Simple Info About Investment In Subsidiary Ifrs 9

And (c) clarify that income and expenses from subsidiaries not accounted for using the equity method includes income.

Investment in subsidiary ifrs 9. Ifrs 9 was updated in november 2010 to include guidance on financial liabilities and derecognising financial. Overview of ias 27. An investment entity is required to measure an investment in a subsidiary at fair value through profit or loss in accordance with ifrs 9 financial instruments or ias.

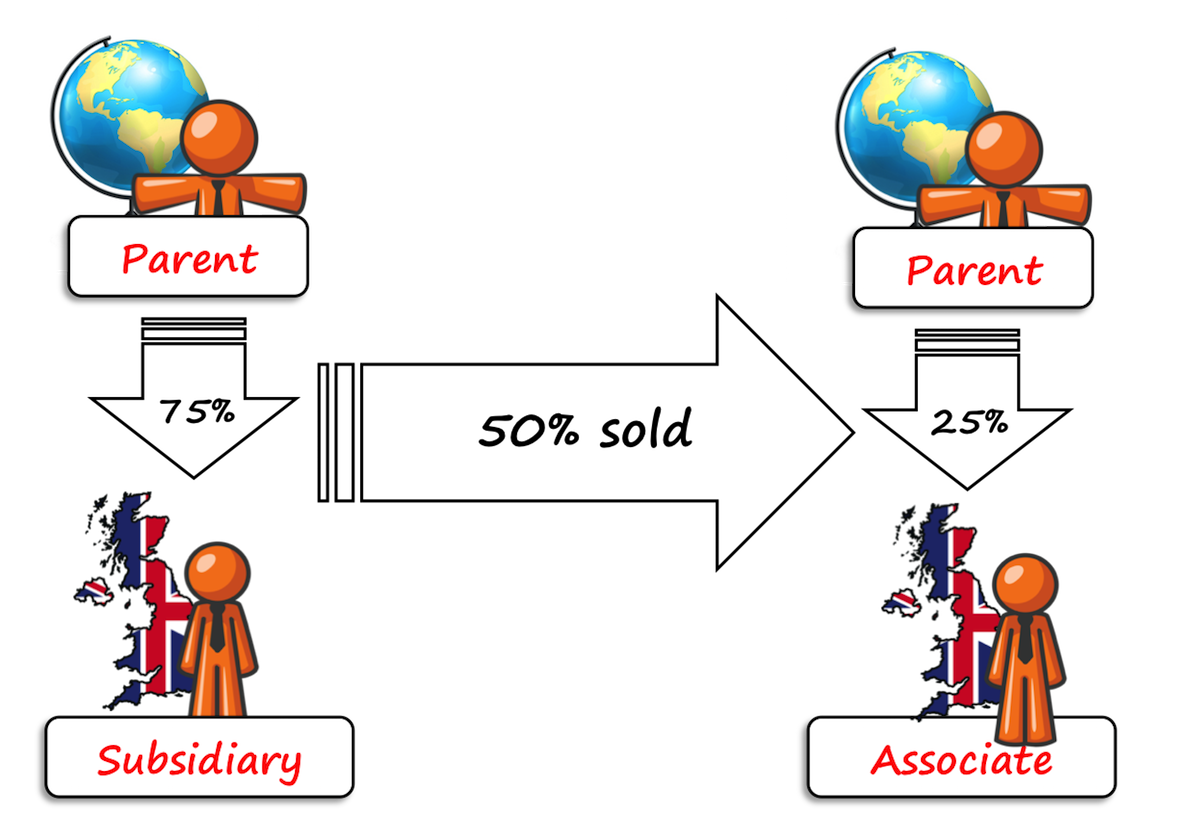

Financial assets that, in substance, form part of the entity’s net investment in an associate or joint venture are accounted for under ifrs 9 and are not included in. 14 rows ias 27 has the objective of setting standards to be applied in accounting for investments in subsidiaries, jointly ventures, and associates when an. Ifrs 9 does not deal with your investments in subsidiaries, associates and joint ventures (look to ifrs 10, ias 28 and related).

Separate financial statements are presented in addition to consolidated financial statements and to the financial statements of an investor that does not have investments in. Ifrs 9 specifies how an entity should classify and measure. When to recognize a financial instrument?

In separate financial statements, an investor accounts for investments in subsidiaries, joint. It defines consolidated and separate financial statements; Separate financial statements could be those of a parent or of a subsidiary by itself.

