Beautiful Work Tips About Insurance In Profit And Loss Account

Zepbound, the newly approved weight loss drug from eli lilly, may be easier to find.

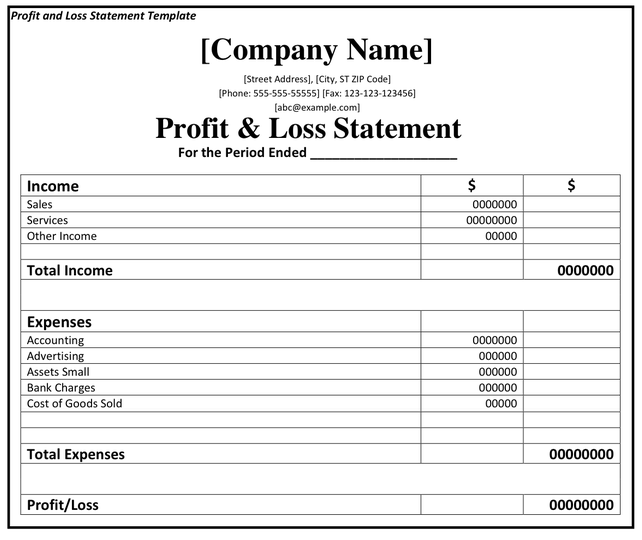

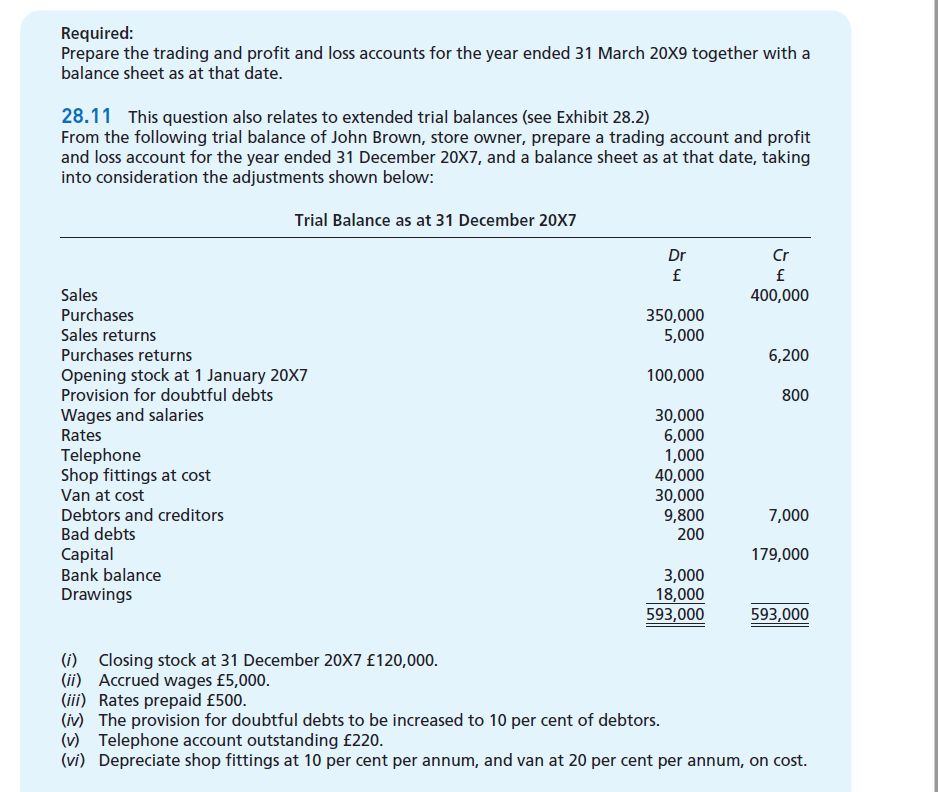

Insurance in profit and loss account. The insurance companies are required to prepare their financial statements i. Key takeaways on understanding a profit and loss account. Fundamental analysis balance sheet vs.

