Looking Good Tips About Ca Certified Balance Sheet

When tax audit required u/s.

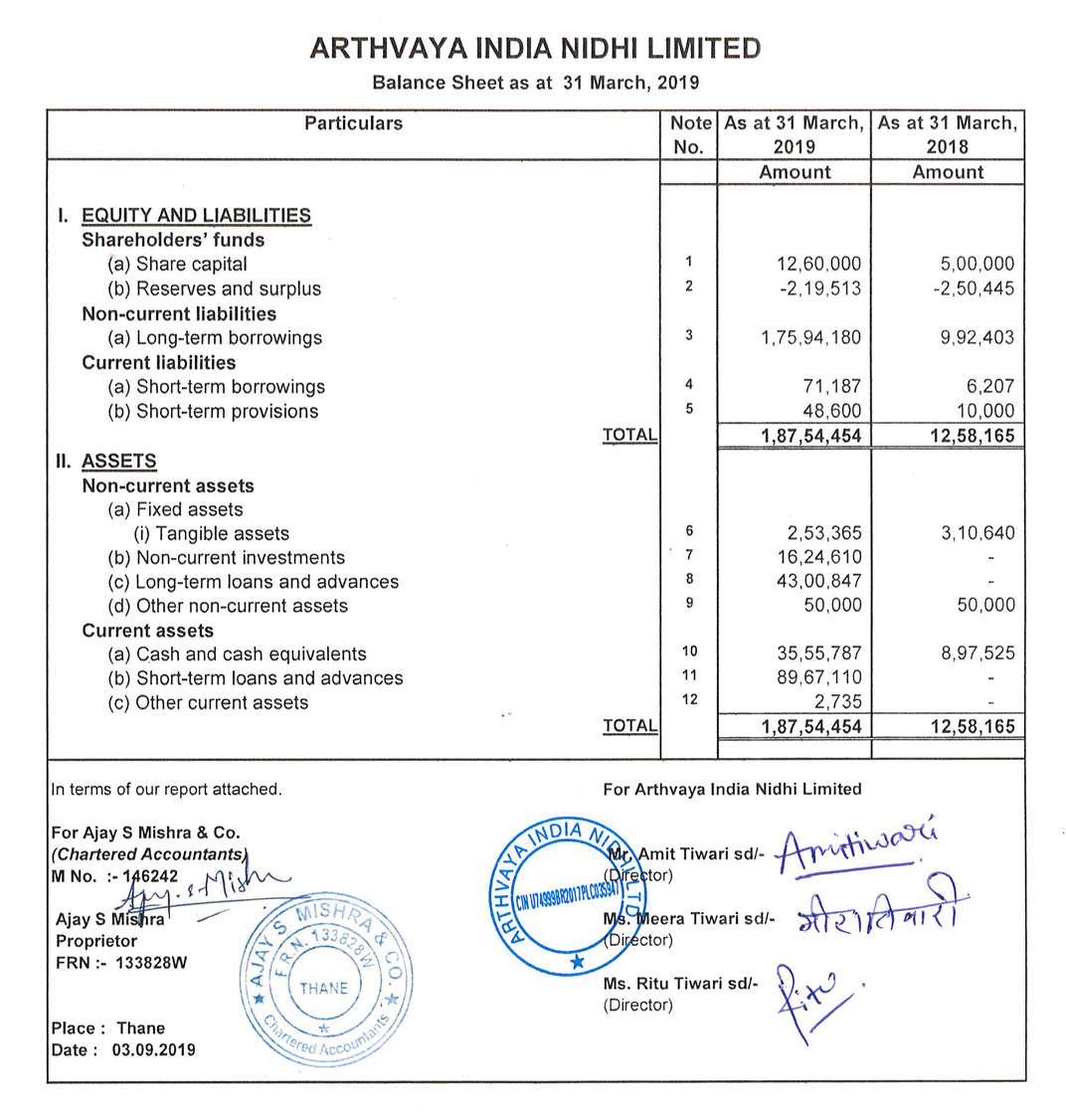

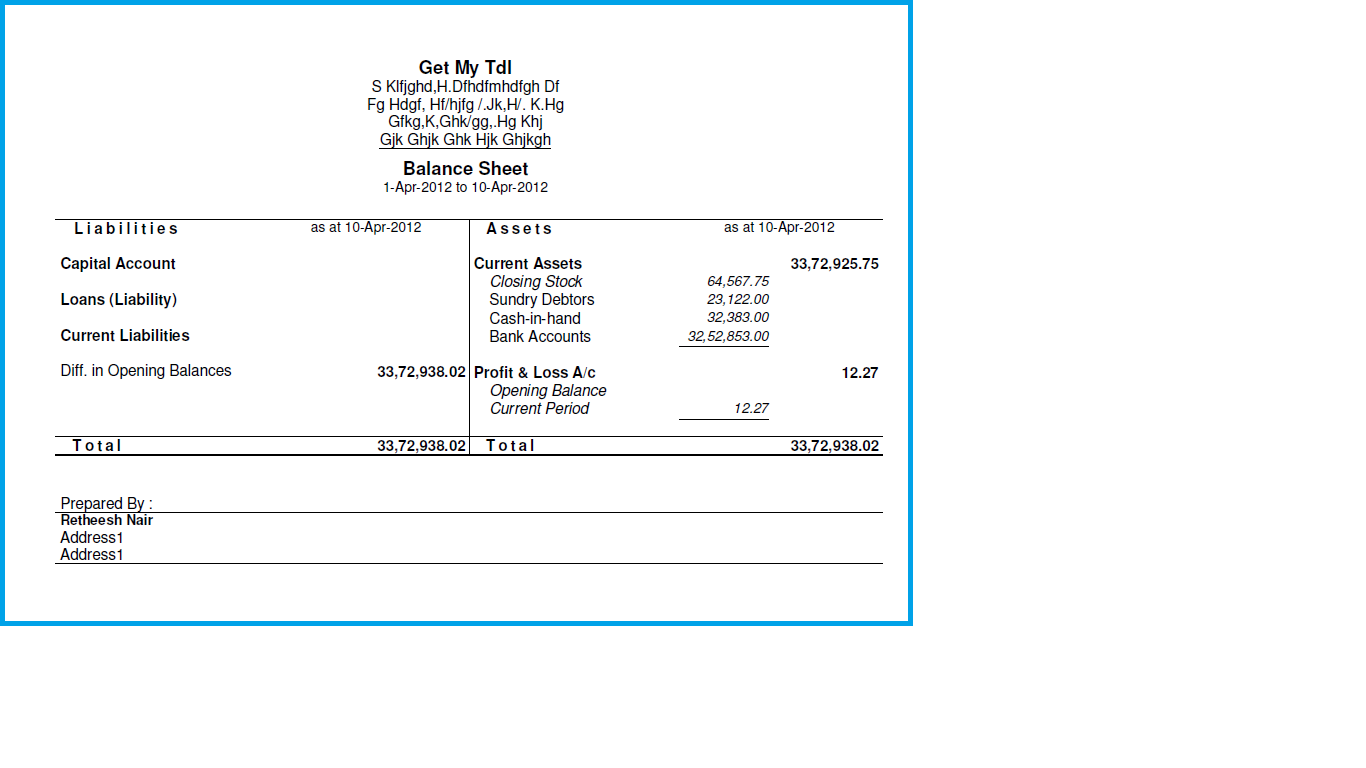

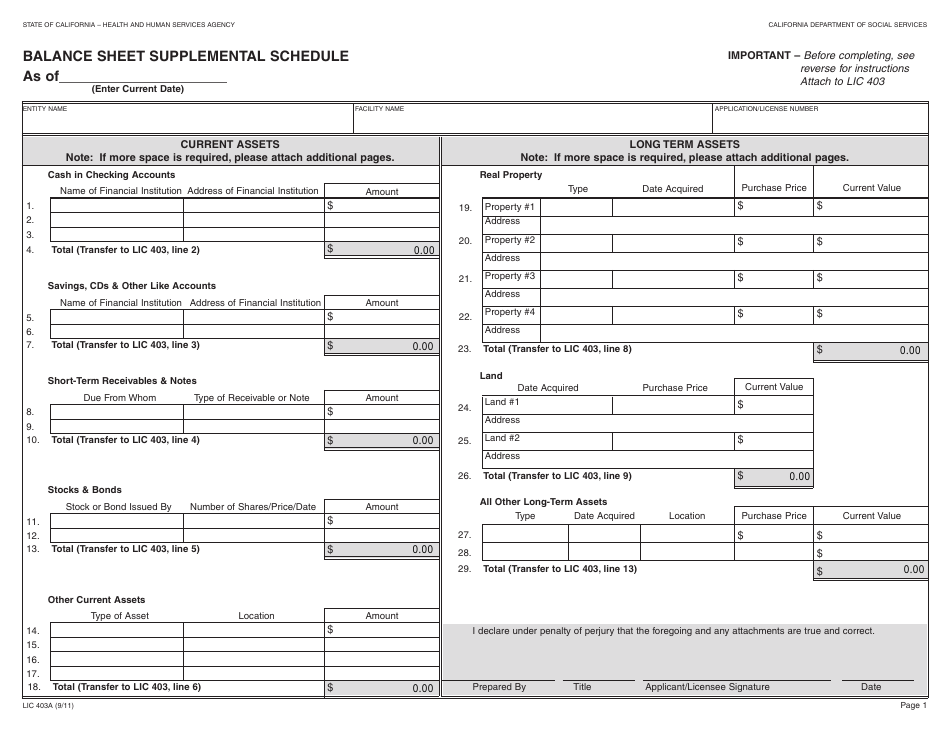

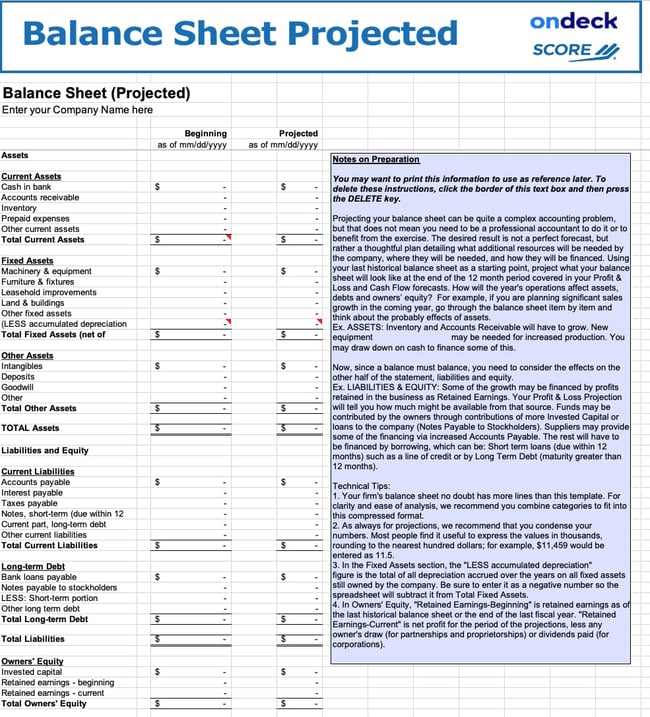

Ca certified balance sheet. Can a chartered accountant sign a provisional balance sheet? Balance sheets that outline its assets and liabilities a certified public accountant (cpa) will audit the contents of these statements using generally accepted accounting principles (gaap) to. I wish to ask reserve bank of india if there is specific circular/notification issued by them to all the commercials banks.

In respect of the provisional financial statements a ca can sign the provisional financials subject to compliance the provisions of srs 4410 (revised) a standard on related services, compilation engagements effective. In the audit report, the auditor attests to. 3 replies deepak gupta (ca student) (15922 points) replied 07 january 2016 a ca.

