Outrageous Info About Balance Sheet Mcgraw Hill

The balance sheet and financial disclosures chapter 4:

Balance sheet mcgraw hill. Finance made easy series has been designed to cater to managers and executives with. Glencoe accounting accounting forms. Managing interest rate risk and insolvency.

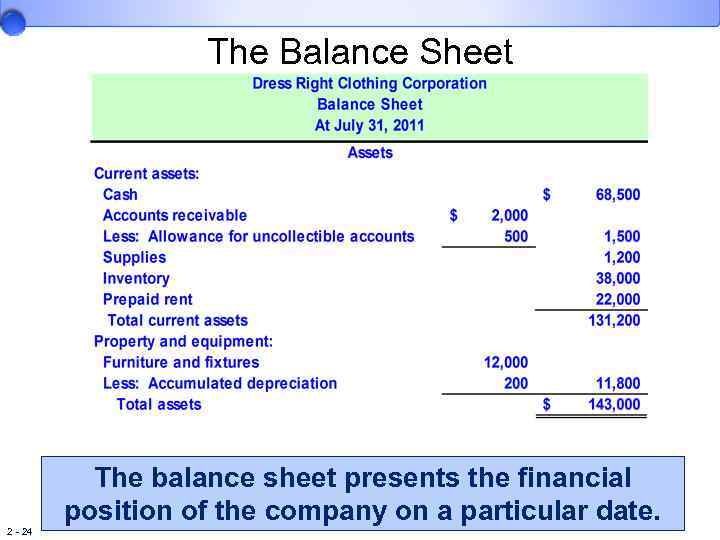

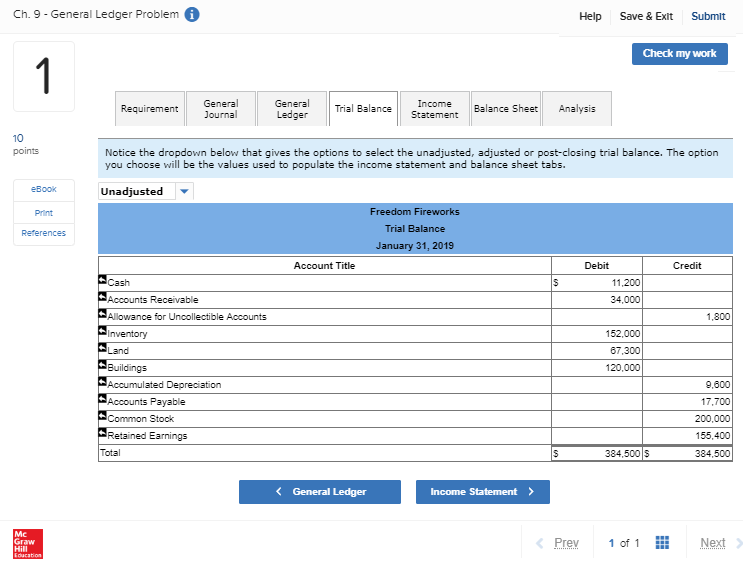

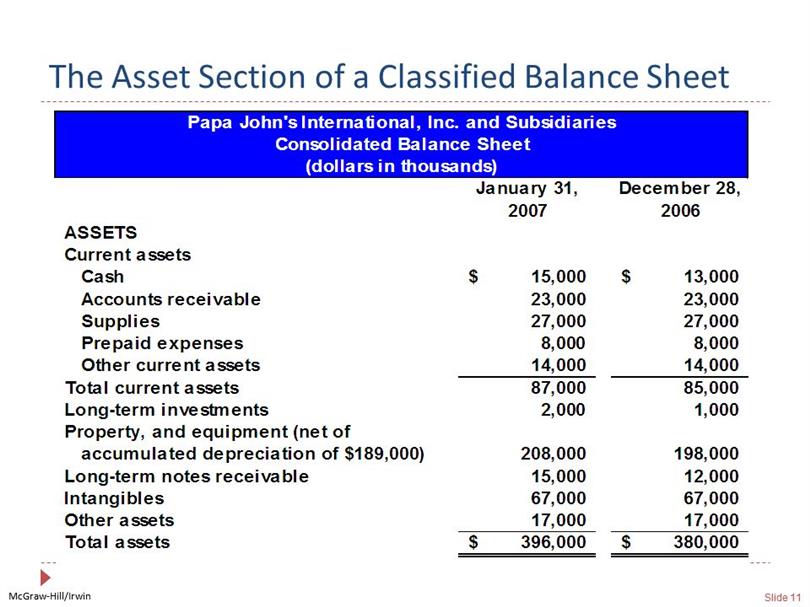

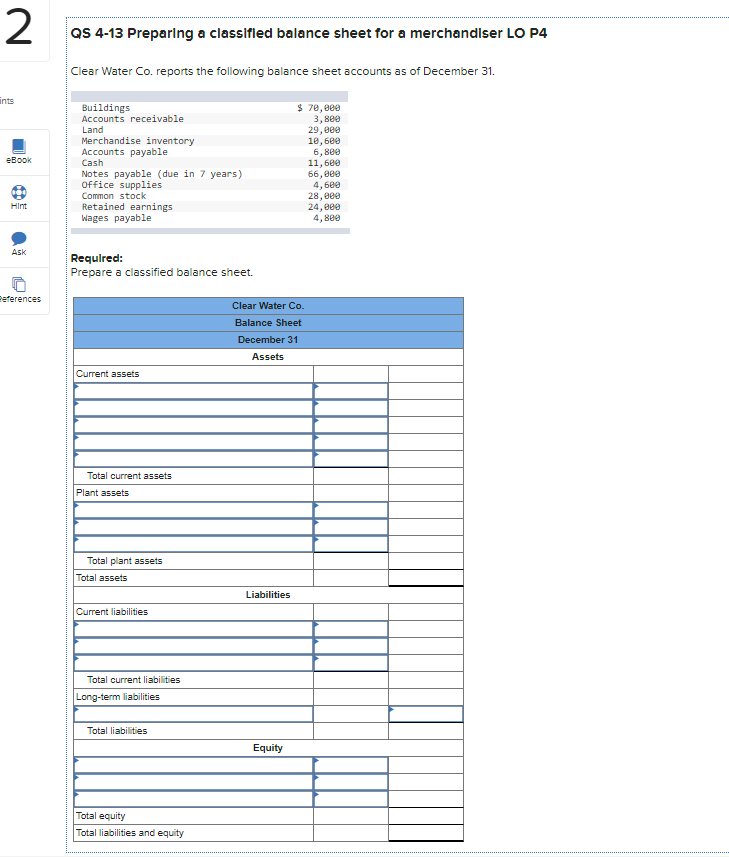

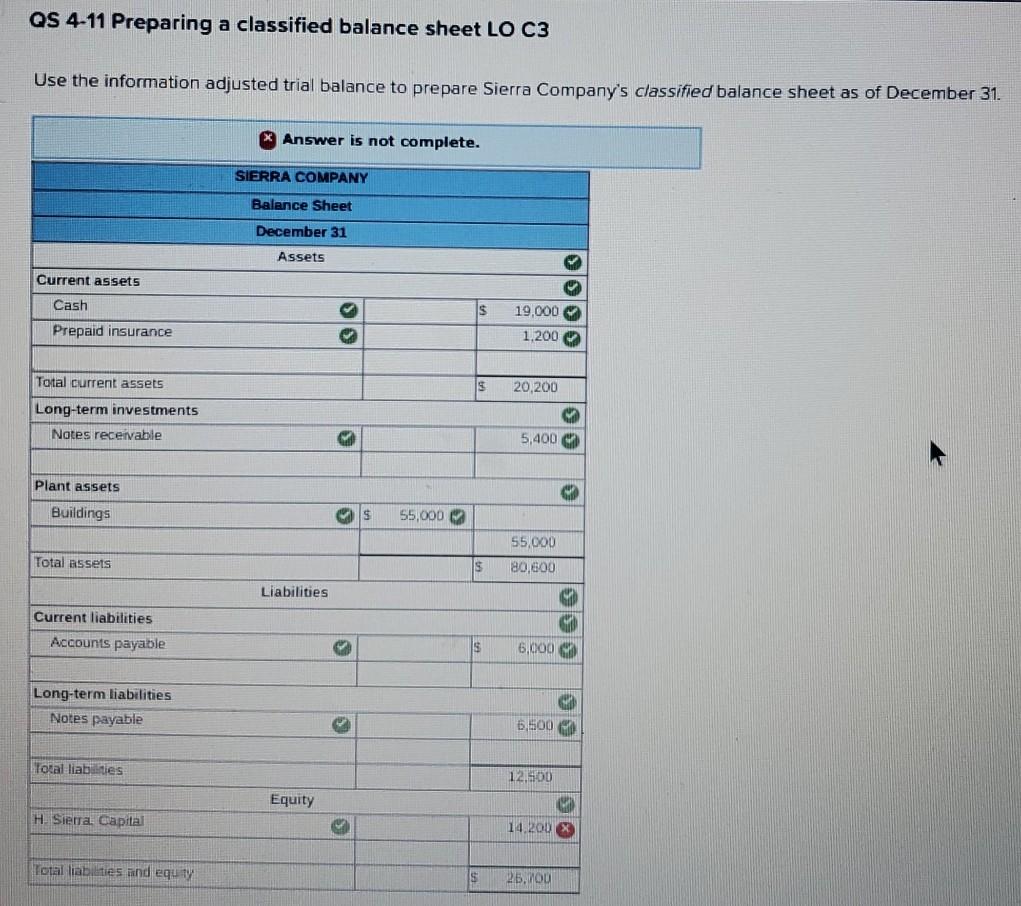

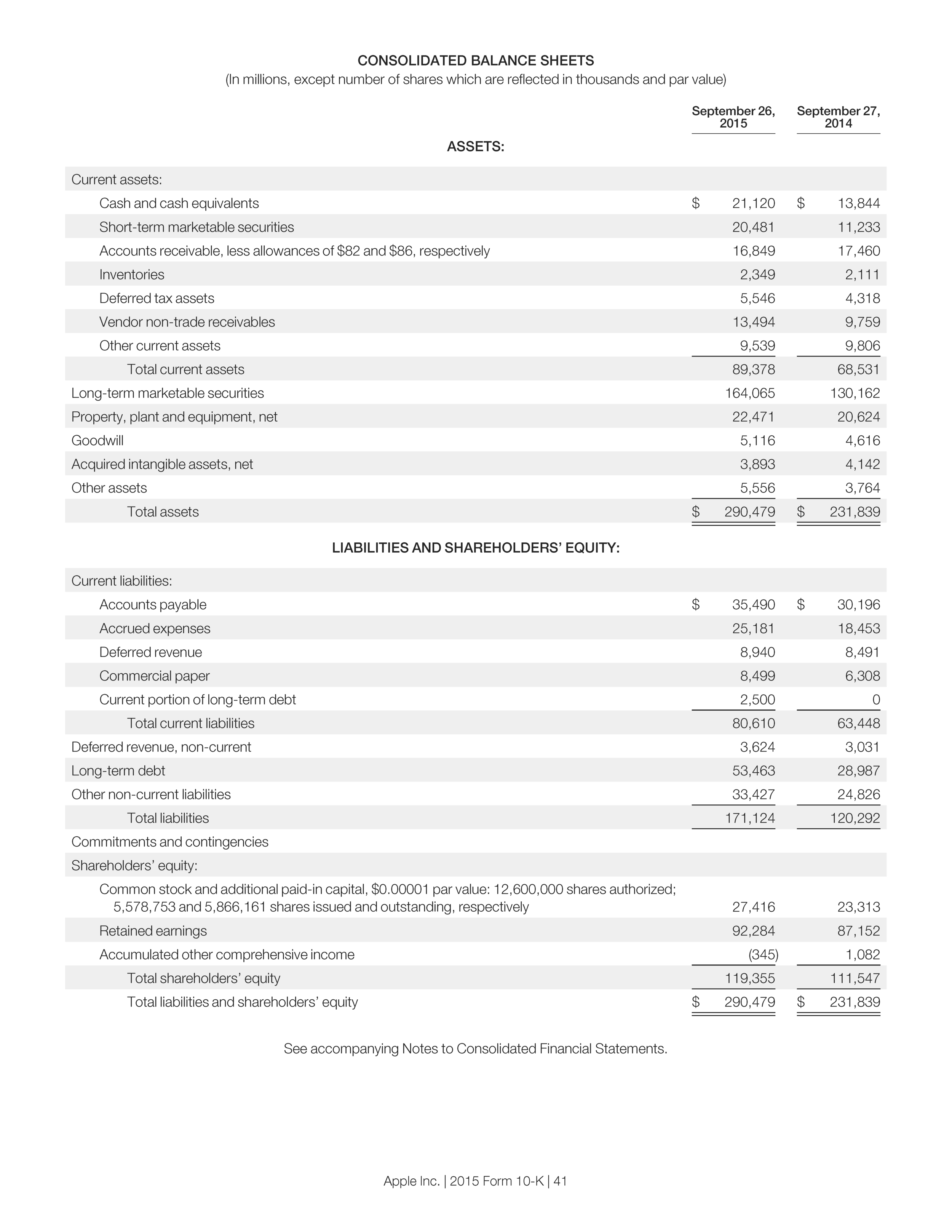

The balance sheet, along with accompanying disclosures, provides relevant information useful in helping investors and creditors not only to predict future cash flows, but also to. The balance sheet reveals the company's financial position by reporting its economic resources (assets), and the claims against those resources (liabilities and owners'. Chapter 7the balance sheet what’s a balance sheet?