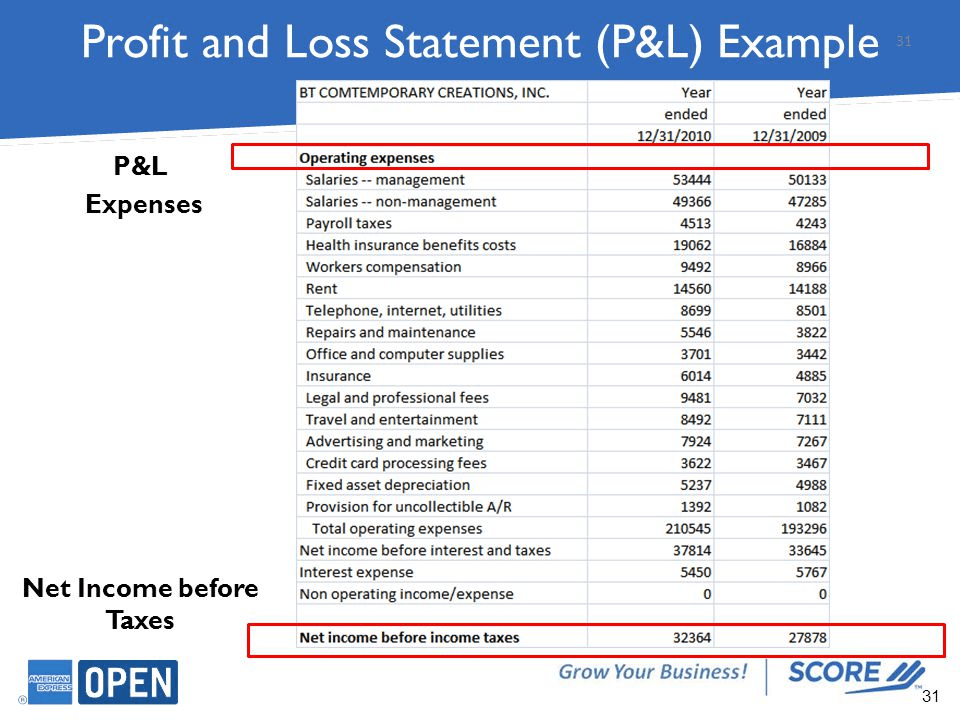

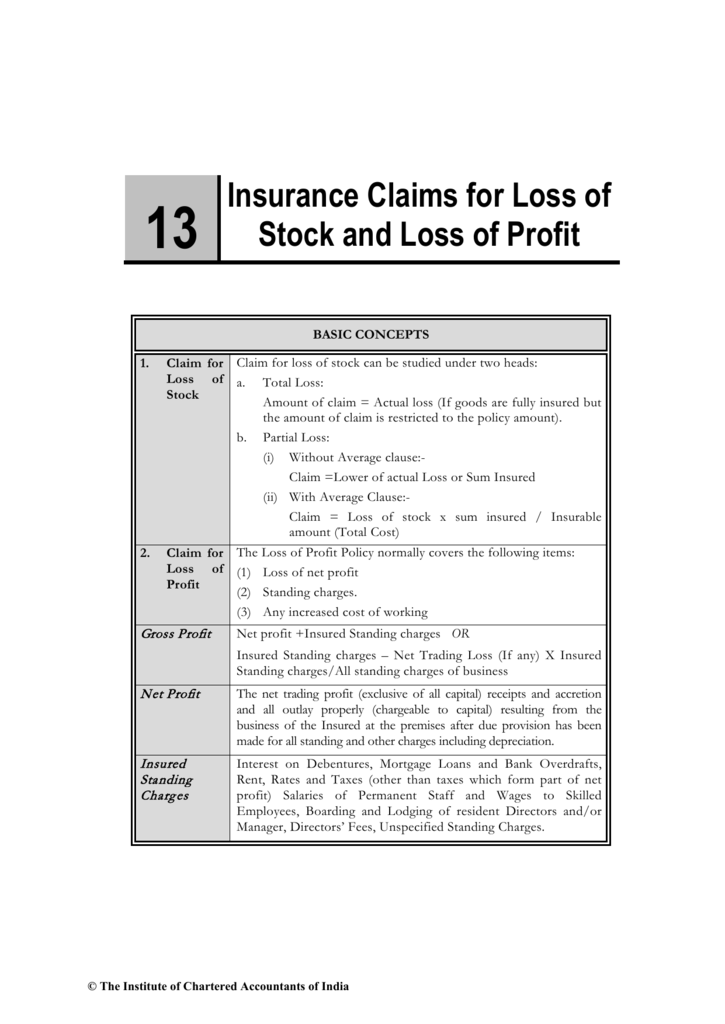

When a business suffers a loss that is covered by an insurance policy, it recognizes a gain in the amount of the insurance. The profit and loss account starts with the credit from the trading account in respect of gross profit or debit if there is gross loss. Only indirect expenses are shown in this account.

All the items of revenue and expenses. The profit and loss account is compiled to show the income of your business over a given period of time. It might not seem obvious by looking at a profit and loss statement, but the final figure at the bottom (i.e., the total profit or the total loss) may be very different from the actual amount of cash that’s made or lost.

Imposter scams remained the top fraud category, with reported losses of $2.7 billion. Get general insurance corporation of india latest profit & loss account, financial statements and general insurance corporation of india detailed profit and loss accounts. Carter, a profit and loss account is an account into which all gains.

