Lessons I Learned From Tips About Accounts Receivable On The Balance Sheet

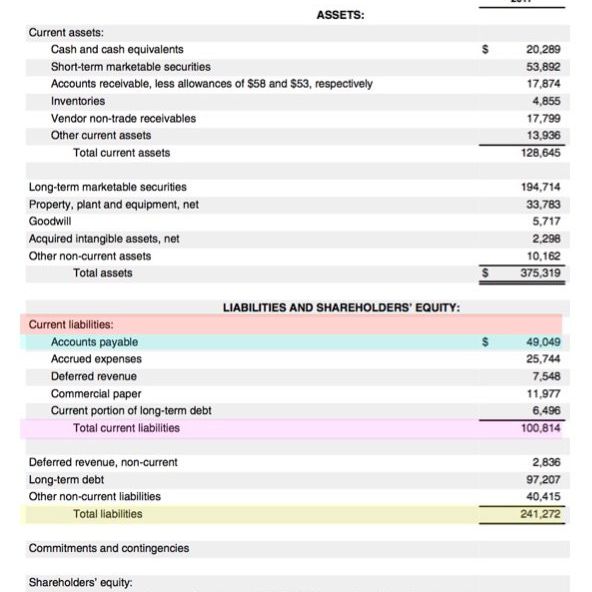

On a company’s balance sheet, owners’ equity shows what the owners of the business (or shareholders) would have if the company.

