Best Info About 10k Balance Sheet Marketable Securities Examples

A firm must report any unrealized losses or gains — changes in the value of a holding that it hasn't sold — on marketable securities on its balance sheet to show.

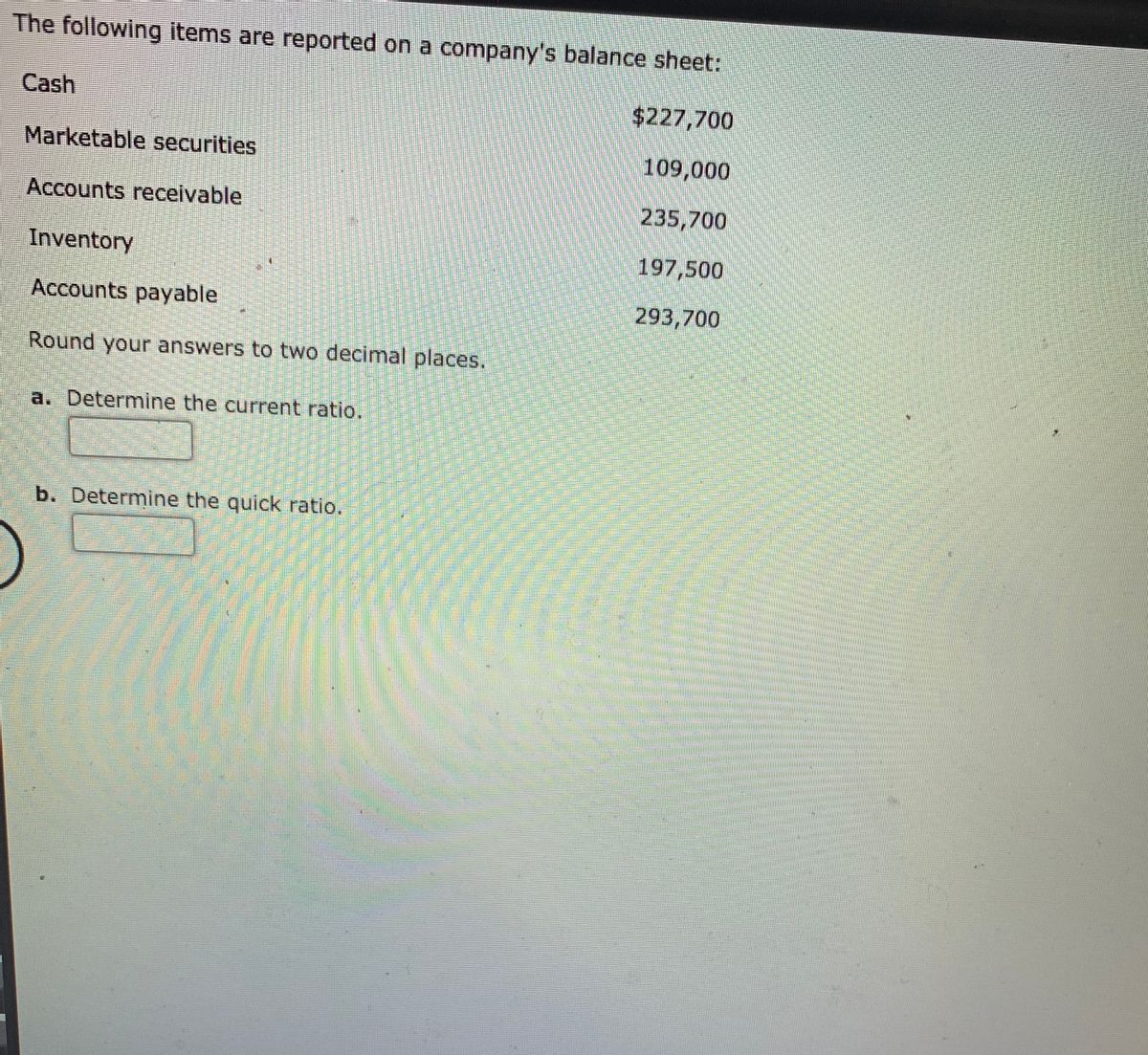

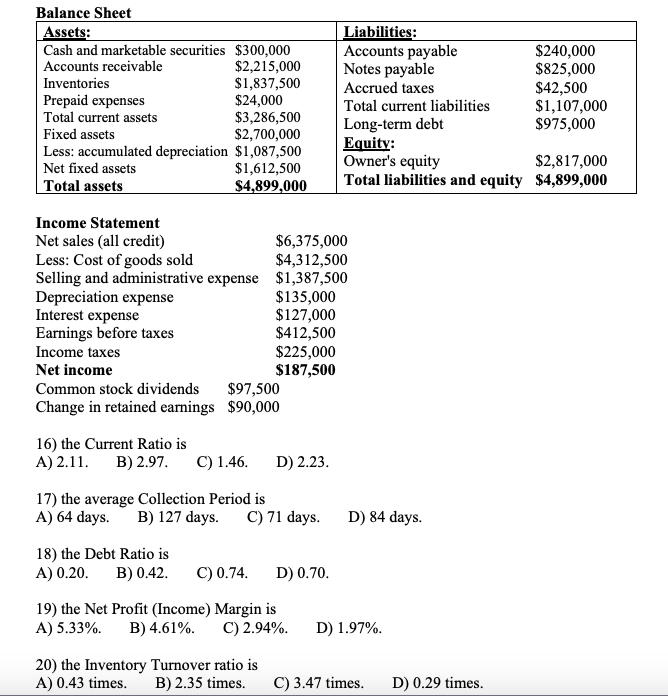

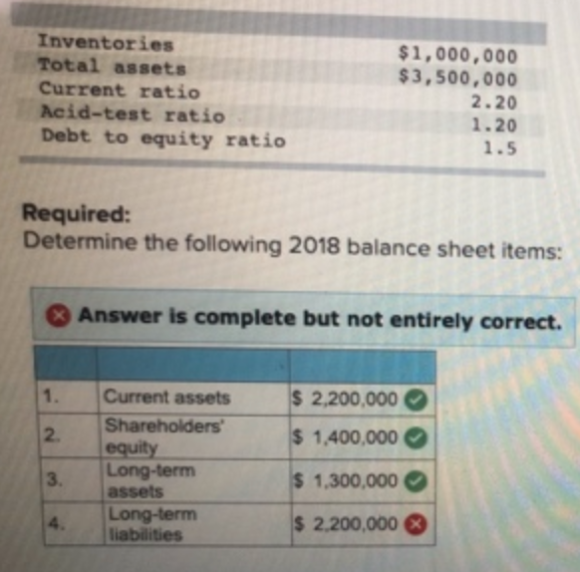

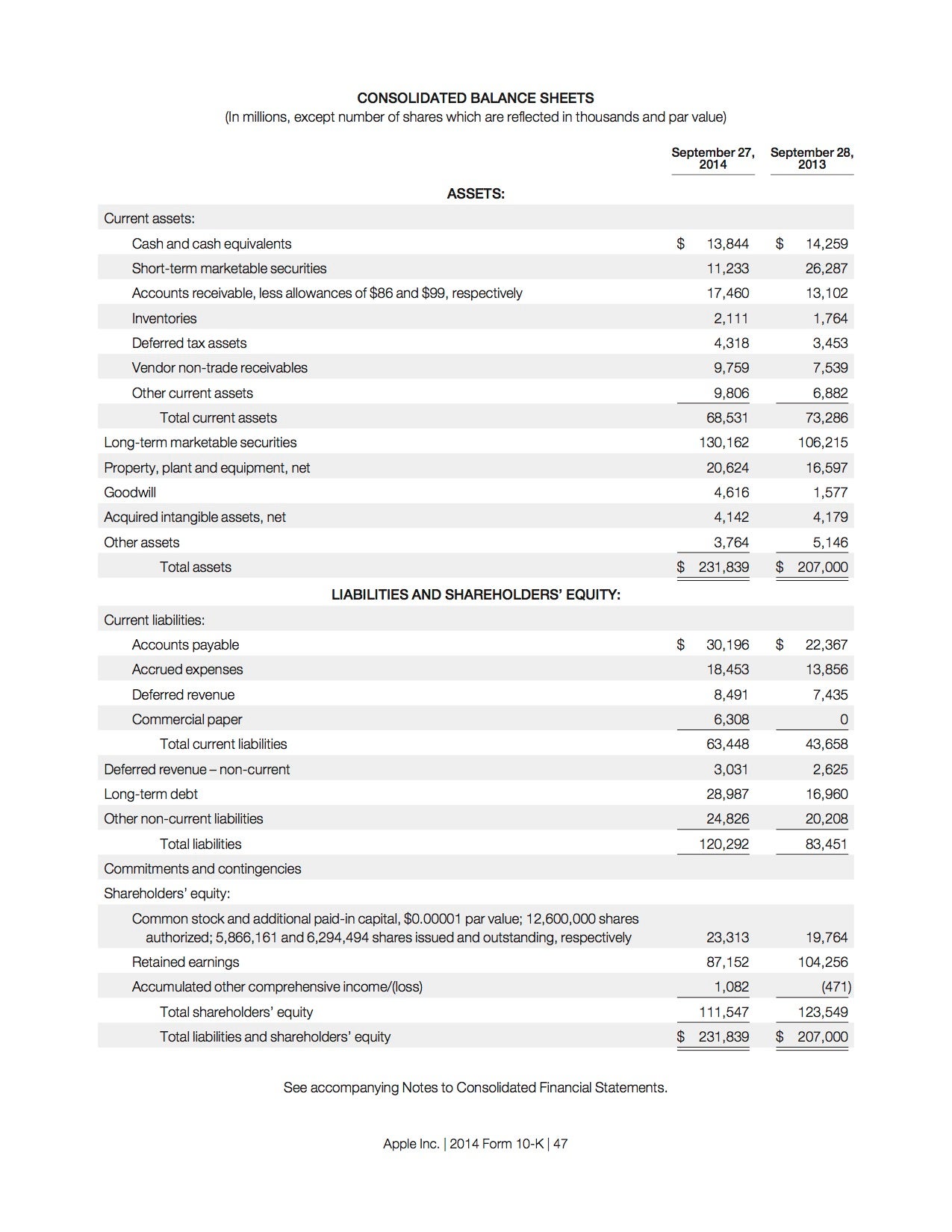

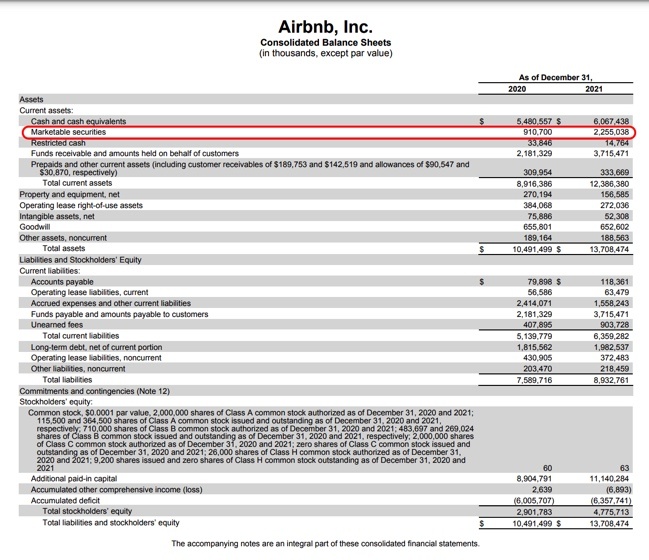

10k balance sheet marketable securities examples balance sheet. For example, suppose a company has the following balance sheet data: Read more about company assets on the balance sheet. What are the 3 components of the balance sheet?