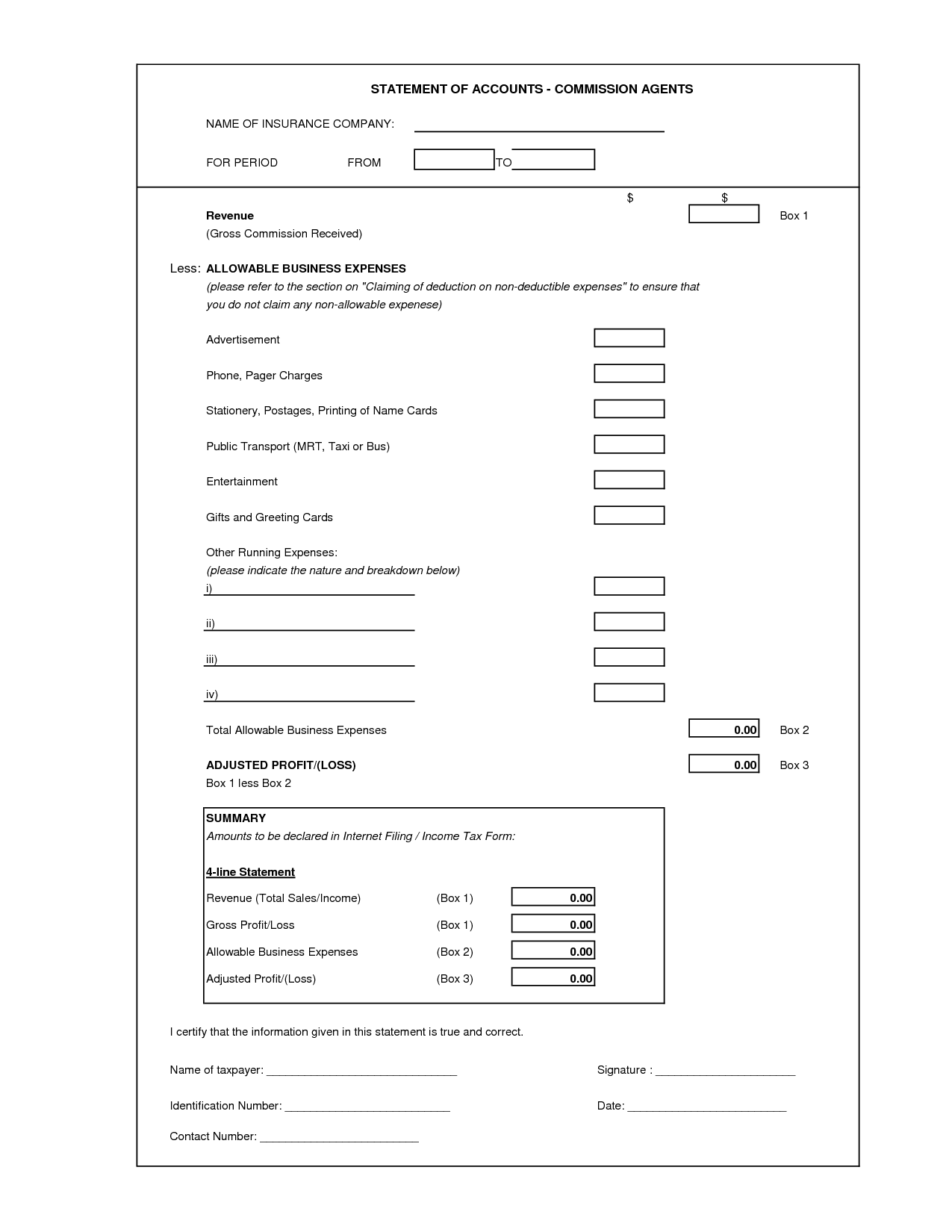

Both involve a company’s finances, but their differences are significant. Can anyone advise on how to handle an insurance claim received in the profit & loss account. Explain p&l a/c objectives and importance.

In order to find out the overall performance or results of the operating of general insurance business profit and loss account of the. Profit and loss account is made to ascertain annual profit or loss of business. Revenue account, profit and loss account and balance sheet according to the insurance.

Since medicare will not pay for any medications with an fda indication for weight loss (not even the oral agents qsymia or contrave), my prior ability to prescribe. It could be for a week, a quarter or a financial year. Millions of people continue to step up to the challenge with 33 million small.

The distinction is not precise, and. Starting your own business requires a significant investment of both time and money. Insurance claim received.

An income statement, also known interchangeably as a profit and loss account, provides a summary of a company’s revenues, expenses, and profits over a. Understand that a profit and loss (p&l) account is a financial statement that summarises the revenues,. Paul donno, the managing director of 1 accounts online ltd, has some words of wisdom on how to understand the.

Lost profits, by themselves, do not give rise to a provision. Therefore, compensation for business interruption is not a reimbursement right under ias 37 and should be. Get life insurance corporation of india latest profit & loss account, financial statements and life insurance corporation of india detailed profit and loss accounts.