The rbi replied that no specific instructions are issued in this regard. Namastevarious stakeholders ask for provisional financial statements to be certified by a ca. A certified financial statement is an income statement, balance sheet, and/or statement of cash flows that is issued along with an auditor’s report from a certified public accountant.

Chartered accountants play a key role in providing assurance regarding the accuracy and fairness of a company’s financial statements. Here are templates of such ca certificates for fixed assets. A certificate on the value of fixed assets duly certified by a chartered accountant in whole time practice is required from an entity on certain occasions for submission to the appropriate authority.

Giving certification/ signing on unaudited balance sheets and on income tax returns of clients (for those who does not fall under the category of audit cases such as income tax, company act etc) & generating udin thereon. Ca certification of provisional balance sheet neetish (working in bank) (28 points) 07 january 2016 can a chartered accountant sign on provisional balance sheet. A chartered accountant (ca) is a financial professional who is qualified to execute certain accounting procedures.

18 march 2021 yet not clear on the fact that whether a ca can certify balance sheet of a client whose books are not required to get audited but the banker needs certified true copies of balance sheet of the client for loan purposes, the icai recent faq's (link below) suggest that a ca cannot certify itr. Today, president biden announced the approval of $1.2 billion in student debt cancellation for almost 153,000 borrowers currently enrolled in the saving on a valuable education (save) repayment plan. It also refers to an accounting designation granted internationally to.