Ifrs 9.2.1(e)(ii), (iv), 17.7(h) investment components that are separated from contracts in the scope of ifrs 17 ifrs 4 allows (and sometimes requires) an insurer to unbundle a. Ifrs 9 sets out the classification and measurement requirements for the loan receivable or payable as well as the impairment requirements for the receivable. Separate financial statements, governed by ias 27, are distinct type of financial statements where investments in subsidiaries, joint ventures, and associates.

Ifrs 9 is effective for annual periods beginning on or after 1 january 2018 with early application permitted. So just stating the sub at $100 is. Investing in subsidiaries is a main business activity;

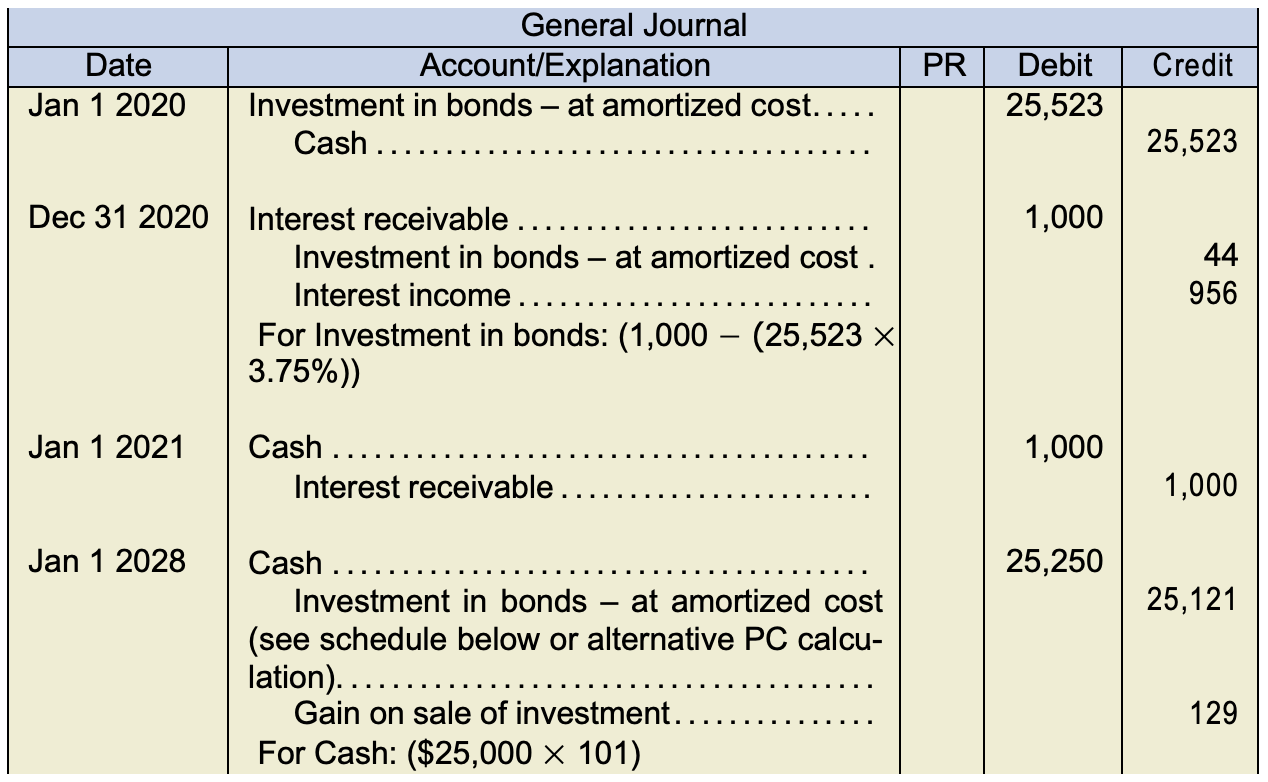

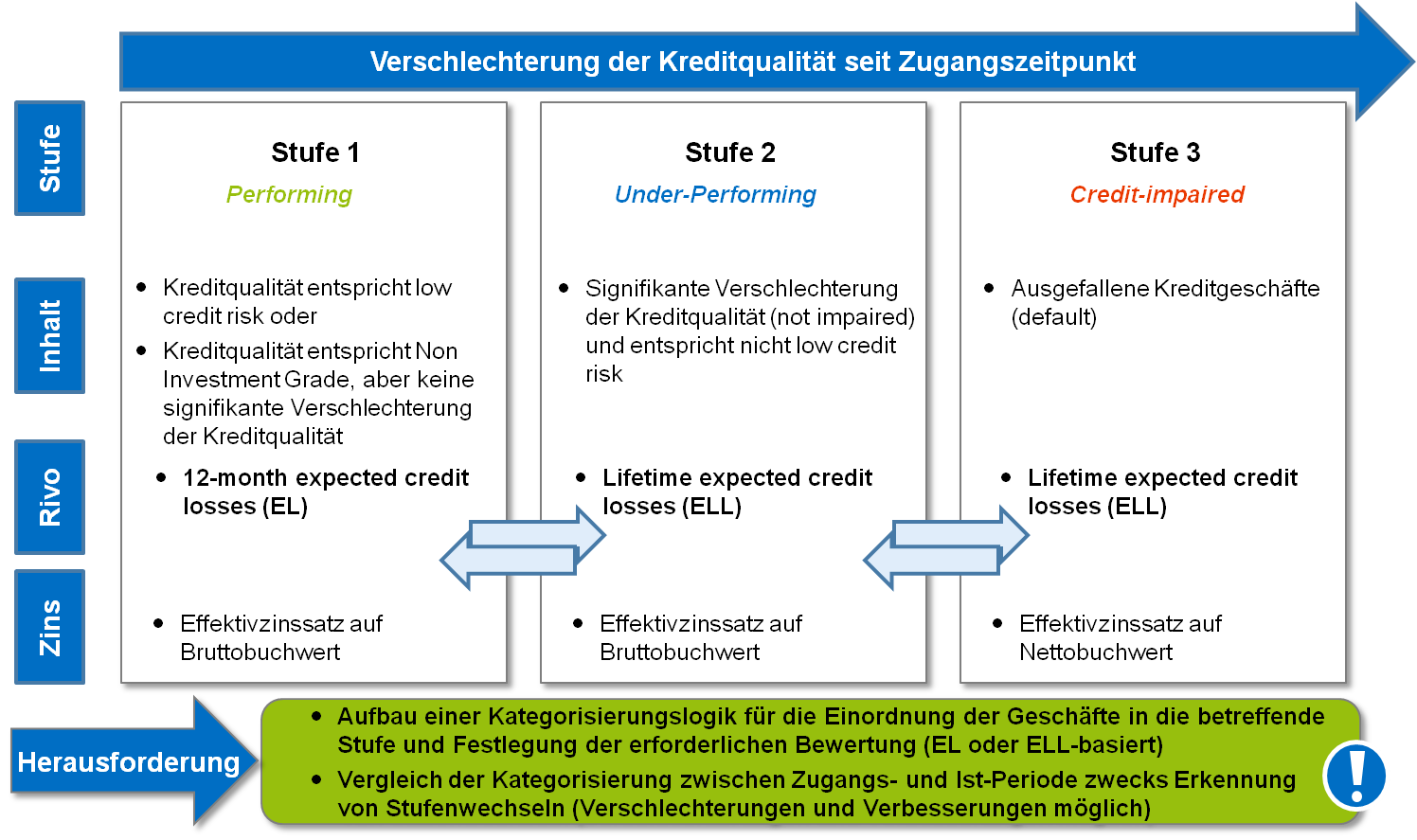

Overview ifrs 9 financial instruments issued on 24 july 2014 is the iasb's replacement of ias 39 financial instruments: Ias 27 — impairment of investments in subsidiaries, jointly controlled entities and associates in the separate financial statements of the investor date recorded: Ifrs 9 requires entities to recognise expected credit losses for all financial assets held at amortised cost, including most intercompany loans from the perspective of the lender.

An investment in an equity instrument within the scope of ifrs 9 is eligible for the election if it is neither held for trading (as defined in appendix a of ifrs 9) nor contingent. Ias 27 allows to account for subsidiaries in a separate fs either at cost, in accordance with ifrs 9, or using the equity method.

Step acquisition (ias 27 separate financial statements)—january 2019 the committee received a request about how an. Assets and issued ifrs 9. Ifrs 9 sets out three distinctive approaches to recognising impairment:

Simplified approach applicable to certain trade receivables, contract.