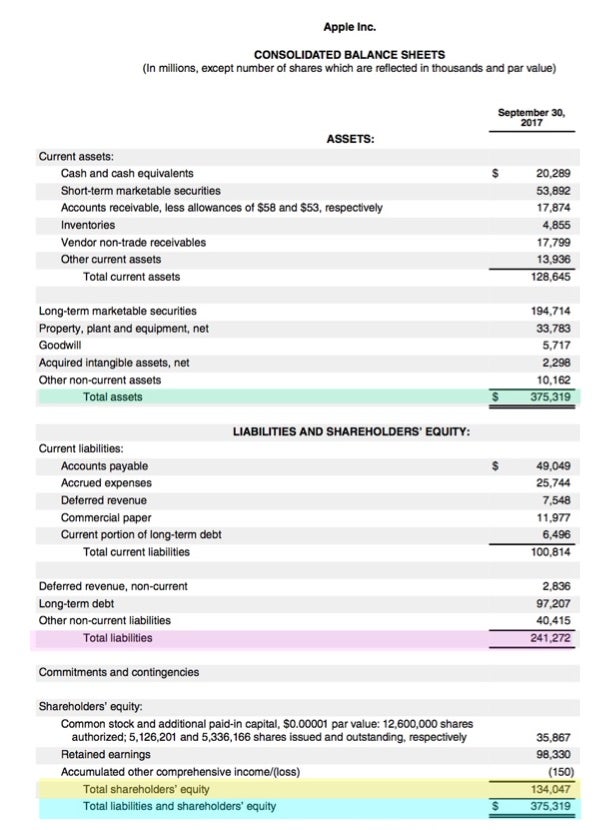

What is the relationship between assets, liabilities, and shareholder's equity? Liabilities are presented as line items, subtotaled, and totaled on the balance sheet. For instance, when a company earns income for the year and records the tax.

