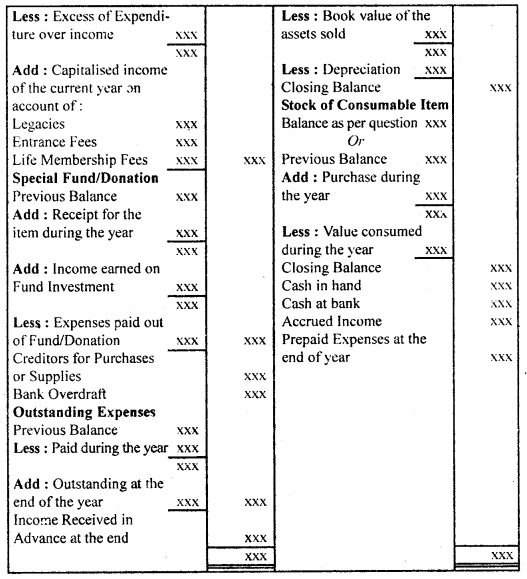

Exemplary Info About Accounting In Not For Profit Organisation

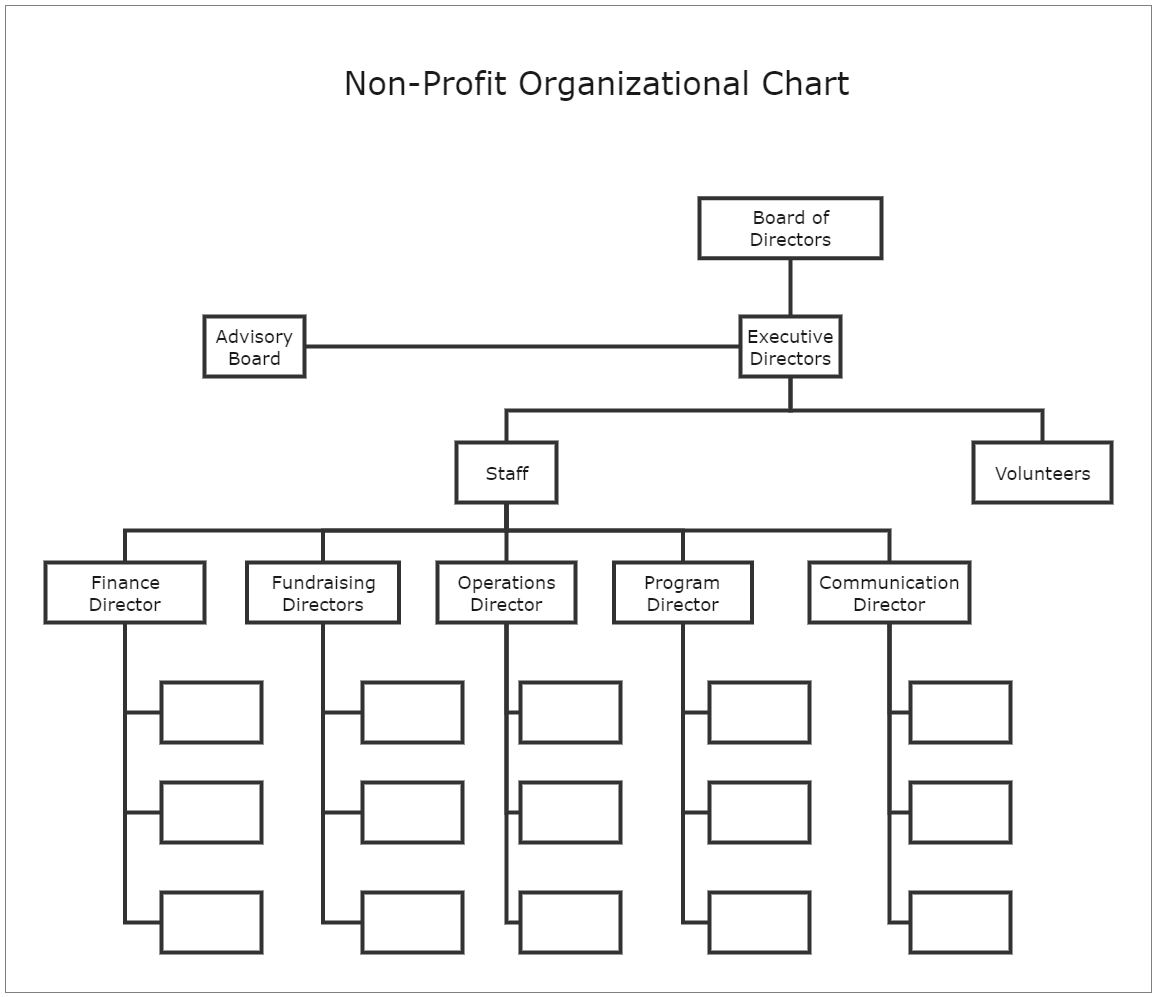

Governing body is a term used to describe those persons who direct.