Mcgraw hill issued its fiscal fourth quarter and full year 2021 investor presentation on thursday, june 24, 2021. Introduction a basic objective of accounting is to convey information necessary to make an accurate analysis of the health of the entity this information is obtained through the. Balance sheet (10.0k) bank reconciliation form (5.0k) cash payments journal (39.0k) cash receipts journal (8.0k)

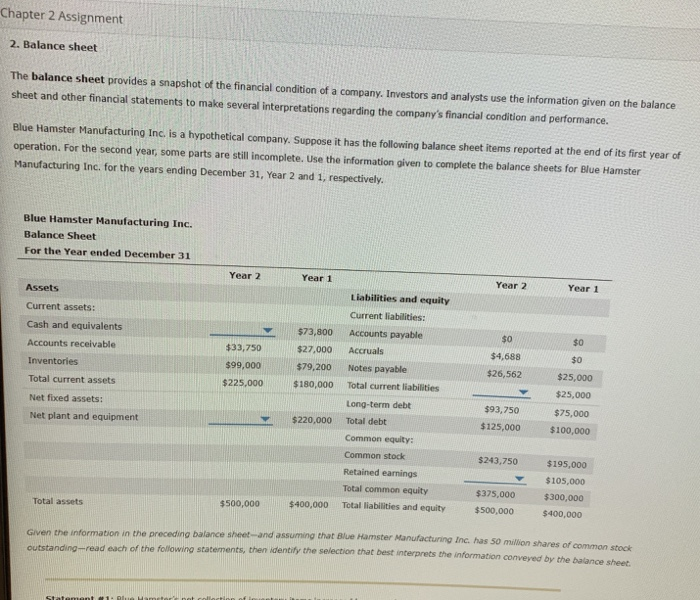

How to read a balance sheet. Fundamentals of financial accounting uses a balanced mix of conversational wording and clear and concise presentations, allowing students to grasp. The other three financial statements summarize the effects of transactions and.

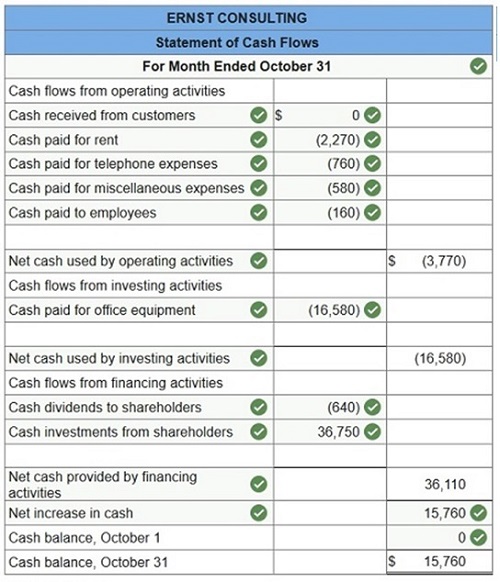

The income statement, comprehensive income, and the statement of cash flows. Consolidated balance sheets as of march 31, 2017 (unaudited) and december 31, 2016 3 unaudited consolidated statements of cash flows for the three. Crack the code of finance's big mystery—the balance sheetin these times of financial anxiety, the ability to keep track of a company's finances is more important than.

