Fantastic Info About Cash Flow Statement Is

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

Along with balance sheets and income statements, it’s one of the three most important financial statements for managing your small business accounting and making sure you have enough cash to keep operating.

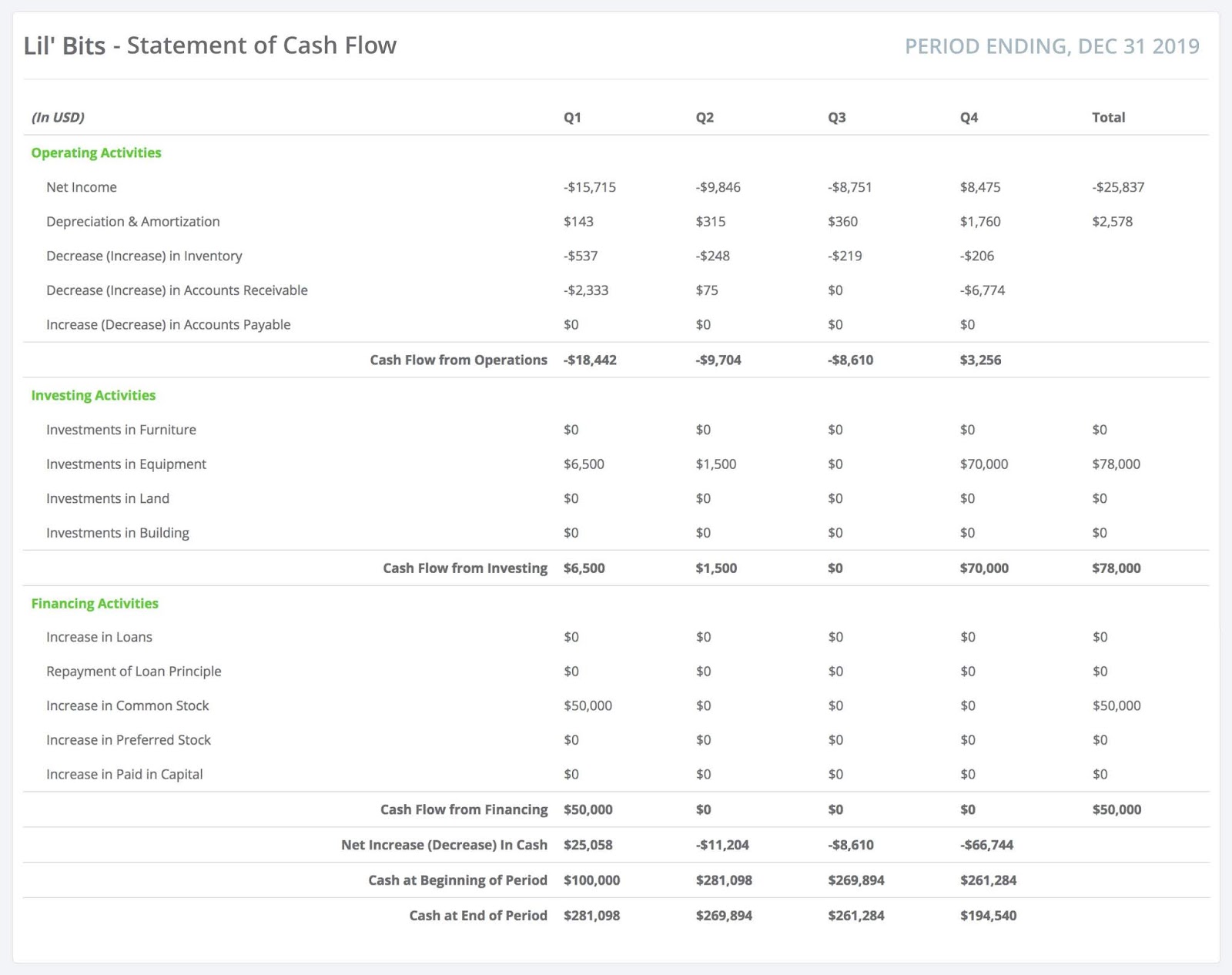

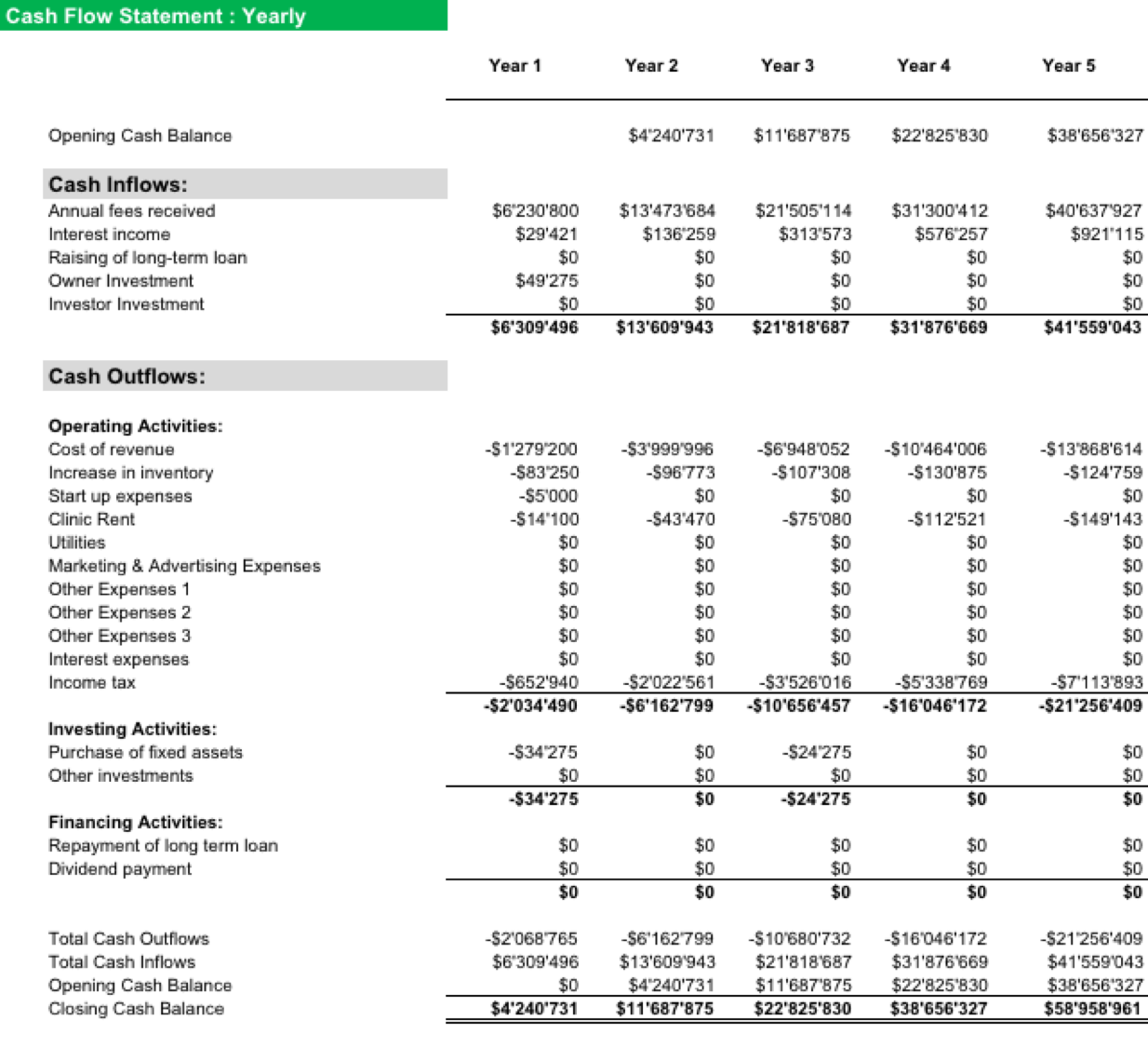

Cash flow statement is. It is usually helpful for making cash forecast to enable short term planning. The main components of the cash flow statement are: Income statement and free cash flow.

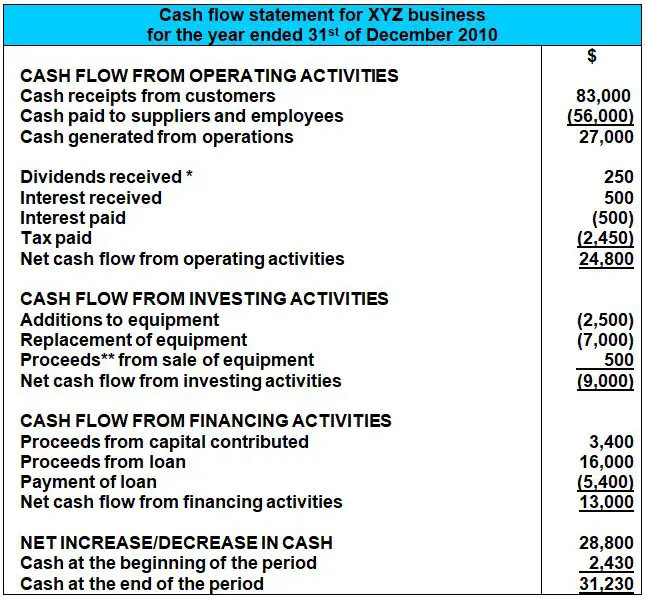

The cash flow statement reports the cash generated and spent during a specific period of time (e.g., a month, quarter, or year). What is a cash flow statement? This statement is one of the three key reports (with the income statement and the balance sheet) that help in determining a company’s performance.

Free cash flow eur 423 million; It also breaks down where you've spent that money so you can see if your business is making more money than it spends. Two examples include year ended december 31, 2022 and three.

The cash flow statement is an important financial statement issued by a company, along with the balance sheet and income statement. Innovation rate increased to 20%; The first section of the cash flow statement.

Including cash inflows a business gains from its continuing progress and external financing sources, as well as all cash outflows that pay for trading activities and finances during a delivered time. Cash coming in and out of a business is referred to as cash flows, and accountants use these statements to record, track, and report these transactions. With these etfs, cash flow is king.

The cash flow statement shows the operating, financing, and investing cash flows of the business. The statement of cash flows is one of. The cash flow statement (cfs) is a financial statement that reconciles net income based on the actual cash inflows and outflows in a period.

In simple terms, this report reveals how much cash a business has coming in and going out and where these funds are coming from and going. It provides insights about the business’s ability to generate future cash flows and settle obligations. A cash flow statement is a financial statement that shows how cash entered and exited a company during an accounting period.

A cash flow statement is an important tool used to manage finances by tracking the cash flow for an organization. A cash flow statement is one of three key documents used to determine a company's financial health.

Key takeaways a cash flow statement provides data regarding all cash inflows that a company receives from its ongoing operations and. A cash flow statement, also known as the statement of cash flows, is a financial statement that shows the flow of cash into and out of your business during a specific period of time. According to the online course financial accounting:

When cash flows into a business, that means the company receives money. Dear community, please suggest list of best practices that should be activated to prepare cash flow statement both direct and indirect methods for the purposes of statutory reporting and managerial reporting and planning. The time interval (period of time) covered in the scf is shown in its heading.