Painstaking Lessons Of Info About Cash Flow Statement Calculation

Cash flow statements provide valuable insights into a company’s financial health.

Cash flow statement calculation. Free cash flow (fcf) is a company's available cash repaid to creditors and as dividends and interest to investors. A cash flow statement is a regular financial statement telling you how much cash you have on hand for a specific period. Here’s how this formula would work for a company with the following statement of cash:

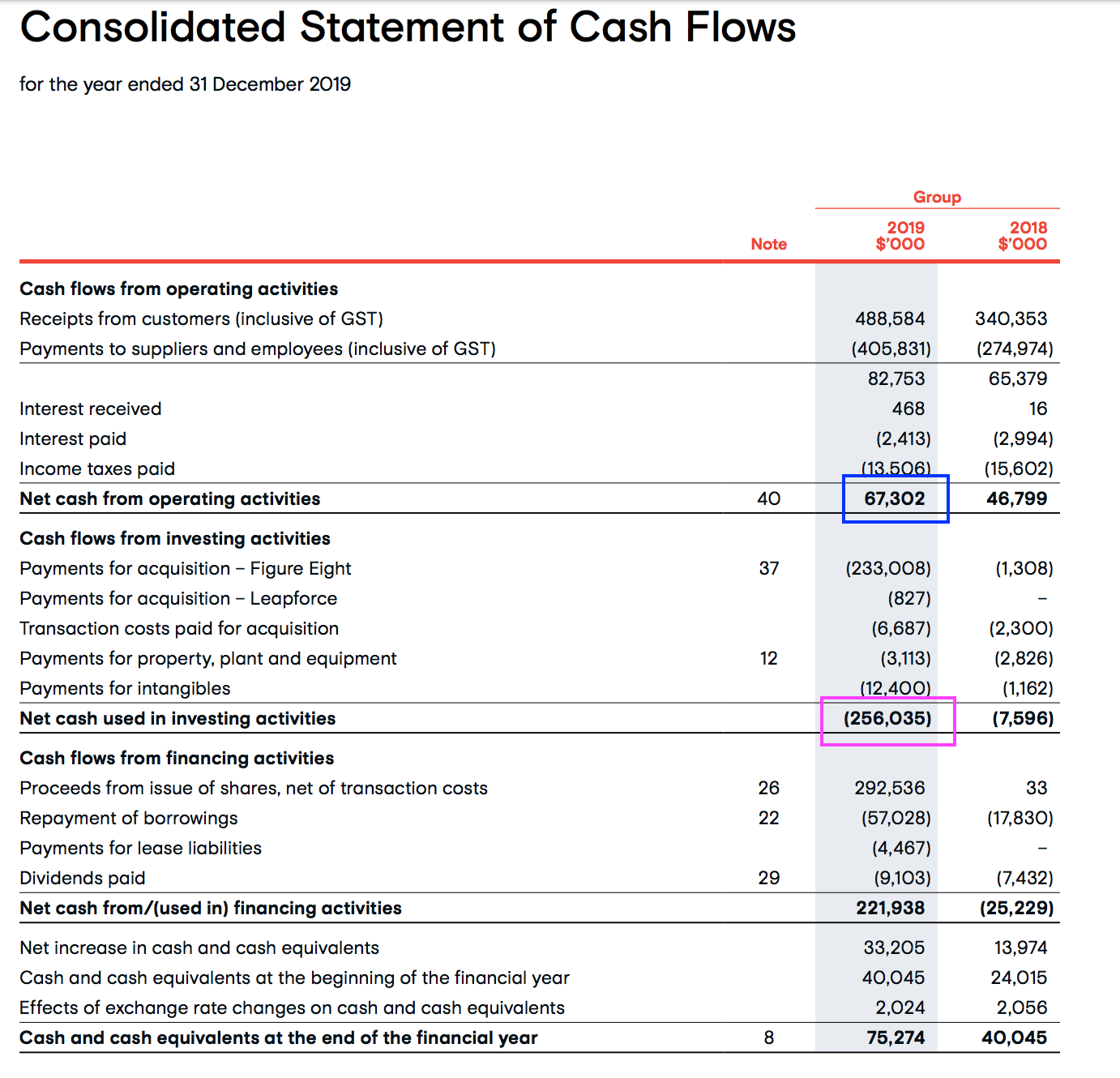

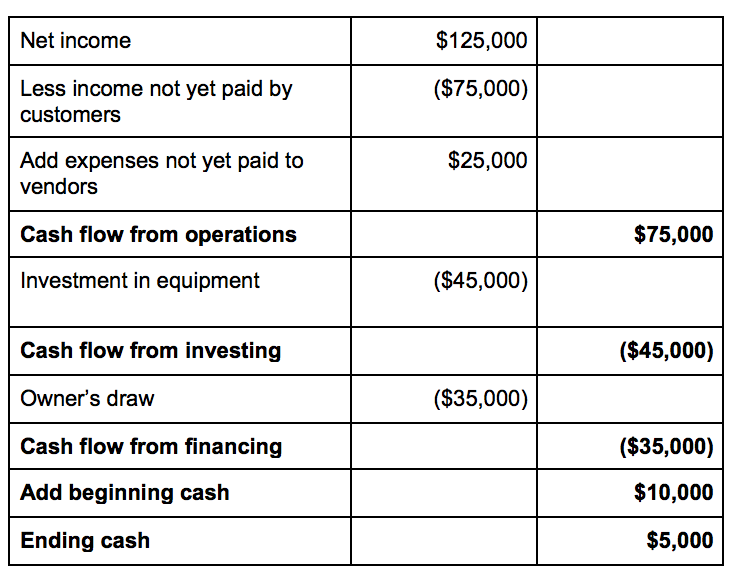

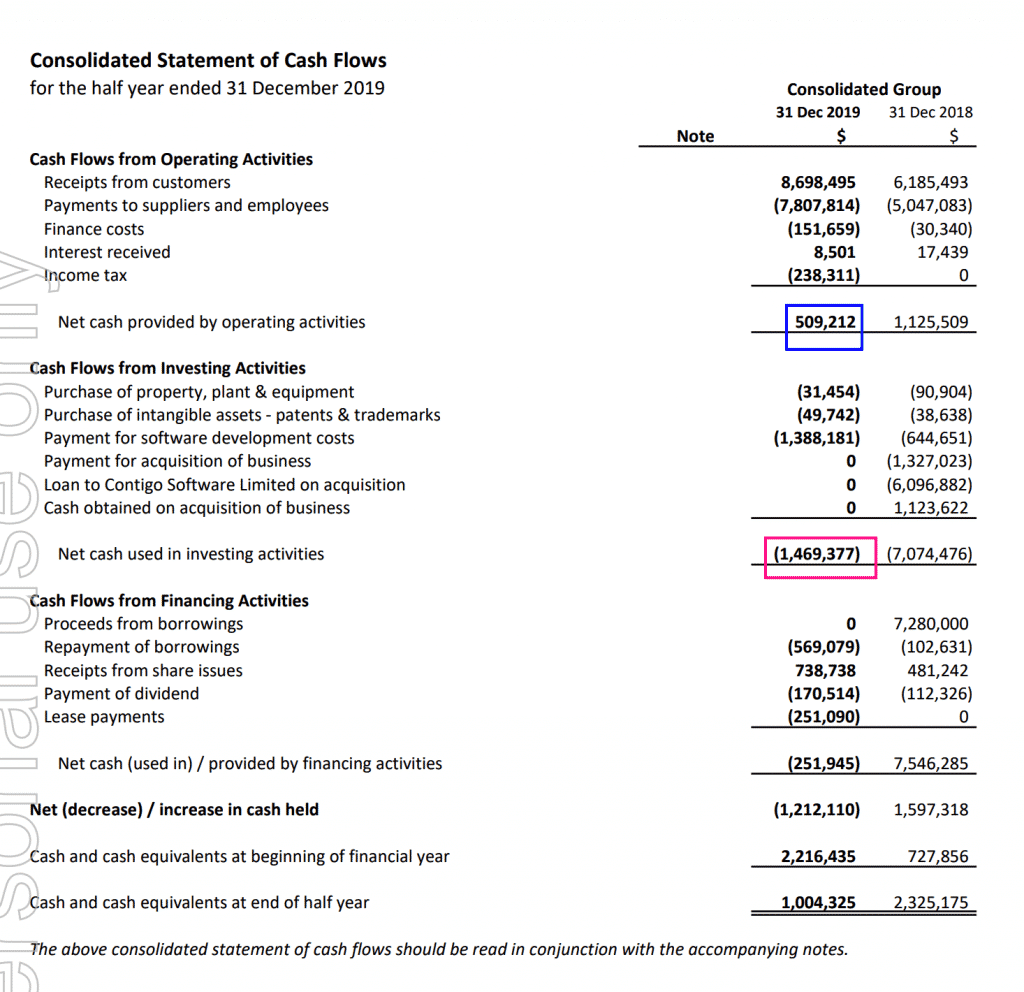

That bottom line is calculated by adding the money received from the sale of assets, paying back loans or selling stock and. Determine the starting balance the first step in preparing a cash flow statement is determining the starting balance of cash and cash equivalents at the beginning of the reporting period. The indirect method is used in most cases.

It shows the cash that a company can produce after deducting the purchase of assets such as property, equipment, and other major investments from its operating cash flow. Once you have a cash flow figure, you can use it to calculate various. Assess the cash flows generated by the company's activities.

Payroll and other expenses) for a set period. Overall, the cash flow statement seems. Net cash flow calculation example.

Income statement and free cash flow. Cash flow from the operation means accounting for cash inflows generated from the normal business operations and their corresponding cash outflows. While income statements are excellent for showing you how much money you’ve spent and earned, they don’t necessarily tell you how much cash you have on hand for a specific period of time.

This allows the company to determine its cash balances to manage operational expenses and meet its financial obligations. The next component of a cash flow statement is investing cash flow. Revenue and income) is enough to cover your financial obligations (i.e.

Main models operating cash flow. Investors can use this financial statement to. Ending cash balance = beginning cash balance + net change in cash

The formula is: Current share price of us$4.89 suggests transocean is potentially 39% undervalued. The equipment purchase and depreciation are accurately reflected in the cash flow analysis.

Cash flow calculator use this calculator to determine if the money coming into your business (i.e. By examining the cash flows from investing and financing activities, analysts can identify potential risks and opportunities. Transocean's estimated fair value is us$8.00 based on 2 stage free cash flow to equity.

A basic way to calculate cash flow is to sum up figures for current assets and subtract from that total current liabilities. A cash flow statement (cfs) is a financial statement that captures how much cash is generated and utilized by a company or business in a specific time period. By looking at the cash flow statement, one can see whether the company has sufficient cash flowing in to pay its debts, fund its operations, and return money to shareholders via.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)