Cannot sign the provisional balance sheet as an auditor. We have panel of chartered accountants (ca) for various services. Giving certification/ signing on unaudited balance sheets and on income tax returns of clients (for those who don’t fall under category of audit cases such as income tax, company act etc.) & generating udin thereon.

Connect with us for ca turnover certificate, fund utilization certificate, ca certificate for tender purpose, visa purpose certification, ca certification for loan, itr and income tax computation (coi). Unique document identification number (udin) being made mandatory from 1st july, 2019 for all audit/assurance/attest function. Can a ca sign on projected financial statements.

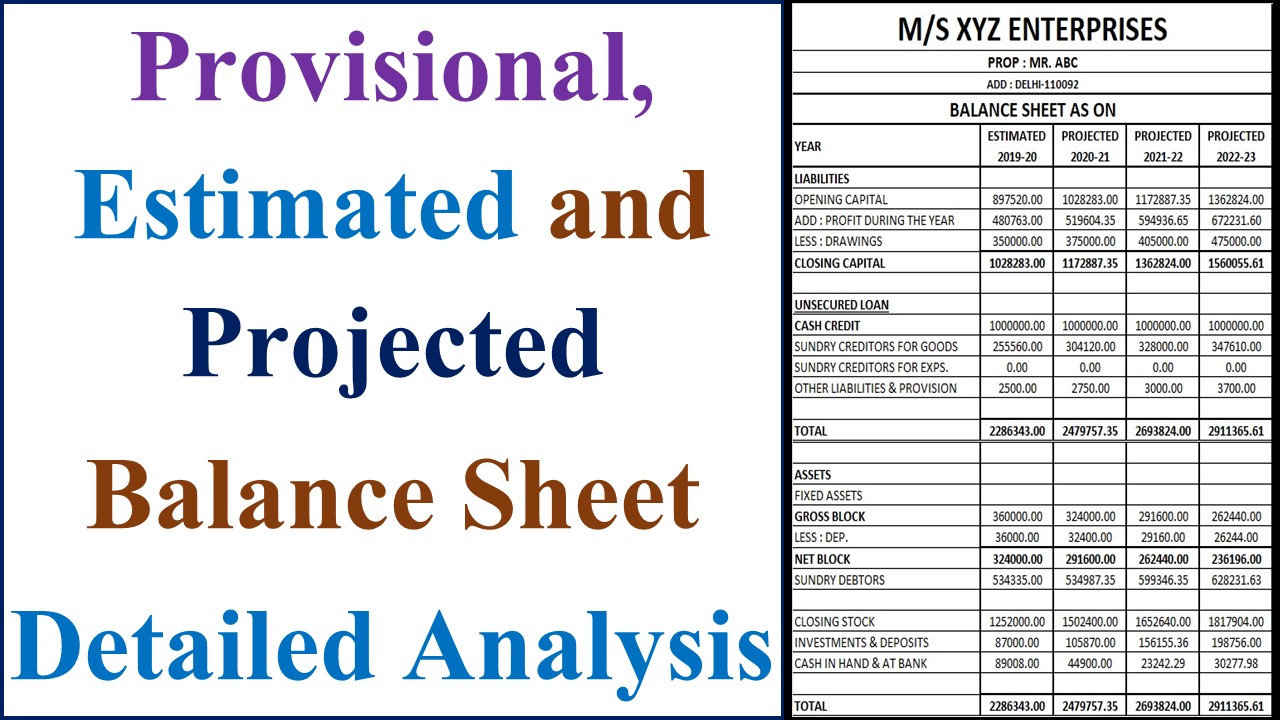

Ca does not certify the correctness of values but only prepares a balance sheet as per detail of assets &. Chartered accountants and forgeries of signatures of ca’s that mislead the authorities and stakeholders relying upon such documents or certificates. #casansaar #icai #financialstatementcan a chartered accountant sign the provisional / projected balance sheet / financial statement?

Certification on unaudited balance sheets and income tax returns: Here are some key details regarding the ca certification of a balance sheet: The annual accounts of all the eurosystem national central banks will be finalised by the end of may 2024, and the final annual consolidated balance sheet of the eurosystem will be published thereafter.