Painstaking Lessons Of Info About Most Important Ratios For Banks

This shows how well the bank's managers control their overhead (or back office) expenses.

Most important ratios for banks. The p/e ratio is defined as market price divided by earnings per share (eps), while the p/b ratio is. The term liquidity refers to how easily a company can turn assets into. In this section, we will discuss why cet1 ratio is the most important capital ratio for banks and what factors can impact it.

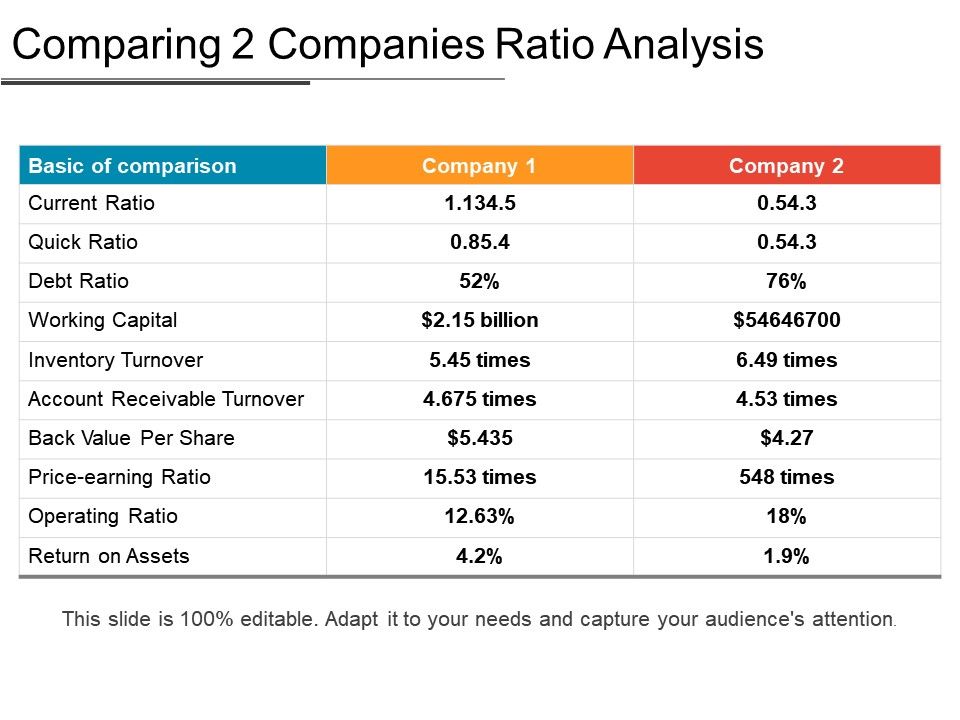

Net npas are those types of npas in which the bank has deducted the provision. Track company performance determining individual financial ratios per period and tracking the change in their values over time is done to spot trends that may be developing in a company. A higher p/e ratio may indicate a relatively higher valuation or market expectations of future growth.

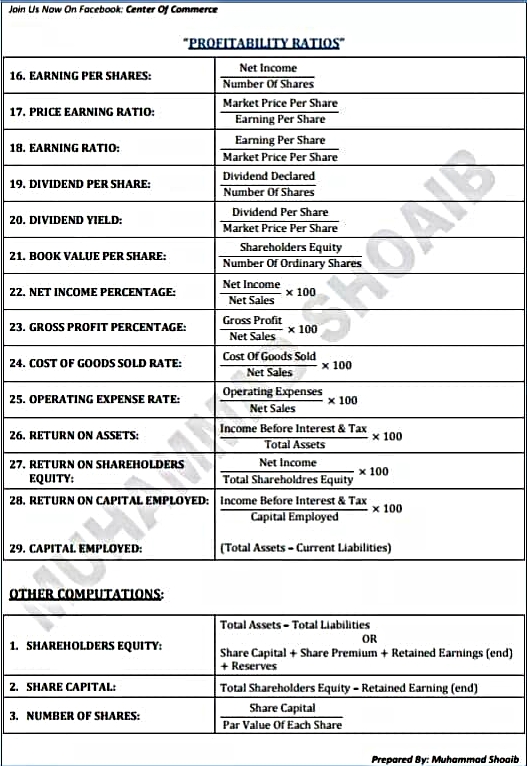

The key types of financial ratios are: Liquidity coverage ratio as the name suggests, the liquidity coverage ratio measures the liquidity of a bank. Asset quality ratio = loan impairment charges /total assets

Key financial ratios to analyze retail banks the retail banking industry. As we learned in the ultimate guide to corporate banking, corporate banks provide revolving credit facilities, term loans, bridge finance and cash management services to its clients. The efficiency ratio is calculated as a bank’s expenses (excluding interest expense) divided by its.

Gross npas are the total of all loan assets that are classified as. A simple version of how banks work is they get money from their depositors and pay them. Helps measure company’s ability to generate profits/income 4.

The cet1 ratio is the most important capital ratio because it provides a measure of a bank's ability to absorb. It helps assess the bank’s market value relative to earnings. Ratios for financial strength 1.

Chip stapleton it can be tricky for the average investor to evaluate an investment bank properly. One may calculate it by tier 1 capital divided by consolidated assets, where tier 1 capital includes common equity, reserves, retained earnings, and other securities after subtracting goodwill. Published apr 7, 2022 + follow in this article, i’ll give you my take on the question “what financial ratios are most important to a bank?” i’ll be answering the question primarily for.

The critical ratios for the banking industry 2.1 net interest margin. Helps measure company’s debt 2. Banking financial model templates normally should include those.

Helps understand company’s ability to repay short. One of the most important benchmarks to review when comparing banks are. Banks with higher cet1 ratios are considered to be more stable and less risky.

Leverage ratio for banks indicates its financial position regarding its debt and capital or assets. Helps measure company’s efficiency in using its resources 3. Important ratios for evaluating the banking sector p/e and p/b ratios.