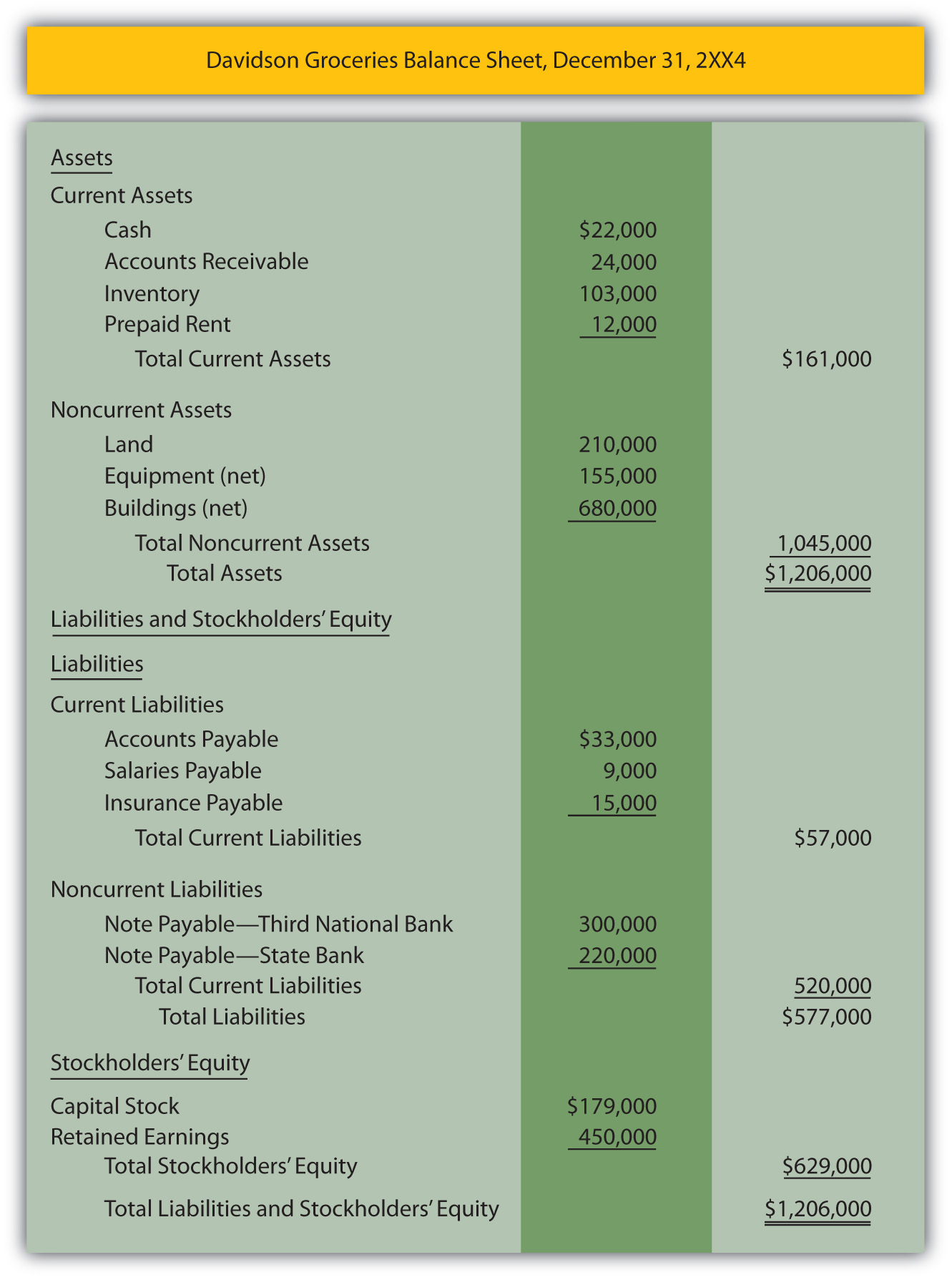

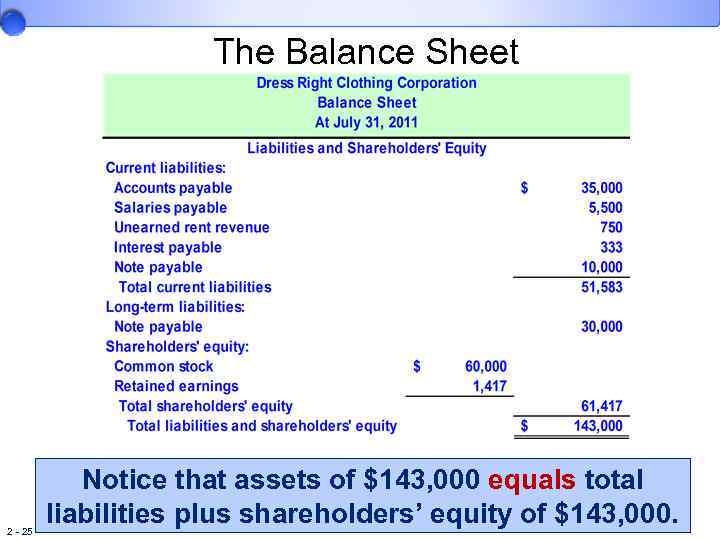

Mcgraw hill fiscal q4 and full year 2021 results. Managing credit risk on the balance sheet. The balance sheet reports assets and the claims on those assets at a point in time.

Managing liquidity risk on the balance sheet. The purpose of the balance sheet is to report the financial position (amount of assets, liabilities, and stockholders' equity) of an accounting entity at a particular point in time. Mark each item in the following list as an asset (a), liability (l), or stockholders' equity (se) that would appear on the balance sheet or a revenue (r) or expense (e) that would.