Amazing Tips About Common Size Income Statement Problems And Solutions

As a company’s assets could be calculated as the sum of its liabilities and its equity:

Common size income statement problems and solutions. Common size income statement is calculated as similarly, calculate for the years 2017 and 2016. A statement that indicates the percentage relation of each income/expense to the revenue since operations (net sales), is known. Common size balance sheet as at 31.3.2018 and 31.3.2019 (₹ in lakhs) question 2 following is the statement of profit and loss of crown.

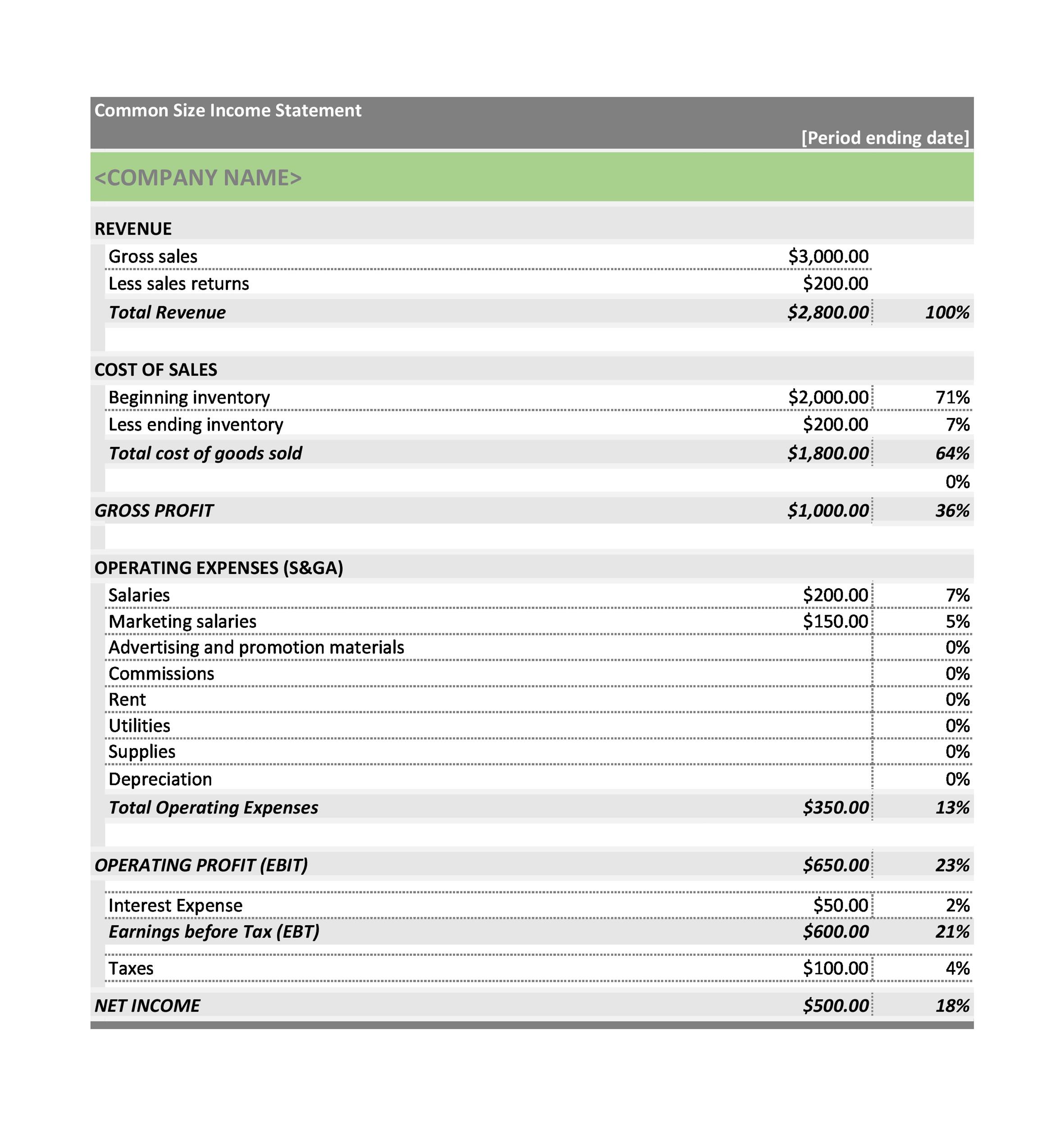

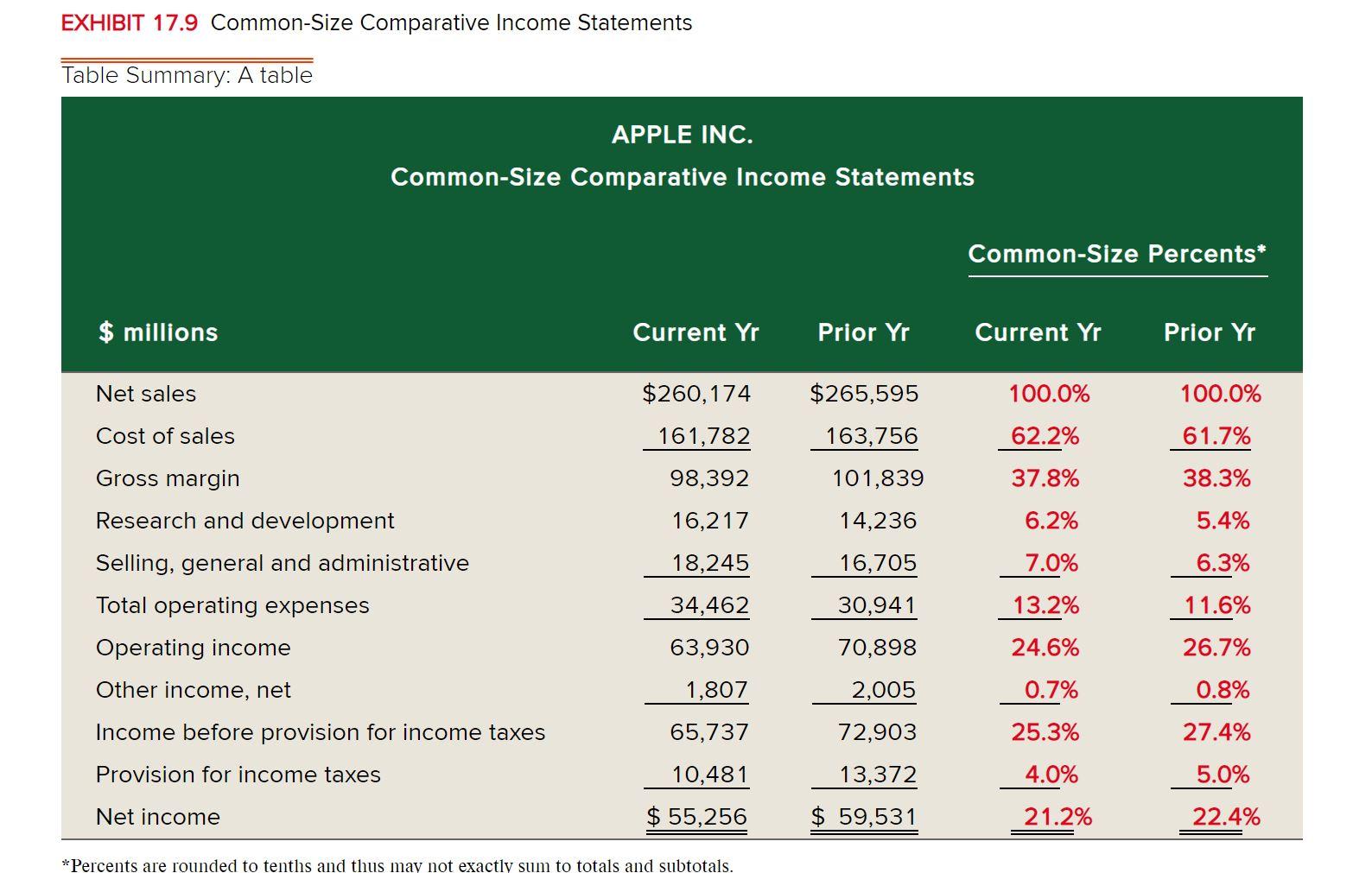

A common size income statement is the presentation of a company’s income and expenses in percentage terms instead of dollar amounts. A common size income statement is the presentation of a company’s income and expenses in percentage terms instead of dollar amounts. This type of analysis helps you see how revenue.

The correct answer is a. In the above table, it can be seen that the. For instance, the quarterly income statement includes all.

