Painstaking Lessons Of Tips About Financial Projection For Startup

Essential components of effective startup financial projections.

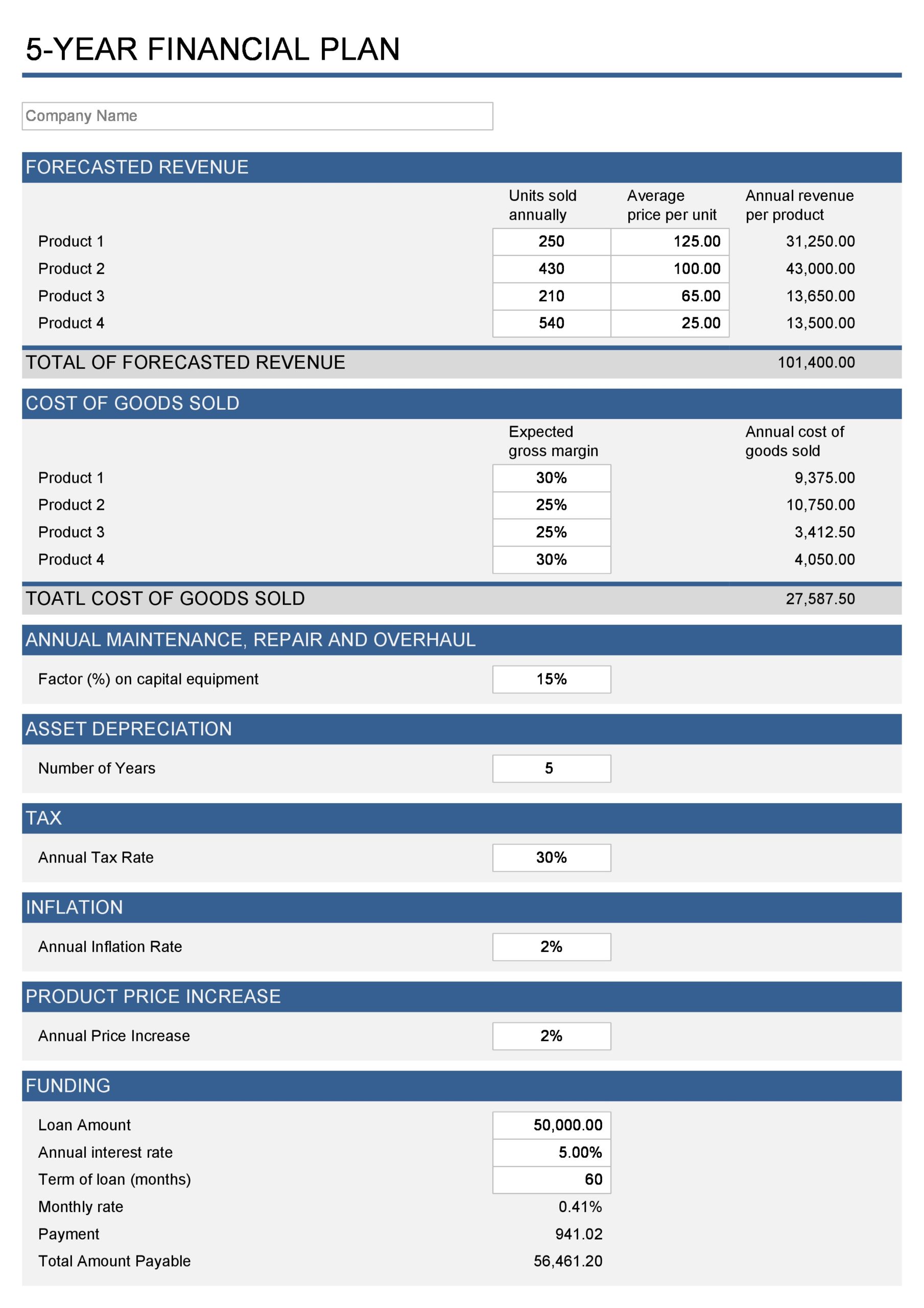

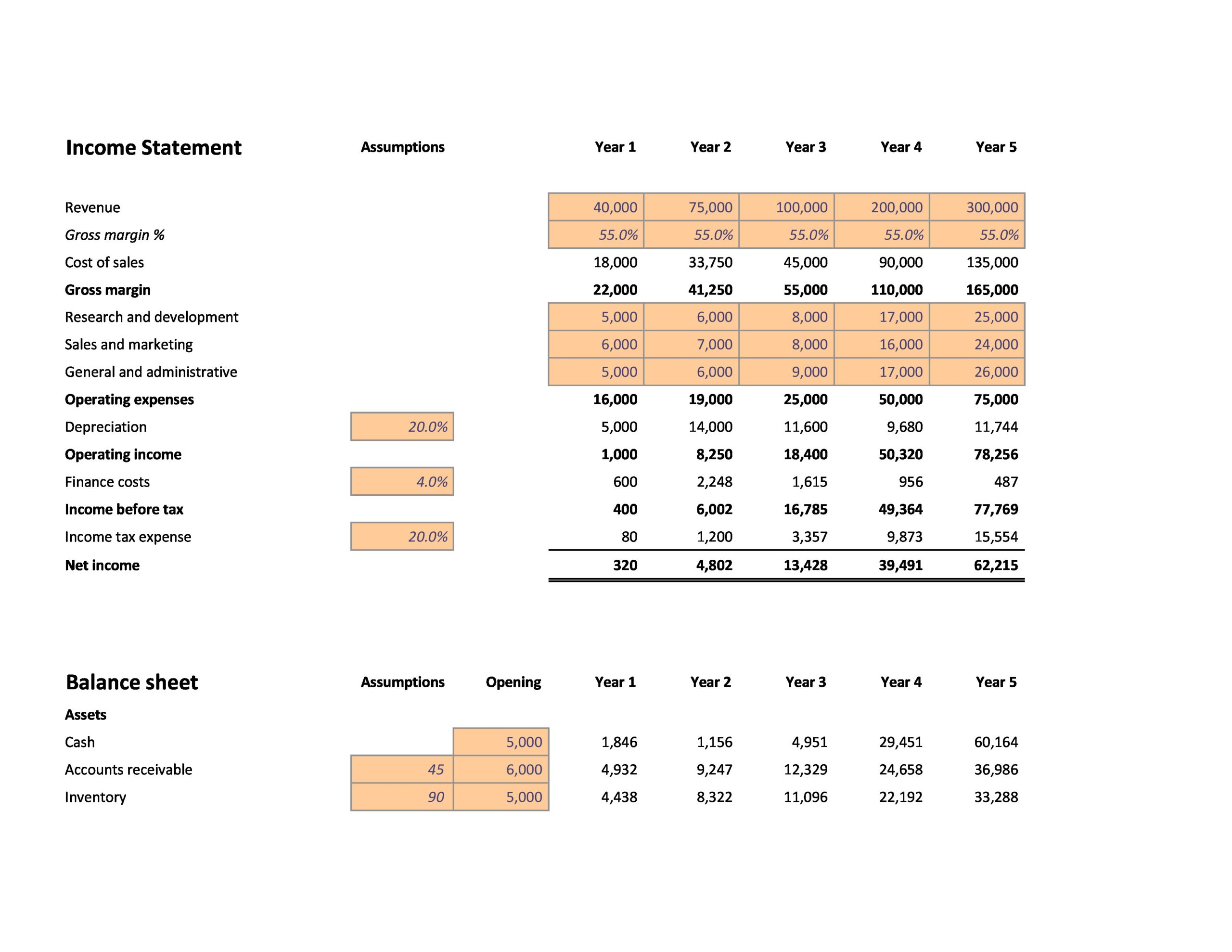

