Who Else Wants Info About Loan Given In Cash Flow Statement

Cash flow arising from investing activities typically are:

Loan given in cash flow statement. Along with balance sheets and income statements, it’s one of the three most important financial statements for managing your small business accounting and making sure you have enough cash to keep operating. Cash receipts from disposal of fixed asset; First things first, a loan can be repaid in number of ways for example in cash, by handing over certain asset or converting debt to shares etc.

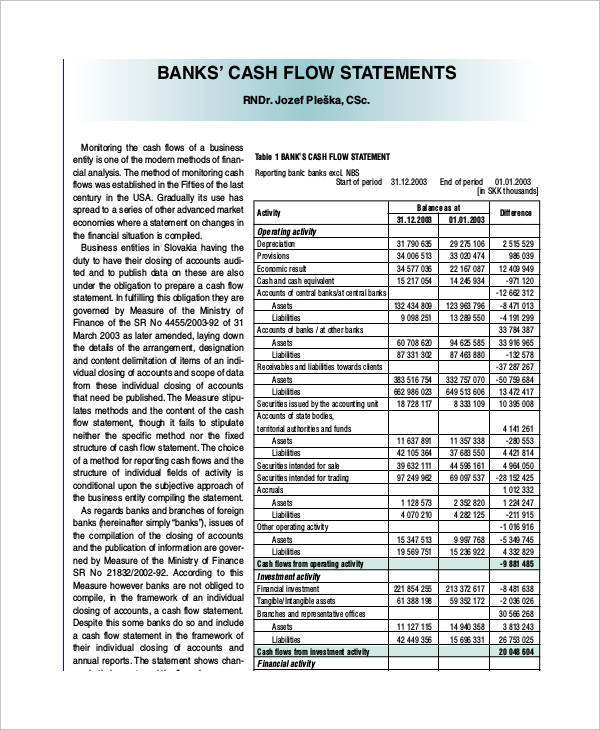

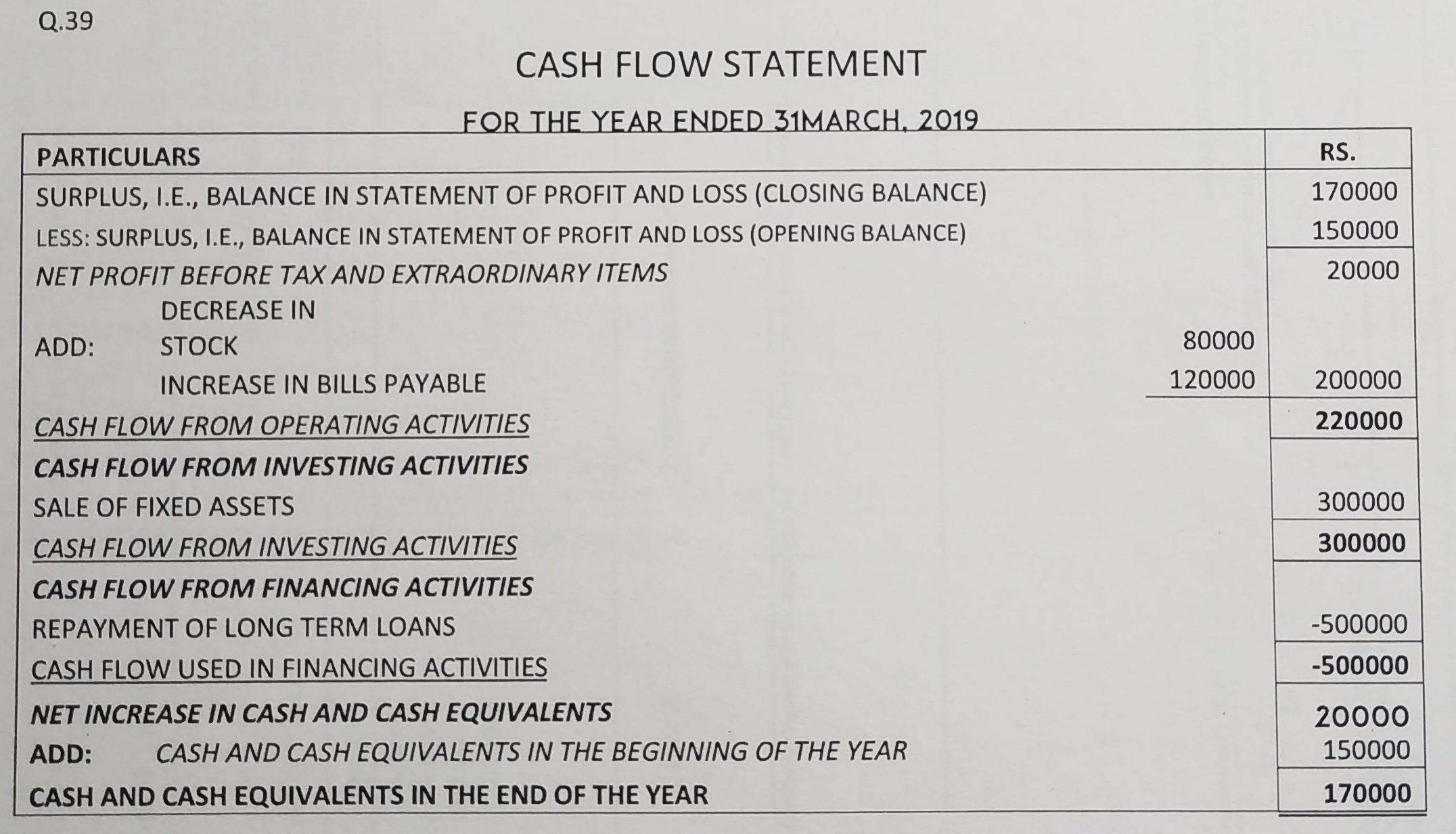

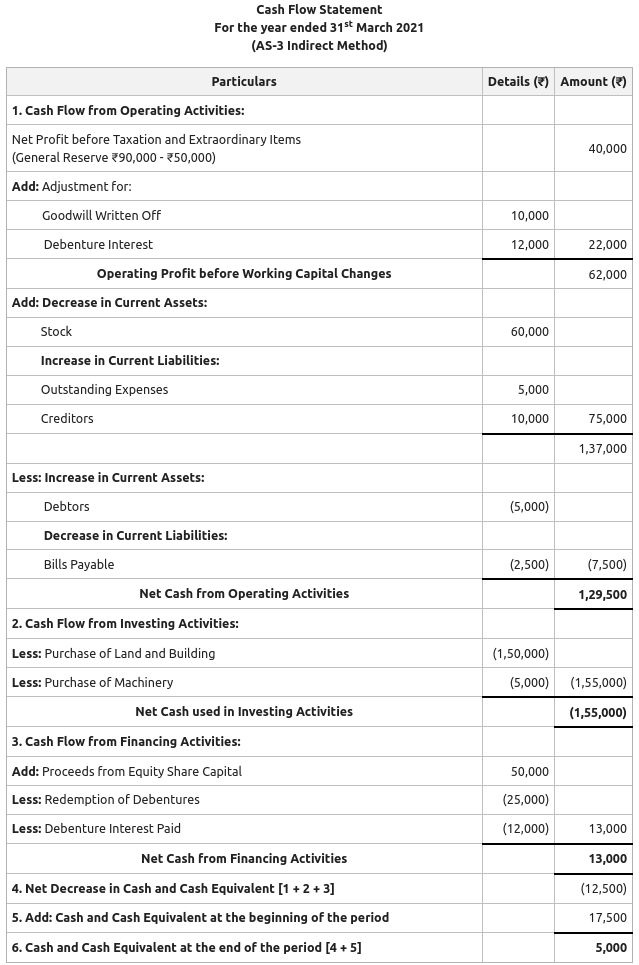

The first step in preparing a cash flow statement is determining the starting balance of cash and cash equivalents at the beginning of the reporting period. Cash flow from financing activities is a section of a company’s cash flow statement, which shows the net flows of cash that are used to fund the company. A vertical presentation of the numbers lends itself to noting the source of the numbers.

This value can be found on the income statement of the same accounting period. Finance activities include the issuance and repayment of equity, payment of dividends, issuance and repayment of debt, and capital lease obligations. Furthermore, examples of cash inflow from investing activities are:

Operating if your company's business is of giving loan. Judge fines donald trump more than $350 million, bars him from running businesses in n.y. The financing activity in the cash flow statement focuses on how a firm raises capital and pays it back to investors through capital markets.

Learn more about how it works. Receipts received on trading of shares, debentures, bonds etc. Dashrath maheshwari (taxpert) (15090 points) replied 24 may 2015

But if the repayment does not involve cash outflow then such transaction will not be disclosed in the statement of cash flows. A cash flow statement summarizes the amount of cash and cash equivalents entering and leaving a company. Cash outflows to pay dividends

Cash flows from financing (cff), or financing cash flow, shows the net flows of cash used to fund the company and its capital. Cash flow from financing activities is the net amount of funding a company generates in a given time period. Cash receipts from the repayment of advances and loans made to third parties;

The payment of a dividend is also treated as a financing cash flow. Cash payments to acquire fixed asset ; A cash flow statement is a financial statement that provides aggregate data regarding all cash inflows that a company receives from its ongoing operations and external investment sources.

Cash flow financing is a form of financing in which a loan made to a company is backed by the company's expected cash flows. Cash outflow from investment activities Cash payments to acquire shares or debenture investment;

Often used interchangeably with the term, “statement of cash flows,” the cash flow statement tracks the real inflows and outflows of cash from operating, investing and financing activities. Investing if your company's business is not of giving loan. Can anyone tell me the treatment of loan to employee in cash flow statement whether its operating,financing,investing?

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)