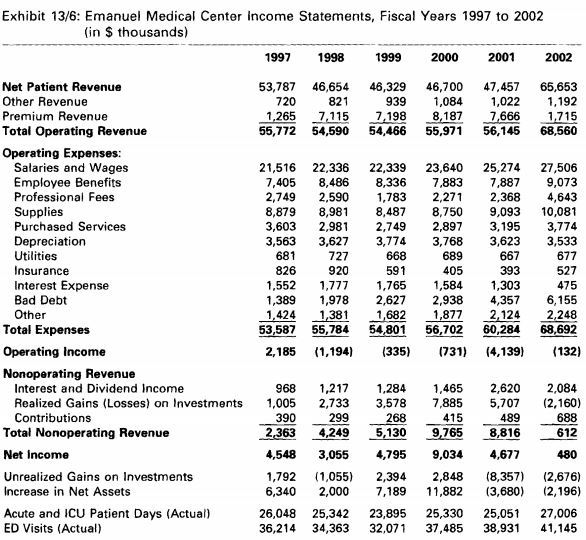

$$ \text{assets} = \text{liabilities} + \text{equity}. Use industry comparisons to assess organizational performance. (a) balance sheet (b) profit and loss account (c) cash flow statement (d) all the above answer (d).

To common size an income statement, analysts divide each line item (e.g. Gross profit, operating income, marketing expenses) by revenue or sales. Common size statements are those statements in which figures reported for the period are converted into percentage or ratios of a total item.

Analysis of financial statements ts grewal 2019 solutions for class 12 commerce accountancy chapter 3 tools of financial statement analysis comparative. Common size income statement:

/dotdash_Final_Common_Size_Income_Statement_Oct_2020-01-f6706faee5644055954e9e5675485a5e.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Common_Size_Income_Statement_Oct_2020-01-f6706faee5644055954e9e5675485a5e.jpg)

:max_bytes(150000):strip_icc()/CommonSizeIncomeStatement_v1-6d2a9c4def2449168cbd16525632bbd1.jpg)