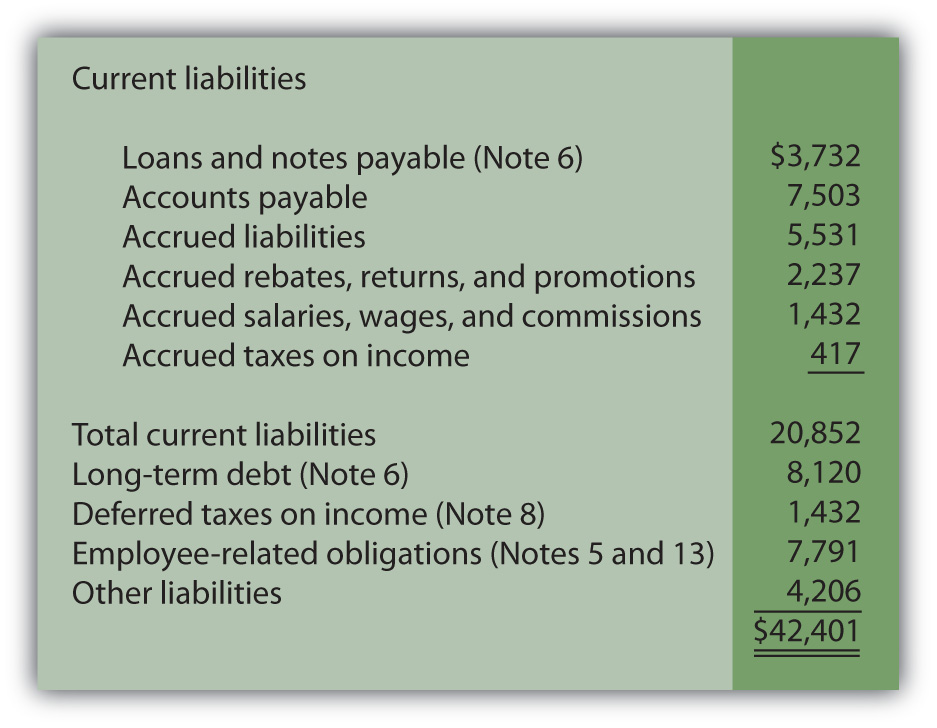

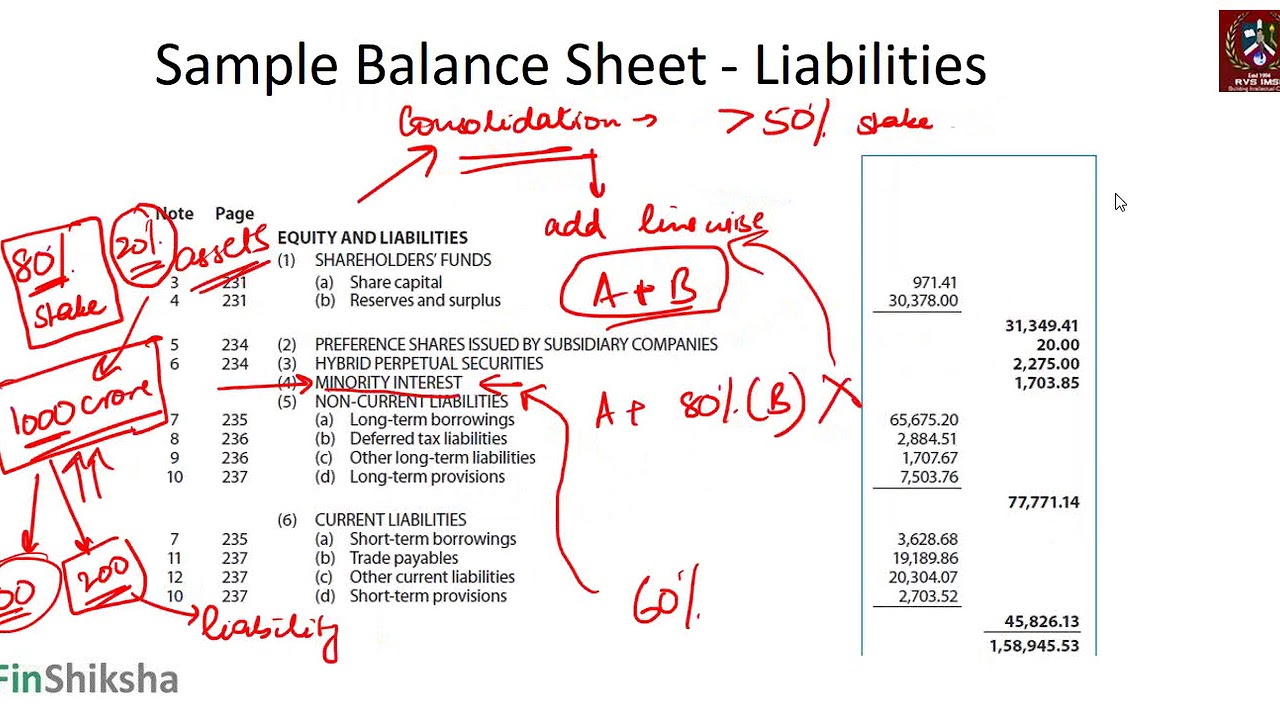

You saw that on the ford balance sheet (just the liabilities section is shown here): Various ratios using noncurrent liabilities are used. The requirement for an entity to have the right to defer settlement of the liability for at least 12 months after the reporting period.

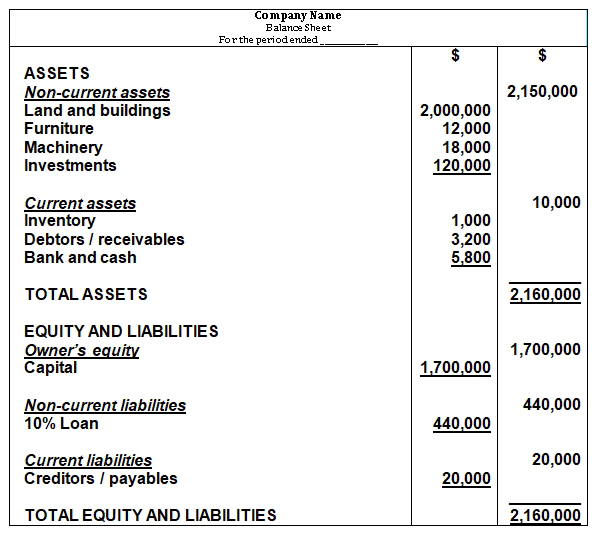

Business studies intermediate accounting non current liabilities Thus, owners can contribute capital at the time of starting the business or even later as per the requirements of funds. It anticipates settling the liability within its normal operating cycle;

Describe the components of shareholders’ equity; Below liabilities on the balance sheet is equity, or the amount owed to the owners of the company. It primarily holds the liability for trading purposes;

Non current liabilities are referred to as the long term debts or financial obligations that are listed on the balance sheet of a company. Describe different types of assets and liabilities and the measurement bases of each; Capital the capital of a business is the amount which the owner or owners of the business contribute.

On the balance sheet, the liabilities section can be split into two components: Liabilities are amounts a company owes to someone else, either immediately or over a long period.

:max_bytes(150000):strip_icc()/dotdash_Final_How_Current_and_Noncurrent_Assets_Differ_Oct_2020-01-e74218e547134e3db0ac9e9a7446d577.jpg)

/dotdash_Final_Current_Liabilities_Sep_2020-01-6515e265cfd34787ae2b0a30e9f1ccc8.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Liability_Definition_Aug_2020-01-5c53eb9b2a12410c92009f6525b70e7a.jpg)

![[Solved] The classified balance sheet and selected SolutionInn](https://s3.amazonaws.com/si.experts.images/questions/2022/11/636a720c3544d_396636a720c25008.jpg)