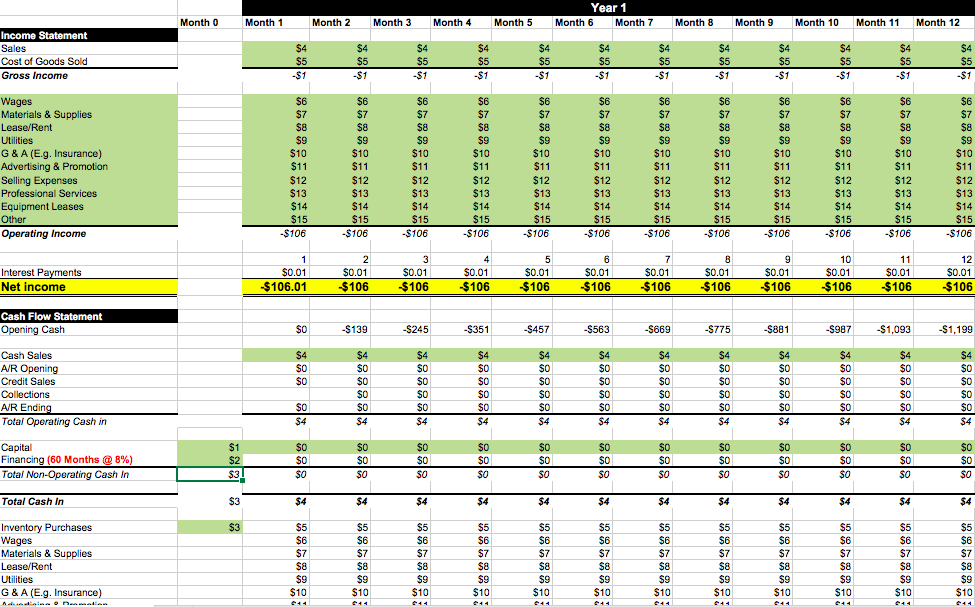

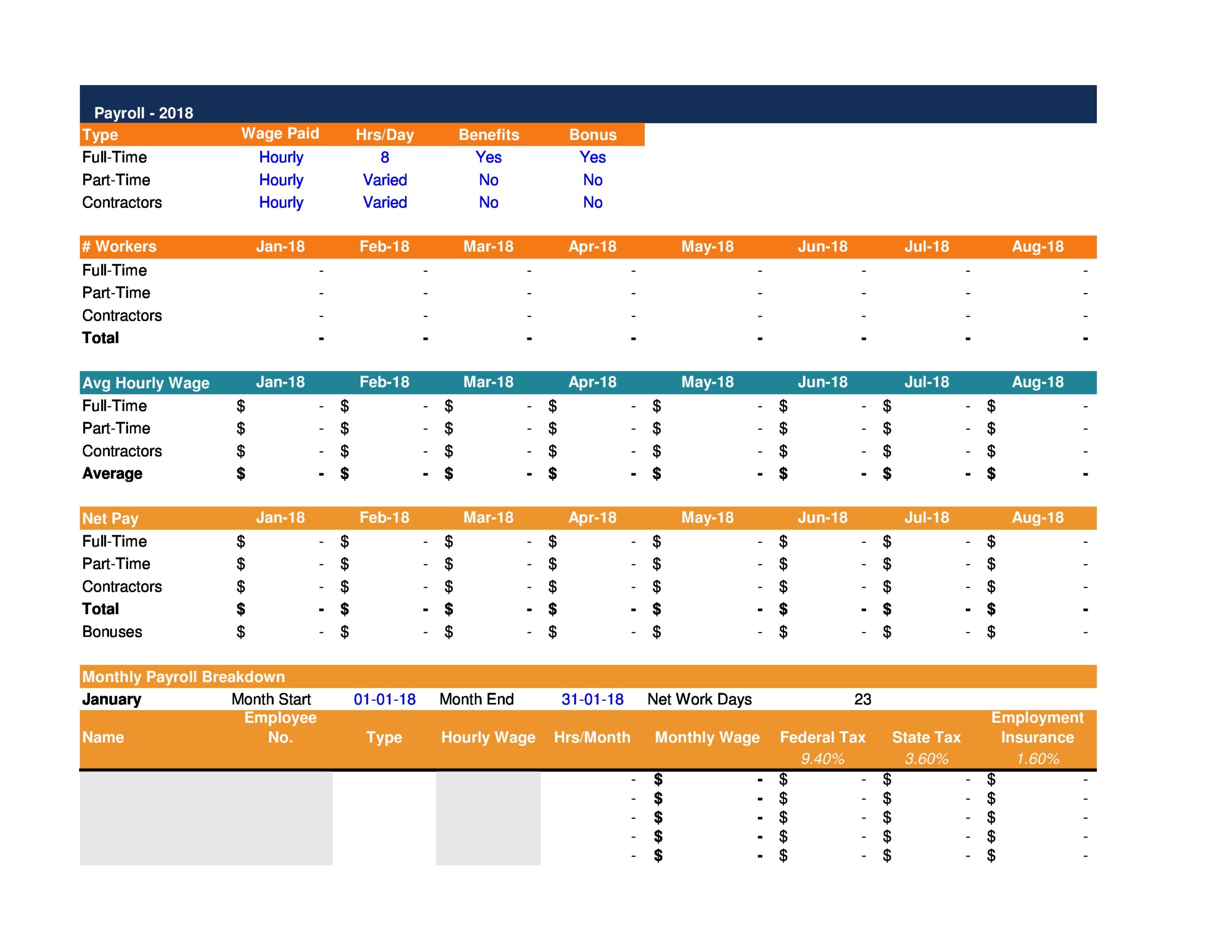

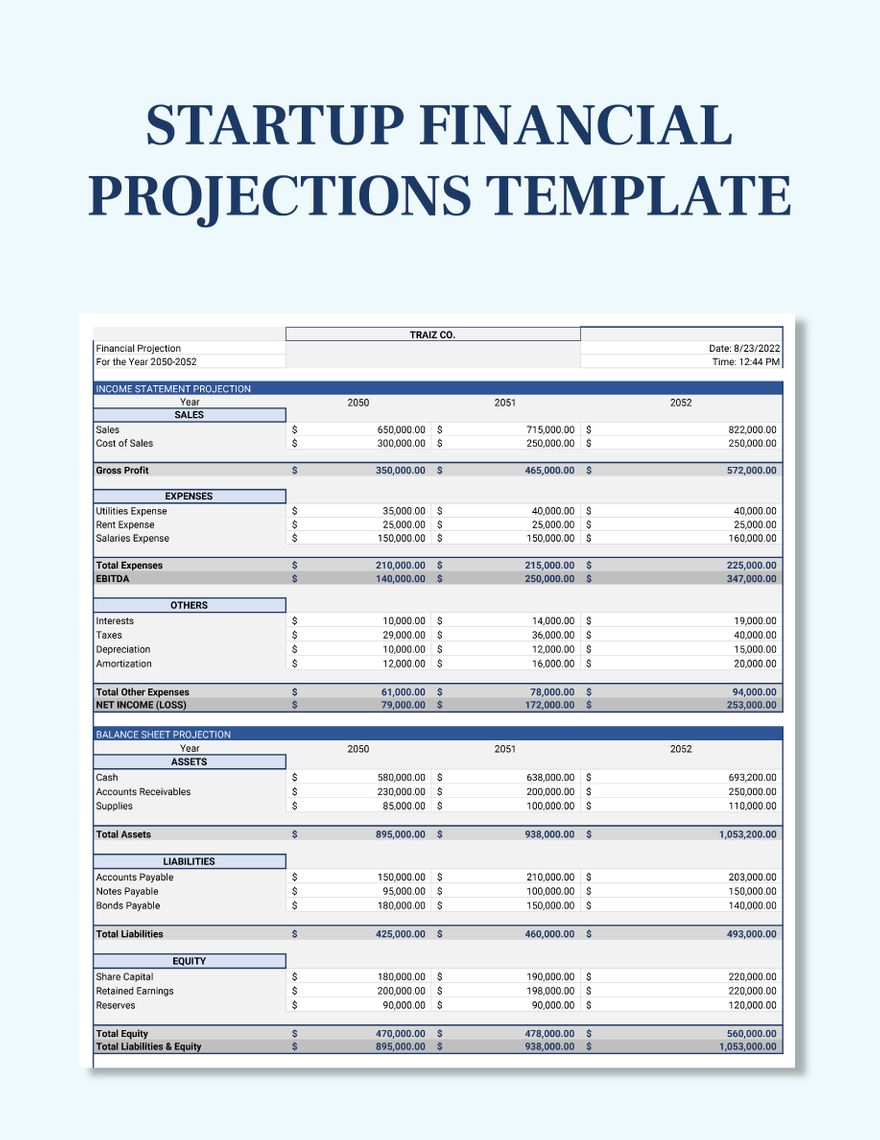

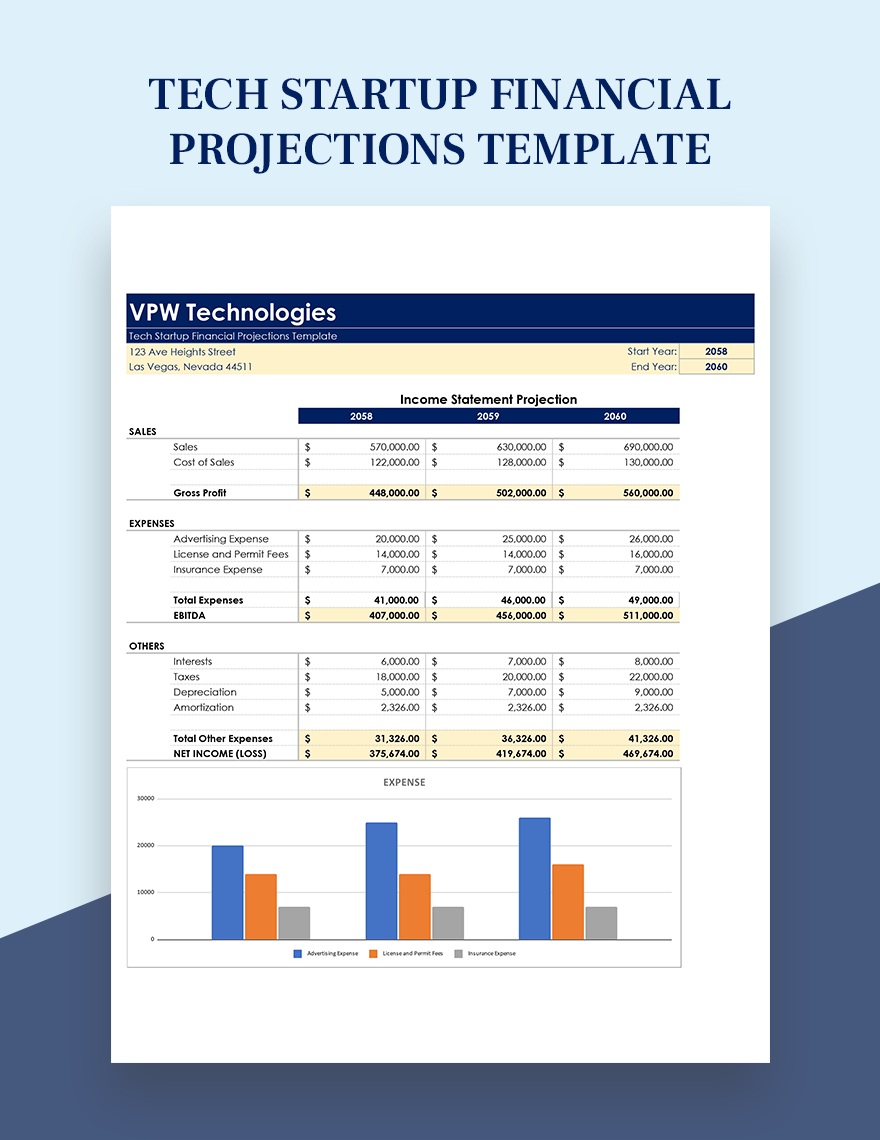

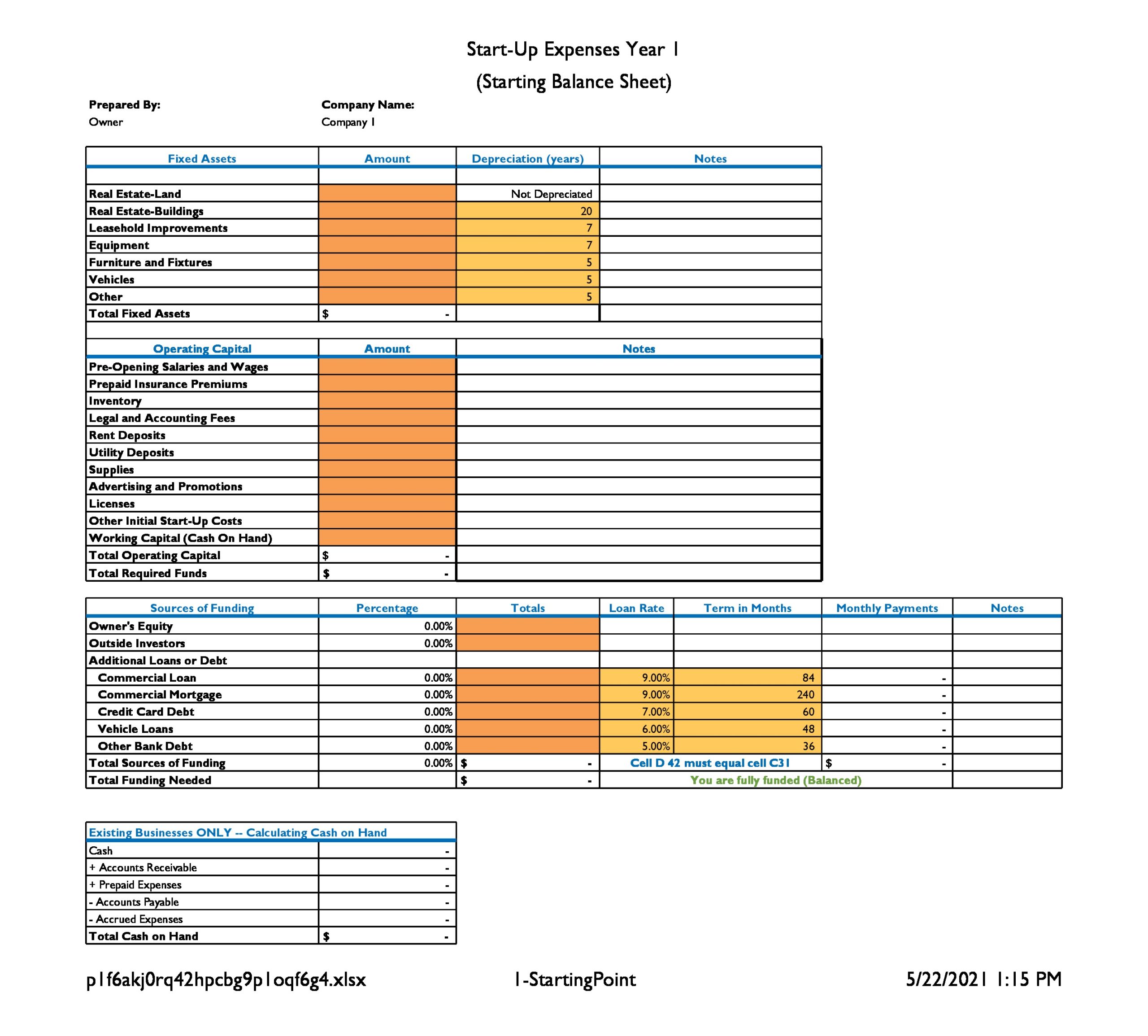

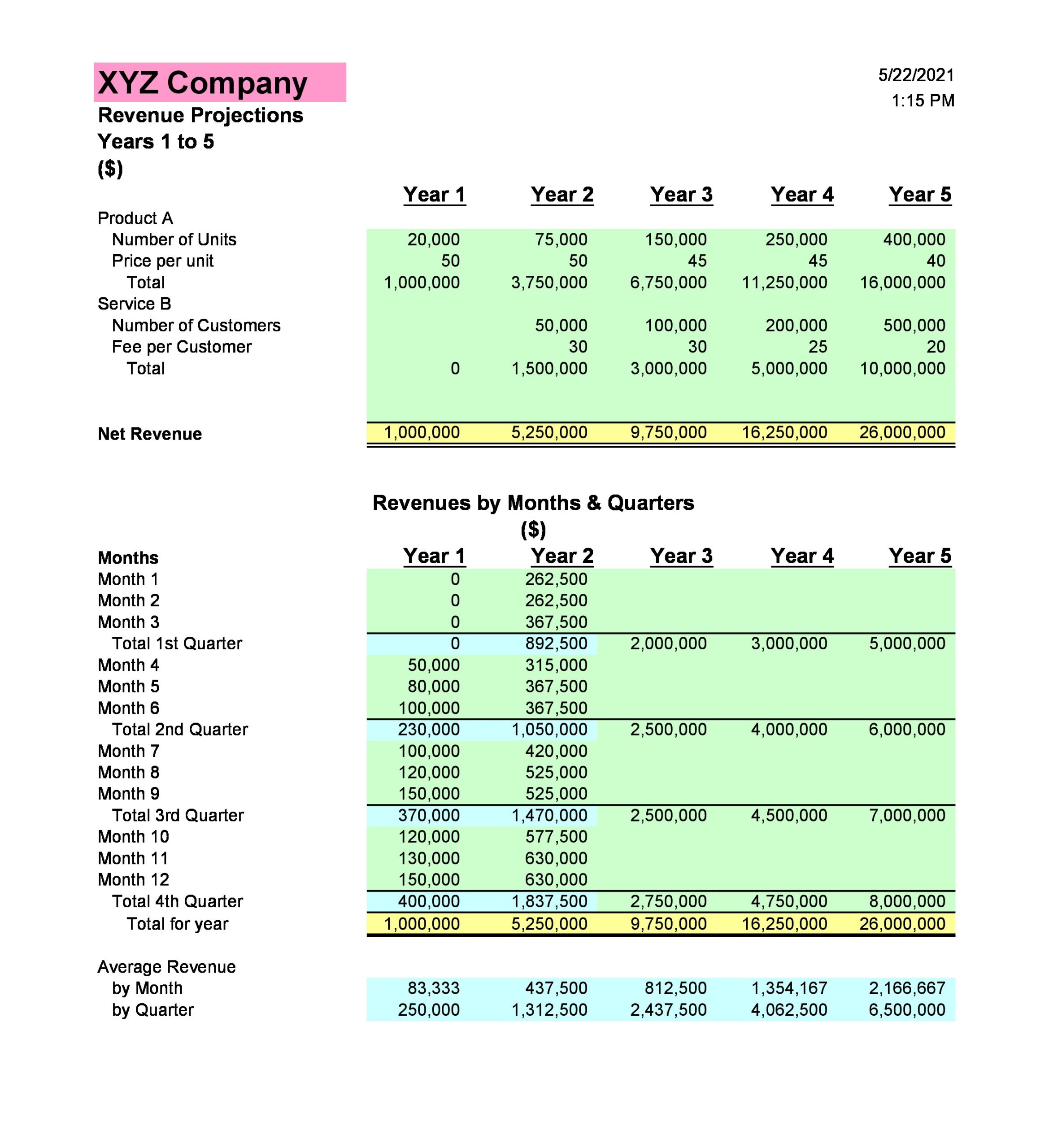