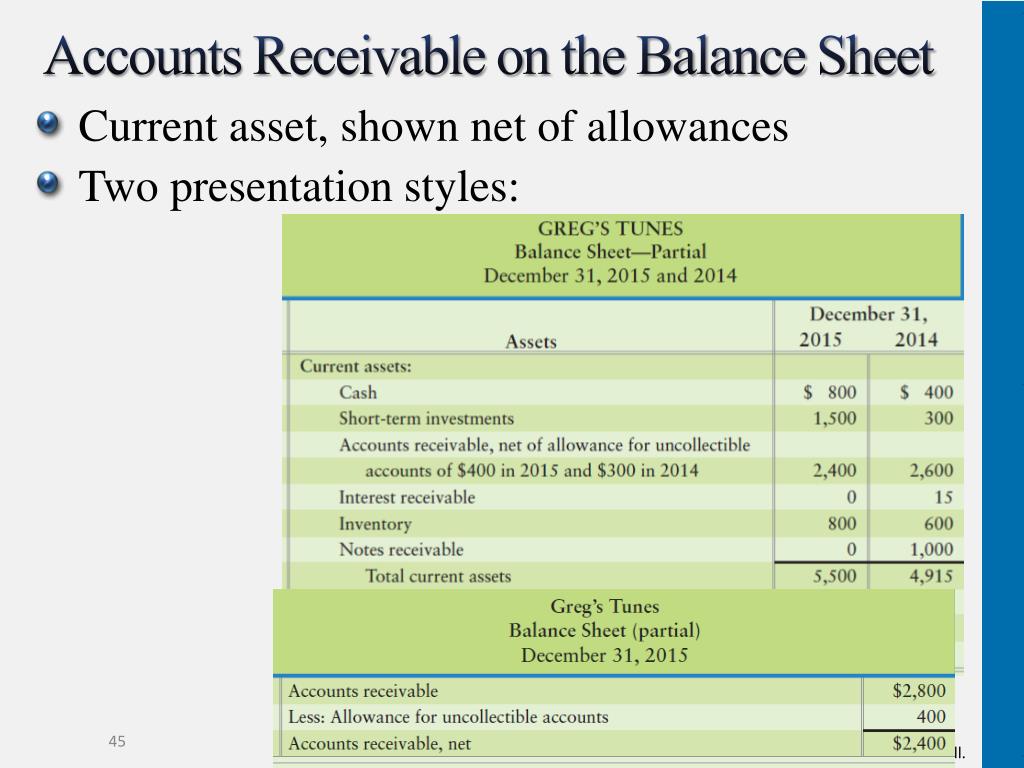

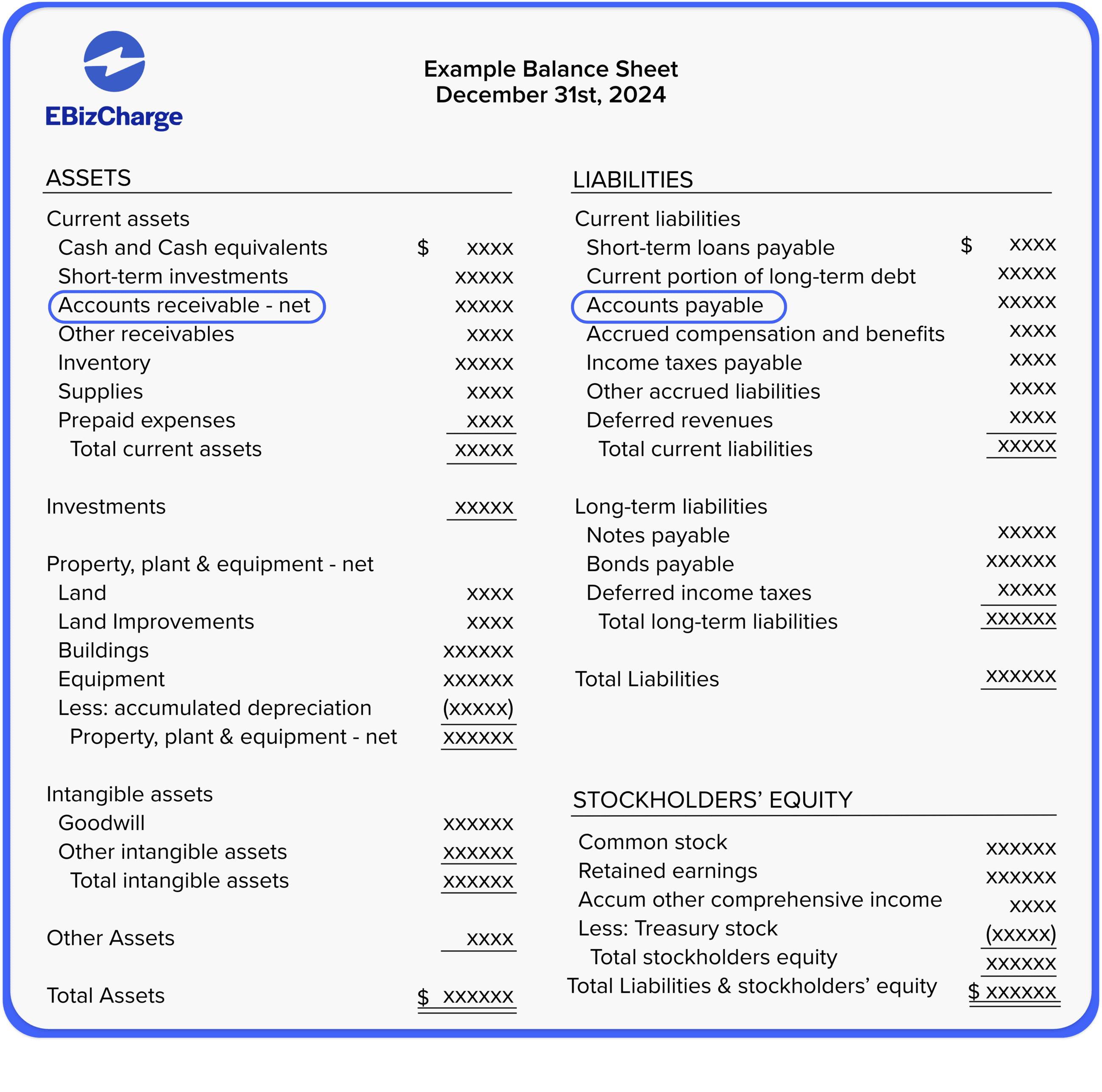

Accounts receivable on the balance sheet. Accounts receivable is the amount a company is owed by customers for providing goods or services on credit rather than being paid upfront with cash. This financial statement is used both internally and externally to determine the so. Gaap and ifrs accounting standards.

