Brilliant Strategies Of Tips About Balance Sheet With Adjustments

Irrecoverable debts and allowances for.

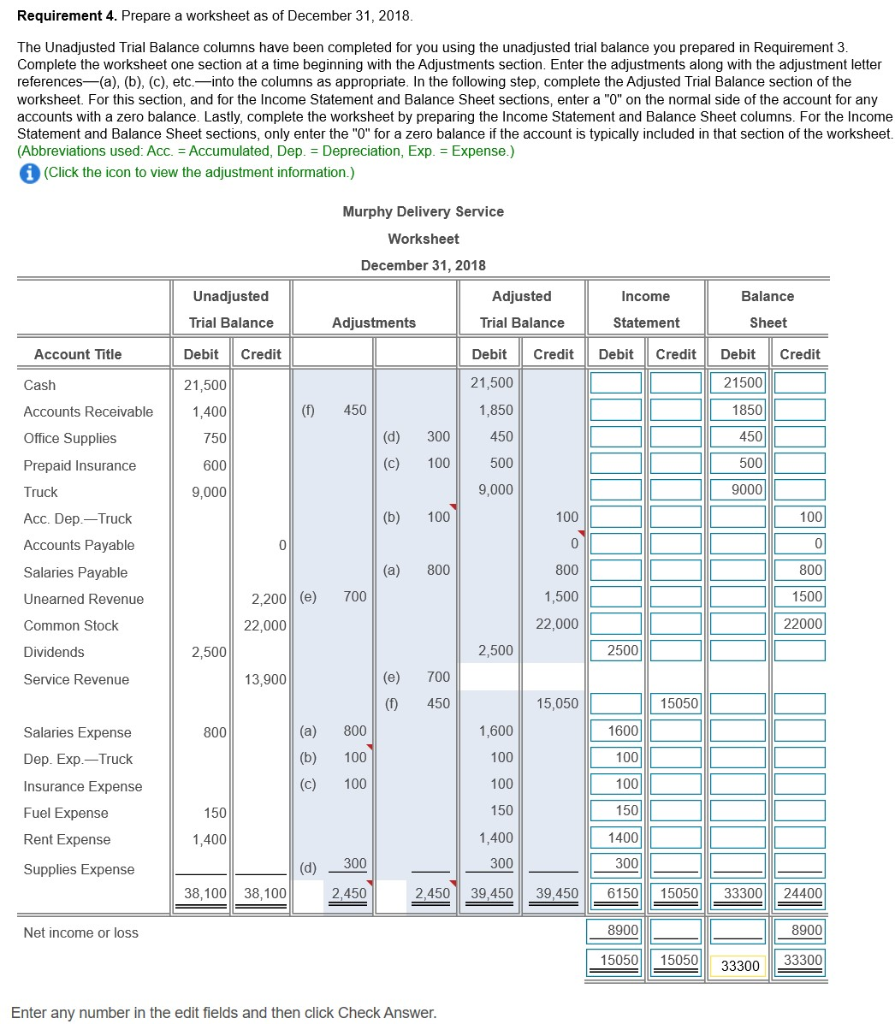

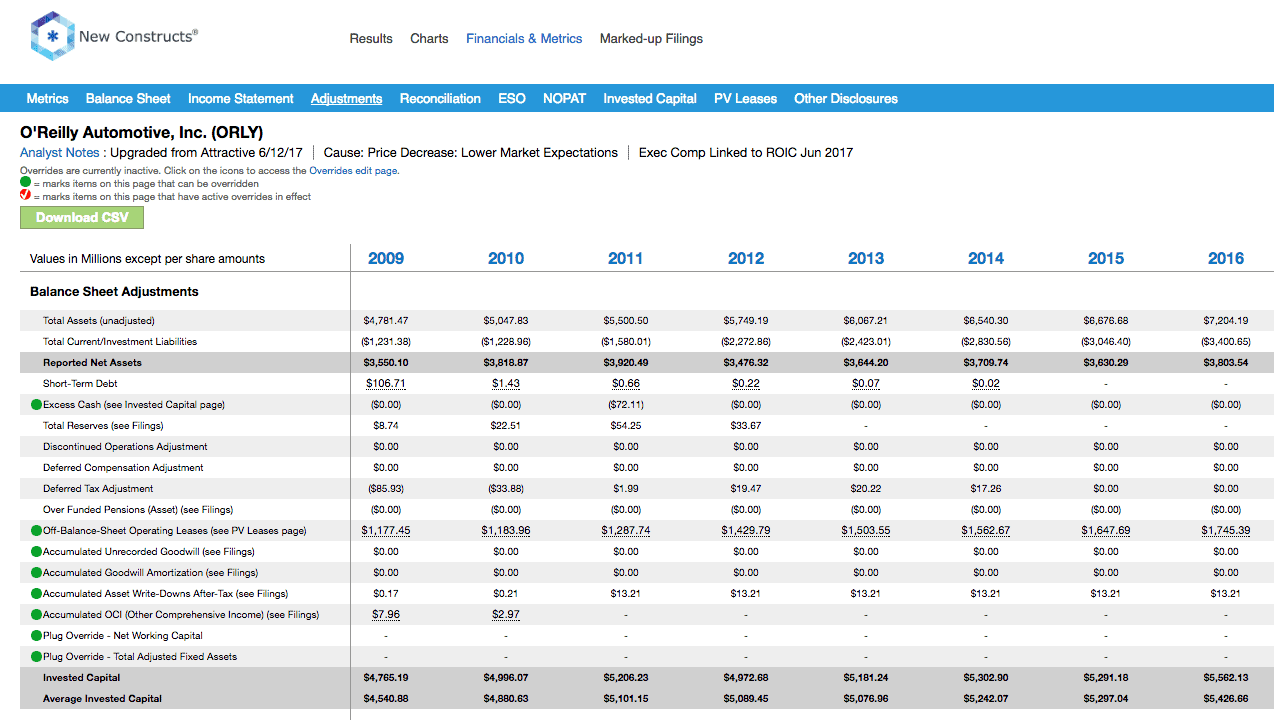

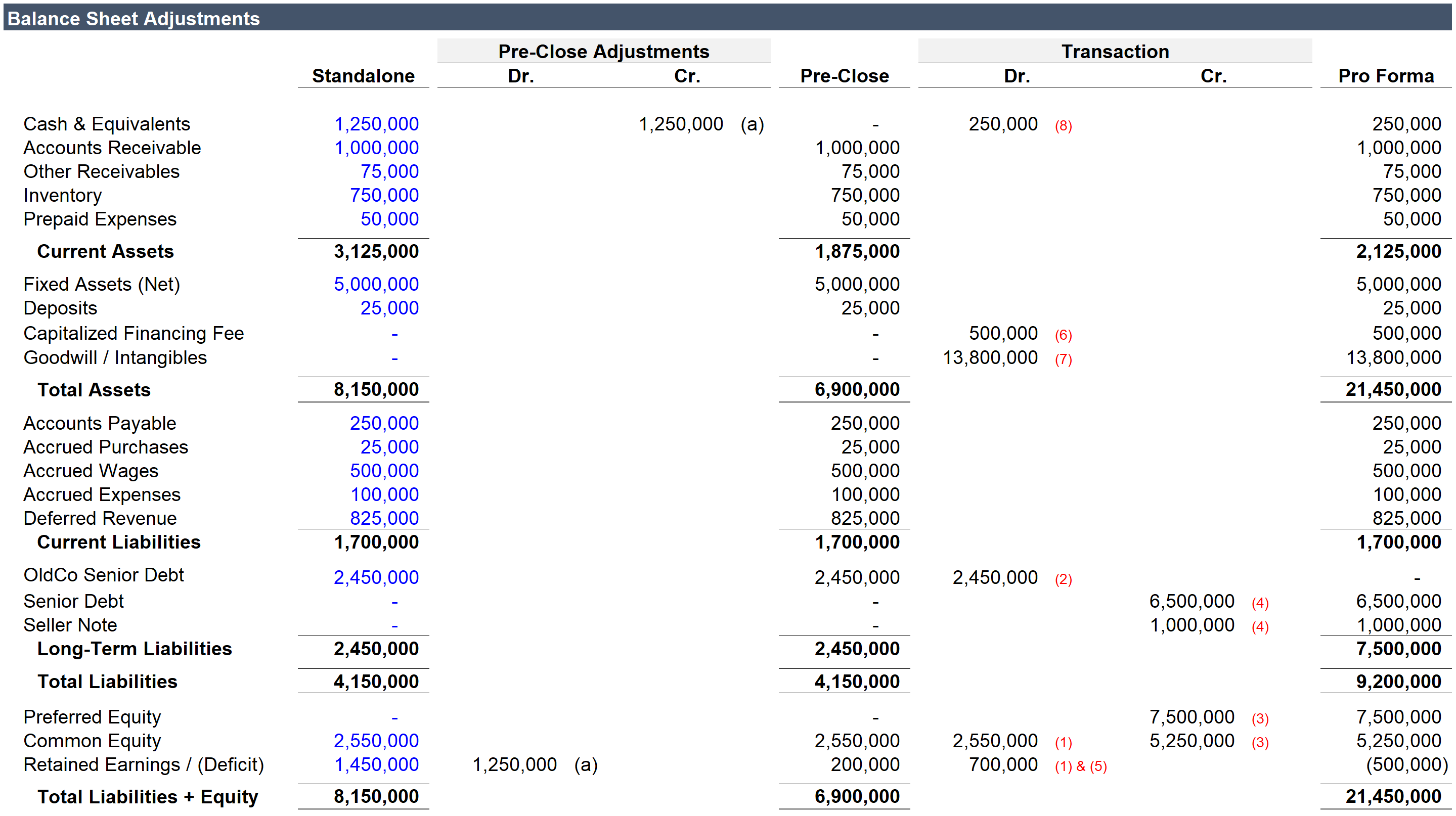

Balance sheet with adjustments. The five column sets are the trial balance, adjustments, adjusted trial balance, income statement, and the balance sheet. Preparing an unadjusted trial balance is the fourth step in the accounting cycle. A reasonable way to begin the process is by reviewing the amount or balance shown in each of the balance sheet accounts.

The five column sets are the trial balance, adjustments, adjusted trial balance, income statement, and the balance sheet. A trial balance sheet, which in itself, is a complete summary of an organization’s transaction gives a clearer picture of it when adjusted to such expenses. Prepare a statement of owner’s equity.

It is an internal document, a. Understand the accounting treatment of the adjustments in trading a/c, profit and loss a/c and balance sheet. Once we have all the data, including all the budgets and last year’s balance sheet, we start to make adjustments.

The adjusting entry records the. It is valued at cost price or market price whichever. If adjusting entries are not made, those statements, such as.

Prepare an opening balance sheet at the date of transition to ifrs (see sd 2.1.3); A trial balance is a list of all accounts in the general ledger that have nonzero balances. Cash will never be in an adjusting entry.

It shows the company’s assets along with how they are financed, which may be by debt,. Receivables and payables in customer and vendor reconciliation accounts; A balance sheet adjustment distributes:

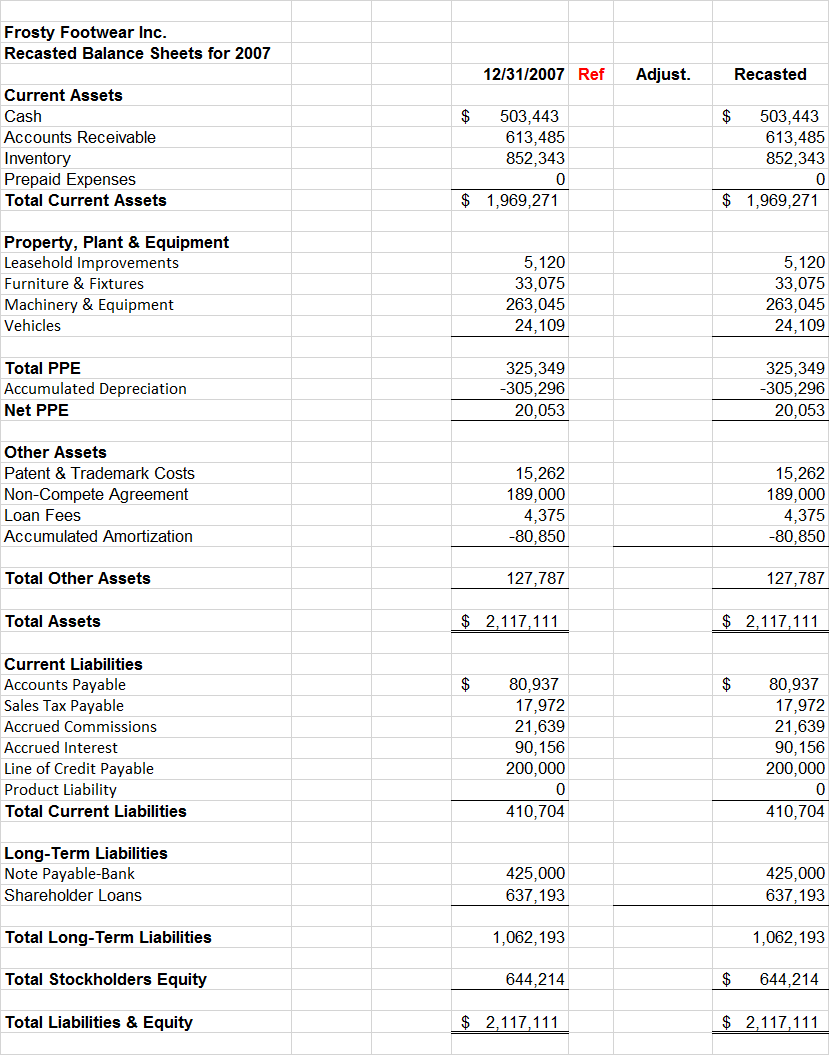

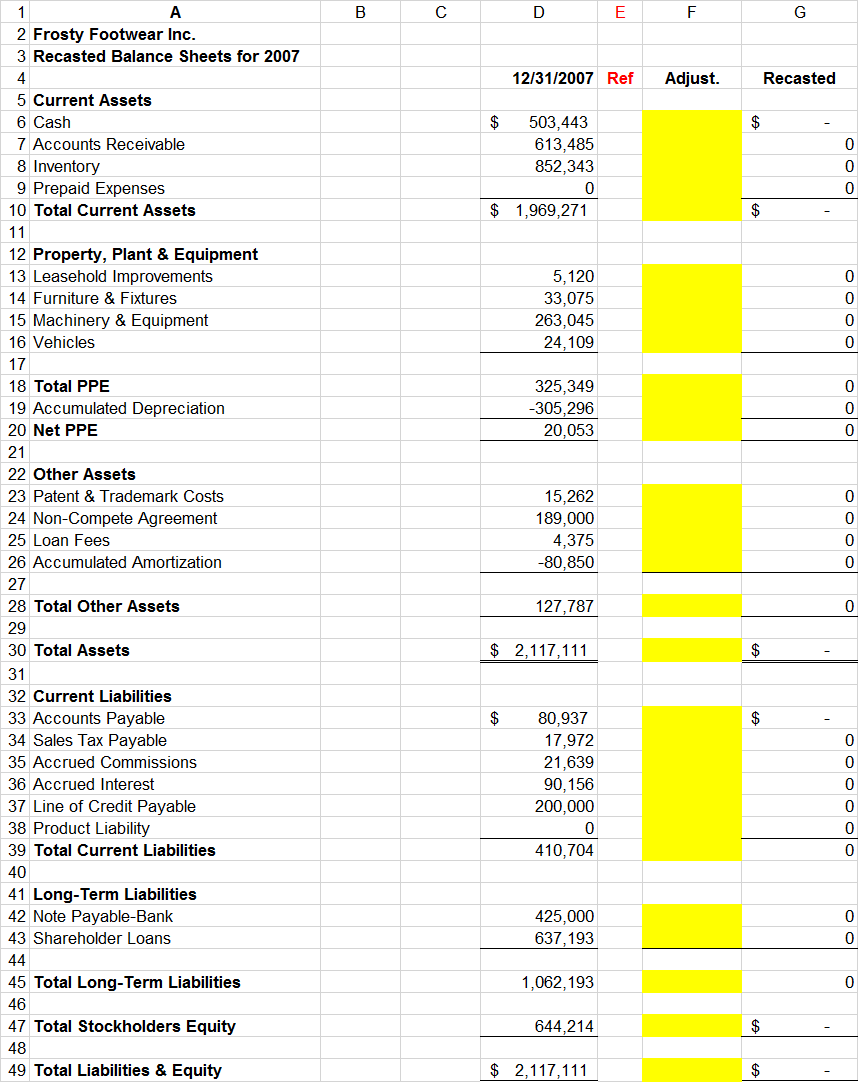

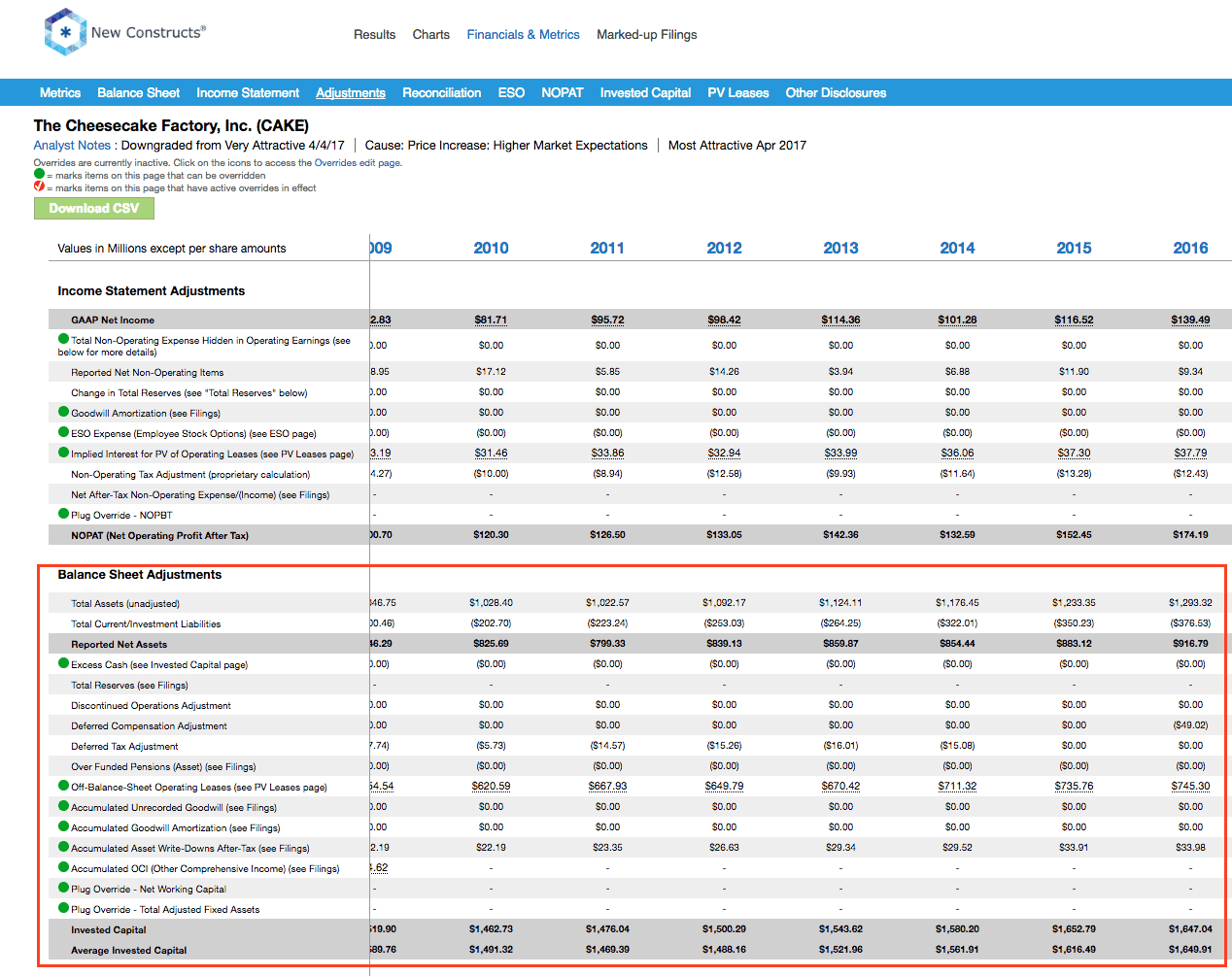

Prepare an income statement. We first jointly model firms' ability to. Balance sheet adjustments means adjustments that reflect (unless already reflected in the projected closing balance sheet and the closing balance sheet), as applicable) (i).

Identify the first ifrs financial statements; This article explains how to treat the main possible post trial balance adjustments, including: The number of goods that remain unsold at the end of the financial year is called closing stock.

A balance sheet summarizes your firm’s current financial worth by showing the value of what it owns (assets) minus what it owes (liabilities). We will use the following preliminary balance. Many candidates struggle with certain adjustments in the exam.

Making adjustments to real balance sheet. Select accounting policies that comply with ifrs. The balance sheet represents the financial position of a business at any given point in time.