Financial projection for startup. Startup financial projections template. Realistic projections help you build a financial plan for your startup business. Determine the goal of the projections.

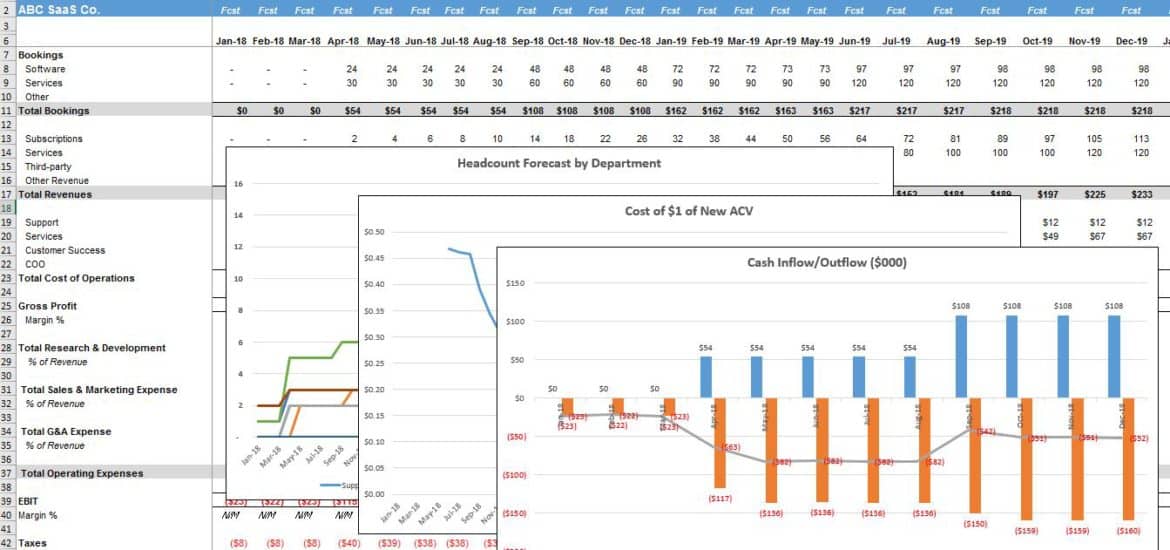

Determine the kpis for your company that will drive, and be outputs, of the spreadsheet. Outside the company’s proverbial four walls, financial statements demonstrate business performance to shareholders, investors and lenders while financial models and. On wednesday, nvidia reported that revenue in its fiscal fourth quarter more than tripled from a year earlier to $22.1 billion, while profit soared nearly ninefold to $12.3 billion.