Yes, accounts receivable should be listed as an asset on the balance sheet. In accounting terms, accounts receivable are considered a current asset on a company’s balance sheet. The money owed from customers that paid using credit.

On a financial report, accounts receivable is a collection of individual customer accounts listing money that customers owe the company for products or services they've already received. Accounts receivable is any amount of money your customers owe you for goods or services they purchased from you in the past. What is a balance sheet?

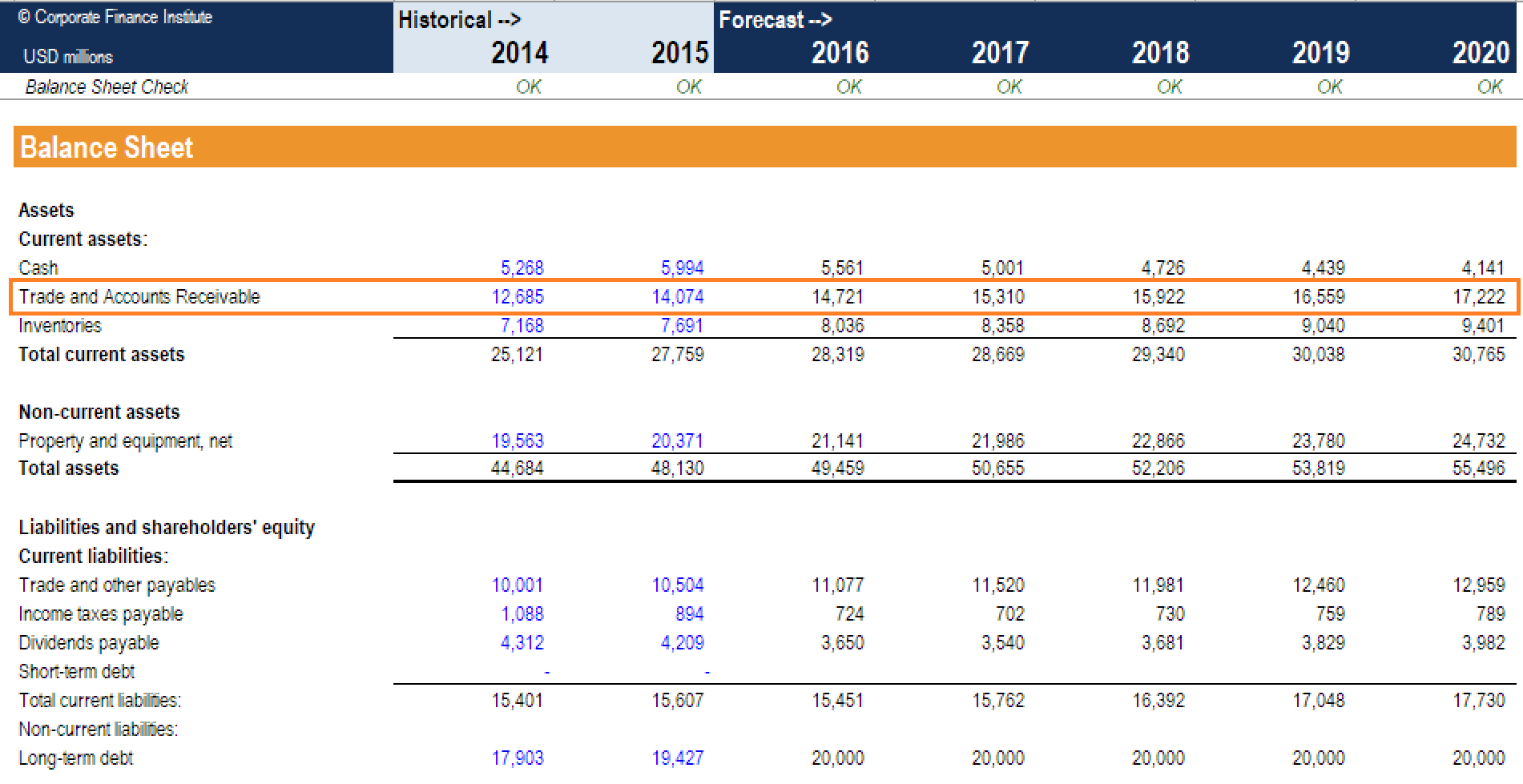

This account includes the balance of all sales revenue still on credit, net of any allowances for doubtful accounts (which generates a bad debt expense). Definition and examples of accounts receivable accounts receivable is the balance owed by customers to a business for goods and services that the latter has sold or provided on credit. Consequently, officials for dell inc.

Check specific accounts receivable accounts in the balance sheet reconciliation: Unlike received, receivable adheres to the future prospects of the payment. Check the ageing balance for the customers, be in close cooperation with sales to handle claims.

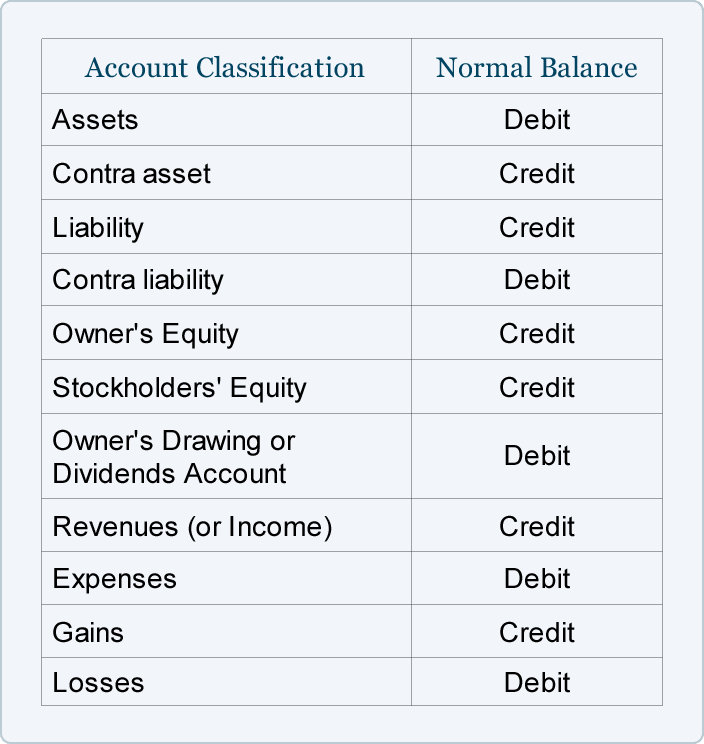

This money is typically collected after a few weeks and is recorded as an asset on your company’s balance sheet. Whether accounts receivable represents a debit or credit entry. Accounts receivable (ar) represents money for goods and services a company has delivered but not yet received payment for.

Accounts receivable is the money owed to that company by entities outside of the company. How to pass gst receivable journal entry in the books of accounts. This could be because of the good and services they took from you or simply because of the transaction that is still undone.

Accounts receivable are a current asset on the balance sheet. Accounts receivable is an asset —a plus on your company’s balance sheet—symbolizing money owed by customers for products or services already delivered. Accounts receivable (ar) is an asset account on the balance sheet that represents money due to a company in the short term.

It provides a snapshot of a company's finances (what it owns and owes) as of the date of. A company must carefully monitor not. Calculating accounts receivable on the balance sheet is not a formula, rather it is the sum of all unpaid credit invoices that have been issued to customers.

You then record a decrease in accounts receivable, from $300,000 to $200,000. Again, for simplicity, it’s the only transaction of the month. The balance sheet is one of the three core financial statements that are used to evaluate a business.