The format of reporting marketable securities on the balance sheet typically includes the following: Accounts receivable (ar) grow with sales (net revenues). Debt securities have a fixed cash flows stream for a specified period of time.

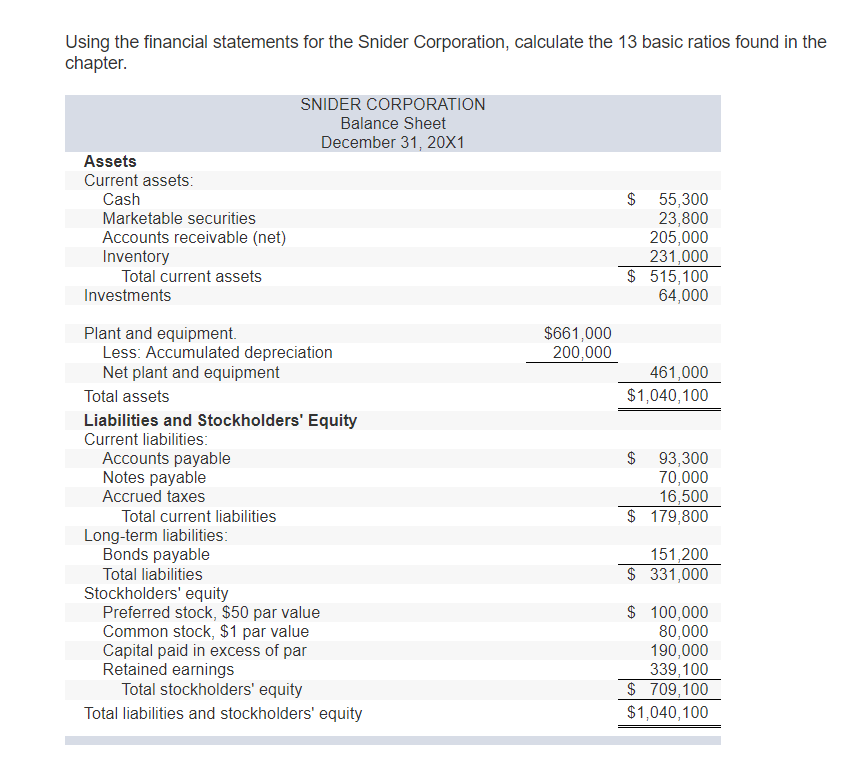

The balance sheet shows the carrying values of a company’s assets, liabilities, and shareholders’ equity at a. The securities exchange act of 1934 (exchange act or 1934 act) requires most publicly held companies to file an annual report with the securities and exchange. Using an if statement, model should enable users to override.

Marketable securities = $10 million; On the balance sheet, marketable securities are classified based on their liquidity and the intent of the. Aapl) for fiscal year ending 2022.

Cash is king for apple, its strong cash position is a major strength. A balance sheet is a financial statement for a company that shows its assets, liabilities, and equity at a point in time. There are many features of these securities, but the two most important ones that set them apart from the rest are highlighted below.

Classification of marketable securities on balance sheet. Marketable securities are predominantly of two types: Common stock, commercial paper, banker's acceptances, treasury notes,.

The name and details of each. Held to maturity these classifications are dependent on certain criteria, but also on the history of transactions any given investor or firm has employed in their past accounting.

:max_bytes(150000):strip_icc()/ScreenShot2021-05-03at11.03.30AM-985f846f70e347c69f0f288359e7beed.png)

/GettyImages-824185000-03c0d898d7e449ac8fef137d17f73dd1.jpg)