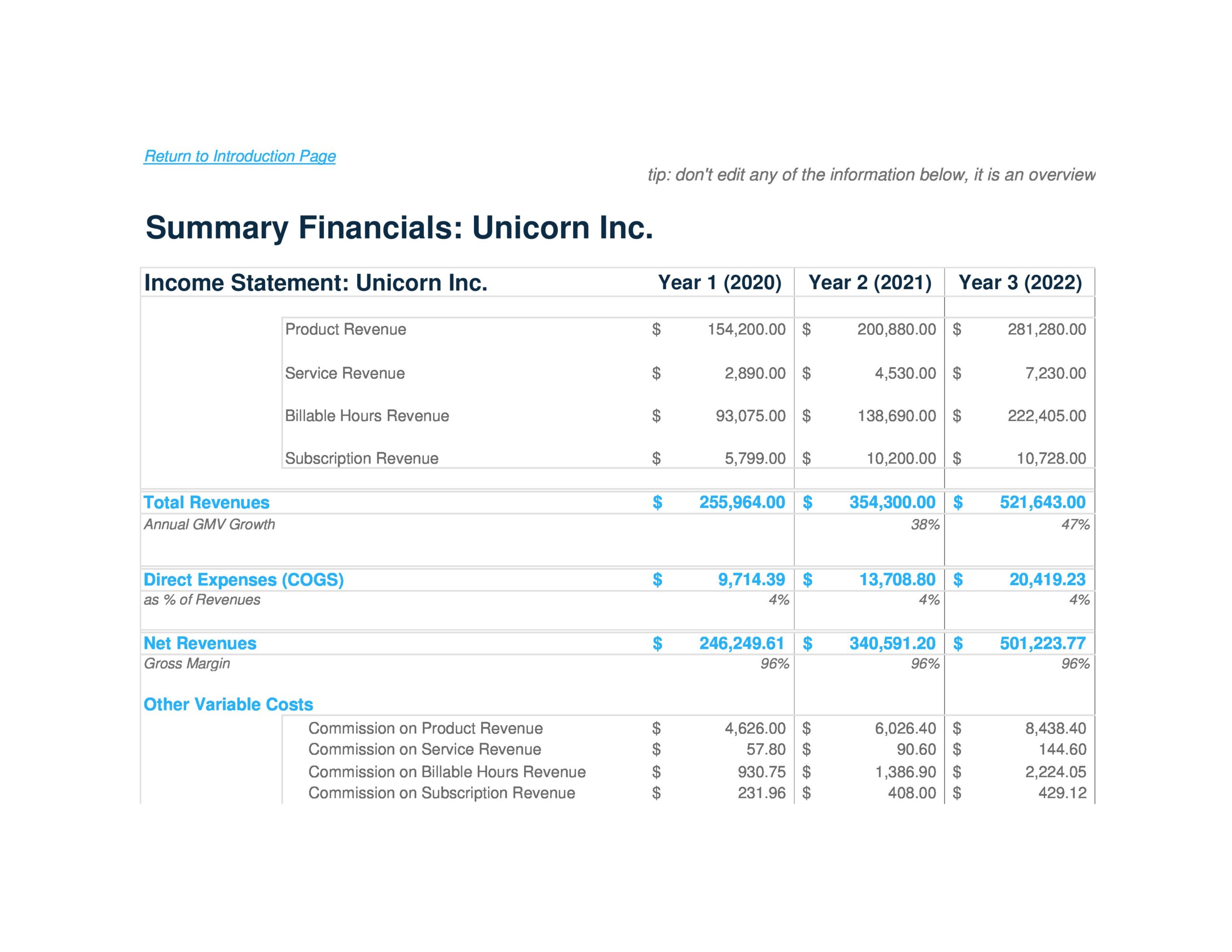

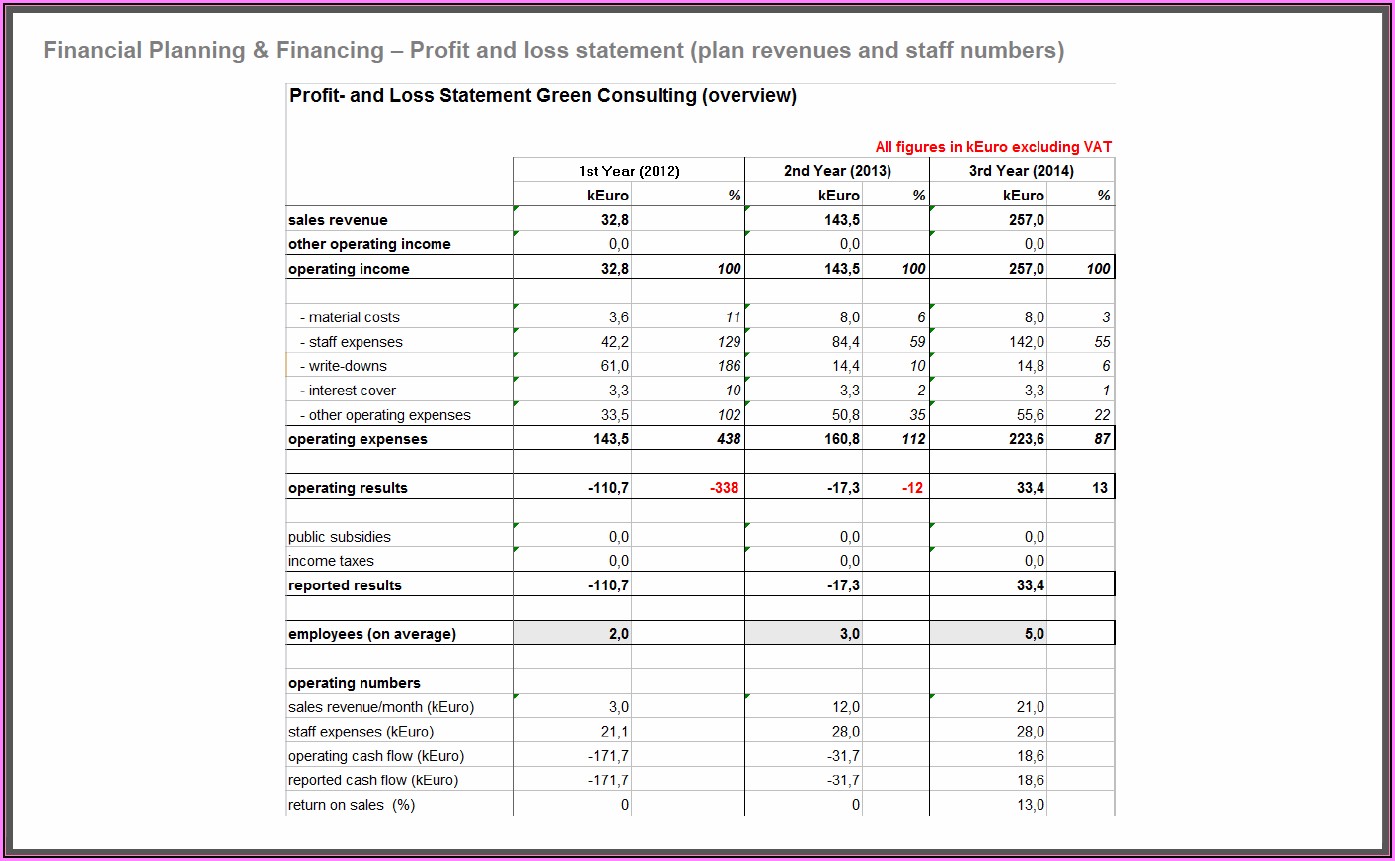

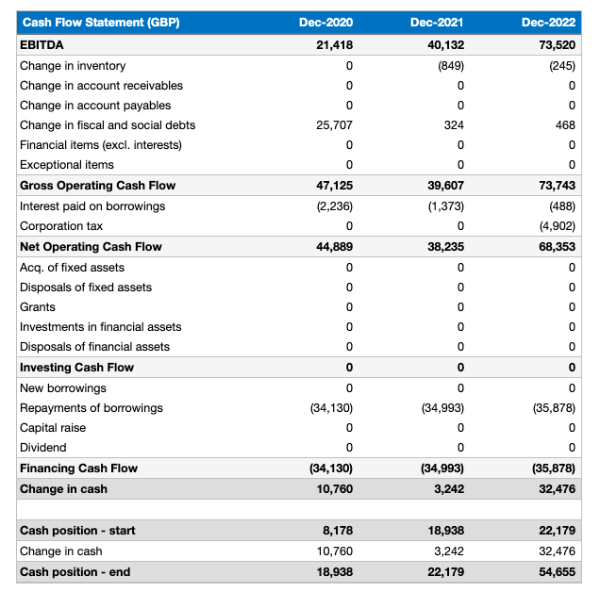

Financial projections paint a picture of your company’s financial performance today and in the future. It forecasts estimated cash flow, sales, expenses, profit and other financial results you plan to achieve. At the core of every startup, financial projections act like a heartbeat, reflecting the vital signs of your business.

They often include different scenarios to see how changes to one aspect of your finances (such as higher sales or lower operating expenses) might affect your profitability. In this article, we explain what financial projection for a startup is, discuss its key elements, provide steps to build one and give tips to do so successfully. Startup financial projections form the basis of business strategy.

Start with the basics, and layer on details as you go. They help you monitor cash flow, change pricing or alter production plans. With the start of spring practice less than two weeks away, here is an early projection for kansas state football's 2024 depth chart.

We’ve zipped and zoomed through the intricacies of financial projections for startups, and hey, if it feels like your brain just ran a marathon, that’s okay. A startup financial model forecasts your company’s financial performance based on its current data, assumptions, and projections. Sound financial projections give startups and established businesses a significant boost in making informed decisions and preparing for unexpected events.