Accounting in not for profit organisation. An organisation that is an entity operating for its purpose and not for the profit or gain (either direct or indirect) of individual members2. Bearing in mind the important role of npos and with the objective of ensuring accountability and transparency for npos and their operations, the research committee of the. Charities are established for general or specific philanthropic purposes.

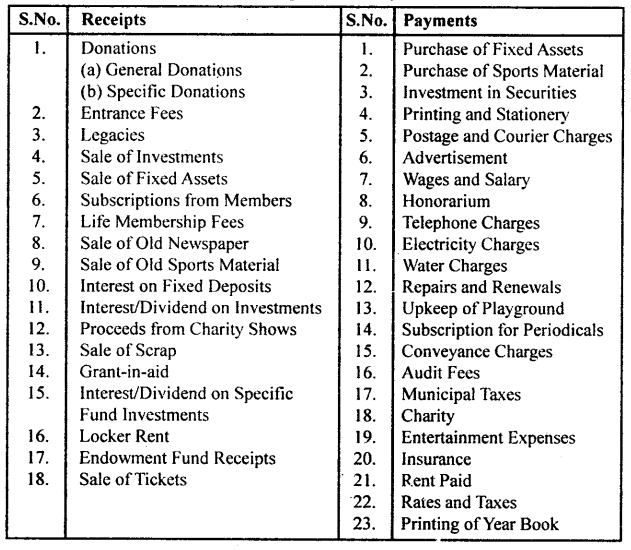

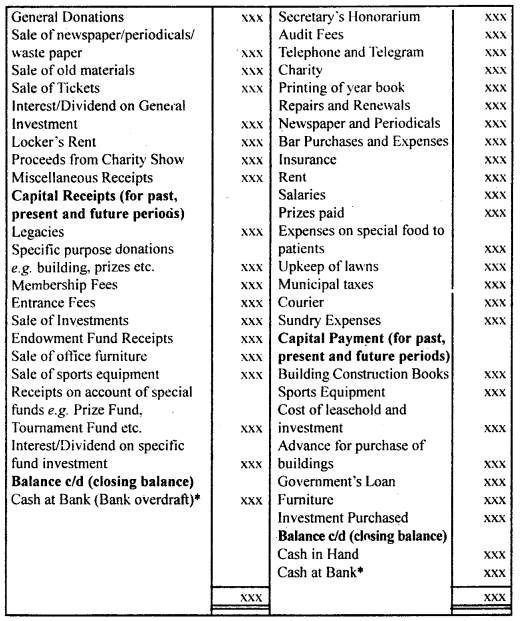

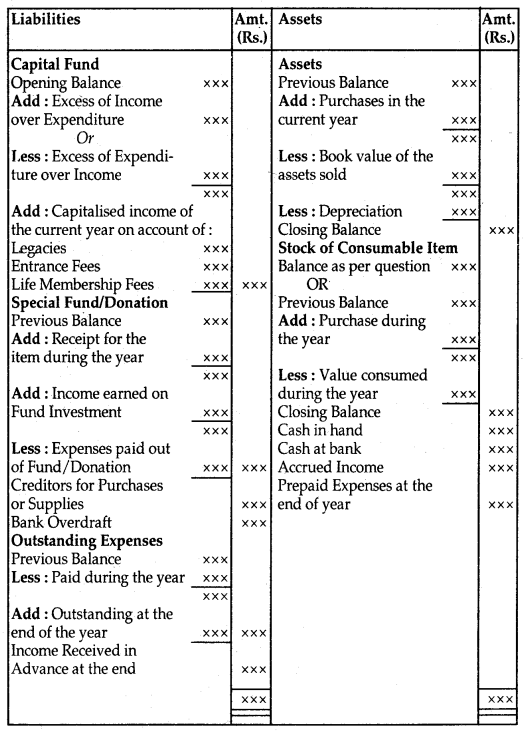

In nonprofit accounting, you should create financial statements to report your business’s finances. How nonprofit accounting is different as we mentioned before, nonprofit accounting focuses on the accountability aspect of finances. 1300 144 113 or [email protected].

Overview everyone working in nonprofit accounting and finance should have a strong grasp of reading and understanding nonprofit financial statements. First, nonprofits are just that: Guidance resources when it comes to asnpo, the search is over.

At the fundamentals level, these include. Get free, practical guidance on accounting and. They use all their revenues to achieve their mission.

Known in the accounting world as a public benefit entity (pbe), cics are at liberty to make a profit and act just like any other business as long as they comply with. Best overall nonprofit accounting software. In order to provide guidance on accounting treatment to be followed in case of various types of transactions carried out by npos as well as to impart uniformity in the diverse.

They are one type of not‑for‑profit. Nonprofit accounting uses specific language and designations to note funded activities and create reports to show donors how their money is being used: The term ‘charity’ refers to the practice of benevolent giving.

Nonprofit accounting is a type of accounting that differs from others in specific ways.