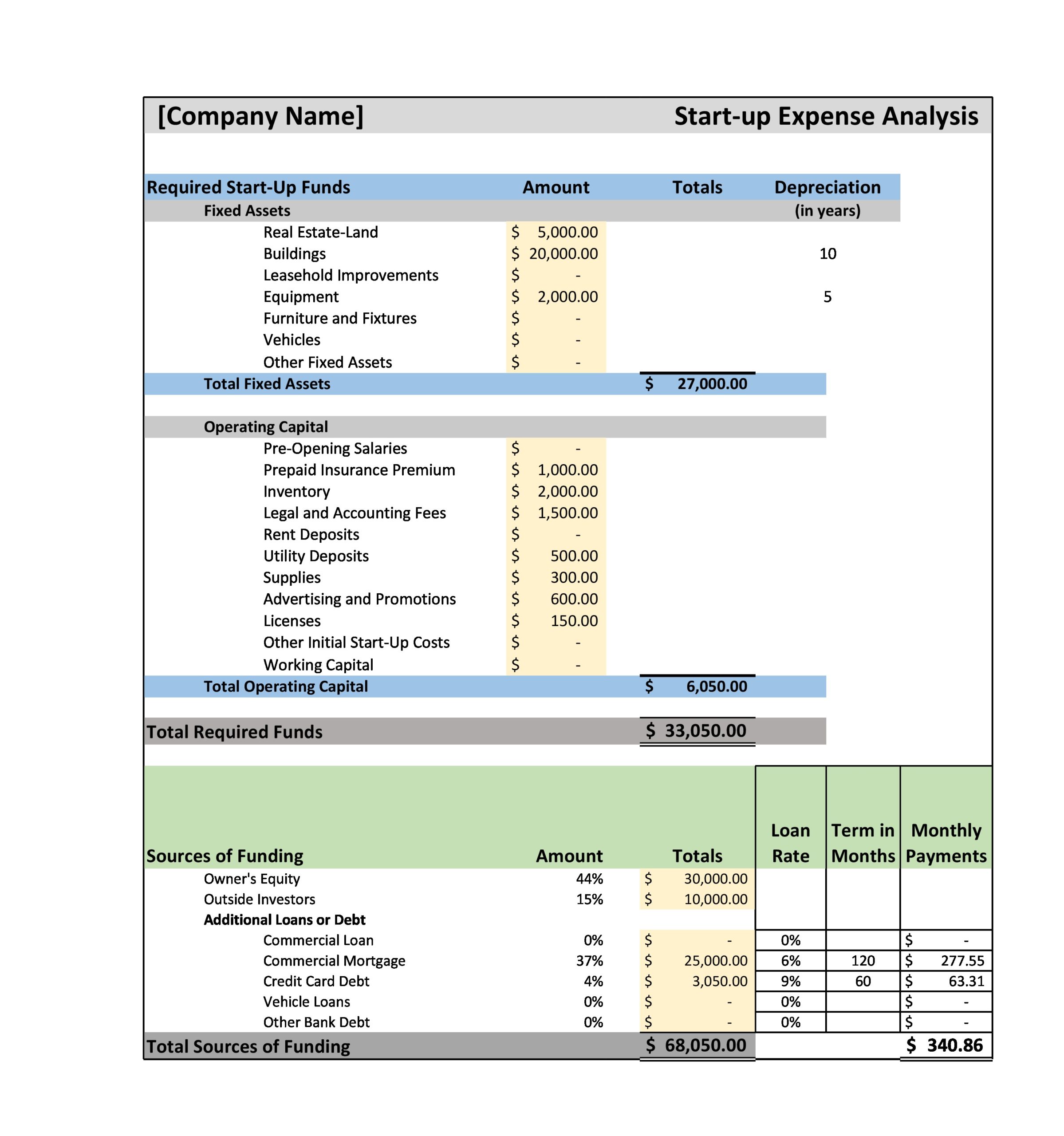

This can ultimately lead to your business running out of cash. A startup’s financial projection represents the future income and outgoings of the company alongside historical data as a reference. It’s a roadmap for your startup, helping your founding team, stakeholders, and potential investors understand the financial trajectory of.

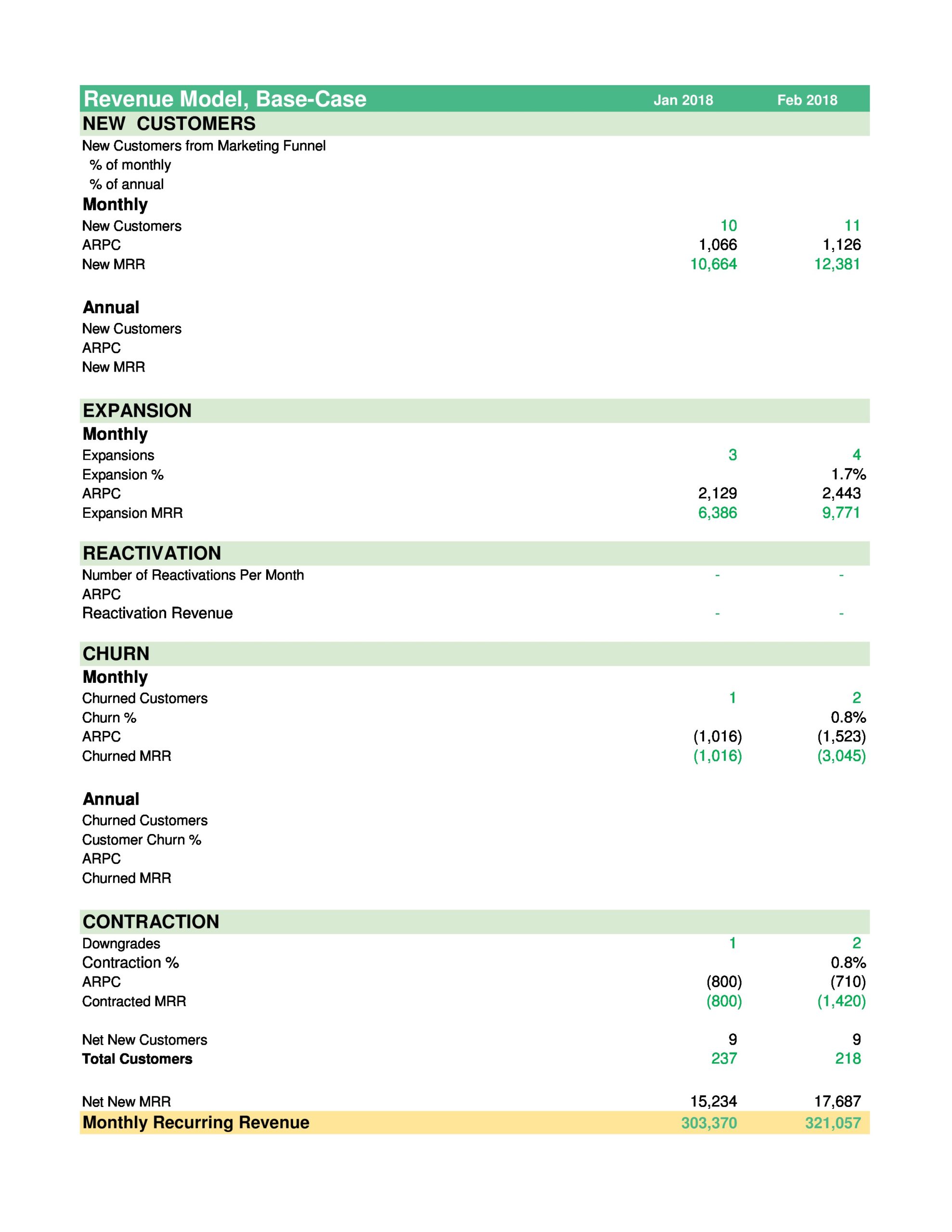

Most financial models fall into one of two categories: Financial projections and financial forecasting provide a view into the future financial health of your startup. Revenue levers are the various opportunities to earn revenue.

Why are financial projections so important for startups and small businesses? If you don't plan accurately for your startup, you may end up spending more money than you earn. As you grow and evolve, your financial projections for startups will likely become more intricate.

The group, based on the concession agreement, will pay an upfront payment of p30 billion and p2 billion annuity pay aside from the revenue. These projections are typically based on a set of assumptions and are used to help businesses plan for the future and make informed decisions about investments, financing, and other strategic matters. To complete financial projections, startups can use current and historical financial statements and external market information such as reports from government agencies such as the department of labour or market and industry projections from consulting firms.